Key facts today

MicroStrategy has priced $2.8 billion of its 9% preferred stock at $90 per share, up from $500 million, to fund more Bitcoin purchases.

MicroStrategy's performance was negatively impacted by the downturn in cryptocurrency prices, despite the overall market, including the S&P 500 and Nasdaq 100, reaching record highs.

The Ohio Public Employees Retirement System increased its investment in MicroStrategy by purchasing an additional 21,499 shares in the second quarter, raising its total holdings to 101,880 shares.

−1.05 USD

−1.04 B USD

411.64 M USD

About MicroStrategy

Sector

Industry

CEO

Phong Q. Le

Website

Headquarters

Vienna

Founded

1989

ISIN

ARCAVA4601E2

MicroStrategy, Inc. engages in the provision of enterprise analytics and mobility software. The firm designs, develops, markets, and sells software platforms through licensing arrangements and cloud-based subscriptions and related services. Its product packages include Hyper. The company was founded by Michael J. Saylor and Sanjeev K. Bansal on November 17, 1989, and is headquartered in Vienna, VA.

Related stocks

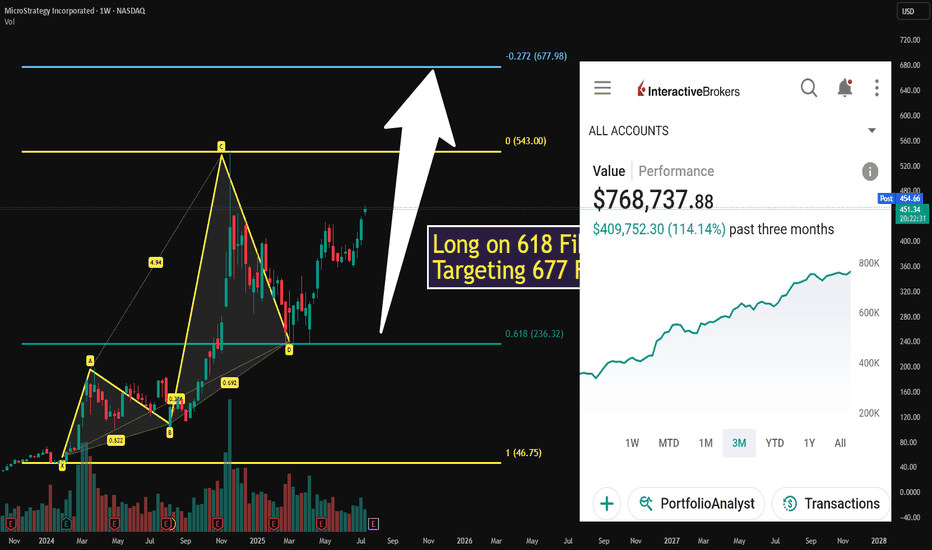

Possibility for MSTRIf bitcoin moves, Strategy moves.

I am no expert, so this is just for entertainment purposes.

But Strategy is acquiring bitcoin like there is no tomorrow and bitcoin inelastic supply tend to give a way to radical and fast grow in price.

Hence why I'd be keen to see MSTR move as much as I show in t

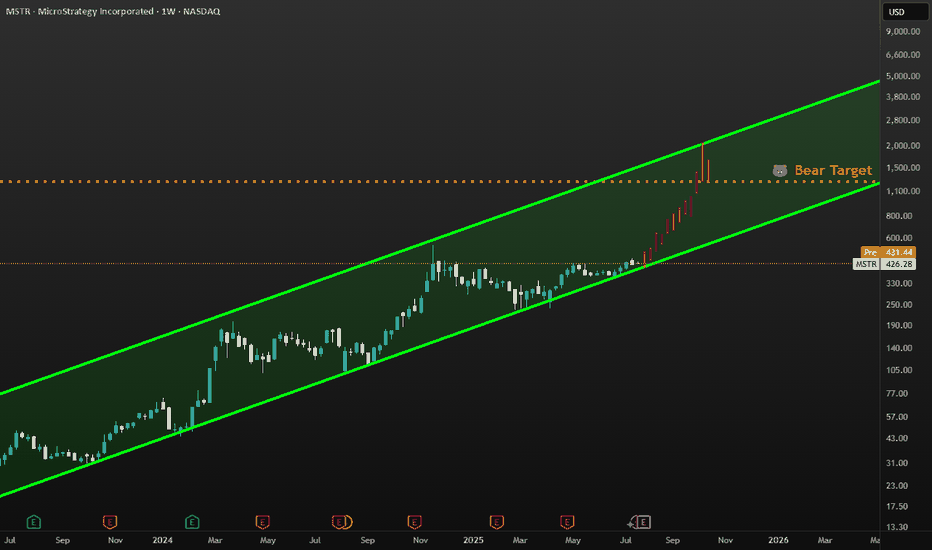

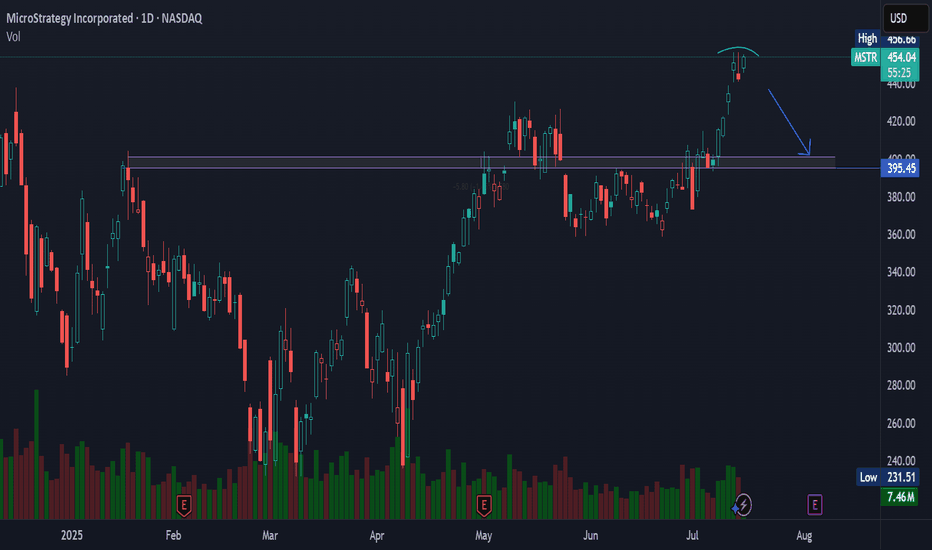

MSTR – On the Path to New ATHI was initially skeptical about the recovery structure unfolding since the April lows — it looked like a possible macro lower-high before deeper correction (as outlined in my previous idea).

However, given the strength in underlying #BTC price action (covered in my recent video-idea on crypto t

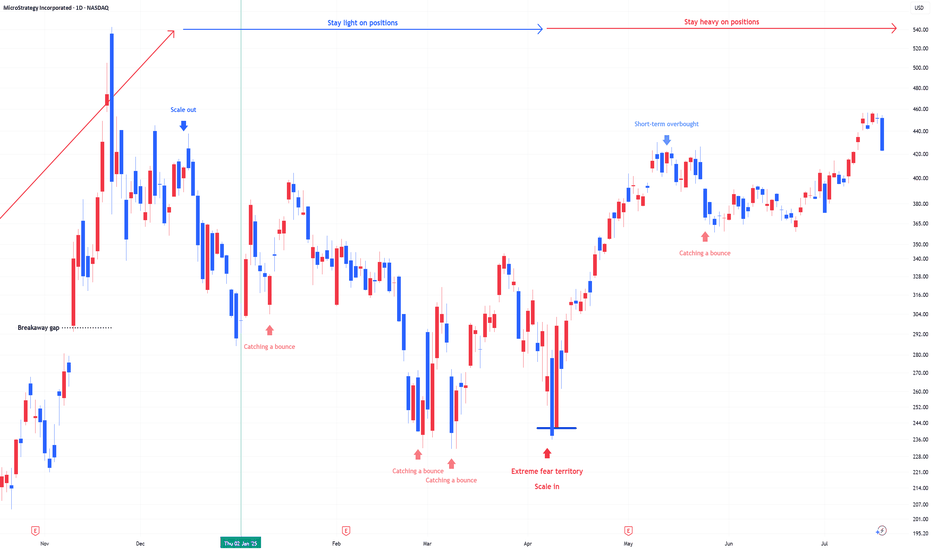

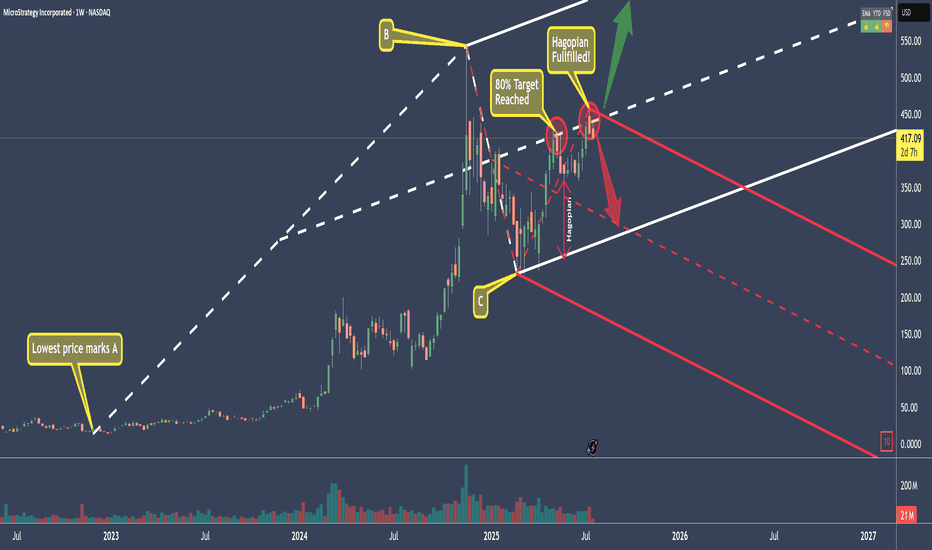

MSTR - Microstrategy Short...for now.The White Fork is created by choosing point A, which must be the lowest price before the swing.

B and C are the natural high and low of the swing we want to measure.

What this gives us is a Pitchfork that projects the most probable path of price.

Additionally, with the three lines that make the F

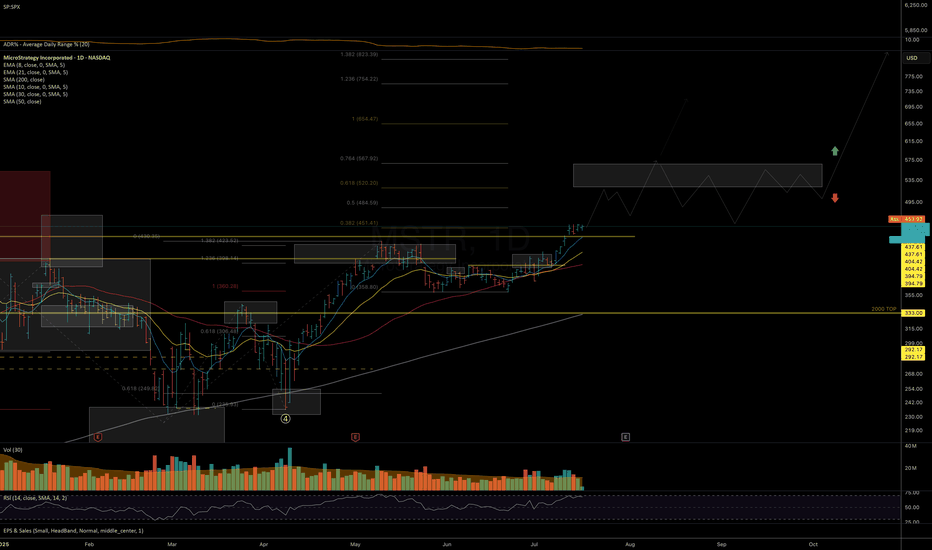

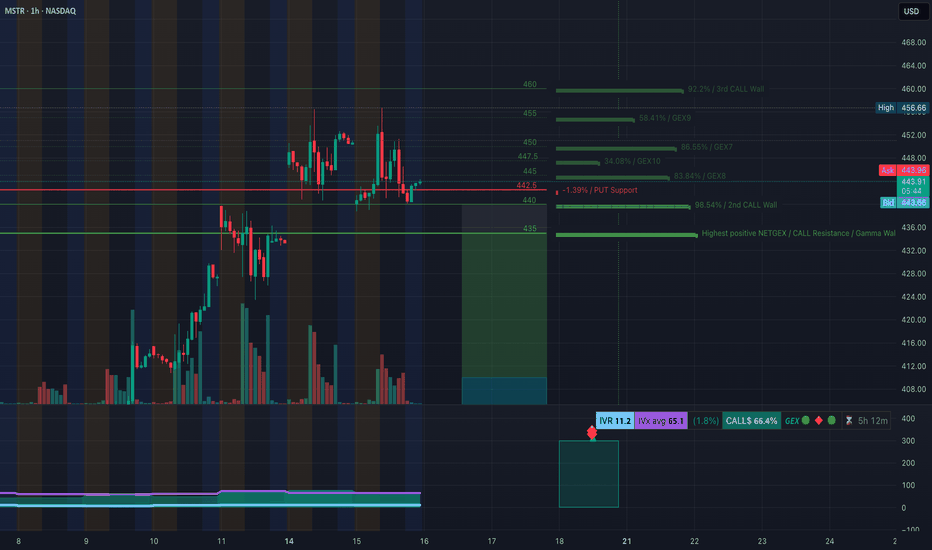

MSTR at Decision Zone! TA for July 16GEX + Price Structure Align for Breakout or Breakdown 🔸

🧠 GEX Levels & Options Sentiment (as of July 15, 2025)

* ⚠️ Key Call Resistance Levels:

• $460 (3rd Call Wall, 92.2%)

• $455 (58.41%)

• $447.5 (GEX10)

• $444.5 (GEX7) – overhead friction

* PUT Support Levels:

• $442.5 (near current price)

• $4

Strategy Finished Consolidating, New High With BTC Leading MicroStrategy (MSTR), the stock is currently demonstrating significant volatility and a strong correlation with Bitcoin's price movements, acting almost like a leveraged play on the cryptocurrency.

From a charting perspective, MSTR has been in a long-term bullish trend since its pivot to a Bitcoin

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

MSTR5946535

MicroStrategy Incorporated 0.0% 01-DEC-2029Yield to maturity

5.77%

Maturity date

Dec 1, 2029

US594972AR2

MICROSTRAT. 24/29 CV ZOYield to maturity

0.67%

Maturity date

Dec 1, 2029

US594972AT8

MICROSTRAT. 25/30 CV ZOYield to maturity

−3.60%

Maturity date

Mar 1, 2030

US594972AN1

MICROSTRAT. 25/32 CVYield to maturity

−6.87%

Maturity date

Jun 15, 2032

MSTR6034213

MicroStrategy Incorporated 0.875% 15-MAR-2031Yield to maturity

−7.92%

Maturity date

Mar 15, 2031

MSTR6032672

MicroStrategy Incorporated 0.625% 15-MAR-2030Yield to maturity

−13.51%

Maturity date

Mar 15, 2030

US594972AP6

MICROSTRAT. 24/28 CV 144AYield to maturity

−18.02%

Maturity date

Sep 15, 2028

See all MSTRD bonds

Curated watchlists where MSTRD is featured.