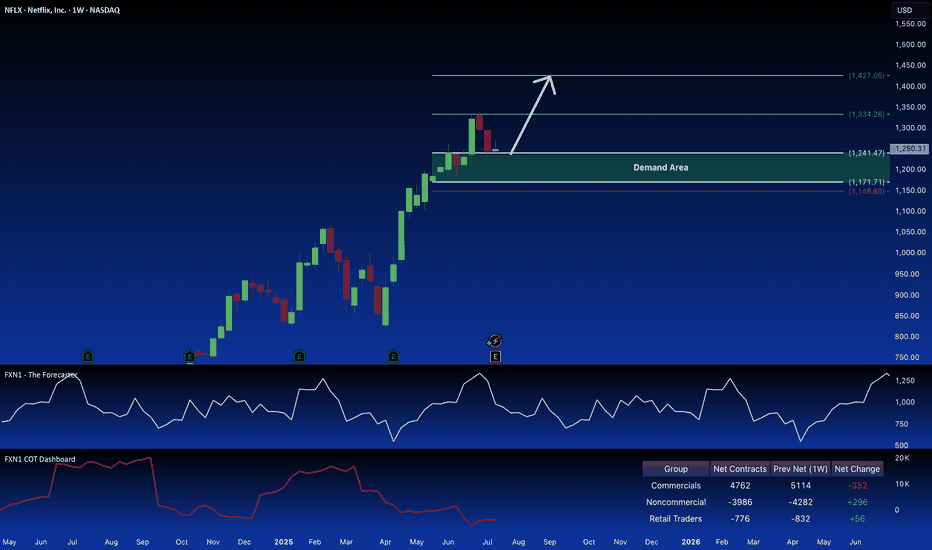

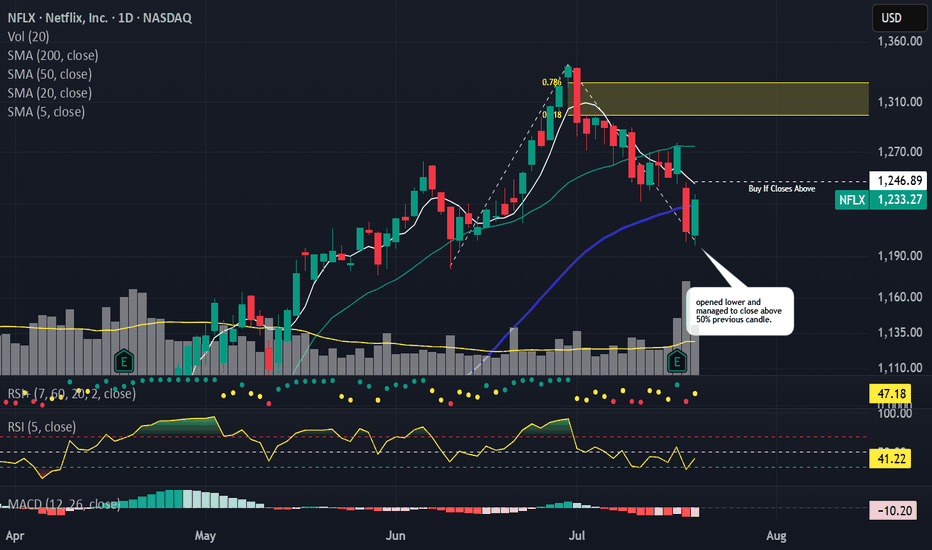

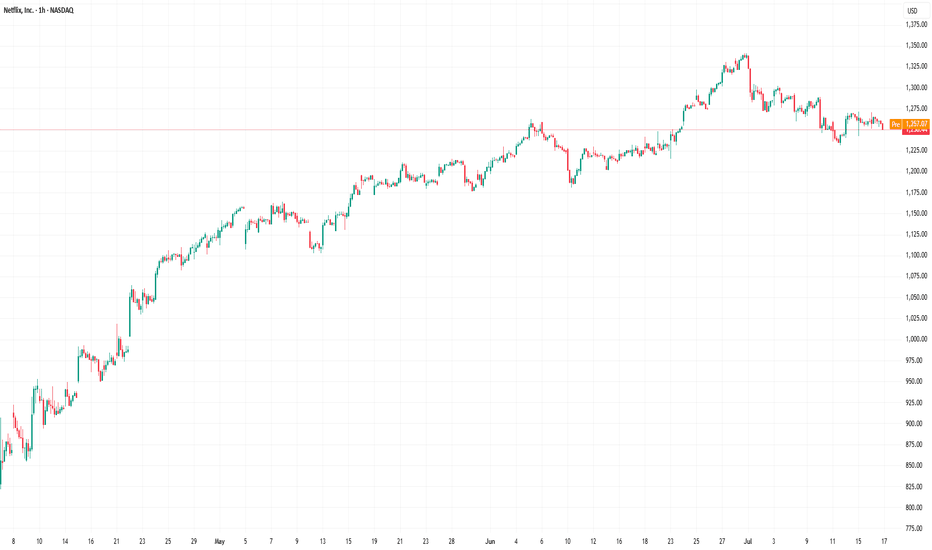

NFLX: Bullish Signal in Demand ZoneNetflix (NFLX) recently retraced within a key weekly demand zone, potentially presenting a long opportunity. Non-commercial traders are also accumulating long positions in the stock. This suggests a possible bullish setup. Your thoughts?

✅ Please share your thoughts about NFLX in the comments

0.45 USD

7.74 B USD

34.53 B USD

About Netflix, Inc.

Sector

Industry

Website

Headquarters

Los Gatos

Founded

1997

ISIN

ARBCOM4601D2

Netflix, Inc. engages in providing entertainment services. It also offers activities for leisure time, entertainment video, video gaming, and other sources of entertainment. It operates through the United States and International geographic segments. The company was founded by Marc Randolph and Wilmot Reed Hastings on August 29, 1997 and is headquartered in Los Gatos, CA.

Related stocks

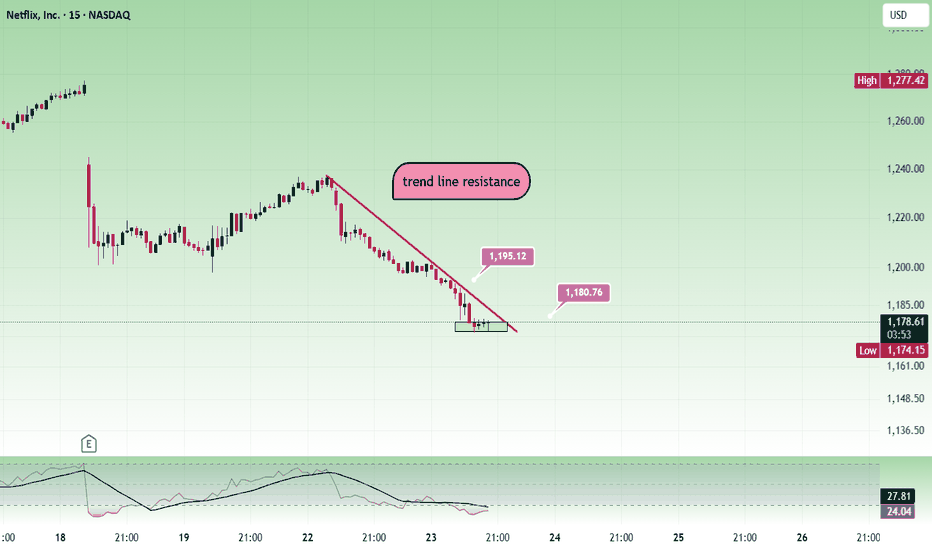

NetflixMay be people are not watching Netflix nowadays and the price is falling. 1200 is a strong resistance.

Sell below 1180 with the stop loss of 1195 for the targets 1165, 1150, 1130 and 1115.

Price can pull back towards 1190 and then fall. Its better to see bearish confirmation and trade.

Always do you

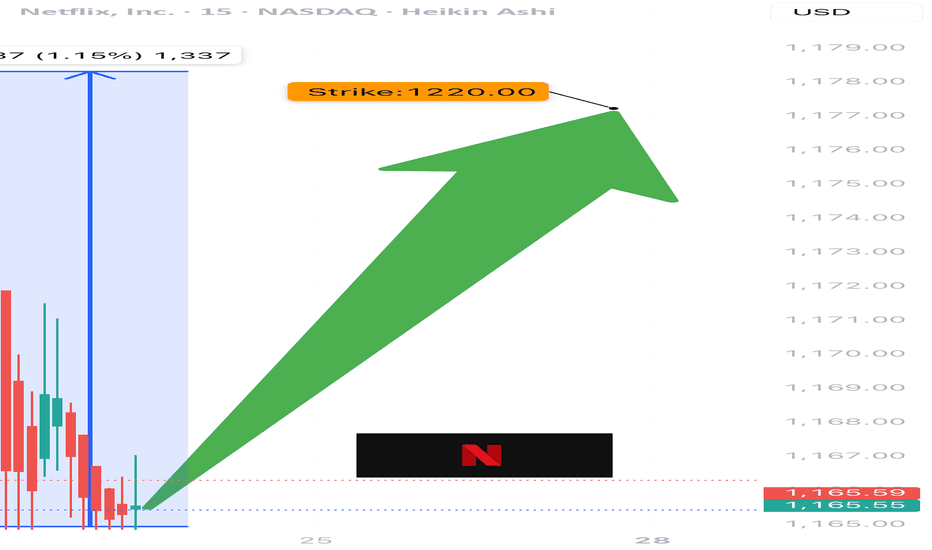

NFLX TRADE IDEA (07/24)

🚨 NFLX TRADE IDEA (07/24) 🚨

⚔️ Bulls vs. Bears… but calls are winning 🐂📈

🧠 Quick Breakdown:

• Call/Put Ratio: 1.27 → bullish edge

• RSI < 45 = 🔻oversold territory

• VIX favorable = room to run

• High gamma = big moves incoming ⚡️

• Expiry: TOMORROW = 🔥 time decay risk

💥 TRADE SETUP

🟢 Buy NFLX $12

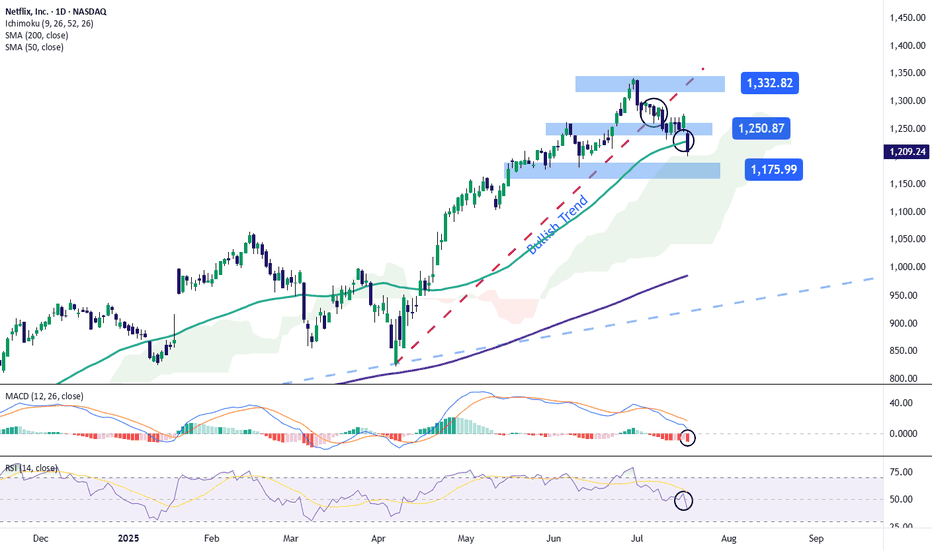

Netflix Stock Drops After Earnings ReleaseShortly after publishing its financial results, Netflix posted a decline of over 5% toward the end of the week and continues to show a strong bearish bias. This comes despite reporting a positive earnings per share (EPS) figure of $7.19, beating the expected $7.08, and revenue of $11.08 billion, sli

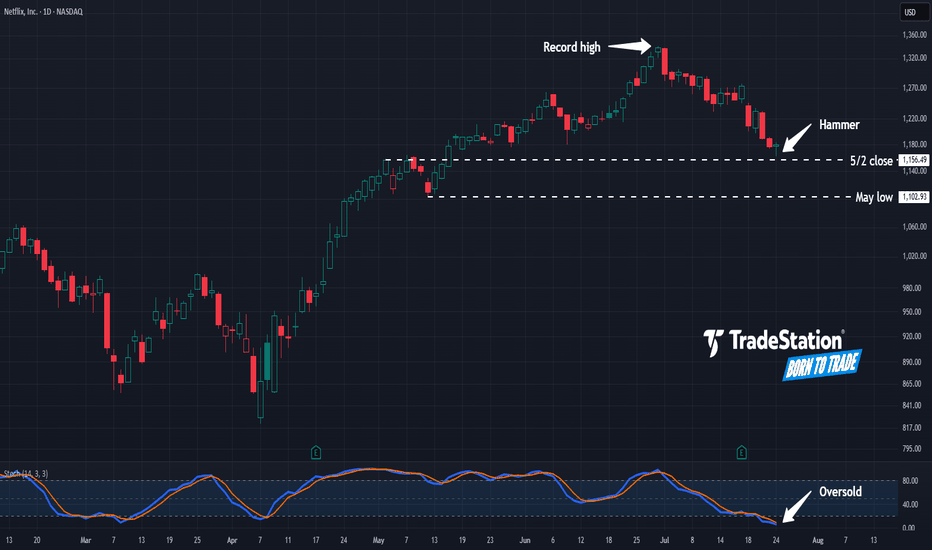

Hammer in NetflixNetflix has pulled back from record highs, and some traders may see potential opportunities in the streaming video giant.

The first pattern on today’s chart is the $1,156.49 level. It was a weekly close on May 2 and near the high the following week. NFLX is now showing signs of potential stabilizat

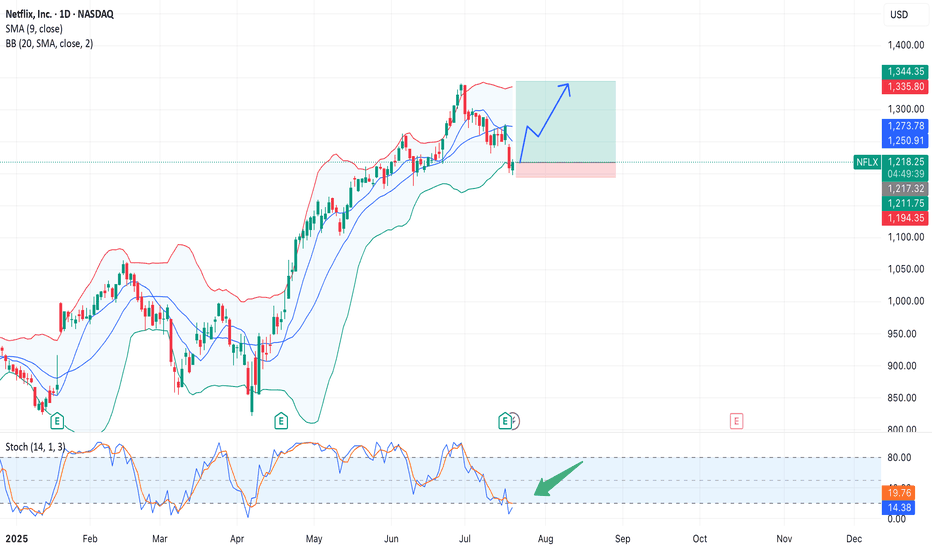

Netflix (NFLX) Long Setup – Bounce from Lower Bollinger Band $NASDAQ:NFLX. After pulling back from the $1350 area, Netflix stock is testing the lower Bollinger Band (BB 20/2σ), a level that previously acted as support.

At the same time, the Stochastic Oscillator (14,1,3) is in oversold territory and starting to curl upward, suggesting a potential bullish reve

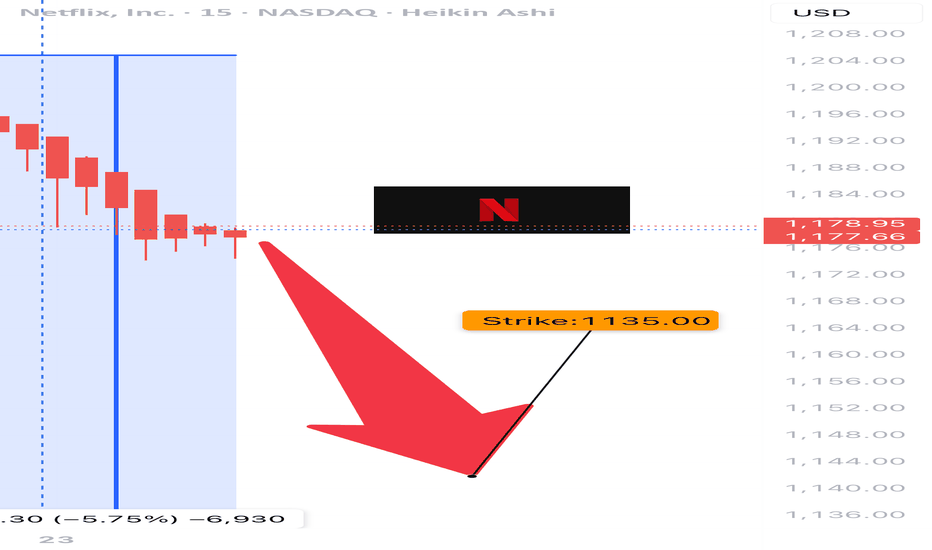

NFLX WEEKLY BEARISH PLAY — 07/23/2025

📉 NFLX WEEKLY BEARISH PLAY — 07/23/2025

🧠 Multi-model AI Consensus Trade Setup

⸻

🔍 QUICK SUMMARY

After reviewing 5 AI model reports (Grok, Gemini, Claude, Meta, DeepSeek), the consensus is moderate bearish for NFLX this week following heavy institutional selling and post-earnings weakness.

💣 Ke

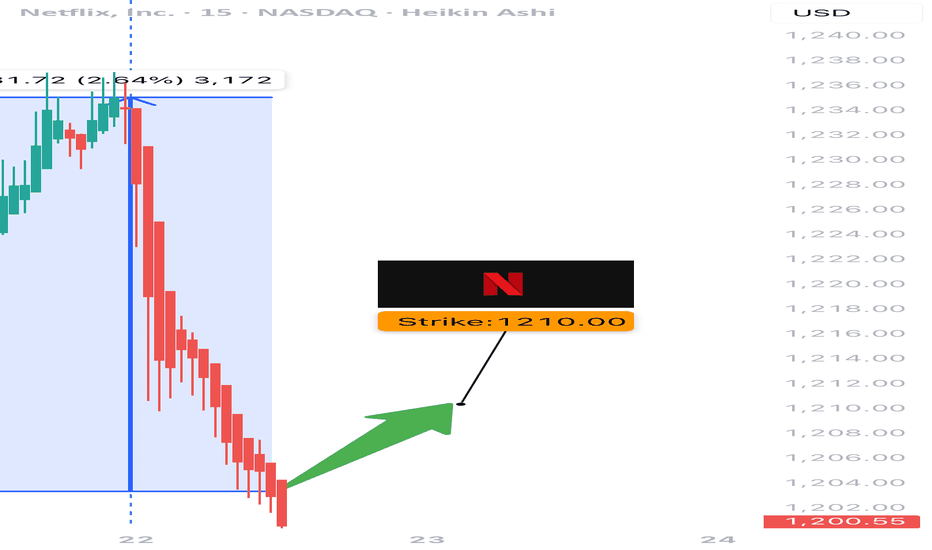

$NFLX Weekly Call Setup – 07/22/25

🚀 NASDAQ:NFLX Weekly Call Setup – 07/22/25

Volume Surge 📈 | RSI Bullish ✅ | Options Flow Mixed 🔁 | 3DTE Lotto Play 🎯

⸻

📊 Market Snapshot

• Price: $1203.16

• Call/Put Ratio: 1.01 → ⚖️ Neutral

• Weekly RSI: ✅ 63.2 (Momentum confirmed)

• Volume Surge: 📈 1.6x previous week

• Gamma Risk: ⚠️ Mo

How Earnings Reporting Could Impact Netflix (NFLX) Share PriceHow Earnings Reporting Could Impact Netflix (NFLX) Share Price

Earnings season is gaining momentum. Today, after the close of the main trading session, Netflix (NFLX) is set to release its quarterly financial results.

Analysts are optimistic, forecasting earnings per share (EPS) of $7.08, up from

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

NFLX5862368

Netflix, Inc. 5.4% 15-AUG-2054Yield to maturity

5.62%

Maturity date

Aug 15, 2054

NFLX5862367

Netflix, Inc. 4.9% 15-AUG-2034Yield to maturity

4.44%

Maturity date

Aug 15, 2034

USU74079AN1

NETFLIX 19/29 REGSYield to maturity

4.40%

Maturity date

Nov 15, 2029

NFLX4901374

Netflix, Inc. 4.875% 15-JUN-2030Yield to maturity

4.21%

Maturity date

Jun 15, 2030

NFLX4764899

Netflix, Inc. 4.875% 15-APR-2028Yield to maturity

4.19%

Maturity date

Apr 15, 2028

NFLX4908613

Netflix, Inc. 6.375% 15-MAY-2029Yield to maturity

4.17%

Maturity date

May 15, 2029

NFLX4826528

Netflix, Inc. 5.875% 15-NOV-2028Yield to maturity

4.11%

Maturity date

Nov 15, 2028

US64110LAN64

NETFLIX 4.375% CALL 15NV26Yield to maturity

4.01%

Maturity date

Nov 15, 2026

XS198938050

NETFLIX 19/29 144AYield to maturity

3.48%

Maturity date

Nov 15, 2029

XS207282979

NETFLIX INC. 19/30 REGSYield to maturity

2.80%

Maturity date

Jun 15, 2030

XS198938017

NETFLIX 19/29 REGSYield to maturity

2.75%

Maturity date

Nov 15, 2029

See all NFLXC bonds

Curated watchlists where NFLXC is featured.