NVDA: Buy the Dip or Miss the Run?NVDA 💥🔥

Let’s be real, the market’s been shaky. Between the spike in volatility and the new tariff chatter coming out of the Trump camp, tech stocks are getting tossed around. But here’s the thing—volatility is where the setups live. And NVDA, sitting at the center of the AI revolution, isn’t going to stay down forever.

This might be the window. We’re talking a solid entry zone between 90 and 70, right where volatility meets opportunity.

Our profit targets?

✅ 110 for a clean bounce

✅ 125 as momentum builds

✅ 145+ if the bulls take the wheel again

It’s not about chasing—this is about timing the wave before it rips. So if you’re into smart risk, layered entries, and riding volatility like a pro… NVDA just rang the bell.

Disclaimer: This is not financial advice. All trading involves risk, especially in volatile conditions. Always do your own research or speak to a licensed financial advisor before making any trading decisions.

NVDAD trade ideas

IM BEARISH ON NVIDIA WITH A TARGET OF $55.00. HERE IS WHY:NVIDIA (NVDA) Known for their GPUs, recently has experienced a decline in asset price. Trump tariff's may have been a bearish news catalyst, but do the technicals show a bigger bearish picture?

1 Day chart: While the RSI recently signaled oversold conditions, the RSI line looks to be crossing down the RSI based moving average. Furthermore the 200 Day EMA and 65 Day EMAs appear to be forming a death cross. DMI is still indicating bearish, and the ADX is still above 20.

With recent political news, the tech company has been working on bolstering their U.S based production. But with inflation cooling (6 month low) , I believe many high performing blue chip stocks may see a dip as traders and institutions price in deflation, new news and political events.

My opinion on a target is $55.00 , and there is significant open interest on long puts for this price that are expiring in the coming months.

Will NVIDIA pull out of this downtrend? Or will it become a great value buy for investors?

Disclaimer: Not financial advice.

NVDA short trap may be set..!boost and follow for more! thanks ❤️🔥

Yesterday NVDA broke the trend support that's its held in this downtrend, but it quickly climbed back above.. was that drop the final short trap before the move higher?

it's trying to reclaim the pink support zone now, if it can and we cross 107, then the move higher to my upside targets is likely.🎯

side note: I added 110 weekly NVDA while it was in the 90s yesterday, they hit 100%+ gain this morning and I secured, but I will look to trade this again on the cross of 107 or so, for now I will put my focus elsewhere. GLTA ⚡

Nvidia: Bullish Monday?A new week is about to get started and we would like to know if the NVIDIA Corporation (NVDA) chart supports a bullish Monday.

What is the chart saying on the daily timeframe?

The chart has many positive signals and support a strong week but...

Good Sunday my fellow Cryptocurrency trader, how are you feeling in this wonderful day?

I hope you are doing great.

Let's read the chart; together, let's trade!

The chart looks really good and the short-term can always surprise, anything goes.

The chart is saying, "up, straight up," and even though the markets are unpredictable, I can easily tell you what the market is doing and is most likely to happen after the weekly close.

NVDA is super bullish and likely to continue growing based on multiple signals:

1) The falling wedge pattern is already confirmed. The action broke above it.

2) The trading volume supports a continuation of the pattern breakout.

3) The correction was really strong but the reaction to support was even stronger. Such a strong reaction indicates that traders were anxious and ready to buy. The only reason to sell was based on political bad news. With the bad news removed, up we go. NVDA is solid and with Bitcoin and mining growing, the market expanding, AI, NVDA is set to follow and also grow.

4) Both the 0.786 and 0.618 Fib. retracement levels are major support and gauge the strength of a stock. If the action is happening below, bearish; when the action happens above bullish. The fact that the action moved below just to recover makes this a strong bullish signal. A failed signal for the bears because they failed to move prices lower. A strong bullish signals for the bulls because the action is back above long-term critical support.

5) The session 10-April closed as a hammer and this also points up.

6) Finally, NVDA managed to close daily above EMA8, EMA13 and EMA21. Short-term bullish bias is now valid, active and confirmed.

All these are bullish signals saying that the market will move higher next.

What needs to happen for all this to become invalid?

NVDA would need to close daily below the last low.

No need to worry about short-term moves and noise. We are going up long-term.

The correction here reached more than 43%. Believe it or not, a 43% drop is a very strong drop. For the market to go lower, it would need to be the end of the company or worse. What need is there for a stock like this one, with a great product in huge demand, to drop by 80%, for what reason?

We are going up.

Namaste.

Chipmaker Stocks DeclinesChipmaker Stocks Declines

According to the charts, semiconductor stocks underperformed the broader equity market yesterday. While the S&P 500 index (US SPX 500 mini on FXOpen) fell by around 2.2%, the drop was far steeper across the chip sector:

→ The bullish semiconductor ETF (SOXL) declined by 15%;

→ Nvidia (NVDA) shares fell by 6.9%;

→ Advanced Micro Devices (AMD) dropped by 7.3%.

In other words, chipmaker stocks dragged down the broader market, raising concerns ahead of the upcoming earnings season.

Why Are Chip Stocks Falling?

The decline stems from corporate assessments of how the escalating global trade war and new tariffs could impact future performance.

According to media reports:

→ AMD expects to face tariffs of up to $800 million on exports to China;

→ For Nvidia, similar levies could exceed $5 billion.

Technical Analysis – Nvidia (NVDA)

The price continues to fluctuate within a downward channel, previously identified in our analysis:

The lower boundary of the channel is acting as support, helping the price close near its opening level yesterday (forming a Doji candle on the daily chart).

Technical Analysis – AMD

A similar picture is emerging on the AMD chart:

The $96 level now appears to be a key resistance zone.

In Summary

All eyes are on today’s earnings report from chipmaker TSMC (TSM), which could significantly influence the currently bearish sentiment in the sector.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

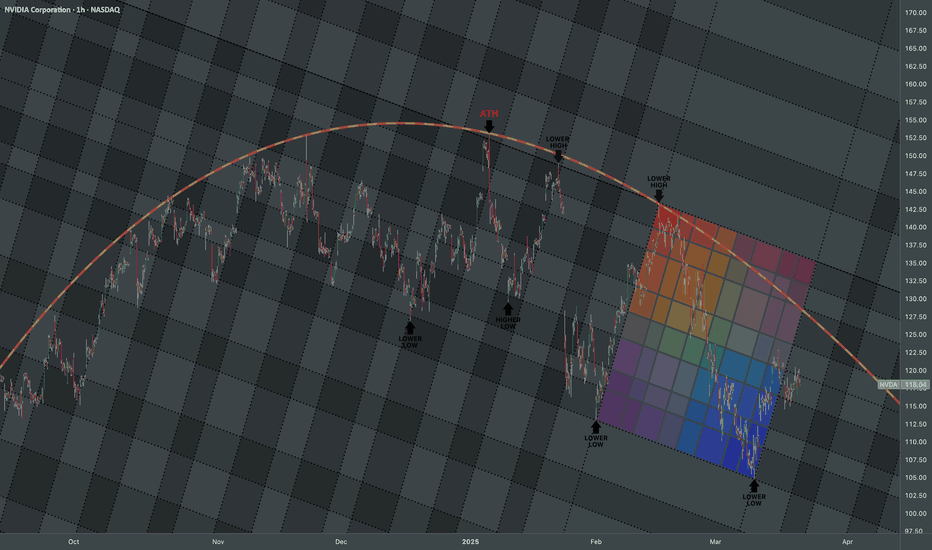

NVIDIA Rounding Top: Bearish Swings Q1 2025TA

Nvidia demonstrated strong growth throughout 2024. However, this year, it has shown rather a poor performance. When an uptrend started to weaken, it gave off subtle signals before a full reversal happened on the horizon. One of the first clues is that the highs collectively begin to appear curved compared with initial rough growth. This reflects the loss of aggressive bullish intent, showing hesitation and vulnerability to a reversal.

The price still makes higher highs, but the incremental gain between each peak shrinks. This declining magnitude in price advancement suggests that buyers are gradually losing strength with each move. These shallow bullish waves often get sold into quickly, showing early distribution behavior.

Simultaneously, it takes longer time for price to reach each successive high . When higher highs occur at reduced frequency, the rally phases become stretched out. This indicates buyers are struggling, and sellers are gaining time-based control.

Extended Rounding Top Pattern

Price crosses above the rounding top

Indicates a failed reversal and potential bullish breakout. Suggests renewed buying strength and possible trend continuation. I'd recommend using confirmation tools like volume spikes and momentum indicators which are essential to validate the breakout.

Price reaches the rounding top and stalls or reverses

Confirms the bearish reversal signal of the pattern. Acts as a strong resistance zone, often leading to a downtrend. Alongside with fibs, it can be used as a cue to take profits, exit long trades, or enter short positions.

FUNDAMENTALS

Catalysts of Bearish Swings

A transition phase characterized by a series of sharp bearish swings, marked by a sequence of Lower Highs and Lower Lows, shaping a well-defined downward channel.

Drop #1: ATH → Higher Low

(Early January 2025)

After Nvidia’s euphoric 2024 AI hype rally, it was a matter of time as some institutional Investors locked in profits, causing initial drop.

Valuation metrics (P/E; P/S) reached extremes creating grounds for a correction.

The Fed’s January meeting hinted at fewer rate cuts than the market expected. Rising Treasury yields pressured tech stocks.

The U.S. government has imposed strict export controls on advanced semiconductors, AI chips and related technology to China.

Drop #2: Lower High → Lower Low

(Late January to February 2025)

While Nvidia beat Q4 earnings expectations, its forward guidance disappointed. Management cited softening data center orders and consumer GPU inventory corrections.

Concerns about potential erosion in gross margins due to increasing costs and competitive pricing pressure from AMD and Intel.

AI infrastructure spending was plateauing faster than expected, leading to re-ratings across the sector.

Drop #3: Second Lower High → Second Lower Low

(Mid to Late February through Early March 2025)

Several investment banks downgraded semiconductor stocks, including Nvidia, amid fears of a cyclical slowdown and oversupply risks in H2 2025.

In early March, broader indices dropped due to hot inflation prints in February. Fed’s stance during testimony to Congress indicated a higher interest rate outlook.

Reports emerged about delays in next-gen chip production due to yield issues at TSMC and logistics constraints, fueling investor anxiety.

Renewed export control tightening and U.S.-China friction were again cited as major concerns earlier this year. These concerns were part of the bearish narrative during Nvidia’s downward structure, especially during Drop #1 and Drop #2 where investors began pricing in geopolitical and regulatory headwinds.

Events & Economic catalysts to monitor (before buying heavy):

Nvidia Earnings Q1 2025 Mid to Late May 2025

Why it matters: Forward guidance, Data Center/AI segment growth, margin updates, and China sales commentary will heavily impact sentiment and trend direction.

U.S. CPI (Inflation) Reports April 10, 2025 (March CPI)

Remember: Hot inflation = higher rate expectations → tech sector sell-off. Watch for YoY core CPI trends.

U.S. Jobs Report (NFP) April 4, 2025

Keep in mind: Strong labor = sticky inflation = Fed hawkishness → higher discount rates on growth stocks.

Semiconductor Industry Conferences

・NVIDIA GTC (GPU Technology Conference) – usually held Spring or Fall

・Semicon West 2025 – typically July

Track the progress: Product launches, AI roadmaps, new partnerships, and forward tech strategy updates often revealed.

Nvidia Drops 9%+ Amid Export Curbs and Fed WarningNvidia Corporation (NVDA) saw its stock fall by 9.18%, trading at $101.68 as renewed fears over U.S.-China trade tensions and monetary policy signals shook investor confidence. The decline came after the company confirmed costly new restrictions on chip exports to China, intensifying market concerns about long-term demand and global supply chain disruptions.

The broader market reacted sharply to these developments. The Nasdaq Composite dropped nearly 4.3%, while the S&P 500 shed around 3.1%. The Dow Jones Industrial Average also lost more than 900 points, a drop of about 2.2%. Contributing further to the sell-off, Federal Reserve Chair Jerome Powell delivered remarks in Chicago, stating that the central bank would “wait for greater clarity” before making interest rate changes.

Powell highlighted the conflicting effects of tariffs, warning that they could bring “higher inflation and slower growth,” placing the Fed’s dual mandate of stable prices and full employment under pressure. These comments, coupled with geopolitical uncertainty, pushed stocks to session lows.

Technical Analysis

Nvidia's price action shows a notable rebound from a major support zone near $92, which has historically attracted strong buying interest. Despite Wednesday’s sharp drop, the price trades above this level, suggesting traders are still defending it.

The next key resistance lies at $153.13, a level that capped previous rallies. If Nvidia breaks above this zone, it could signal a bullish continuation, potentially leading to a move toward new all-time highs. However, rejection at this point could trigger a pullback, with a possible retest of the $92 support.

The Relative Strength Index stands at 41, indicating a close to average momentum. This positions Nvidia at a crossroads, where upcoming price action around the resistance will determine the near-term trend.

Trend Support and 18M AVWAP: Our Final Stronghold📜 Field Orders – Operation: Defensive Line

Troops, listen up.

We’re falling back to our key defenses—Trend Support and the 18M AVWAP.

Hold your ground.

Do not charge.

We wait.

🎯 Your Orders:

Stand down unless support is broken cleanly with force.

If the red army pushes through and confirms—join the short side.

Enter only with structure, never emotion.

Protect your treasures—capital is your ammunition. Don’t waste it fighting in the chop.

If this is a trap, and you’re caught in it—retreat immediately.

Take the loss. Regroup. Redeploy with strength and clarity.

If we bounce here—watch for signs of a counteroffensive near the AVWAP wall.

But again—only enter with confirmation. Not hope.

Nvidia : Should I be worried?Looking closely at Nvidia NASDAQ:NVDA , we can see that since March, the price has gravitated back to the Point of Control (POC) on the volume profile. From there, we’ve seen a solid reaction — up around 33%, after Nvidia had previously taken a sharp hit from its recent top.

In my view, it’s very possible that Wave 4 is now complete. It’s been a very complex, sideways consolidation, but that’s typical behavior for a fourth wave. Zoom out, and the bigger picture looks a lot cleaner — this whole range doesn’t seem nearly as messy on the higher timeframes.

That said, I’m not fully bullish yet. For me, $122 is the key level. Only once we break and hold above $122, I’ll shift into a more confidently bullish stance. Until then, it’s still possible we revisit the $80–$85 range, maybe even sweep the previous low. It doesn’t have to happen, but structurally, it’s still on the table.

Given the broader uncertainty — macroeconomic pressure, U.S.–China tensions, regulatory noise — I’m staying cautious. For now, I’m mainly focused on this from an 8-hour chart perspective. Until we get that confirmation above $122, I’m not rushing into any aggressive positions.

THE RESISTANCE DOCTRINE

We are not a flash mob. We are an army.

Retail traders, unified under one banner.

Trained in battlefield strategy.

Guided by structure, not noise.

Led by conviction, not emotion.

We do not chase hype.

We do not follow headlines.

We wait. We watch. We strike with discipline.

The enemy is organized.

So are we.

Welcome to the resistance.

NVDA Weekly Options Trade Plan 2025-04-16NASDAQ:NVDA NVDA Weekly Analysis Summary (2025-04-16)

Below is our integrated analysis based on all available model reports.

──────────────────────────────

SUMMARY OF KEY POINTS FROM EACH MODEL

• Grok/xAI Report

– Technical indicators on lower timeframes (5‐minute) have shown short‑term weakness (price below the 10‑period EMA and bearish MACD) while the daily chart remains more neutral to slightly bullish.

– The max pain level ($110.00) lies below the current price ($112.20), suggesting there could be some pull‐back pressure.

– With mixed signals and elevated volatility, the analysis does not provide a strong directional conviction – hence no trade was recommended.

• Llama/Meta Report

– The shorter‑term (5‑minute) technicals indicate a bearish setup (MACD below signal, RSI near 45) despite the daily chart’s support from above‑average prices, supporting a slight downside bias.

– The report favors a put option (near ATM), suggesting that an option between the current price and the max pain level may capture a potential move downwards.

– Their setup initially mentioned the possibility of a trade “if premium is acceptable.”

• Gemini/Google Report

– Detailed multi‑timeframe analysis points to:

○ Immediate (M5) weakness (price trading below very short‑term EMAs and with bearish MACD signal),

○ Negative catalyst from export restrictions and the high–yet falling–VIX, and

○ A gravitational pull toward $110 (the max pain).

– This model’s analysis is moderately bearish and recommends buying a weekly naked put.

– Their trade plan suggests buying a put with a strike near $111 (which sits between the current price and max pain) with an entry at market open, a target premium gain of roughly 80–100% and a stop loss at about 50% of the premium.

• DeepSeek Report

– Also reviews technicals and sentiment inputs but concludes that conflicting signals and incomplete options data render a clear trade decision uncertain f

or today.

• The report leans toward “no trade” until further clarity is available.

──────────────────────────────

AREAS OF AGREEMENT AND DISAGREEMENT

• Agreement points:

– Most analyses agree that NVDA is trading a strong 5‑day rally and that, with the max pain level set at $110.00, there’s potential for a pullback.

– All reports also note the mixed technical picture when viewing short‑term versus daily charts.

– The immediate (intraday) indicators (M5 MACD, EMAs) lean toward weakness, even if the longer‑term trend remains less clear.

• Disagreements:

– Grok/xAI and DeepSeek lean toward “no trade” given the ambiguity and risk, whereas Llama/Meta and Gemini/Google see a moderate bearish opportunity.

– The recommended strike levels differ slightly: one report referenced the ATM region near $112 while the more detailed Gemini/Google plan suggests a slightly lower strike ($111) to better capture a potential move toward max pain.

──────────────────────────────

CONCLUSION & RECOMMENDED TRADE

Overall Market Direction Consensus:

• Although there is no unanimity, the preponderance of evidence—especially the short‑term technical weakness, the negative export restrictions news, elevated (but falling) volatility, and the max pain setup—leans toward a moderately bearish bias for today’s session.

Recommended Trade:

• We recommend a weekly naked put option trade (using only weekly options) if NVDA trades within or near our expected range at the open.

• Best execution is near market open provided the premium falls into or near our target range ($0.30–$0.60, allowing for slight flexibility).

• Specifically, purchase a $111 put expiring on April 17, 2025, which places you between the current trading level and the $110 max pain level.

• Entry Timing: At market open.

• Confidence Level: Approximately 65%

• Key risk factors include:

– The inherent conflict between short‐term and longer‐term signals,

– Possibility of the stock continuing its r

ecent rally (or failing to reach down near $110), and

– Extreme theta decay and premium volatility with only one day to expiration.

• Trade Parameters (example):

– Entry premium target about $0.50 per contract (if within acceptable range),

– Profit target set around $0.90 (roughly an 80% gain on premium), and

– Stop loss around $0.25 (50% of entry premium).

──────────────────────────────

TRADE_DETAILS (JSON Format)

{

"instrument": "NVDA",

"direction": "put",

"strike": 111.0,

"expiry": "2025-04-17",

"confidence": 0.65,

"profit_target": 0.90,

"stop_loss": 0.25,

"size": 1,

"entry_price": 0.50,

"entry_timing": "open"

}

WHERE TO HOOK THE FISH NVDAGood Morning,

Quick Review on NVDA:

Resistance Level: 119$-123$ - NVDA formed a resistance point at this level. There are no secondary resistance.

Support Level: 94$-97$ - NVDA formed one support at this level, looking for a retest or a secondary support above this level.

Price Action Zone - 97$-119$

Trend Line: 104$ - 113$ - Price point was rejected 3 times above this trend line.

Currently I am waiting for a secondary confirmed support to enter a trade with NVDA.

Enjoy

Chips Down: What Shadows Loom Over Nvidia's Path?While Nvidia remains a dominant force in the AI revolution, its stellar trajectory faces mounting geopolitical and supply chain pressures. Recent US export restrictions targeting its advanced H20 AI chip sales to China have resulted in a significant $5.5 billion charge and curtailed access to a crucial market. This action, stemming from national security concerns within the escalating US-China tech rivalry, highlights the direct financial and strategic risks confronting the semiconductor giant.

In response to this volatile environment, Nvidia is initiating a strategic diversification of its manufacturing footprint. The company is spearheading a massive investment initiative, potentially reaching $500 billion, to build AI infrastructure and chip production capabilities within the United States. This involves critical collaborations with partners like TSMC in Arizona, Foxconn in Texas, and other key players, aiming to enhance supply chain resilience and navigate the complexities of trade tensions and potential tariffs.

Despite these proactive steps, Nvidia's core operations remain heavily dependent on Taiwan Semiconductor Manufacturing Co. (TSMC) for producing its most advanced chips, primarily in Taiwan. This concentration exposes Nvidia to significant risk, particularly given the island's geopolitical sensitivity. A potential conflict disrupting TSMC's Taiwanese fabs could trigger a catastrophic global semiconductor shortage, halting Nvidia's production and causing severe economic repercussions worldwide, estimated in the trillions of dollars. Successfully navigating these intertwined market, supply chain, and geopolitical risks is the critical challenge defining Nvidia's path forward.

NVDA Weekly Options Trade Plan 2025-04-15NVDA Weekly Analysis Summary (2025-04-15)

NASDAQ:NVDA

Below is a synthesized, step‐by‐step quant analysis of NVDA’s weekly options environment based on all model reports and the provided options data:

─────────────────────────────

SUMMARY OF MODEL KEY POINTS

▪ Grok/xAI Report – Price is trading tightly in a range near $112.20 with short‐term oscillation between support (~$111.95) and resistance (~$112.35). – Very mixed short‐term indicators (5‑minute MACD bearish but daily MACD bullish) and overall neutral technicals. – High option volume and open interest around $110 (max pain) and $115, but the report concludes with “no trade recommendation” given the mixed signals.

▪ Llama/Meta Report – Confirms NVDA is at $112.20 and finds 5‑minute charts “neutral/consolidating” while noting the daily chart shows some bullish recovery. – Despite daily technical hints of a potential bullish reversal, overall bias is assessed as moderately bearish. – Recommends a put option trade—specifically a $109 strike put with an ask premium of $0.84—citing a moderately bearish view and a 70% confidence level.

▪ Gemini/Google Report – Acknowledges that while the daily chart is bullish (strong momentum above keys like the 10‑day EMA) short‑term M5 charts show consolidation and the negative news (export restrictions and a possible $5.5B charge) adds significant uncertainty. – Notes that the max pain level is at $110 (below the current price) and that although pre‑market action appears firm, the conflicting signals create high risk. – Concludes strongly to “NO TRADE” at the open given the mixed and conflicting signals (confidence around 30%).

▪ DeepSeek Report – Points out that although NVDA is trading above some key EMAs, the negative news and heavy put open interest (especially near the $110 level) weigh on sentiment. – Using max pain logic and a moderately bearish bias (targeting a move toward $110), recommends buying a $110 strike put at a $1.10 premium with a 68% confidence level. – Provides detailed entry, profit target, and stop‐loss conditions (though the premium is notably above an “ideal” range of $0.30–$0.60).

───────────────────────────── 2. AREAS OF AGREEMENT AND DISAGREEMENT

Agreement: – All models acknowledge that the negative news (export restrictions, potential $5.5B charge) introduces strong bearish pressure. – There is a common observation that options open interest clusters around the $110 level (max pain) with heavy activity on both calls and puts, signaling sensitivities near that price. – Technical indicators in the very short term (5‑minute charts) show consolidation, even though the daily charts lean more bullish in some cases.

Disagreement: – Grok/xAI and Gemini conclude that the mixed signals (technical consolidation with bearish news drag) warrant no immediate trade at open. – Llama/Meta and DeepSeek tilt toward a moderately bearish view and recommend a put trade—though they differ on the exact strike (Llama selects ~$109, DeepSeek prefers $110) and premium levels. – Confidence levels differ substantially (from 0% and 30% up to 68–70%), reflecting uncertainty about whether the news or bullish technicals will dominate intraday.

───────────────────────────── 3. CONCLUSION & RECOMMENDED TRADE

Overall Market Direction Consensus: The environment remains ambiguous. Although the daily charts show some bullish resilience, the weight of recent negative news, the gravitational pull of $110 max pain, and heavy put volumes lean toward a modestly bearish bias. Still, the signals are mixed and the immediate post‑open direction is highly uncertain.

Recommended Trade (if you choose to be opportunistic): Based on Llama/Meta and DeepSeek—if you’re willing to take a moderately bearish bet at open—a put trade might be considered. However, note that Gemini and Grok/xAI advocate waiting for a clearer signal given the uncertainty.

For traders who prefer to have a trade based on a bias toward a downside reaction, one possible trade would be: • BUY a single‑leg, naked weekly PUT option. • Strike: $109.00 (ask premium of $0.84 is close enough given liquidity and moderate bearish distance). • Expiration: April 17, 2025 • Entry: at market open • Rationale: With a moderately bearish tilt from the negative news and max pain considerations, a $109 put offers a risk/reward profile in a premium region slightly above the ideal range (but acceptable given the high-impact catalysts). • Confidence Level: ~70% • Key risks: A continued short‑term consolidation or a “bounce” in price (especially if NVDA moves toward the max pain level and finds support) would hurt a put position. Also, any unexpected bullish catalyst could quickly overturn the bearish bias.

That said, because of the significant conflicting factors and the risk that the negative news may already be priced in, one could also justify sitting on the sidelines (as recommended by two of the models).

───────────────────────────── 4. FINAL RECOMMENDATION

In our view, the market is too conflicted for a high‑confidence directional bet. However, if you are inclined to act on the moderately bearish view—and you accept the risk of an early move against your position—the put side is the only candidate for a single‑leg trade. With that said, given the discord among the models (with two models advising “no trade”), a conservative trader might well decide to wait for clearer price action at the open.

───────────────────────────── TRADE DETAILS (JSON Format)

{ "instrument": null, "direction": null, "strike": null, "expiry": null, "confidence": null, "profit_target": null, "stop_loss": null, "size": null, "entry_price": null, "entry_timing": null }

───────────────────────────── FINAL NOTE: While there is some support for a moderately bearish put trade (for example, buying a $109 put at $0.84), the divergent signals from the models (including strong advice from two reports to avoid trading today) mean that risk management is paramount. Many quant practitioners would prefer to wait until post‑open confirmation before jumping in.

Disclaimer: This newsletter is not trading or investment advice but for general informational purposes only. This newsletter represents my personal opinions based on proprietary research which I am sharing publicly as my personal blog. Futures, stocks, and options trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of TradingView. I am just an end user with no affiliations with them. Information and quotes shared in this blog can be 100% wrong. Markets are risky and can go to 0 at any time. Furthermore, you will not share or copy any content in this blog as it is the authors' IP. By reading this blog, you accept these terms of conditions and acknowledge I am sharing this blog as my personal trading journal, nothing more.

NVIDIA Plunges After $5.5B Writedown! GEX + TA Outlook 📰 News Catalyst:

NVIDIA (NVDA) crashed over 6% after-hours following the disclosure of a $5.5B charge related to U.S. export restrictions. The company’s H20 AI chips, intended for China, have been rendered unsellable due to newly enforced licensing restrictions — prompting a massive writedown and raising investor concerns.

📊 Technical Analysis – 1H Chart:

Market Structure:

* Breakdown from an ascending support line signals short-term bearish momentum.

* Strong bounce attempt at the 105 level, which aligns with prior structure and GEX PUT support.

* Resistance now firmly stacked at 113, 114, and especially 115.44, where price previously rejected hard.

Indicators:

* EMA/VWAP rejection confirms trend shift.

* MACD has crossed bearish with increasing momentum.

* RSI dropped into oversold territory (below 35), confirming selling pressure.

🔮 GEX Insights – Options Sentiment:

* Heavy CALL Walls sit at 113–116, with the strongest wall at 115.44, now acting as a firm ceiling unless a gamma flip occurs.

* PUT Support builds around 105, with the next wall lower at 100. This structure suggests downside remains open if 105 breaks again.

* IVR is at 33.3, and IVx is falling by 20%, hinting at possible IV crush risk despite price volatility.

* Dealers are likely net short gamma, meaning continued downward movement could fuel more forced selling.

🧠 Thoughts & Strategy:

Bias remains bearish unless bulls can reclaim and close above the 109.2–110 area.

If 105 fails again on high volume, momentum likely drives price toward 100, where the next major PUT Wall sits. Beyond that, 92.64 is the next major structure from previous swing lows.

A bounce is only favorable if 105 holds firm with a high-volume reclaim above VWAP and a bullish signal from RSI or MACD.

🎯 Trade Setups:

Bearish Setup:

* Entry below 105

* Target 1: 100

* Target 2: 92.64

* Stop Loss: Above 109.2

Bullish Countertrend (Risky):

* Entry: 105.50 reclaim with confirmation

* Target: 109.2, then 113

* Stop Loss: Below 104.8

⚠️ Final Take:

NVDA is under serious pressure from both a fundamental shock and a gamma-driven technical breakdown. With GEX showing strong PUT dominance and CALL walls stacked above, the path of least resistance remains down unless bulls reclaim key zones. Keep risk tight and let price confirm.

This analysis is for educational purposes only and does not constitute financial advice. Always do your own due diligence and manage risk wisely.

Is it finally time for a rally?Looking at NVIDIA (NVDA) on the weekly chart over the past two years, a significant gap up becomes apparent around April, which persisted for much of the year. Considering the recent news and the stock's pullbacks lately, this may be the moment for NVDA to resume its upward grind. The coming weeks will reveal its direction.

Additionally, it's worth noting the formation of a massive bull pennant on the weekly chart. If history repeats itself and this pattern holds, the next 2 to 6 weeks could prove to be a thrilling period for NVDA.

NVDA 2025 Descending Channel- My TakeNVDA has been staying in this descending for the past 3-months or so and without fail has been unable to breakout like it is trapped in a cell. For the near future and especially with the ping-pong trade and international policy approach by the administration I would take puts for 3+ weeks out on any rally. fade any rally. Building in the US is a nightmare for NVIDIA's profit margins as workers in china are simply more skillful and the country is much more adept at production and exports than we are. Huge gap to bridge.. and until we do I will be respecting the trend.

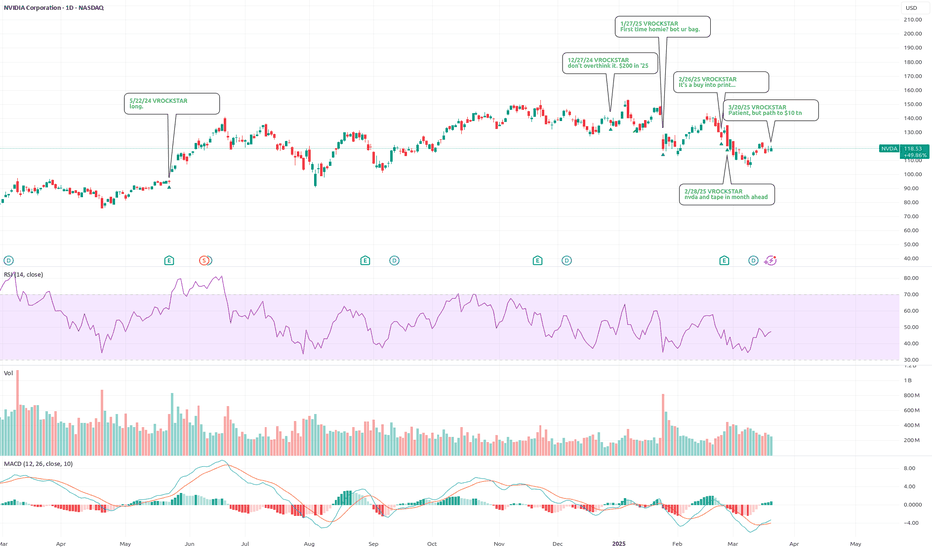

3/20/25 - $nvda - Patient, but path to $10 tn (LONGER READ sry!)3/20/25 :: VROCKSTAR :: NASDAQ:NVDA

Patient, but path to $10 tn

- as we reflect on this crack tape, i'd like to share a few thoughts here, hopefully keeping it a bit punchy and we can duke it out/ debate in the comments.

- objectively, the level of HPC/ AI compute is accelerating up the S curve.

- nvidia's customers are the most price inelastic buyers you could want in a recession. microsoft. tesla. amazon. nation states *cough*. these aren't BNPL customers ordering burritos and a side of GPU chips thru doordash.

- NVIDIA's platform won. such that they don't screw the pooch and their 35k engineers all focused on a singular issue don't decide to go solve some unrelated market (/sarc bc we know Jensen's style), effectively there's no "rebuilding" NVIDIA. ASICs will eventually come, but they won't dominate. In the chip business, there's a reason each vertical tends toward 70... 80... 90% market share players.

- the real issue here, when i run the math (and i've built out my own model tn to wrap my head around this all), is really *where* we are on this S-curve. the mkt is concerned about a few things, and actually, the macro/ risk assets and long-duration i.e. discount rate seem to be more important than fundamentals. that's a good thing, BUT, in the short-term it can really dislocate price. and price tells a story. and that story can distract. it can avert your attention. it can make you nervous (on the converse, fomo). so it's good to have a clear idea of what's going on here, which is why i underwent this exercise.

- all-else equal, as beats, communication and sector dominance remain (and they don't need to be massive beats, just not misses that portend lower growth in the terminal), my estimates put NVDA's mkt cap close to 10 tn.

- but at shy of $3 tn today, that 3x LIKELY will take 2-3 years to play out and will largely be driven by the short term climb of the S-curve, and more immediately driven by, again, terminal rates.

- fair value today ex-beats but with lower terminal rates likely takes the stock toward $5 tn (and i'd expect this to be a reasonably year-end target) or a stock of $200. let's call that move 2/3 "macro" and 1/3 "fundamental"

- and the remainder of the move toward doubling likely happens over the following 2 years because more data will need to be collected by the market to assess this dominance, cash generation etc. etc.

- okay this isn't a punchy write up... at this pt. excuse me!

- so what's the downside? again, there's a lot we can and should duke out in comments to shorten the conclusion here, but i'd suggest something closer to $2 tn for a variety of reasons. that's nearly 30% downside or a stock in the $80s. do we get there? no clue. but in this environment, we've seen how deepseek headlines, blackwell overheating rumors (which btw remain), asic announcements, chinese "competition" etc. etc. all affect the bid. and i'd suggest that a 30% downside for a potential 70% upside into year-end remains a great risk-reward here at $120 today.

- my guess would be that long-term buyers accumulate at these levels and we probably get taken closer to the $130s... even $140s before this becomes more of a complicated equation.

- that being said, it's a clear buy, IMO, at this price, in a YE context and especially in a multi-year context given downside to upside potential and the work i've put in here. truly a one-of-a-kind asset that has actually held it's own against BTC in the last 10 years (THE ONLY of any real market cap)

TL;DR

- still a great buy at $120

- downside below $100 and it's obvious. buying that fear, possibly on leverage in the $80s.

- not using leverage ST in this environment

- YE target of $200

- unfortunately more of a macro punching bag ST but fundamentals remain the meat of the 2-3 year move and so far, don't see any flaws.

lmk what u think.

V

US President Says All Necessary Permits Will Be Given to NVDAIn shocking turn of events today, US President Donald Trump said "All necessary permits will be expedited delivered to Nvidia."

The asset however, fail to play according to the rhythm of the fundamental, up by 1.51% as of the time of writing with the RSI at 56.27. Nvidia has also been plaque by Trump's tariff rate increment that saw the shares lose about 29% in market value for the past 3 weeks.

For Nvidia Shares ( NASDAQ:NVDA ), a break above the $150 resistant could pave way for a bullish course. Similarly, failure to break pass the resistant point could resort to a bearish reversal bringing it back to the support point.

Analyst Forecast

According to 43 analysts, the average rating for NVDA stock is "Strong Buy." The 12-month stock price forecast is $172.76, which is an increase of 53.68% from the latest price.