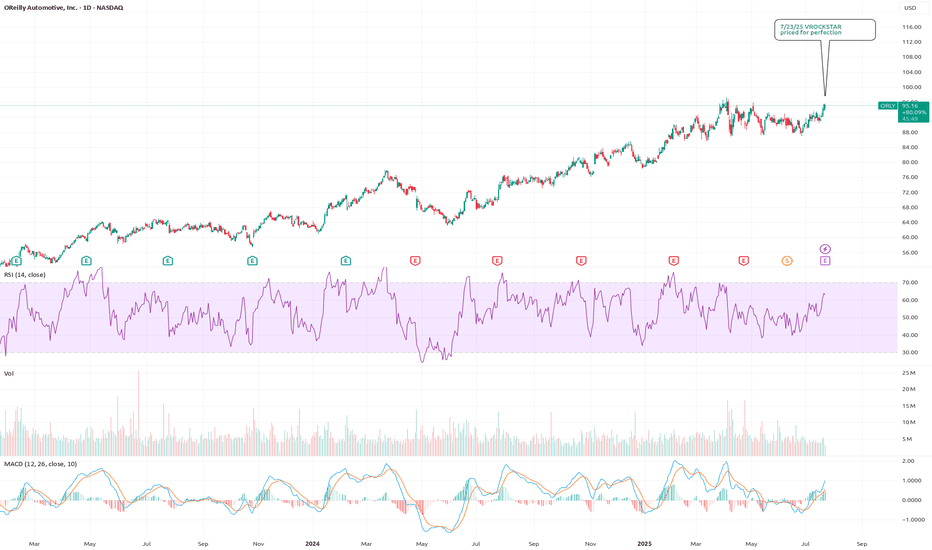

7/23/25 - $orly - priced for perfection7/23/25 :: VROCKSTAR :: NASDAQ:ORLY

priced for perfection

- hard to not consider this as a hedge to my NYSE:DECK long (into tmr print)

- stock has had series of weak Q's

- google trends remains meh

- stock not cheap at <3% fcf yield (staples closer to 3.5%+)

- IV on the chain seems lazy... not pricing in much move

- i'd sense that the upside is quite limited and the downside is probably 2-3x the upside

- so while it's not a 9/10 idea (like the push i made on say BOATS:FI after the open this morning - which worked very well and now back to a comfy spot w ITM leaps)... it's a nice filler position on the hedge side, i think

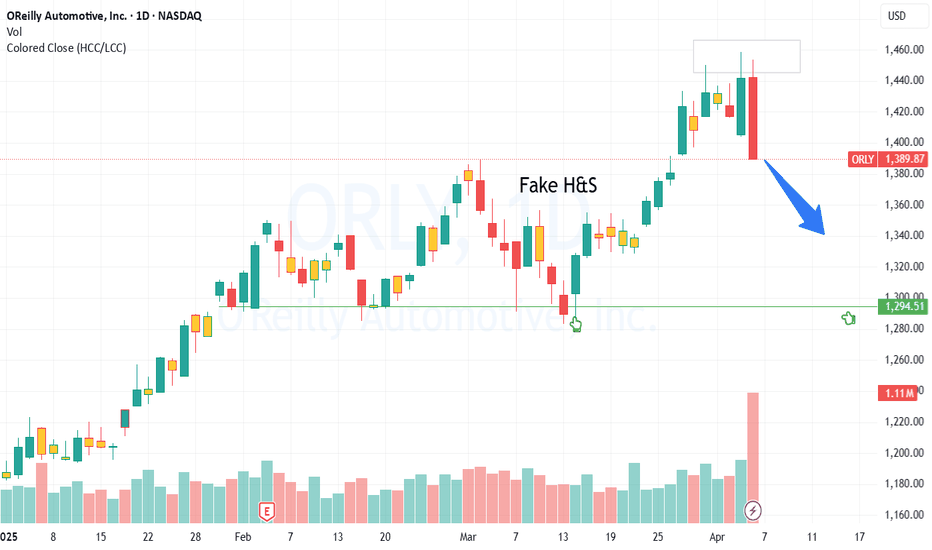

- and honestly it's also a situation where we flip the river card and the stock rips on mediocre restuls... and that tired stock chart just wants to flip bearish, even if it's just a temporary pause before heading higher

- i look at this and i know the personalities that own it

- i'll take under, fam

V

ORLY trade ideas

Looks certain to test previous high at 1450 areaAfter a turbulent week, as things start to normalize a bit, the oversold areas are continuing to step up further. The one thing that stands out is the last candle beating the previous high, as pointed out on the arrow, but also testing resistance. This shouldn't be a great area of concern for bulls until it breaks through and retests the 52-week high.

OReilly Long!I've entered a long position in $ORLY. Since this US stock reached its high in late July of this year, it has been continuously in a sideways correction, which is very bullish. In the last few trading days, it broke out of this channel to the upside and re-tested it on the last trading day.

The price is currently supported by the 38.2% Fibonacci level, the upper boundary of the broken channel, and the moving averages are catching up.

Let's see if this setup plays out as expected.

O'Reilly Automotive Hit All-Time High In March, Nosedived AprilOn March 21, O'Reilly Automotive ( NASDAQ:ORLY ) stock hit an all-time high at 1169.11. However, in April, the stock nosedived and is currently trading at $1074.27 on Friday's session, down by 0.81%.

Despite the confusion in the auto market, O'Reilly Automotive ( NASDAQ:ORLY ), a leading retailer of auto parts and services, may see sales and profit gains, as auto shoppers may opt to wait and see which way the market wind blows.

O'Reilly Automotive ( NASDAQ:ORLY ) stock has a Relative Strength (RS) Rating of 83, which jumped into the 80-plus percentile with an improvement on Monday. But then the stock Plummeted on Friday's trading session now trading in the oversold territory, with a Relative Strength Index (RSI) of 38.49.

RectangleRectangles are a horizontal consolidation pattern and is neutral pattern until broken.

Price is on the support line today.

Recent fall from a bearish Rising Wedge. Both lines slope up narrowing at the apex and represents too much supply within the wedge. This pattern is not valid unless the bottom line is broken. An area of support will usually catch price after a fall from a wedge.

Recent RSI Divergence. Price movement does not match RSI. Bearish divergences are measured on the RSI peaks. A Bullish Divergence is often measured on the valleys.

No recommendation

ORLY Entry, Volume, Target, StopEntry: with price above 964.58

Volume: with volume greater than 343k

Target: 1042 area

Stop: Depending on your risk tolerance; 938.80 gets you 3/1 Reward to Risk Ratio.

This swing trade idea is not trade advice and is strictly based on my ideas and technical analysis. No due diligence or fundamental analysis was performed while evaluating this trade idea. Do not take this trade based on my idea, do not follow anyone blindly, do your own analysis and due diligence. I am not a professional trader.

ORLY: some upside potential?A price action above 922 supports a bullish trend direction.

Bullish confirmation for a break above 956.

The target price is set at 984.00 (upper range of the linear regression channel pattern).

The stop-loss is set at 911.

Upside price momentum supports the bullish trend direction.

ORLY Long on Consolidation Break-Out🐂 Trade Idea: Long

🔥 Account Risk: 1.00%

📈 Recommended Product: Knockout

🔍 Entry: +/- 922.00

🐿 DCA: No

😫 Stop-Loss: 877.99 (898.75 for aggressive trade)

🎯 Take-Profit #1: 977.59 (50%)

🎯 Take Profit #2: -

🎯 Trail Rest: Yes

🚨🚨🚨 Important: Don’t forget to always wait for strong confirmation once possible entry zone is reached. Trade ideas don’t work all the time no matter how good they look. Do not get a victim of FOMO, there is always another trade idea waiting. 🚨🚨🚨

If you like what you see don’t forget to leave a comment 💬 or smash that like ❤️ button!

—

ORLY is in an overall uptrend and broke the consolidation trendline with a strong candle going into a bullish consolidation inside a small range. Entry should only be made if the daily candle remains outside the consolidation range (green box) today. If it falls back wait for another break-out and daily close.

—

Disclaimer & Disclosures pursuant to §34b WpHG

The trades shown here related to stocks, cryptos, commodities, ETFs and funds are always subject to risks. All texts as well as the notes and information do not constitute investment advice or recommendations. They have been taken from publicly available sources to the best of our knowledge and belief. All information provided (all thoughts, forecasts, comments, hints, advice, stop loss, take profit, etc.) are for educational and private entertainment purposes only.

Nevertheless, no liability can be assumed for the correctness in each individual case. Should visitors to this site adopt the content provided as their own or follow any advice given, they act on their own responsibility.

O'REILLY AUTOMOTIVE, INC bullish, broke the resistance levelComment:

O'REILLY AUTOMOTIVE, INC broke the resistance 753.90 level from August 2022 as well as resistance from of April 2022.

Ichimoku Trend Analysis ( AFOBAY STRATEGY):

- Kumo (Senko span A and B) up

- Kijun sen up

- Tenkan sen up

- Chiko span above candles

Next Scenario:

803.72 level is also a monthly pivot point.

5/25/22 ORLYOReilly Automotive ( NASDAQ:ORLY )

Sector: Retail Trade (Specialty Stores)

Market Capitalization: $39.973B

Current Price: $615.79

Breakout price: $621.50

Buy Zone (Top/Bottom Range): $609.20-$564.80

Price Target: $782.00-$788.00

Estimated Duration to Target: 406-418d

Contract of Interest: $ORLY 11/18/22 630c

Trade price as of publish date: $49.95/contract

ORLY.NAS_Swim Trading VZ Breakout_LongENTRY: 646.32

SL: 620.02

TP1: 672

TP2: 692

- ADX<20. Would like to be higher.

- RSI<50, >30. Prefer it to be above 50.

- Maintaining well at pivot point "P" and at 50% fib. level.

- Strength meter remains green indicating strength.

- RS showing increasing strength.

- 2 long shadow head red candles with volume on 30 Nov 2021 and 1 Dec 2021 is a concern.

- Entry based on breakout from VZ today but not a good closing.