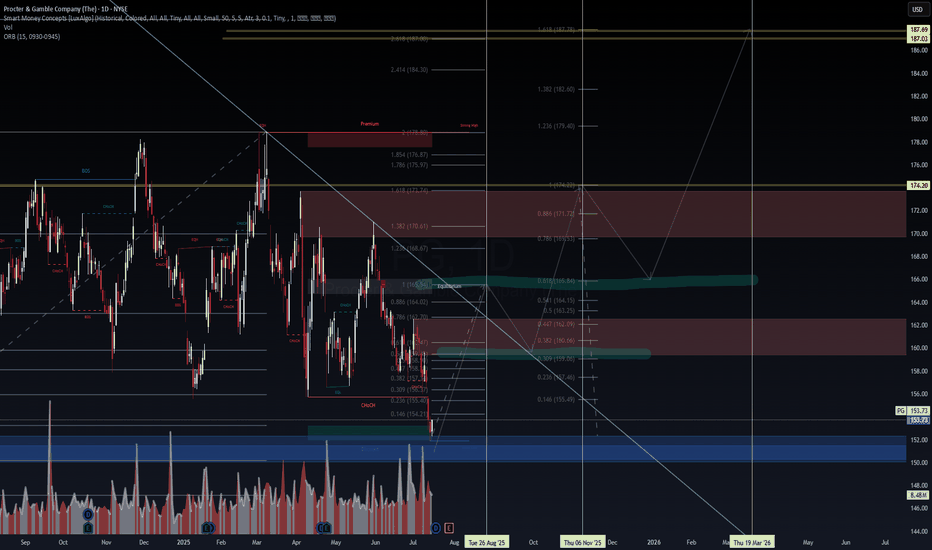

PG Approaching Oversold Discount Zone Ahead of Q4 Earnings BTFD?📝 Procter & Gamble (NYSE: PG) is trading at $153.73 (-10.8% YTD), lagging the S&P 500’s +6.5% YTD gain. Despite recent weakness, a confluence of technical support, dividend resilience, and a looming catalyst could signal a tactical entry. Let’s break it down:

🔍 Fundamentals & Catalysts

Q4 Earnings

Key facts today

Rothschild & Co Redburn lowered Procter & Gamble's price target to $155, keeping a neutral rating. Analysts have an average overweight rating with a mean target of $174.25.

425 ARS

9.18 T ARS

51.84 T ARS

About Procter & Gamble Company (The)

Sector

Industry

CEO

Jon R. Moeller

Website

Headquarters

Cincinnati

Founded

1837

ISIN

ARDEUT110335

FIGI

BBG000FSCHC7

The Procter & Gamble Company is focused on providing branded consumer packaged goods to the consumers across the world. The Company operates through five segments: Beauty; Grooming; Health Care; Fabric & Home Care, and Baby, Feminine & Family Care. The Company sells its products in approximately 180 countries and territories primarily through mass merchandisers, grocery stores, membership club stores, drug stores, department stores, distributors, baby stores, specialty beauty stores, e-commerce, high-frequency stores and pharmacies. It offers products under the brands, such as Olay, Old Spice, Safeguard, Head & Shoulders, Pantene, Rejoice, Mach3, Prestobarba, Venus, Cascade, Dawn, Febreze, Mr. Clean, Bounty and Charmin.

Related stocks

$PG - Charting is Therapeutic NYSE:PG forming solid base at $159 support after 15% pullback from Feb highs.

Strong fundamentals intact with 19% profit margins in Q3. Recent analyst actions positive RBC upgraded to BUY in April, Evercore just raised PT to $190 (19% upside).

Defensive consumer staple with reliable dividend (65

Bullish $PGNYSE:PG forming solid base at $159 support after 15% pullback from Feb highs. Strong fundamentals intact with 19% profit margins in Q3. Recent analyst actions positive - RBC upgraded to BUY in April, Evercore just raised PT to $190 (19% upside). Defensive consumer staple with reliable dividend (65%

Can P&G Weather the Economic Storm?Procter & Gamble, a global leader in consumer goods, currently faces significant economic turbulence, exemplified by recent job cuts and a decline in its stock value. The primary catalyst for these challenges stems from the Trump administration's tariff policies, which have directly impacted P&G's s

Procter&Gamble: Short-Term Strength Still Fits the PlanPG has extended its rally, pushing turquoise wave C higher. While some selling pressure is starting to show, we’re sticking with our primary view: the stock should still break above $180.43 to complete beige wave b before turning lower. However, in our 37% likely alternative scenario, beige wave al

PROCTER & GAMBLE: This volatility implies a major market bottom.Procter & Gamble is neutral on both the 1D (RSI = 47.822, MACD = 0.180, ADX = 17.832) and 1W (RSI = 49.820, MACD = 0.340, ADX = 20.781) technical outlooks as despite last week's rebound and this ones early strong rise, it pulled back and is about to close the 1W candle flat. We are exactly on the 1W

PG - Procter & Gamble Company (Daily chart, NYSE)PG - Procter & Gamble Company (Daily chart, NYSE) - Long Position; Short-term research idea.

Risk assessment: High {volume & support structure integrity risk}

Risk/Reward ratio ~ 1.33

Current Market Price (CMP) ~ 170.40

Entry limit ~ 169

1. Target limit ~ 174 (+2.96%; +5 points)

Stop order

Harmonically Bullish on Procter and Gamble. PGXABC bullish zigzag, within a structure harmonically consistent with a developing XABCD. In harmonic reactions, retracements are often indicative of extensions to follow, which in this case is 1.618. This conveniently aligns in a Fibonacci cluster with a .886 larger retracement, consistent with a Ba

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

PRGM

PROCTER&GAMBLE 20/50Yield to maturity

6.25%

Maturity date

Mar 25, 2050

PRGJ

PROCTER GAMBLE 17/47Yield to maturity

6.21%

Maturity date

Oct 25, 2047

US742718FJ3

PROCTER&GAMBLE 20/40Yield to maturity

5.72%

Maturity date

Mar 25, 2040

US742718DB2

PROCTER GAMBLE 2034Yield to maturity

4.90%

Maturity date

Aug 15, 2034

US742718GN3

PROCTER&GAMB 25/35Yield to maturity

4.85%

Maturity date

May 1, 2035

US742718GL7

PROCTER&GAMB 24/34Yield to maturity

4.83%

Maturity date

Oct 24, 2034

XS15860308

PROCTER GAMBLE 02/33Yield to maturity

4.82%

Maturity date

Jan 19, 2033

US742718GG8

PROCTER&GAMB 24/34Yield to maturity

4.78%

Maturity date

Jan 29, 2034

US742718DF3

PROCTER GAMBLE 07/37Yield to maturity

4.76%

Maturity date

Mar 5, 2037

US742718FY0

PROCTER&GAMB 23/26Yield to maturity

4.70%

Maturity date

Jan 26, 2026

US742718FM6

PROCTER&GAMB 20/30Yield to maturity

4.67%

Maturity date

Oct 29, 2030

See all PG bonds