RIOT breakout soon?Looking at the TA, there’s a wedge forming over the past few days – not the cleanest setup, so mind your risk. But take a look at the option flow: I’m clearly not the only one eyeing this move. A few whales have been scooping up calls, sizeably above the usual flow.

media.discordapp.net

media.discordapp.net

RIOTC trade ideas

Why Riot Stock Dropped After Q2 Earnings Despite Good NumbersWhen I first saw Riot Platforms' Q2 2025 earnings report, the numbers looked impressive at first glance. The company posted net income of $219.5 million, a dramatic turnaround from recent quarters. But as I dug deeper into the details, it became clear why the stock sold off despite what appeared to be strong results.

The most immediate red flag for me was the revenue miss. While Riot reported $153.0 million in revenue against the FactSet consensus of $156.3 million. Given Riot's recent track record of disappointing investors, this miss reinforced concerns about management's ability to meet their own guidance.

What really caught my attention, though, was the composition of that $219.5 million in net income. The company benefited from a massive $470 million gain on changes in Bitcoin's fair value, which was partially offset by a $158 million loss on contract settlements. This tells me that the earnings quality is questionable at best. Strip away the mark-to-market accounting gains from Bitcoin appreciation, and the underlying operational performance looks far less impressive.

I'm particularly concerned about the deteriorating unit economics in Riot's core mining business. The cost to mine each Bitcoin has essentially doubled to around $49,000 compared to $25,300 in the same quarter last year. This dramatic increase stems from the Bitcoin halving event and rising network difficulty, but it fundamentally undermines the investment thesis for Bitcoin miners. Even with Bitcoin trading at elevated levels, these higher production costs are compressing margins and eating into what should be a period of strong profitability.

In the previous quarter, Riot missed earnings estimates by over 260%, posting a net loss of $296 million. The company has now missed consensus estimates in three of the last four quarters, creating a pattern that's hard for investors to ignore. This track record of disappointing execution has clearly eroded confidence in management's ability to deliver consistent results.

In terms of hashrate, Riot only ranked #6 among public miners, after Mara, IREN, Cleanspark, Cango, and BitFuFu.

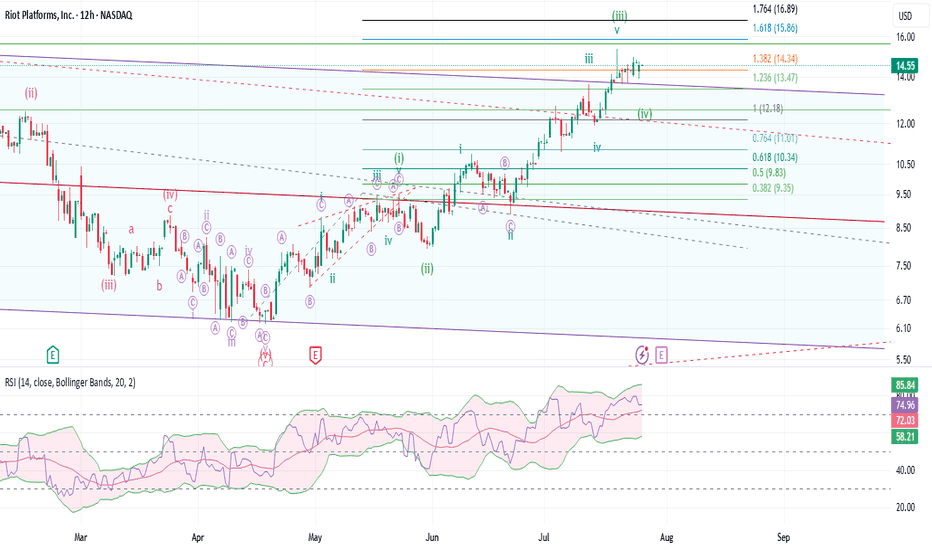

RIOT: Sideways is goodRIOT has broken above a very important downward channel dating back July of 2023. It is imperative that RIOT stays above the channel. The sideways consolidation while BTC and the crypto market corrects is a pretty good sign. Next week might be more of the same, maybe a bit more down to gain the momentum back for the last leg up. If we get the final move up, it will confirm a 5 waves sequence. The target would be between 2 to 2.618 extension between $18.68 to $24.33.

On the flip side, going back inside the channel would be a sign of weakness. Going back to $11 would be a confirmation of bull run end. All will depend on how the broader crypto market performs for the next 2 weeks or so.

RIOT: Looks pretty bad, but still has a chance to recoverBreaking down into the big bad channel maybe was the first warning of a false breakout. August first price action just made things a whole lot worse. The hope here is that RSI is tanked and has multiple pints of bullish divergence. But the bad news is, the overall price action is still a very 3 waves structure. If price falls into wave 1 territory, then it is pretty much game over. It could be a leading diagonal, or it could be another x wave to bring the price back down to the bottom of the channel yet again. BTC is also trying to maintain must keep support level. So, if next week we see a sharp recovery, then the 5 waves structure may still be intact. However, if price breaks down below $10, then best to stay out of it until things settle down. I took some profit at the top of the channel and got stopped out for most of my position for now. I will hold the rest with a stop at $9.5. If price recovers, then will ride the final wave towards $18.

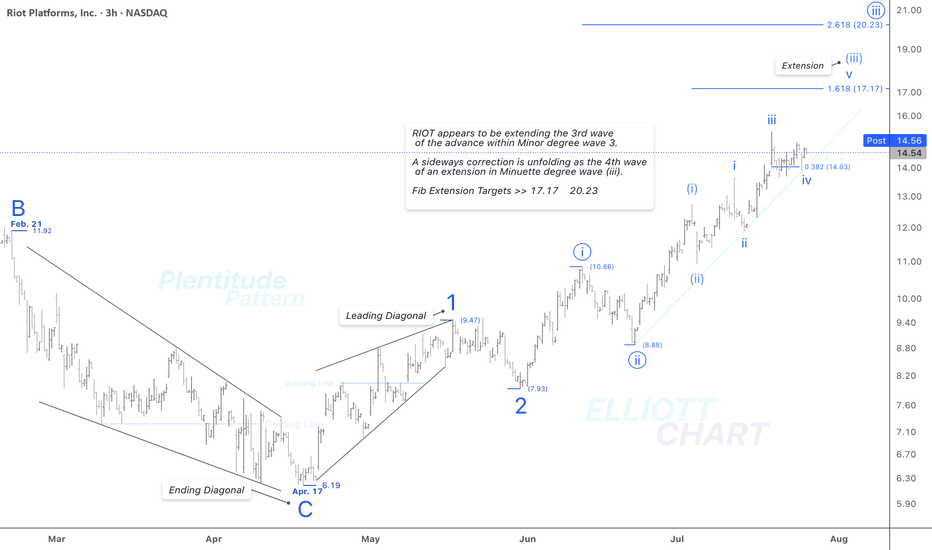

RIOT / 3hAs illustrated on the 3-hour chart above, NASDAQ:RIOT appears to be extending the third wave of an impulsive advance within Minor degree wave 3.

And as anticipated, a sideways correction is unfolding as the fourth wave of the ongoing extension in Minuette degree wave (iii).

Fib Extension Targets >> 17.17 & 20.23.

>>> In this timeframe, I'm analyzing the initial rising tide within the ongoing Intermediate degree wave (1), where a nested series of waves have quite well revealed: 1, 2 → i (circled), ii (circled) → (i), (ii) → i, ii. The extreme high of this impulsive sequence lies beyond the visible range of the current chart.

NASDAQ:RIOT CRYPTOCAP:BTC BITSTAMP:BTCUSD MARKETSCOM:BITCOIN

#CryptoStocks #RIOT #BTCMining #Bitcoin #BTC

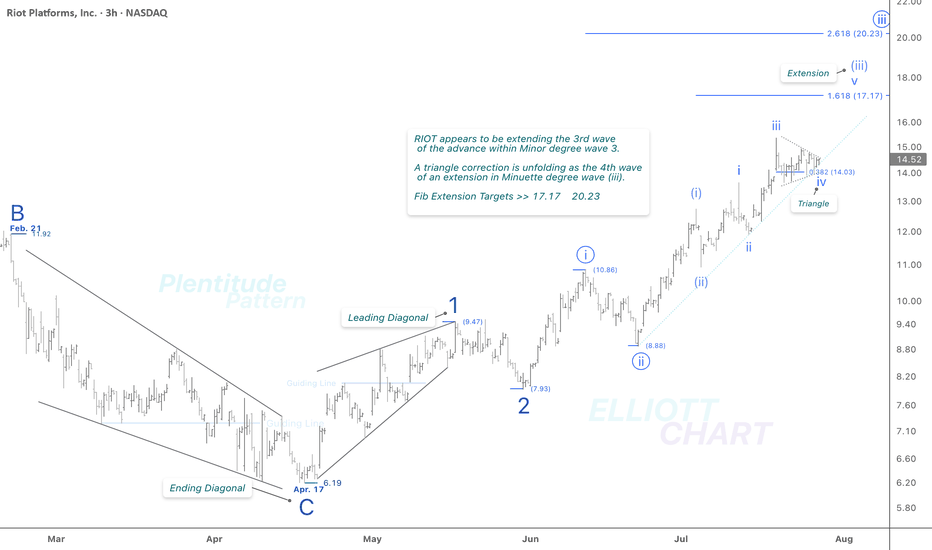

RIOT / 3hThere is no specific change in NASDAQ:RIOT 's previous analysis. As depicted on the 3h frame above, it appears to be extending the third wave of an impulsive advance within Minor degree wave 3. As anticipated, a triangle correction has emerged as the fourth wave within the ongoing extension of the Minuette wave (iii).

The Fibonacci extension levels of 17.17 and 20.23 remain valid and continue to align with the current wave structure.

>>> In this timeframe, I'm analyzing the initial rising tide within the ongoing Intermediate degree wave (1), where a nested series of waves have quite well revealed: 1, 2 → i (circled), ii (circled) → (i), (ii) → i, ii. The extreme high of this impulsive sequence lies beyond the visible range of the current chart.

NASDAQ:RIOT CRYPTOCAP:BTC BITSTAMP:BTCUSD MARKETSCOM:BITCOIN

#CryptoStocks #RIOT #BTCMining #Bitcoin #BTC

$RIOT Targets hitNASDAQ:RIOT has hit my take profit target at the High Volume Node and R3 daily pivot where it has found resistance.

Wave III appears to be complete with wave IV expected targets being the 0.382-0.5 Fibonacci retracement, also the daily pivot point and ascending daily 200EMA, $10.24.

Analysis is invalidated if we continue to the upside with a new swing high. RSI is overbought no bearish divergence.

Safe trading

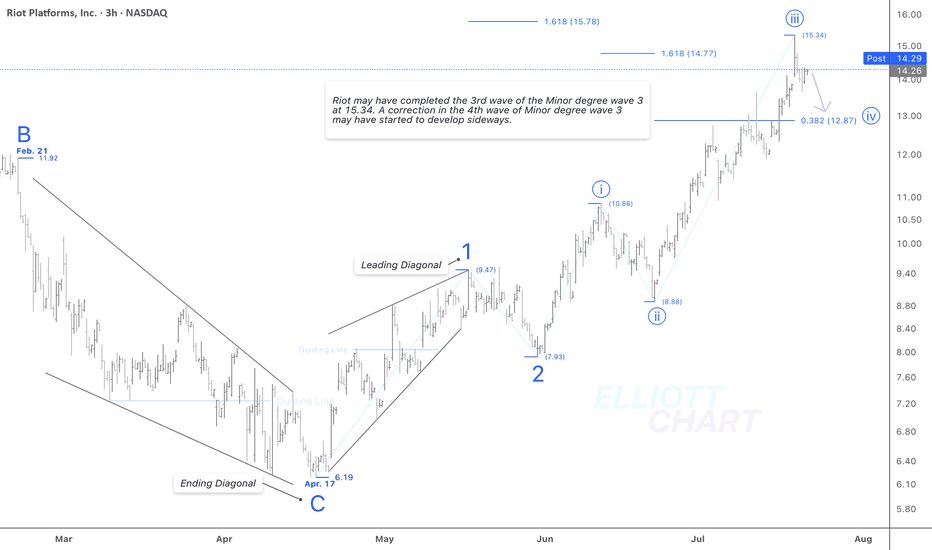

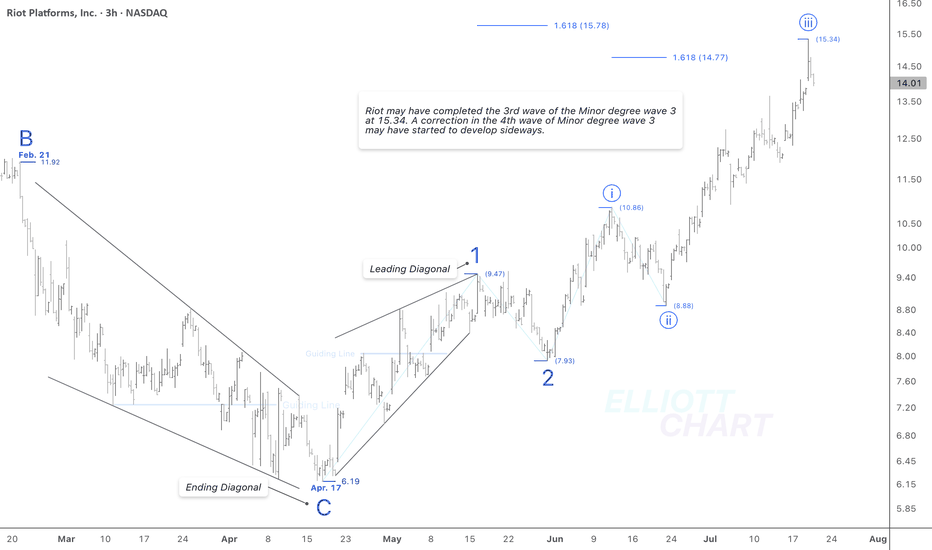

RIOT / 3hThere is no specific change in my NASDAQ:RIOT 's analysis. The wave iii(circled) of Minor degree wave 3 should have ended at 15.34.

Now, a following correction in the 4th wave of Minor degree wave 3 may have started to develop sideways. And it might take just a couple of weeks.

NASDAQ:RIOT CRYPTOCAP:BTC BITSTAMP:BTCUSD MARKETSCOM:BITCOIN

#CryptoStocks #RIOT #BTCMining #Bitcoin #BTC

RIOT Platforms, Inc. ($RIOT) – Price Decision Point Near: $17 Br

📆 Timeframe: Daily (1D)

📈 Current Price: ~$13.56

🪙 Key Correlation: Moves in strong tandem with Bitcoin ( CRYPTOCAP:BTC )

⸻

🔧 Chart Analysis Summary

NASDAQ:RIOT has approached a major confluence zone just below $14.06, where several resistance levels, order blocks, and fair value gaps converge. Historically, this zone has rejected price multiple times, making it a critical inflection point.

The technicals suggest a binary outcome is likely in the near term:

⸻

🟢 Upside Scenario – Target: $17.35 to $17.88

If RIOT breaks above the $14.06 resistance with conviction:

• Price could push quickly toward $17.35–$17.88, where:

• Multiple historical supply zones exist

• Large prior rejection candles originated

• LuxAlgo and order block indicators flag institutional interest

• Momentum would likely align with a concurrent breakout in Bitcoin above $120K

⸻

🔴 Downside Scenario – Target: $10.12 to $9.70

If RIOT fails to close above $14 and loses $12.93 support:

• Expect retracement toward:

• $12.05

• $11.50

• Key demand near $10.12–$9.70

• These zones are backed by previous price consolidation, fair value gap fills, and historical bounce levels.

⸻

🔗 Bitcoin ( BITSTAMP:BTCUSD ) Connection

📉 Current BTC Price: ~$117,747

BTC has recently:

• Tagged a long-standing resistance band ($119,182–$120,000)

• Rejected sharply with multiple fair value gaps below

• Holding trendline support, but weakening structure is visible

If Bitcoin breaks below its trendline, a move toward $91K–$92K becomes likely — this would drag RIOT down with it.

If Bitcoin breaks above $120K, momentum could surge across crypto-exposed stocks, and RIOT may follow with a rapid leg up.

⸻

🎯 Conclusion

Scenario Trigger RIOT Target

✅ Bullish BTC breaks $120K $17.35–$17.88

❌ Bearish BTC rejects + loses trendline $12.05 → $11.50 → $10.12–$9.70

⸻

❓Your Turn:

Do you think RIOT breaks out or breaks down?

Let’s see how this unfolds.

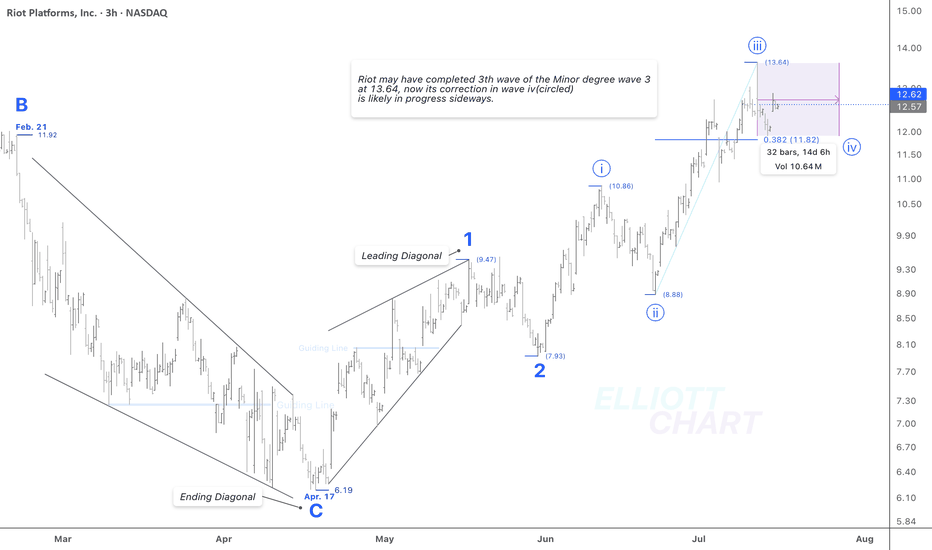

RIOT / 3hThere is no change in the NASDAQ:RIOT 's trend analysis.

Wave Analysis >> As illustrated in the 3h-frame above, NASDAQ:RIOT may have completed the 3rd wave of the ongoing Minor degree wave 3 at 13.64, its correction in wave iv (circled) is likely in progress sideways.

#CryptoStocks #RIOT #BTCMining #Bitcoin #BTC

NASDAQ:RIOT CRYPTOCAP:BTC MARKETSCOM:BITCOIN

$RIOT Hit The Target Whats Next?NASDAQ:RIOT hit the descending orange resistance were I took partial take profits on my trade this week and it was immediately rejected as expected.

Price is now above the weekly pivot so that is the next support. This level also matches the weekly 200EMA.

Wave (II) hit the 'alt-coin' golden pocket of 0.618-0.786 Fibonacci retracement at the High Volume Node (HVN) support and descending support line which kicked off wave (III).

A breakout above the descending resistance line bring up the the next target of the HVN and previous swing high at $18-20 and $40 following a breakout above that.

Safe trading

$RIOT Continues to Follow PathNASDAQ:RIOT Is sticking closely to the plan testing the bottom and top of the channel multiple times.

Price closing above the weekly 200EMA and weekly pivot Friday will be a very bullish signal. As we have over 4 tests of the upper boundary resistance there is a high probability we break through and continue higher in a high degree wave 3.

Initial targets are the weekly R5 pivot at $39 and all time high at range at $79.

Price tested the .618 Fibonnaci retracement in a complex correction for wave 2.

Analysis is invalidated below the channel support.

Safe trading

RIOT: Do or Die timeI am going back on forth between two counts, both bullish for the time being. It is all about how wave 1 completed. I have readjusted wave 1 as leading contracting diagonal which has several impulsive moves but still in 3 waves, making things very difficult count. The May low is deep enough to be wave 2 following the diagonal. Wave 1 of 3 started off strong but the June dip was a bit too deep. Now, it is do or die time. We want to see a very strong wave 3 of 3 holding the narrow and steep channel to the outer edge of the macro downward channel. That will be the true test of the bull market. If RIOT has any chance of breaking out of the rut, it needs to have a short wave 4 and then try for a clean break. Even then, the entire move since April low would be in 3 waves. For the rest of the summer, we need to see if the price dips back into the channel or gets support on top of it and makes the final move up to give us a clean 5 waves move. By the end of this year, overall markets should also top out for the cycle and head for wave 2 of various degrees. 2026 should be very interesting if the rest of 2025 stays with the current trajectory. For now, staying long until something happens.

RIOT / 3hNASDAQ:RIOT has exceeded 12.12, which I'd considered as a validating line at the extreme high of that leading diagonal in my prior analysis. Hence, the leading diagonal as the entire wave (1) is not valid now.

Wave Analysis >> According to this adjusted wave count, wave 1 and 2, i(circled) and ii(circled) all are over, and advance in wave iii(circled) of Minor degree impulsive wave 3 is underway.

#CryptoStocks #RIOT #BTCMining #Bitcoin #BTC

RIOT / 3hAccording to the adjusted wave count in this 3h-frame, the continuous advance in NASDAQ:RIOT may be considered as an ending diagonal in the 5th wave of the one larger degree leading diagonal as wave (1), which could have remained in the late stages!

Wave Analysis >> The Minor degree wave 5 might continue to advance just to 7.7% >> 12.12 as an extreme high of the entire leading diagonal pattern as wave (1).

Trend Analysis >> The entire pattern in a leading diagonal as wave (1) quite well indicates a bullish view in the medium term, at the beginning of an ongoing UPTrend!

#CryptoStocks #RIOT #BTCMining #Bitcoin #BTC

RIOT / 2hNASDAQ:RIOT traced out the retracement in wave B in a three-wave sequence upward. Now, a 24% decline lies ahead to develop wave C as the final subdivision of the ongoing correction in wave (2).

Trend Analysis >> The trend may remain correct downward in the Intermediate degree wave (2), which will take less than couple of weeks to thoroughly develop.

The retracing down targets remains intact >> 8.20 >> 7.93 >> 7.67

#CryptoStocks #RIOT #BTCMining #Bitcoin #BTC

RIOT / 2hThe retracement up in wave B has reached the anticipated target at 10.38, although that's not traced out like a flat or zigzag formation in a three-wave sequence.

A following decline of 20% lies ahead to develop the wave C as a final subdivision of the ongoing correction in wave (2).

Trend Analysis >> The trend remains correct downward in the Intermediate degree wave (2), which will take just a couple of weeks to thoroughly develop.

The retracing down targets >> 8.20 >> 7.93 >> 7.67

#CryptoStocks #RIOT #BTCMining #Bitcoin #BTC

RIOT / 2hAccording to the NASDAQ:RIOT 's prior analysis, Minor degree wave B is retracing upward, as I'd outlined at the end of the second paragraph in the note on the chart.

Wave Analysis >> The leading diagonal in Minor degree wave A, is correcting up now in the same degree wave B which would develop in a three-wave sequence like a flat formation or zigzag.

Trend Analysis >> The trend would remain correcting downward in the Intermediate degree wave (2), which will take a few weeks to develop.

The retracing down targets >> 8.76 >> 8.20 >> 7.93 >> 7.67

#CryptoStocks #RIOT #BTCMining #Bitcoin #BTC

RIOT / 2hAs anticipated in the prior NASDAQ:RIOT 's analysis, the expected decline(7.3% intraday) as the last subdivision of the leading diagonal wave A, is quite well done.

Wave Analysis >> The leading expanding diagonal in Minor degree wave A, as the first subdivision of the ongoing correction in wave (2), indicates that a relatively deep correction in wave (2) might be thoroughly developed.

Trend Analysis >> The trend is correcting down in the Intermediate degree wave (2), which will take a few weeks to develop.

The retracement targets >> 8.76 >> 8.20 >> 7.93 >> 7.67

#CryptoStocks #RIOT #BTCMining #Bitcoin #BTC