Key facts today

Starbucks is negotiating with investors like Carlyle, KKR, JD.com, and Tencent for a stake in its China operations to strengthen its brand in the competitive market.

0.16 USD

3.01 B USD

28.95 B USD

About Starbucks Corporation

Sector

Industry

CEO

Brian R. Niccol

Website

Headquarters

Seattle

Founded

1985

ISIN

ARDEUT111481

FIGI

BBG000HGBZ14

Starbucks Corp. engages in the production, marketing, and retailing of specialty coffee. It operates through the following segments: North America, International, and Channel Development. The North America segment focuses on the United States and Canada. The International segment is involved in China, Japan, Asia Pacific, Europe, Middle East, Africa, Latin America, and Caribbean. The Channel Development segment includes roasted whole bean and ground coffees, Seattle’s Best Coffee, and Teavana-branded single-serve products. The company was founded by Jerry Baldwin and Howard D. Schultz on November 4, 1985, and is headquartered in Seattle, WA.

Related stocks

What The 3 Step Rocket Booster Strategy Is In Short SellingTrading is not easy at all.

But with practice you will get it.

These past few days have been horrible because

i was so stressed i nearly fainted away not only

my body but also my spirit.

Sleeping is your number one goal.

I dont care if you have money or not.YOU HAVE TO SLEEP.

Because of this pers

Starbucks: Sideways Trend Continues Starbucks shares have remained in a sideways range over the past two weeks. This does not alter our primary outlook: We continue to see the stock in the dark green wave , which is expected to peak near the resistance level at $117.46. After reaching this high, we anticipate a move lower, with the s

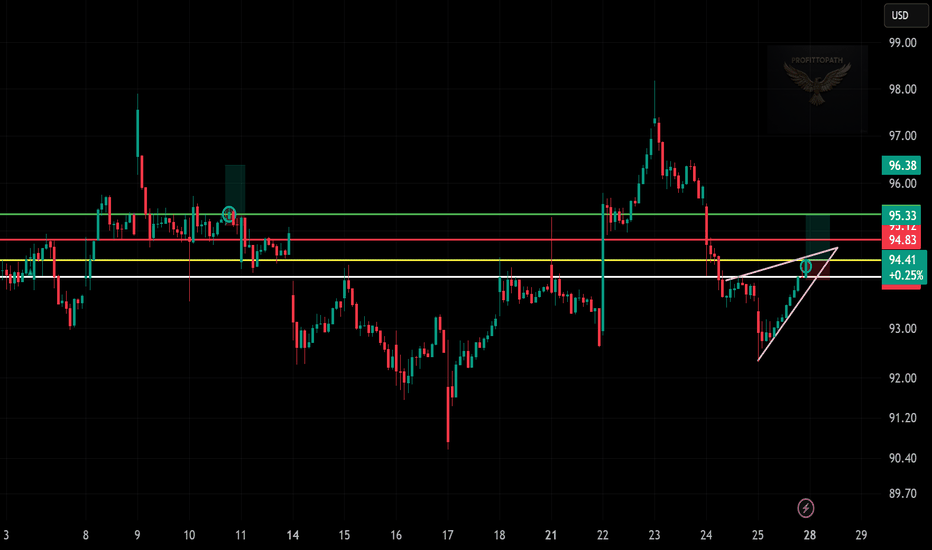

SBUX Long Trade Brewing! Caught a symmetrical triangle breakout☕t 📈

Momentum is building — this could push to $96+ if it clears resistance 🚀

📍 Entry: $94.46

📉 SL: $93.70

🎯 TP1: $95.31

🎯 TP2: $96.02

Let’s see how this cup fills up! 🔥

#SBUX #StarbucksStock #BreakoutTrade #TechnicalAnalysis #StockTrader #TradingView #ProfittoPath #BullishMomentum #SmartTrading

Cup and Handle with a shot of espresso: A bullish blendSince March, Starbucks ( NASDAQ:SBUX ) has been in a sustained downtrend, gradually rounding out a base. Now, the chart is showing early signs of a trend reversal.

Yesterday, price broke out of a bull flag formation on the daily chart and is now testing the $95.50 zone — a critical neckline level o

Consumers sentiments changing direction in ChinaFor quite some years, it was the novelty, foreign and luxury brands that sits well with many Chinese who aspires a different kind of lifestyle, thanks to the western social media influence.

Fast forward years later, with the continuing depressed property market, tepid job market and deflationary en

PDF-RDF-LDT-BBA perceived fibonacci pattern was fulfilled when SB stock was at 117USD, seeing a drop that could have given us liquidation in a matter of a month, reaching a trend line waiting for a price change fulfilling a fibonacci retracement when the price reached 76USD, giving us liquidation to buy for two m

Starbucks Breakout: Bullish Triangle Targets $94.90" 🚀📈"

📝 Caption/Description:

✅ Long Trade Setup on SBUX (30-min Chart)

🔹 Entry: $91.45

🔹 Stop Loss: $90.26

🔹 Target: $94.90

🔹 R:R Ratio: ~1:2.8

🔸 Breakout from symmetrical triangle with bullish momentum

🔸 Watch resistance around $93.10 for partial profits

📊 Strategy: Breakout + Trend Continuation

🦅

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US855244AX7

STARBUCKS 20/50Yield to maturity

7.10%

Maturity date

Mar 12, 2050

US855244BA6

STARBUCKS 20/50Yield to maturity

6.93%

Maturity date

Nov 15, 2050

US855244AM1

STARBUCKS 17/47Yield to maturity

6.80%

Maturity date

Dec 1, 2047

SRBC

STARBUCKS 15/45Yield to maturity

6.55%

Maturity date

Jun 15, 2045

US855244AU3

STARBUCKS 19/49Yield to maturity

6.38%

Maturity date

Aug 15, 2049

SBUX4665314

Starbucks Corporation 4.5% 15-NOV-2048Yield to maturity

6.23%

Maturity date

Nov 15, 2048

SBUX6071258

Starbucks Corporation 5.4% 15-MAY-2035Yield to maturity

5.00%

Maturity date

May 15, 2035

US855244AZ2

STARBUCKS 20/30Yield to maturity

4.88%

Maturity date

Nov 15, 2030

US855244AW9

STARBUCKS 20/30Yield to maturity

4.85%

Maturity date

Mar 12, 2030

SBUX5359418

Starbucks Corporation 3.0% 14-FEB-2032Yield to maturity

4.80%

Maturity date

Feb 14, 2032

US855244BE8

STARBUCKS 23/26Yield to maturity

4.79%

Maturity date

Feb 15, 2026

See all SBUXD bonds

Curated watchlists where SBUXD is featured.