SHOPD trade ideas

SHOPIFY: Earnings Come in Historic; Stock Blasts-offShopify earnings were released today (Feb 12) around 8:30 PM EST and came in massive. EPS, revenue, growth, earnings and profit came in at historic levels and drastically beat expectations.

This is a company that is ran by one of the top CEOs with incredible vision and Shopify continues to surprise quarter after quarter - year after year - and continues to win against Amazon against this similar and specific service.

Shopify has surged on the US side pre-market and it appears it will trade around 750 (CAD) or more today with no sign of letting up.

Shopify continues to show signs of a large turnaround similar to Tesla where everyone discounted the name and now that the company has become profitable, the stock could rocket to levels over 1000 in the next 12 months or so.

This is certainly a company you want in your portfolio especially as online shopping is the 'way of the future' as retail stores become antiquated. You can play it directly with the stock or purchase ETF: XIT which plays mostly the top 10 Canadian technology companies. In this etf by BlackRock, Shopify represents a nice and juicy 30%+ by weight.

2020 Year End Target: $850-900 (Canadian Dollars).

- zSplit

SHOPIFY: Should Hit $650 (CAD) this YearDespite some headwinds that we are facing with the US and Iran, this will be short-term noise for a healthy 5% or so pullback (not necessarily all in consecutive days), but mostly in January before we turn the tide.

In the longer-term this will have little impact to the sentiment of the market, but instead, will allow defense stocks, energy stocks (including oil) and precious metals to surge strong this year. As I have been saying for the past 6 months, look for big moves in oil/energy and precious metal stocks. It will take 1 or 2 months of elevated oil prices to see significant moves in the energy sector, but its coming. Be patient!

Despite so much cheap money in the market - I don't want to be - but I am very bullish on certain tech stocks this year. I am expecting the following for some big names such as Facebook, Google, Apple, Microsoft, AMD, Netflix, Tesla, Baba, Bidu and Amazon.

Facebook could be one of the dark-horses this year, and a 40-50% gain is not out-of-the-question.

Shopify will continue to break-out after its fallen descending triangle and eventually break-out to run to 650 or more by year-end.

Remember: don't invest based on what you want to happen; invest on what you believe will happen.

- zSplit

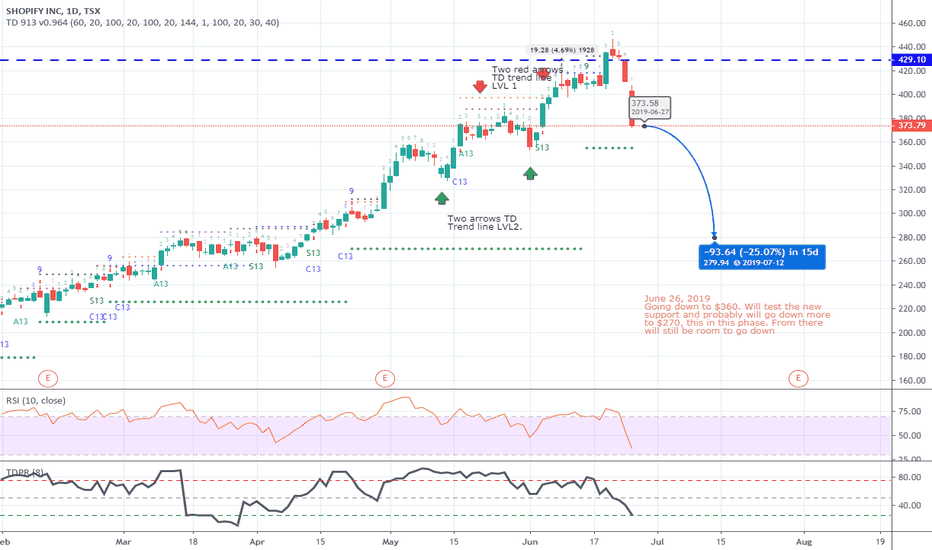

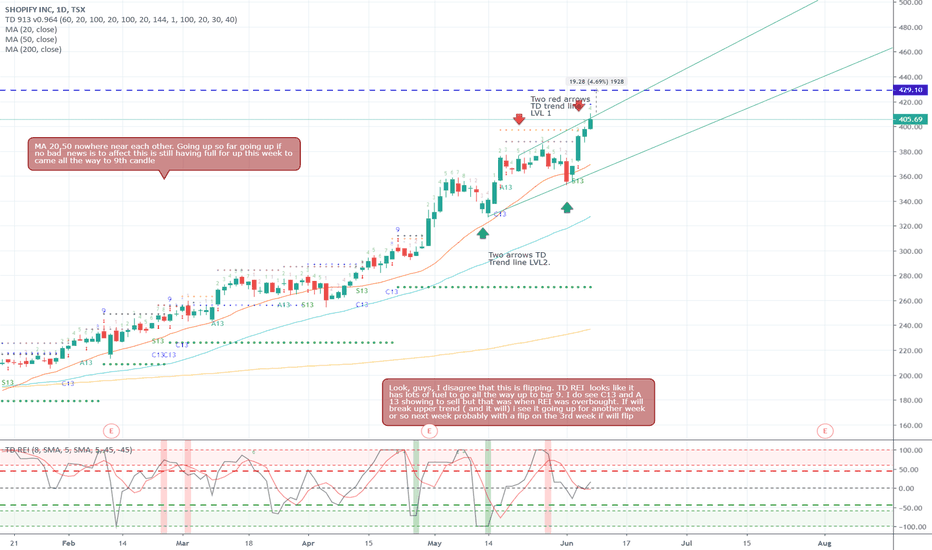

TOPIFY? Shop at the top of the Long Term ChannelSHOP looks ready to roll technically - heavy resistance at the top of the long term channel, along with a 1.618 extension off the all time low. Timing wise, we have a TD8 on the weekly bar. Very potent cocktail of technicals. I would expect a retrace to the 230-260 range, at minimum.

Decoupled from Facebook -- Making me rich legally. Excited to see how this market opens....

Watch previous thoughts...

Shopify is good ecosystem (customers, customer customers, developers,...) not just a company...

Believe me such ecosystems are goldmines....

My DAD told me...

Would like to see a retest from the upper red line (to cool RSI).. good price action from there...

Would consider reentering.... sold 33% @200 earlier from a long position since @180...