SHOP - Breakout from Bull Flag?Did SHOPify breakout of a bull flag?

1) Bullish open and close candle above the trend line.

2) MACD bullish (although histogram is slowing)

3) Force Indicator is bullish

4) RSI is not overbought or showing any signs of bearish divergence.

5) Parabolic SAR is bullish

6) 20 EMA is above the 40 EMA indicating a bullish trend

7) 50 EMA is above the 200 EMA also supporting a bullish trend

8) However, is the price to far overextended from the 20 EMA? Might it pull back? Is this a false breakout?

SHOPD trade ideas

SHOP - Breakout from Bull Flag? Did SHOPify break out of a bull flag?

1) Bullish open & close candle above the trend line

2) MACD bullish (though the histogram is slowing)

3) Force Indicator is bullish

4) RSI is not overbought or displaying any signs of bearish divergence

5) Parabolic SAR is bullish

6) 20 EMA is greater than 40 EMA indicating a bullish trend

7) 50 EMA is greater than 200 EMA also indicating a bullish trend

8) HOWEVER - is the price breakout overextended from the 20 EMA? Might it pull back? Is this a false breakout?

Shopify following old trendsDrew this chart almost 2 months ago, and it's been hitting its trendlines perfectly ever since without any adjustments, which lead me to believe that this will continue on in this fashion for the foreseeable future

Leaning more towards a long position here with entries on the small dips in between these two major trendlines

Daily DOUBLE TOP !!!SHOP clearly hit a double top it was right to the penny at $190.00 If we can break 190 we looking for next resistance in the low $200. However, in the past when SHOP had double top there was a bearish reversal. Also Apple bearish reaction to earnings may have some negative effect on the tech sector

SHOP Setting up for a potential double bottom SHOP hit the low of 166.00 on Oct 11th when the initial dump bottomed out. Since the stock had a nice bounce reaching 190.00. Which would be a nice trade. Right now with some market weakness SHOP is back to the 166 area Closing 166.07 Friday. It may signal that the bulls are defending the 166 range. I will watching and may make a potential entry if Monday the 166 level holds. Than we can watch for SHOP to set a lower high compare to 190 before continuation to higher highs and higher lows. I will keep my eye on SPY (seeing some correlation) and if there is further market weakness SHIOP could see breaking the 166 support and hit to lower lows. If we loosing the 166 support level the next support is in the mid 140 range.

Is Shopify going to be the Amazon of the Dope Game?Rumors

Shopify is a platform that allows small businesses to launch e-commerce websites, so who knows online retail better than them?

shopify-weed-biz.jpg

Shopify SHOP:CN is a Canadian e-commerce powerhouse. Kylie Jenner made almost a billion dollars and guess which platform is credited with helping her do the most in the make up game?

In February of this year news came that it would be partnering with the Ontario Government to handle online cannabis sales with the provincially run Ontario Cannabis Retail Corp. This is probably one of the better moves by the Government, because they are known to be literally the worst at making business decisions.

ocs_primary_logo_reg-768x292.jpg

I mean, who pays $700k for a logo that looks like this? Bruh, I could have done that shit in paint. Holy Face Palm Emoji Batman.

OK, so there was some other marketing wrapped up in that deal but let’s just say that Ontario tax payers and blunt smokers alike should have been happy about the Shopify news.

Anyways, the news in Feb sent SHOP stock soaring to new highs and was baked into the price at the time.

After a recent pullback, the stock is now moving back to its all time highs. This is because there are many new articles coming out about the impact that Cannabis will have to SHOP’s bottom line. At this time, several Canadian provinces have picked Shopify to run their e-commerce websites and the company has also signed deals with marijuana companies including Canopy Growth Corp.

This has the stock up about 3% at the time of this writing.

This is an abbreviated synopses of my thesis for investing in this stock. A detailed and rigorous analysis relying on trusted information from various sources and analysis tools learned over time is always present in the decision making of these equity choices, but omitted for proprietary reasons.

Fundamentals

Everybody knows that Cannabis is the new frontier. The once taboo “drug” has now become mainstream, and investors cannot wait to jump in to companies that produce, refine or sell it on the retail level.

Shopify is not a cheap company by any traditional metrics. We normally like to buy good companies that are growing fast when they are cheap, so caution is warranted here. However, this company is doing 9 Billion dollars in sales a quarter and is growing at 56% a year.

That being said, the numbers are growing like weed (ha), even without the company slingin’ herb on the side. The potential for this to entice investors to jump in the stock and set the stock a blaze. Ok, I’ll stop.

If these deals fall apart it is difficult to justify a valuation of over $120. In a down market this kind of stock can fall to $40-50 easily. The trading range on this stock is wider than my waistline after Thanksgiving Dinner.

Technicals

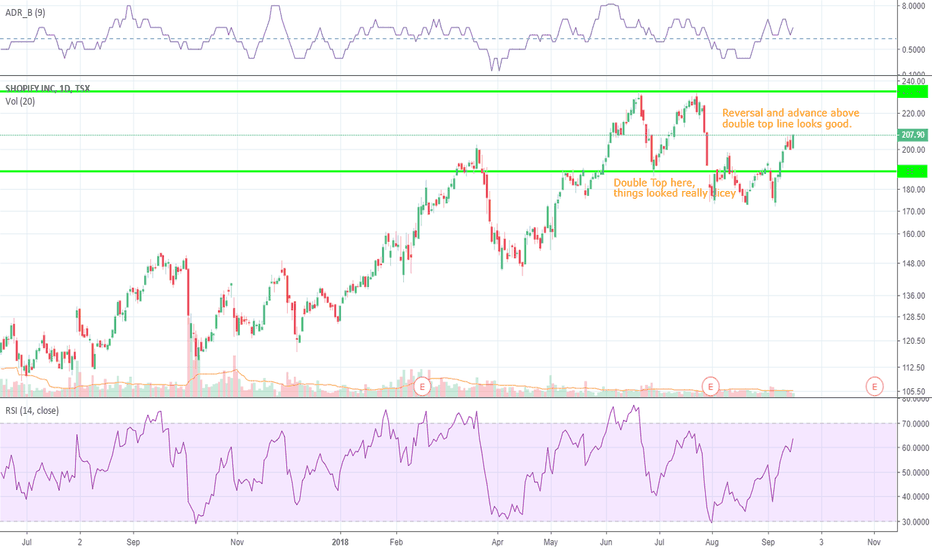

Technically, the stock has consolidated after a pullback from what looked like a double top in early august and has reversed that pattern, which is typically very bullish. This is because when there’s a technical pattern that easy to recognize, technical traders rush to short the stock. As that pattern get’s invalidated, those short sellers have to cover their positions and buy back the stock.

See the chart for a quick TA and trade breakdown.

Is Shopify going to be the Amazon of the Dope Game?Shopify SHOP:CN is a Canadian e-commerce powerhouse. Kylie Jenner made almost a billion dollars and guess which platform is credited with helping her do the most in the make up game?

In February of this year news came that it would be partnering with the Ontario Government to handle online cannabis sales with the provincially run Ontario Cannabis Retail Corp. This is probably one of the better moves by the Government, because they are known to be literally the worst at making business decisions.

ocs_primary_logo_reg-768x292.jpg

I mean, who pays $700k for a logo that looks like this? Bruh, I could have done that shit in paint. Holy Face Palm Emoji Batman.

OK, so there was some other marketing wrapped up in that deal but let’s just say that Ontario tax payers and blunt smokers alike should have been happy about the Shopify news.

Anyways, the news in Feb sent SHOP stock soaring to new highs and was baked into the price at the time.

After a recent pullback, the stock is now moving back to its all time highs. This is because there are many new articles coming out about the impact that Cannabis will have to SHOP’s bottom line. At this time, several Canadian provinces have picked Shopify to run their e-commerce websites and the company has also signed deals with marijuana companies including Canopy Growth Corp.

This has the stock up about 3% at the time of this writing.

This is an abbreviated synopses of my thesis for investing in this stock. A detailed and rigorous analysis relying on trusted information from various sources and analysis tools learned over time is always present in the decision making of these equity choices, but omitted for proprietary reasons.

Fundamentals

Everybody knows that Cannabis is the new frontier. The once taboo “drug” has now become mainstream, and investors cannot wait to jump in to companies that produce, refine or sell it on the retail level.

Shopify is not a cheap company by any traditional metrics. We normally like to buy good companies that are growing fast when they are cheap, so caution is warranted here. However, this company is doing 9 Billion dollars in sales a quarter and is growing at 56% a year.

That’s without the company slingin’ herb on the side, so the potential for this to be a good longer term hold is quite high.

If these deals fall apart it is difficult to justify a valuation of over $90. In a bear market this kind of stock can fall to $30. The trading range on this stock is wider than my waistline after Thanksgiving Dinner.

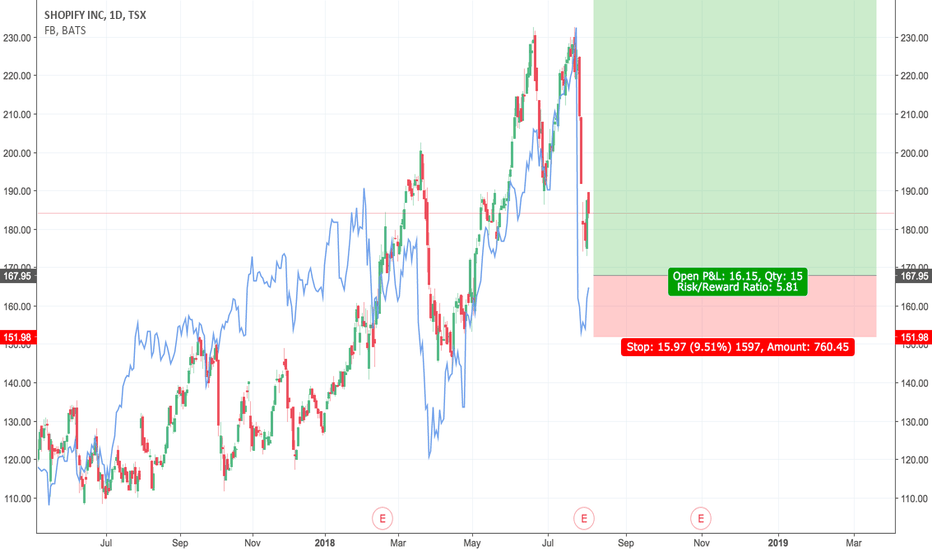

bottom for SHOPTSX:SHOP NYSE:SHOP

This call is primarily based on price action and risk reward.

We can see a lower low being pushed on the daily time frame but over last week price rejected the $173 level.

The other notable mention is the Risk to reward ratio, with a bottom formed we have an excellent place to set our stop knowing the trend would go bearish is it was triggered

Remember to always manage you risk

Shopify tightening range holding uptrend, preparing for breakoutSHOP.TO is tightening up on the daily as price forms an equilibrium. Decreasing bull volume on the daily tells me we're likely to set a lower high relative to 199.50 before coming back to test the uptrend that's held since Dec 2017, and set a higher low relative to 172.95. Volume within this pattern will be key clue about how the pattern will break

SHOP - The w[E]ed-[Commerce] solution from CANADA So you should know this buy now

www.cbc.ca

And if you are from Ontario and over 19 years old, I bet you also know what happens on October 17, 2018.

www.ontario.ca

Shopify Inc. (Nasdaq: SHOP) is a company that’s about to make billions from the end of marijuana prohibition without ever touching the leaf.

It’s the online retailer – not Amazon.com Inc. (Nasdaq: AMZN) – that just inked a contract to provide an e-commerce platform for a major Canadian cannabis retailer.

You see, when Canada goes fully legal later in summer 2018, pot companies will want to sell (and their customers will want to buy) their wares online. Makes sense.

And the great news for investors in Shopify? The Ontario Cannabis Retail Corp. (OCRC) – the government agency in charge of sales in the province – is relying on Shopify, and only Shopify, to make it happen.

That’s going to be a huge boon for cannabis investors. Ontario is home to 13.6 million people, with bustling Toronto and its financial sector at the heart of the province.

That’s the perfect place to begin cashing in on Canada’s legal weed market, which Deloitte says could hit $8.7 billion over the next few years.

But that’s really just the beginning for Shopify.

This tech-forward company develops the kind of sophisticated software that allows small retailers to plug into e-commerce platforms like Amazon and sell their stuff.

With Shopify’s platform, they can manage orders, collect sales dollars, and send out emails to buyers. Or, if they prefer to go it alone, Shopify can help small retailers build their own online storefront, handle multiple sales channels, and plug into social media for customer outreach.

That business model alone qualifies this as a solid choice for investors. Its sales grew an average 85% over the past three years, compared to 26% growth for Amazon during that stretch.

Now, OCRC has picked to exclusively use Shopify’s e-commerce platform for cannabis sales online. Shopify’s technology will also be used inside OCRC’s Ontario Cannabis Stores to process transactions and for digital kiosks displaying product information.

And Ontario is just the “first mover” here. Many of Canada’s other nine provinces are likely to follow the leader here in choosing the home-grown Shopify (which is based in Ottawa) as their e-commerce partner.

That could double Shopify’s total market opportunity there.

In fact, Quebec province-based grower Hydropothecary Corp. has already chosen Shopify to help it sell medical marijuana online.

Thanks to moves like the OCRC deal, Shopify’s total addressable market stands to exceed $50 billion…

As a side note, just imagine if they integrate cryptocurrencies

$SHOP Parallel Channel Repeat - BullishEntered long position since MACD cross.

Parallel channel AA and BB repeating. Parallel Support = BB; Parallel Resistance AA

Likely to consolidation between S1 = 171, R = 178 to continue previous parallel channel

Golden cross short term EMA (15,5)

Overall bullish unless Citron attack