TSLA trade ideas

TSLA at Key Resistance—Breakout or Rejection?Hi Traders! 🚀 TSLA is approaching a key resistance zone—will it break out or face rejection?

🔹 Scenarios:

📈 Buy if it breaks above $284, with a stop loss at $275 and targets at $290 and $320.

📉 Sell if it rejects $284 and falls below $270, with a stop loss at $280 and targets at $260 and $230.

📊 RSI is recovering from oversold territory—momentum could push prices higher! Keep an eye on the price action.

📢 Watch out for earnings reports and macro news! These could add volatility.

🔥 Smash that like button and show some energy! Let’s trade like pros! 🚀

⚠️ Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Trade at your own risk.

Tesla entering key $275 area.Tesla's stock price is currently at a critical juncture, entering the significant resistance zone around $270. The chart highlights this level as a pivotal threshold separating bearish and bullish market sentiments. Tesla's behavior around this region will likely determine its next major trend.

### Analysis of the Scenarios:

1. **Below $270: Bearish Outlook**

If Tesla's stock fails to effectively break above the $270 resistance zone and instead gets rejected, the bears will remain in control. Previous price actions indicate this level as a significant area of selling pressure, with multiple failed breakout attempts in the past. A rejection here could set the stage for a continuation of the downtrend, with potential declines back to lower support levels.

2. **Above $270: Bullish Resurgence**

A clear breakout above $270, confirmed by successive daily or weekly closes, would signal a bullish shift in Tesla's technical structure. This would suggest that buying momentum has overcome prior resistance, paving the way for further upward price movements. Breaking through this level could reignite investor enthusiasm and potentially initiate a new rally.

### Key Observations from the Chart:

- The $270 level has acted as both support and resistance in the past, underscoring its importance as a psychological and technical barrier.

- Tesla has recently bounced back after a sharp decline, suggesting a potential recovery attempt. However, the current price action faces a stiff challenge at this resistance level.

- A failure or success at $270 could trigger broader directional movement, with implications for both short-term traders and long-term investors.

### Conclusion:

Tesla's stock is at a decisive crossroads as it entered the $270 resistance zone. A rejection would signify continued bearish dominance, while a sustained breakout would indicate a bullish reversal. Investors will be closely watching the price action around this critical level to gauge the next directional move. As the market exhibits uncertainty, patience and prudent risk management will be key for traders looking to navigate Tesla's current trajectory.

$TSLA Strong Rebound Eyeing $304—Can It Break Key Resistance?

On March 11th, NASDAQ:TSLA filled the gap at $219, which was left on October 23rd following the "surprise" Q3 positive earnings call. Then, on March 23rd, it confirmed strength with an Island Reversal Pattern, signaling potential for further upside. The stock now appears poised to test higher levels, where it will encounter resistance from the Tom DeMark descending trendline. The exact resistance level will depend on the speed of the upward movement—the faster it rises, the higher the resistance. Key levels to watch include the $304 horizontal resistance and the point where both resistances converge in approximately 10 trading days.

TSLA - Bearish trend towards Apr earningsEveryone has read enough about TSLA's overvaluation. This chart simply shows relevant levels - given the broader downtrend, I'm looking at a break of $232 in the near term (possibly today), followed by a retest of the $215. Any upside will be capped at the $250 resistance.

I'm expecting bounces between $215-$235 up till the end of March, and a break of $215 in April towards $180 in anticipation for abysmal earnings.

I'm short TSLA from $245 with a first TP of $200, and holding past earnings for sub-$180.

Tesla at major support. I'm long.Tesla is at major yearly support. Confluence between levels and fib. This is where we need to hold to maintain the trend on the monthly chart. I don't know if it will hang out at this level or possibly go below the level before we regain and higher. But this is a valid long trade at these levels. If we don't hold here it is much lower. Long term target is $670. Remember the fud around Tesla is meaningless. It's all the charts. If the markets were "rational" we wouldn't even be at these levels in the first place.

My Technical Analysis for $TSLA (Tesla)📊 Technical Analysis: NASDAQ:TSLA (Tesla)

🗓️ Updated: March 24, 2025

🚨 Critical Zone Being Tested

After breaking out of a multi-year symmetrical triangle, NASDAQ:TSLA is now retesting the upper boundary of the pattern — perfectly aligned with the key ACTION ZONE (liquidity zone + long-term MAs).

🔵 ACTION ZONE ($245–265):

High-probability decision area. Holding this level could trigger a fresh bullish leg.

🟣 SWING BOX ($180–210):

If support fails, this is the next logical area for a potential bullish reaction.

🟡 FVG Daily ($75–115):

Unmitigated Fair Value Gap. Only relevant in case of a major breakdown.

📉 SMI (Stochastic Momentum Index):

Currently in negative territory, but nearing oversold — watch for a potential reversal.

🎯 Scenarios:

Bullish: Strong rejection from the Action Zone → potential move to $350–400 ✅

Bearish: Breakdown below the blue zone → eyes on Swing Box or FVG for reentry ⚠️

📌 Reminder: This is not financial advice. Always manage risk and wait for confirmation before entering a trade.

💬 What do you think? Is Tesla preparing for a bounce or heading lower?

👇 Share your thoughts in the comments!

Tesla Is Retail Traders' Choice, JPMorgan Says. Are You Buying?Tesla NASDAQ:TSLA has endured a soul-crushing experience over the past three months or so. The stock is down 50% from the record high of $480 hit in December (more than $700 billion in market cap washed out). Even insiders have sold a big chunk of their holdings.

But over the past three weeks (12 trading days to be precise), investment bank JPMorgan NYSE:JPM says, retail traders just couldn't get enough of it.

Retail net buying activity in TSLA stock. Source: JPMorgan

They’ve consistently been buying the dip, and then the dip of the dip and then… you get it. Every new dip is seen as a buying opportunity to the daredevils among us who try to catch a falling knife.

In the latest issue of “Retail Radar” — JPMorgan’s weekly report revealing where the retail money is flowing — the banking giant traced a net $12.5 billion of retail cash poured into stocks or stock-related investments last week.

As much as $4.2 billion went into ETFs (diversification, nice), where a cocktail of ETFs with a broad selection of stocks took the lion’s share along with some gold ETFs . Still, the big chunk of the pie went into individual equities — $8.3 billion of cold hard cash was injected into the retail-trading darlings Tesla NASDAQ:TSLA , Nvidia NASDAQ:NVDA and other Mag 7 members.

🤿 Buying the Dip

Here’s what the bank said:

“Single stocks accounted for +$8.3B of the inflow. TSLA (+$3.2B, +3.5z) and NVDA (+$1.9B, +1.1z) collectively contributed more than half, and the rest of Mag 7 contributed another $1B. Notably, they have been buying TSLA for 12 consecutive days, adding $7.3B in total.”

The 3.5z and the 1.1z describe the standard deviation of the retail traders’ net flows compared to the 12-month average. (Keep reading, it gets even better.)

Did you hear that? Tesla dominated the charts. Day trading bros have kicked in a total of $7.3 billion into Elon Musk’s EV maker over the past 12 cash sessions. It even won some praise from JPMorgan analysts who said this endeavor represents “the highest magnitude among all past ‘buying streaks’ in over a decade.”

Here’s the best part:

“Retail investors returned as aggressive buyers on Wednesday, breaking the $2 billion threshold in the first half of the day (the 2nd time this year), and ending the day at $3.7 billion inflows (+7z),” JPMorgan noted (Wow, 7 standard deviations above the mean). “We observed their allocation into ETFs/single names are at 30/70% during a typical heavy buying day. Among single names, NVDA and TSLA led the inflows.”

JPMorgan also estimated that retail traders’ efforts to snatch the W this year are just bad.

“We estimate retail investors’ performance is down by 7% year to date (vs. -3.3% loss in S&P). Most of the drawdown came from March as they increased their holdings in Tech.”

Retail traders' performance, year to date. Source: JPMorgan

🤙 The YOLO Moment

Buying Tesla shares right now is the ultimate YOLO play. We’re only a week away before Tesla announces what’s shaping up to be the worst delivery figure in years. After a few cuts to delivery targets, considering Europe’s sales took a huge L earlier this year, analysts now predict first-quarter deliveries to land at an average of 418,000 vehicles.

Goldman Sachs NYSE:GS , for one, is bigly bearish on the number. It trimmed its target by 50,000 to 375,000 cars. If true, it would mean that Tesla’s business is shrinking by 3% compared with Q1 of 2024 when deliveries hit 387,000 units.

For the year, analysts expect sales to land anywhere between 1.9 million and 2.1 million. With looming competition in the global auto space , Tesla will need to work extra hard to meet these numbers. In 2024, Tesla rolled 1.8 million vehicles off the assembly line and into customers’ hands (down 1% from 2023).

👀 Are Retail Traders Buying the Dip?

What better place to gauge retail traders’ sentiment than the absolute best trading community out there? Let’s hear it from you — share your thoughts on Tesla! Have you been buying the dipping dip that just keeps carving out new lows? Or you’re a freshly minted Tesla bear after all the havoc and drama around Elon Musk? Off to you!

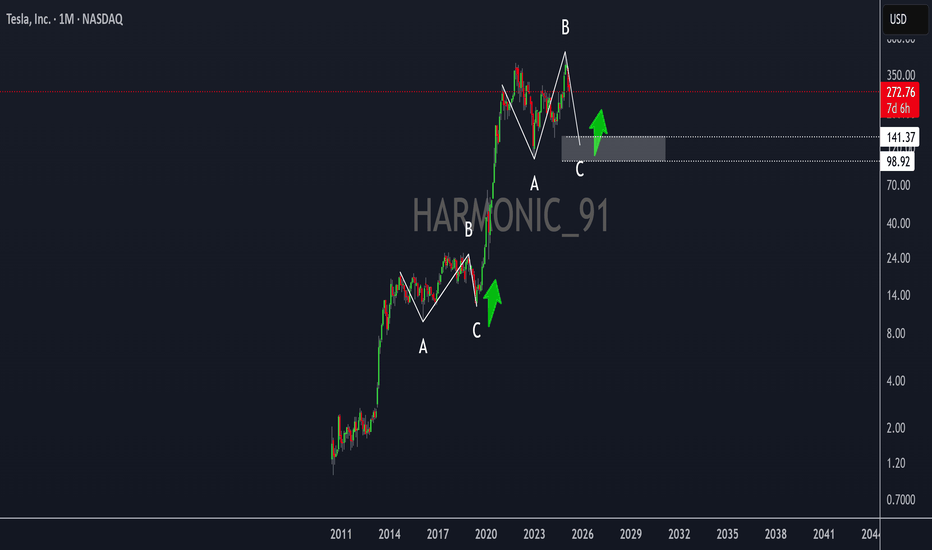

TSLA Tesla correcting towards 90Tesla appears to be correcting the 2022 top in an expanding flat to reach the missing volume at about 80-90. There is a match with the expanding wedge. Soon the wave 1 will end and the retracement in wave 2 is expected to be 50% and reach 350, at which it is time to exit or maybe even short. The PE is over 100 so a correction seems reasonable. Maybe as the correction ends next year, the selfdriving cars and optimus has a breakthrough. Tough competition from BYD

Tesla stock predictionI believe Tesla is a fine company that has lot's of potential to grow. Considering the fact that I think gas prices will go up, people will eventually realize electric vehicles are the way forward. Tesla stock is undervalued right now. A lot of traders are short selling it based on short term views and opinions, eventually the short sellers will need to close their positions! I believe Tesla will continue to pioneer the way forward for electric vehicles. I am going to add Tesla to my portfolio on Monday morning.

TSLA short term rally and long term consolidationAs of March 23, 2025, TSLA stock reflects global economic shifts, geopolitical tensions (e.g., U.S.-China trade), and EV/energy sector dynamics. Short-term, a rally is likely, driven by FSD progress, Cybercab hype, and strong delivery numbers (e.g., China outperformance), bolstered by energy storage growth. Technicals suggest momentum with RSI nearing overbought levels and MACD signaling bullish crossover. Long-term, consolidation looms as high P/E ratios (100x+) face scrutiny amid regulatory risks, EV market saturation, and rising rates. Competitive pressures and execution challenges could cap gains, with support likely at $300-$320 and resistance near $400. Short-term upside, long-term range-bound.

TESLA Stock and the Elliott Wave Theory We are in the Wave B of Flat that started in late April 2024, and from the rules of Elliott Wave, B must have 3 waves(two impulses and one corrective). The first impulse is marked in Green as Wave A. Wave B(Green) is the correction that comes inbetween the two impulses and is a Zigzag. Our last impulse unravels in a 5-Wave move and is marked in Blue.Wave 2 of this 5-wave move was a Zigzag and we should expect a Flat for the 4th Wave. This Wave 4 begins with a deep 3 Wave move that retests around the 161.8 mar. Therefore Wave A(Red) is complete and we should expect a strong 3 Wave move to complete B of the Flat.

Let's Explore Swing Trading !Hello, Trading Community!

I'm excited to share my 100th publication with you all! Grateful for the support and learning from this journey. To mark this milestone, I’m sharing an educational post on Swing Trading—hope it adds value to your trading.

Thank you for being a part of this! Let’s keep growing together.

Happy trading!

Introduction-:

Swing trading is a powerful trading strategy that allows traders to capture market fluctuations over a period of several days to weeks. Unlike day trading, which requires constant monitoring of charts, swing trading enables traders to take advantage of medium-term price movements without being glued to the screen all day.

This guide explores the fundamentals of swing trading, key indicators, strategies, risk management, and common mistakes traders should avoid. By the end of this article, you’ll have a solid foundation to approach swing trading effectively and improve your trading success.

Have you ever wondered how professional traders capitalize on market swings without constantly watching the charts? Let's break it down.

🔹What is Swing Trading-:

Swing trading is a trading style that focuses on capturing short- to medium-term price movements in financial markets. Traders hold positions for several days or weeks, aiming to profit from price swings within a trend.

Unlike day traders, who enter and exit positions within the same day, or long-term investors who hold assets for months or years, swing traders take advantage of short-term fluctuations while aligning with the broader trend.

A key principle in swing trading is identifying trends and trading in their direction. For instance, in an uptrend, a trader looks for pullbacks to enter at a favorable price, while in a downtrend, they may look for rallies to enter short positions.

A well-structured chart example showing an uptrend with higher highs and higher lows can help illustrate this concept effectively.

🔹Key Indicators and Tools for Swing Trading-:

Swing traders rely on technical analysis to find high-probability trade setups. Some of the most commonly used indicators and tools include:

1. Moving Averages (50 & 200 EMA) – Helps identify the overall trend. A price above the 50-day EMA indicates an uptrend, while a price below suggests a downtrend.

2. Relative Strength Index (RSI) & MACD – Used for entry confirmation. RSI helps identify overbought and oversold conditions, while MACD provides trend direction and momentum shifts.

3. Fibonacci Retracement – Useful for identifying pullback levels within a trend. Traders use Fibonacci levels (38.2%, 50%, 61.8%) to anticipate where price might find support or resistance.

4. Support and Resistance Levels – Key price areas where reversals or consolidations often occur. Identifying these levels helps traders find entry and exit points.

A well-annotated chart with these indicators applied can illustrate their importance in real trading scenarios.

🔹Swing Trading Strategies with Examples-:

Trend-Following Swing Trading

This strategy involves entering trades in the direction of the prevailing trend.

Traders wait for pullbacks to enter a position rather than buying at the peak.

Moving averages and RSI are commonly used to confirm the trend and entry points.

Example: A stock in an uptrend retracing to the 50-day moving average with RSI bouncing from the 40 level can be an ideal entry point.

🔹Breakout Swing Trading-:

This strategy focuses on trading breakouts from consolidation patterns such as triangles, flags, and channels.

Traders use volume and MACD to confirm the breakout’s strength before entering.

Example: A stock breaking out from a flag pattern with increased volume signals a strong continuation. A stop-loss is placed below the breakout level to manage risk.

🔹Mean Reversion Swing Trading-:

This approach involves buying oversold conditions and selling overbought conditions.

Bollinger Bands and RSI divergence help identify potential reversals.

Example: If the price touches the lower Bollinger Band and RSI is below 30, traders anticipate a reversal and enter a long position.

Charts illustrating each strategy with proper entry, stop-loss, and target levels can significantly enhance the reader’s understanding.

🔹Risk Management in Swing Trading-:

Successful swing trading isn’t just about finding the right setups—it’s also about managing risk effectively.

1. Risk-Reward Ratio (Minimum 1:2) – Ensuring that potential profits outweigh potential losses. If a trade has a stop-loss of 10 points, the target should be at least 20 points.

2. Stop-Loss Placement – Placing stop-loss orders below swing lows for long trades and above swing highs for short trades to limit downside risk.

3. Position Sizing – Avoiding excessive exposure by ensuring no more than 2% of total capital is risked on a single trade.

4. Using ATR (Average True Range) – A dynamic way to set stop-loss levels based on market volatility.

An example chart demonstrating a well-placed stop-loss and take-profit target can reinforce these concepts.

Common Mistakes to Avoid in Swing Trading-:

1. Overtrading – Entering too many trades based on impulse rather than solid setups.

2. Ignoring Market Context – Trading against the trend or ignoring macroeconomic factors.

3. Not Using Stop-Loss Orders – Holding onto losing trades in the hope that the market will reverse.

4. FOMO (Fear of Missing Out) Trades – Entering trades too late, after the move has already happened.

Understanding these common pitfalls can help traders refine their strategy and improve long-term success.

🔹Conclusion: Becoming a Profitable Swing Trader-:

Swing trading offers an excellent balance between short-term trading and long-term investing. By using technical indicators, proper risk management, and well-defined strategies, traders can capitalize on price movements while minimizing risk.

Before implementing these strategies in a live market traders should backtest them using TradingView to see how they perform over historical data.

Best Regards-: Amit

MAKE OR BREAK SITUATION FOR TESLA - KEEP AN EYEFundamentals

-Tesla faces tough competition in the EV market, with its global share at 19% in 2024, as rivals like BYD grow faster.

-Sales growth might slow down in 2025 due to weaker demand in key markets like China.

Profits are under pressure after price cuts in 2024, with margins dropping to 8.2% in Q4.

Latest News

-Analyst Dan Ives said Elon Musk needs to focus to improve Tesla’s image, which is under pressure (Investopedia, March 21, 2025).

-Tesla led a late-day rally in megacaps, but overall market mood is shaky (Yahoo Finance, March 21, 2025).

-Investors are worried about EV demand slowing down due to high interest rates (Livemint, March 18, 2025).

Recommendation

Tesla (TSLA) rallied from $180 to $480 in an ascending channel on the daily chart from June 2024 to March 2025, but a recent "Trapped Candle" pattern at the highs signals potential volatility, with the stock now at $248.71 near the channel’s lower boundary around $216. In recent sessions, Tesla has definitely shown some support even after a deadly day on March 10, holding above the $216 level. The Fixed Range Volume Profile (FRVP) shows a high volume node between $220-$240, indicating that the market is at a strong position with significant liquidity in this zone. However, this looks like a fear zone where many traders might get trapped if the stock closes above $253, leading to a false sense of recovery. Traders should keep a close eye on whether the stock holds the $216 support or breaks above $253 on the daily chart to determine the next move.

Disclaimer

This content is for informational and educational purposes only. This is not a recommendation regarding any investment or investment strategy.

Investing involves risks. Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options, futures, or digital assets); therefore, you should not invest or risk money that you cannot afford to lose.

TESLA's DILEMMA: A Long-Term Trap or an Opportunity?Brief About the Chart

Descending Channel with Breakout: Tesla (TSLA) traded in a descending channel on the weekly chart from late 2022 to early 2025, with a breakout above the upper boundary (around $300) leading to a rally to $475, followed by a pullback to $248.71, now consolidating near the 50-week moving average.

Fundamental Analysis

Big Player in EV: Tesla is a top name in electric vehicles, holding about 19% of the global market in 2024, and its new products like Cybertruck make it strong for future growth.

More Sales Expected: Tesla’s sales might grow in 2025 because of bigger factories in Shanghai and Texas, with experts saying sales could rise by 15-20% this year.

Profit Worries: Tesla’s profits dropped a bit in 2024 due to price cuts, but better demand and cost-saving steps can help it make more money in the long run.

Latest News (Long-Term Focused)

EV Market Growth: A report says global EV sales might grow 25% in 2025 and keep rising till 2030 due to cheaper batteries and government support, which is great for Tesla (Livemint, March 18, 2025).

Tesla’s Robotaxi Plans: Tesla is working on self-driving robotaxis, with plans to launch them by 2026, which could add billions to its revenue in the future (Investopedia, March 19, 2025).

Battery Tech Push: Tesla is investing in new battery tech to cut costs by 30% over the next 5 years, making its cars cheaper and boosting sales (Yahoo Finance, March 20, 2025).

Conclusion

Since this is a long-term view, Tesla’s current price of $248.71, after a breakout from a descending channel and a pullback to a key support level, indicates that this is indeed not a bad place to start investing in the stock at all. However, more attention is needed in order to analyze the entry, particularly by monitoring whether the stock holds above the $245 support level and shows signs of renewed momentum on the weekly chart.

Tesla Approaching Key Support: Potential Long Setup in PlayTesla has recently experienced a strong bearish expansion, retracing toward previous value areas and currently trading below the value area high. It is finding support at a key daily support/resistance (SR) level of $217.

At this stage, Tesla is approaching a potential reversal zone, but for a long trade setup to be confirmed, we need to see consolidation on the daily timeframe, signaling exhaustion of selling pressure.

The next major technical support lies at $176, which aligns with multiple confluences:

1. 0.618 Fibonacci retracement level

2. Daily SR support at $176

3. VWAP (golden line) acting as support

4. Value area low of the previous range

This confluence increases the probability of a reaction in this zone, making it a key area to monitor for a potential long entry.

Trade Execution Considerations:

• Patience is key—we may see a bounce on lower timeframes before Tesla trades toward the $176 entry zone.

• Entry trigger should be established on lower timeframes, confirming bullish structure or a shift in momentum.

• Technical target: The key swing high once bullish confirmation is in place.

Until then, monitoring price action and waiting for confirmation will be crucial before taking a long position.

TESLA Trading Opportunity! SELL!

My dear followers,

I analysed this chart on TESLA and concluded the following:

The market is trading on 249.11 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 240.93

About Used Indicators:

A super-trend indicator is plotted on either above or below the closing price to signal a buy or sell. The indicator changes color, based on whether or not you should be buying. If the super-trend indicator moves below the closing price, the indicator turns green, and it signals an entry point or points to buy.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK