WBA Walgreens Boots Alliance Options Ahead of EarningsLooking at the WBA Walgreens Boots Alliance options chain ahead of earnings , I would buy the $30 strike price Puts with

2023-6-16 expiration date for about

$1.01 premium.

If the options turn out to be profitable Before the earnings release, I would sell at least 50%.

Looking forward to read your opinion about it.

WBAD trade ideas

Green on Walgreens. WBAConfirmed pivot.

We are not in the business of getting every prediction right, no one ever does and that is not the aim of the game. The Fibonacci targets are highlighted in green with invalidation in red. Confirmation level, where relevant, is a pink dotted, finite line. Fibonacci goals, it is prudent to suggest, are nothing more than mere fractally evident and therefore statistically likely levels that the market will go to. Having said that, the market will always do what it wants and always has a mind of its own. Therefore, none of this is financial advice, so do your own research and rely only on your own analysis. Trading is a true one man sport. Good luck out there and stay safe.

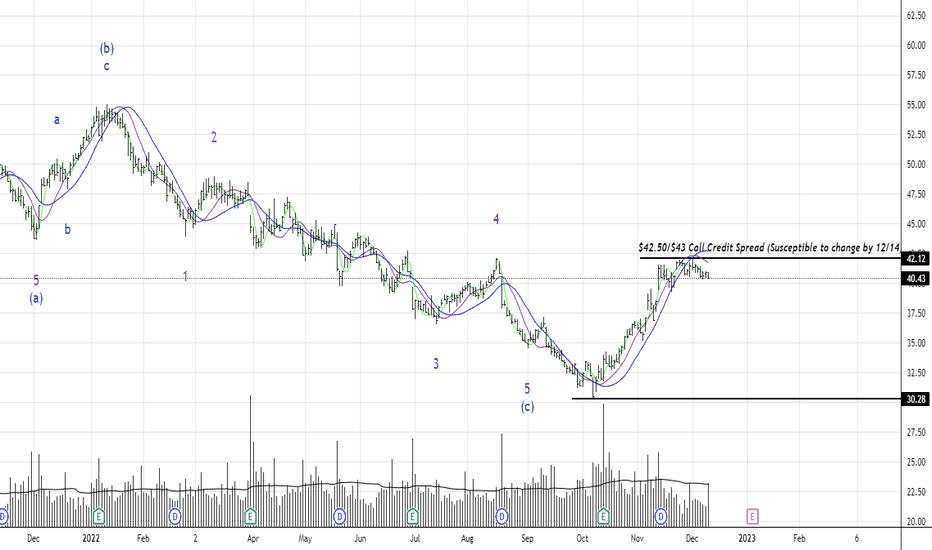

Walgreens Boots Alliance: Take Your Medicine 💊Walgreens Boots Alliance should take its medicine as the share needs some more strength to make it above the resistance at $42.29. From there, the course should rise into the green zone between $52.38 and $59.29 to conclude wave 3 in green before we anticipate a countermovement. A 38% chance remains, though, that WBA could drop below the support at $32.70 instead, subsequently slipping below the support at $30.39 as well.

WBA earnings on ThursdayWBA Q1 November 2022 earnings are on Thursday 1/5/2023 at 7am. Walgreens Boots Alliance (WBA) reported Q4 August 2022 earnings of $0.80 per share on revenue of $32.4 billion. The consensus earnings estimate was $0.78 per share on revenue of $32.1 billion. Revenue fell 5.3% compared to the same quarter a year ago. The company said it expects fiscal 2023 earnings of $4.45 to $4.65 per share. Here's WBA levels on the 1-day chart:

Q1 November 2022 consensus:

EPS = $1.14

Revenue = $33B

SMA200 = $39.65

SMA20 Triangular Trend Channel ATR(beta):

top = $43.96

R3 = $42.89

R2 = $41.81

R1 = $40.74

pivot = $39.66

S1 = $38.59

S2 = $37.52

S3 = $36.44

bottom = $35.37

Do your own due diligence, your risk is 100% your responsibility. This is for educational and entertainment purposes only. You win some or you learn some. Consider being charitable with some of your profit to help humankind. Good luck and happy trading friends...

*3x lucky 7s of trading*

7pt Trading compass:

Price action, entry/exit

Volume average/direction

Trend, patterns, momentum

Newsworthy current events

Revenue

Earnings

Balance sheet

7 Common mistakes:

+5% portfolio trades, capital risk management

Beware of analyst's motives

Emotions & Opinions

FOMO : bad timing, the market is ruthless, be shrewd

Lack of planning & discipline

Forgetting restraint

Obdurate repetitive errors, no adaptation

7 Important tools:

Trading View app!, Brokerage UI

Accurate indicators & settings

Wide screen monitor/s

Trading log (pencil & graph paper)

Big, organized desk

Reading books, playing chess

Sorted watch-list

Checkout my indicators:

Fibonacci VIP - volume

Fibonacci MA7 - price

pi RSI - trend momentum

BBMC - bollinger bands

TTC - trend channel

AlertiT - notification

tickerTracker - MFI Oscillator

www.tradingview.com

WBA (Range Trade)The last two times price touched $42 was in August ($42.10) and December ($42.03). Price hovered near $42 highs in November but didn't hold. Could also be a start of new impulsive wave to the downside. Might wait til the fed decision and cpi reports pass next week to get a second look.

WBA - Horizontal Support Leading to Double BottomWBA has formed a strong horizontal support

This provides a good support for price

Price has already bounced once off this area recently

Right now we are just waiting on the next test

This is on the Weekly timeframe but it would also be evident on the daily

WBAexcelente riesgo beneficio

patron armonico

Walgreens Boots Alliance, Inc. engages in the provision of drug store services. It operates through the following segments: Retail Pharmacy USA and Retail Pharmacy International. The Retail Pharmacy USA segment consists of the Walgreens business, which includes the operation of retail drugstores, health and wellness services, and mail and central specialty pharmacy services. The Retail Pharmacy International segment consists of pharmacy-led health and beauty retail businesses and optical practices. The company was founded in 1901 and is headquartered in Deerfield, IL.