WFC Earnings Setup – 07/14/2025 $86C | Exp. July 18 | Betting on

📈 WFC Earnings Setup – 07/14/2025

$86C | Exp. July 18 | Betting on a Bank Bounce

⸻

🔥 EARNINGS HEAT CHECK

💼 WFC reports BMO (07/15)

📊 Historical move avg: ~3–5%

📍 Current price: $82.53

📈 Above 20D/50D MAs → trend intact

⚠️ RSI = 78.07 = overbought 🚨

💥 Expected move: $2.89

⸻

🧠 SENTIMENT SNAPSHOT

🔄 Call OI stacked at $86

🔻 Put OI focused at $81

⚖️ Balanced flow → slight bullish tilt

🧾 IV is elevated, so IV crush is coming

⸻

🏦 SECTOR SUPPORT

• Financials showing strength 📈

• No major institutional bias

• VIX @ 16.40 → macro calm = earnings-friendly

⸻

🎯 Trade Plan – IV Exploitation Setup

{

"ticker": "WFC",

"type": "CALL",

"strike": 86,

"exp": "2025-07-18",

"entry": 0.81,

"target": 1.62,

"stop": 0.40,

"size": 1,

"confidence": "70%",

"entry_timing": "pre-earnings close"

}

🔹 Call Entry: $0.81

🎯 Profit Target: $1.62 (+100%)

🛑 Stop: $0.40 (-50%)

📅 Expiry: 07/18/25

📆 Earnings Date: 07/14 (BMO)

📈 Expected Move: ~$2.89

🧠 Confidence: 70%

⸻

⚠️ Key Risks

• IV crush = quick decay if WFC doesn’t move

• Guidance could swing the stock either direction fast

• Overbought = short-term pullback risk even on good earnings

✅ Why $86C?

• Just outside expected move

• High OI = liquidity

• Reasonable premium = good risk/reward

⸻

📣 Model Consensus:

“Moderately Bullish” — strong setup but keep it tight around earnings!

Tag your favorite bank stock trader 🏦👇

Who’s playing WFC earnings this quarter?

#WFC #EarningsPlay #OptionsTrading #CallOption #BankingStocks #IVCrush #RiskReward #AITrading #

WFC trade ideas

WFC · Daily — Rising-Channel Breakout Idea Toward $89-90Why This Setup Caught My Eye

Multi-year rising channel: Since late 2022 price has respected a neat parallel channel; we’re now testing the upper rail.

Fresh bull-flag breakout: The June pullback carved a tight triangular flag. Last week’s high-volume close above $83 confirmed the breakout.

Measured-move logic: Flagpole ≈ $15 (from the March swing-low $68 → May swing-high $83). Projecting that height from the June pivot ($74) lands at $89-90 — perfectly matching the 100 % Fibonacci extension on my chart.

Volume-profile tailwind: A low-volume node spans $86-91, suggesting limited overhead supply until the top of the target box.

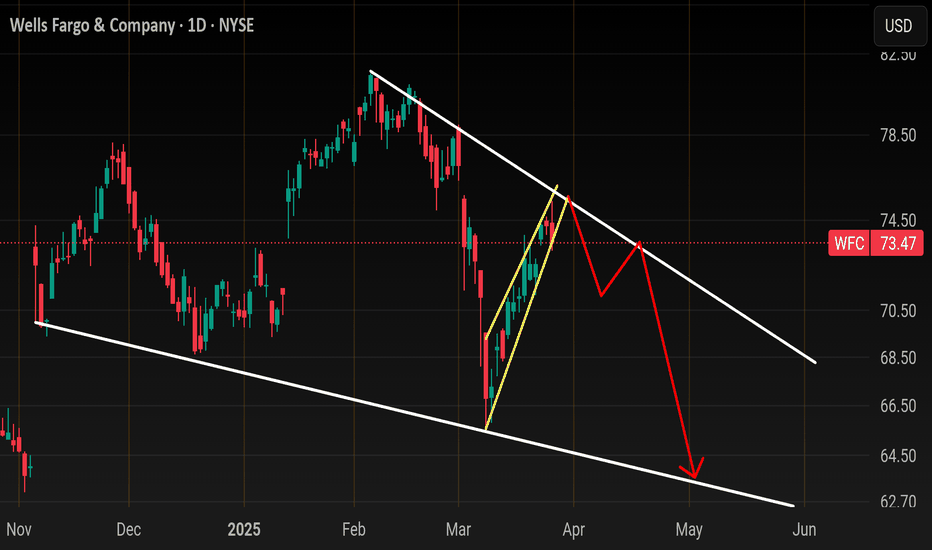

Shorting WFC for short-term correction NYSE:WFC is looking at near-term weakness after a strong bearish counter attack candle was seen rejecting the 123.6% Fibonacci extension of the range (71.82-76.50) and the 88.6% deep retracement level of the larger swing low to high (50.20-80.70).

23-period ROC is looking at a bearish divergence and volume has spike up on selling.

Target is likely to be at 71.80 and 67.10. Should the opening reverse above 76.50, the stock is likely to resume its upside and we will cut short the short-sell trade.

WFC eyes on $74: Major Resistance going into FED rate decision WFC testing a Major Resistance zone going into FED day.

Looking for a Rejection or a Break-and-Retest for next move.

Financials in general are doing well but due for a little dip.

$73.56-74.11 is the key zone of interest.

$68.91-69.60 is first good support below.

=====================================================

.

WFC Trade LevelsEither or set-up while in this range.

For day trades, expect price to move between 64.86-66.30 where there is a daily gap down.

For now, the gap is acting as resistance.

When trading gaps, it depends on your objective. Scalpers might be interested in playing off the H/L of the gap.

While intraday traders will be more interested in trading once price breaks above the gap or rejects below.

WFC - Faster Up PhaseAs price transitions through fib circle acceleration of price upwards is allowed

Price has been going through an upward movement however slowly, I expect price to move up faster

This is similar to Tesla's moves upward. Kind of moving up in chunks or in big waves

Weekly timeframe

WFC is moving ahead of the market for better or worse?My overall thesis is we are in the very early stages of a multi-year decline ultimately with the S&P 500 below 3500. I have been wrong many times before so I will just take this thing in stages and see if it plays out. After this massive decline, we should be in for a great market rally of many decades. I am expecting the market to end its recent rally this week. The current rarely would be about a week in length depending when it began for individual stocks. The rally has done a few important things with its slow and prolonged upward movement, mainly prevents a wave 3 signal from occurring during the next decline.

My wave 3 indicator tends to signal wave 3s and 3 of 3s. See my scripts for the specifics of the indicator. If the market had a short wave 4 up and then a sharp or prolonged drop during wave 5, a new wave 3 signal would occur which violates the currently placed Minor wave 3 (yellow 3). Allowing separation from the current wave 3 signal enables wave 5 to drop quick or slow.

This chart applies select movement extensions based on wave 1's movement on the left and then another based on wave 3's movement on the right. I keep the values between 0%-100% on the chart for wave 2s and 4s retracements of the preceding wave's movement for reference even though the retracement values would be inverted.

Specifically for WFC, Minor wave 3 was the shortest impulsive wave, likely indicating wave 5 will be 49 bars (30 minute scale) or less. This will likely put a restriction on the length of the decline. Additionally wave 4 is moving faster for this ticker than it has been on the others I have studied. Minor wave 5 should drop below wave 3's bottom of 65.515. Using some basic movement extensions, it will likely go lower, but likely not too much more. Once we bottom, we should see another rally over a few weeks. I will forecast what that could look like as Intermediate wave 1 nears its end.

While WFC has been trading with most of the other signals I am watching, the current rally could be a sign of Intermediate wave 1 possibly having ended at the current Minor 3 bottom. This would mean we are in Intermediate wave 2 now. In this case, the top of Intermediate wave 2 is quickly approaching (no higher than 78.98. I will evaluate this solution if the rally continues next week.

Wells Fargo $WFC at a turning point📌 09.03.2025 Analysis:

✅ 1. Bearish Divergence:

Price Action: Higher high from Nov 26, 2024 → Feb 6, 2025.

SMI: Lower high from Nov 26, 2024 → Feb 19, 2025.

Interpretation: This confirms a bearish divergence—institutions were not supporting the price move despite a new high.

📌 Notes:

Look at how sharp the SMI drop is after making the lower high. The steeper the decline, the stronger the conviction in institutional selling.

If price makes a lower high and SMI declines aggressively, it confirms a reversal.

✅ 2. Volume Confirms Weak Breakout Attempt:

Price made a new high but volume was below the 50-day VMA.

Low volume on a higher high = Weak breakout attempt.

This suggests that buyers lacked conviction, likely retail-driven.

📌 Notes:

Check if there were any large red volume bars during this uptrend.

If large red candles appear in an uptrend with high volume, it signals distribution (institutions selling into strength).

If green candles were small and volume was low, buyers were weak, and the move was unsustainable.

✅ 3. High-Volume Sell-Off Confirms Bearish Conviction:

The last 5 days saw increasing volume on red candles.

Volume during the sell-off is above the 50-day VMA, showing institutional selling.

SMI MA (red line) is declining further = Smart money is not buying at these levels.

📌 Notes:

Since SMI is still declining while testing $70, it suggests institutions are not stepping in to defend support yet.

If WFC closes below $70 with strong volume, expect further downside.

If SMI starts flattening or rising while price holds $70, institutions may be accumulating.

📌 Final Trade Plan:

❌ Bearish Breakdown (If WFC closes below $70 with volume above 50-day VMA)

Sell-off target: $68 → $66.

Confirmation: SMI keeps dropping, high red volume.

✅ Bullish Reversal (If SMI flattens/rises while $70 holds)

Buy signal: WFC stabilizes at $70 with rising green volume.

Target: First bounce to $74 → Next target $78.

Happy Sunday!

Follow me for more updates on this trade 😊🚀

Wells Fargo are we good to participate in the banking industry?Hi guys ,off to our next opportuntiy WFC , currently one of the bigger banks in the US which have some good upside potential!

Fundamentals :

Financial Performance

In the third quarter of 2024, Wells Fargo reported a net income of $5.1 billion.

This performance reflects the company's resilience and adaptability in a dynamic economic environment.

Wells Fargo offers a comprehensive range of services, including banking, insurance, investments, mortgage, leasing, and credit cards. The company operates approximately 5,200 branches and 13,000 ATMs, serving one in three U.S. households and more than 10% of small businesses in the U.S.

The company has been under a regulator-imposed asset cap of approximately $1.95 trillion since February 2018, following past regulatory issues. There is anticipation that this cap may be lifted in 2025, which could significantly enhance Wells Fargo's growth and profitability.

Wells Fargo remains a significant player in the financial services industry, demonstrating both strengths and challenges. The company's extensive range of services and substantial asset base position it well for future opportunities, while ongoing regulatory and market challenges require careful navigation.

Entry : On market open

Target: 87.15

P.S. If you have questions or inquiries about one of my existing set-ups or personal questions / 1 on 1 sessions consider joining my community so you can follow up with me in private!

Wells Fargo & Company: Here's Why Investors Shouldn't Miss Out!Hello,

Wells Fargo & Company is a financial services company. It provides a diversified set of banking, investment and mortgage products and services, and consumer and commercial finance, through banking locations and offices, the Internet

www.wellsfargo.com) and other distribution channels to individuals, businesses and institutions in all 50 states, the District of Columbia and in countries outside the United States. Its segments include Consumer Banking and Lending; Commercial Banking; Corporate and Investment Banking, and Wealth and Investment Management. The Wealth and Investment Management segment provides personalized wealth management, brokerage, financial planning, lending, private banking, trust and fiduciary products and services to affluent, high-net worth and ultra-high-net worth clients. Commercial Banking products and services include banking and credit products across multiple industry sectors and municipalities, secured lending and lease products, and treasury management.

TECHNICAL ANALYSIS- Checklist

1.Structure drawing (Trend line drawing on past price chart data)- As shown below

2.Patterns identification (Naming patterns on past price chart data for future wave)- The price is currently correcting & filling the Nov 5th gap.

3.Future indication (Reading indicator for future wave)- 0 crossover on MACD.

4.Future wave (Drawing on future price chart using future indication from indicator)- As shown

5.Future reversal point (Identifying trend reversal point on price chart using structure)- Target price $90

FINANCIAL SUMMARY

BRIEF : From 2018 to 2023, total revenue increased overall from $96.25 billion to $116.22 billion, though it dipped in 2020 and 2022; net interest income fluctuated, starting at $49.99 billion in 2018, dropping to $35.78 billion in 2021, then recovering to $52.38 billion by 2023; meanwhile, net income was highly variable, peaking at $19.55 billion in 2019, significantly dropping to $3.38 billion in 2020, before soaring to $1.914 billion in 2023.

Risks to consider

•Revenue growth has become challenging at Wells Fargo. Though the Federal Reserve cut the interest rate by 50 basis points in September 2024, the bank’s Non-Interest Income may continue to face challenges in the near term as stabilizing funding costs might take time. The company is trying to increase fee-based income sources, but it will take some time to reflect in its financials. Hence, top-line growth is less likely to improve in the quarters ahead.

Q3 EARNINGS SUMMARY (Date of release 11.10.2024) (Next report date Jan 15,2025)

•Wells Fargo reported a net income of $5.1 billion down from 5.7 billion in the same Quarter last year 2023.

•Total revenue decreased to $20.37 billion, down from $20.86 billion in Q3 2023.

•Non-interest expenses were slightly reduced to $13.07 billion, compared to $13.11 billion a year earlier.

•The provision for credit losses was reported at $1.07 billion, down from $1.20 billion in Q3 2023.

•Average loans were $910.3 billion, a decrease from $943.2 billion.

•Average deposits increased slightly to $1,341.7 billion, compared to $1,340.3 billion.

•The bank repurchased 62 million shares, totaling $3.5 billion in Q3 2024.

•Return on Equity (ROE) was at 11.7%, down from 13.3% in the prior year.

•Return on Average Tangible Common Equity (ROTCE) decreased to 13.9%, from 15.9%.

•Consumer Banking and Lending revenues decreased by 5%, primarily due to lower deposit balances.

•Commercial Banking revenues showed a slight decline of 2%, while Corporate and Investment Banking revenues remained stable.

•CEO Charlie Scharf highlighted ongoing investments in diverse revenue sources, with fee-based revenue growing by 16% during the first nine months of the year, largely offsetting net interest income challenges.

Our recommendation

Wells Fargo reported third-quarter earnings of $5.1 billion, which included a one-time loss of $447 million ($0.10 per share) due to adjustments in their investment securities portfolio. Despite this setback, the bank's strategic realignment is expected to bolster future interest income. Over the past year, Wells Fargo's stock has corrected -12% since November 2024 giving us a great entry opportunity. Key to note is also that Wells Fargo’s Share Repurchase has been performing a share repurchase program. In the reported quarter 3 2024, Wells Fargo repurchased 62 million shares, or $3.5 billion, of common stock.

From a technical perspective, the recent correction in the Wells Fargo & Company stock provides a perfect entry point for this stock. The stock has approached its moving averages, which often signals potential support levels. Additionally, there's an anticipation of a zero crossover on the MACD (Moving Average Convergence Divergence), an indicator used to spot changes in a stock's momentum, suggesting a possible shift from bearish to bullish trends. This combination of technical signals indicates that the stock might be at an advantageous point for entry. Our target for this stock is at USD 90.14 with a buy at USD 71.31.

Looking ahead, external factors like the election of Donald Trump and Republican control of Congress present potential opportunities for the U.S. banking sector, evidenced by a post-election rally of over 10% for many bank stocks. While valuations in the sector range from fair to slightly overvalued, easing capital regulations—such as the revised Basel III proposal that lowers capital requirements for large banks—could spur balance sheet growth, profitability, and shareholder returns. The proposed law revisions to reduce capital requirements and a more conducive environment for mergers and acquisitions could enhance profitability and shareholder returns. Our recommendation is Buy on this stock.

WFC Wells Fargo & Company Options Ahead of EarningsIf you haven`t bought WFC before the breakout:

Now analyzing the options chain and the chart patterns of WFC Wells Fargo & Company prior to the earnings report this week,

I would consider purchasing the 70usd strike price Puts with

an expiration date of 2025-3-21,

for a premium of approximately $2.82.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

$WFC earning Bullish!WFC is demonstrating a strong bullish trend, even while sitting near a resistance NYSE:WFC looks like the catalyst of earning could push them past that point having recently pulled back to its 5-day exponential moving average (ema). This suggests that the upward trajectory is likely to continue.

WFC pullback to $64MODs have suggested that I provide more detail about the picks I make.

Sorry. I'm not as verbose as y'all, and I don't like things to be complicated.

My trading plan is very simple.

I buy or sell at top & bottom of parallel channels.

I confirm when price hits Fibonacci levels.

Bonus if a TTM Squeeze in in play.

I hold until target is reached or end of year, when I can book a loss.

So...

Here's why I'm picking this symbol to do the thing.

Price above channels (period 100 52 39 & 26)

Stochastic Momentum Index (SMI) at overbought level

VBSM spiked positive

Price at/near Fibonacci level

In at $73.33

Target is $64.43 or channel bottom

Stop loss is $76

Wells fargo.. Top watch here on WFC.. approaching

25 year trend line 🚩

Outside weekly Bollinger band 🚩

Outside monthly Bollinger band 🚩

AMEX:XLF banking sector near resistance 🚩

The cup and handle that sent WFC from 50 to 75 is completed

Expect a correction back to 60$ from here .. price shouldn't close above 75.00$