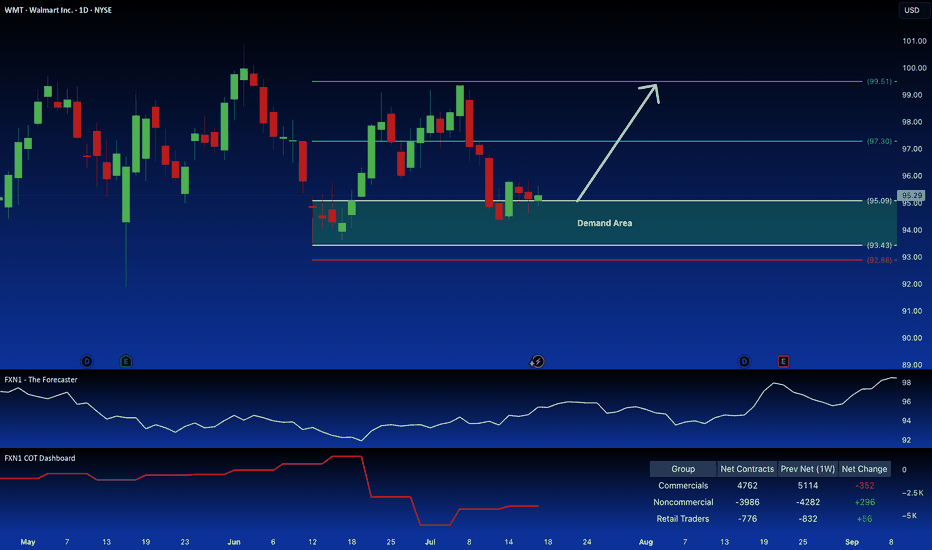

Walmart: Long Position Attractive on Demand ZoneWalmart Inc. presents a compelling long opportunity. The price action is reclaiming a key demand zone, suggesting a continuation of the current uptrend, a pattern reinforced by seasonal factors. Further bolstering the bullish case is the observed increase in large speculator positions.

✅ Please share your thoughts about WMT in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

WMTD trade ideas

WMT is ready for another phase of the price discoveryThis Week (July 8 - 12):

Support: The 20-day moving average around $96.70 is the first floor. Below that, the key range support is at $95.00.

Resistance: The top of the range and the all-time high around $101.50 is the ceiling that needs to break.

Next Month (July):

Support: The main support for the entire structure is the $95.00 level. A break below that would be a major warning sign.

Resistance: If we break above $101.50, there is no overhead resistance. We would be in "blue sky territory," with a projected target near $108.

Stocks SPOT ACCOUNT: WMT stocks Buy Trade with Take ProfitStocks SPOT ACCOUNT: NYSE:WMT stocks my buy trade with take profit.

This is my SPOT Accounts for Stocks Portfolio.

Trade shows my Buying and Take Profit Level.

Spot account doesn't need SL because its stocks buying account.

Looks good Trade.

Disclaimer: only idea, not advice

Walmart: Retail Giant Positioned for Growth Amid Bullish MomentuCurrent Price: $94.40

Direction: LONG

Targets:

- T1 = $98.20

- T2 = $101.80

Stop Levels:

- S1 = $92.10

- S2 = $90.40

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to identify high-probability trade setups. The wisdom of crowds principle suggests that aggregated market perspectives from experienced professionals often outperform individual forecasts, reducing cognitive biases and highlighting consensus opportunities in Walmart.

**Key Insights:**

Walmart continues to demonstrate resilience within the retail sector, benefiting from strong consumer spending trends. Its position at the 200-day simple moving average (SMA) indicates a key technical support level, providing investors with an attractive entry point for potential upside. As e-commerce gains momentum, Walmart’s operational strengths, bolstered by strategic pricing and logistics, emphasize its long-term growth potential. Consumer discretionary spending remains robust despite inflationary pressures, solidifying Walmart's steady trajectory.

The company's push into hybrid models of shopping, blending in-store and online experiences, has given it a significant edge over competitors. With strong leadership and strategic investments in technology and supply chain efficiencies, Walmart has proactively positioned itself for sustained profitability.

**Recent Performance:**

In recent sessions, Walmart’s price has shown resilience by maintaining stability at the $94 range, aligning closely with its 200-day SMA. Despite broader market volatility, bullish sentiment in the retail sector has supported investor confidence. Comparatively, Walmart has showcased better performance than many of its peers in controlling costs while expanding its digital footprint.

**Expert Analysis:**

Market experts view Walmart as a bellwether of the retail industry. Its ability to balance cost leadership with quality offerings underscores a competitive advantage. This analysis shows optimism for Walmart's e-commerce investments and operational efficiency. Technical indicators such as a narrowing Bollinger band suggest potential volatility expansion, which combined with recent upward price action, hints at possible bullish momentum. Indicators of increasing relative strength support the potential for breakout levels.

**News Impact:**

Retail activity has been positively influenced by consumer interest in savings-focused platforms, with Walmart emerging as a primary destination. Events like Amazon Prime Day indirectly bolster competition, driving visibility toward Walmart's comparable discount strategies. Additionally, Walmart's robust supply chain measures have ensured product availability, catering to high consumer expectations and supporting its market credibility.

**Trading Recommendation:**

With Walmart holding key technical support levels and benefiting from strong consumer trends, a long position appears substantiated. Traders should consider entering near the current price with stops placed below $92 for risk mitigation. Price targets at $98.20 and $101.80 reflect meaningful upside potential spurred by favorable market dynamics and Walmart’s strategic initiatives.

Exact Entry Levels & Profit Potential (July 3, 2025)🎯 Market Structure Breakdown – Exact Entry Levels & Profit Potential (July 3, 2025)

📊 In today’s session, I revisit the market for the second time – and you’ll see why I’m ruling out some setups altogether. There’s value in looking twice. What did I miss earlier? It's all in the structure.

I break down price action step by step, highlight precise entry zones, and show where the real potential for movement lies. Clean levels, no guessing.

⚠️ Note: I don’t trade the first 10 seconds – all orders are placed after 9:30:10 and I'm looking for entries only until 11:30:00.

👉 Check out the full breakdown and stay ahead of the game.

NASDAQ:AMZN

NYSE:ANET

NASDAQ:AVGO

NYSE:BA

NASDAQ:COIN

NASDAQ:CZR

NYSE:DELL

NASDAQ:GOOG

NASDAQ:MSFT

NASDAQ:AMD

NASDAQ:RKLB

NASDAQ:SBUX

NASDAQ:SMCI

NYSE:VRT

NASDAQ:NVDA

Long Position Targeting Key Resistance LevelsCurrent Price: $97.27

Direction: LONG

Targets:

- T1 = $100.25

- T2 = $102.50

Stop Levels:

- S1 = $95.50

- S2 = $94.25

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to identify high-probability trade setups. The wisdom of crowds principle suggests that aggregated market perspectives from experienced professionals often outperform individual forecasts, reducing cognitive biases and highlighting consensus opportunities in Walmart.

**Key Insights:**

Walmart continues to outperform in the Consumer Defensive sector, showcasing resilience in both stable and adverse market conditions. Experts have highlighted the stock's inclusion among bullish setups for the upcoming week, reinforcing optimism surrounding its operational strength, demand consistency, and ability to withstand broader economic volatility. These factors make Walmart a compelling candidate for potential near-term upside.

**Recent Performance:**

Walmart has maintained solid momentum, benefiting from strength within the Consumer Defensive sector, which remains a preferred choice among investors during uncertain economic phases. The stock has positioned itself as a safe harbor amid broader market volatility, garnering attention alongside peer staples like Costco and Pepsi.

**Expert Analysis:**

Consensus among market analysts paints a favorable outlook for Walmart, rooted in its enduring competitive edge, operational reliability, and robust consumer demand. The bullish sentiment ahead aligns with Walmart's ability to cater to investors seeking both stability and moderate growth in uncertain conditions. Analysts’ perspectives suggest the stock may trend upward, particularly if it breaches next week’s projected resistance levels.

**News Impact:**

While no major recent announcements have been flagged, Walmart's sector resilience combined with market enthusiasm for its strategic positioning signals optimism. Investors should remain alert for potential catalysts such as earnings reports, operational strategy updates, or changes in consumer spending that could influence performance. Walmart’s reputation as a core staple positions it well for consistent interest and demand.

**Trading Recommendation:**

The positive sentiment surrounding Walmart’s operational strength and sector resilience makes it a strong candidate for a LONG position with an upside potential to the next resistance levels. With robust performance in uncertain conditions, Walmart presents traders with an opportunity for growth with defined risk parameters provided by the stop-loss levels.

Wake-Up Time for Walmart?Walmart has snoozed for months, but some traders may think it’s waking up.

The first pattern on today’s chart is the price range on either side of roughly $95. The retail giant peaked at that level in early December and is back near the same location more than six months later. That indicates a period of consolidation has occurred.

Second, a weekly low of $93.43 developed near the bottom of the range. WMT held it last week and bounced, which may suggest support is in place.

Third, stochastics have rebounded from an oversold condition and prices are bouncing at the 100-day simple moving average. Those signals may imply a longer-term uptrend remains in effect and is reasserting itself.

Finally, traders looking to the upside may notice the February 20 gap around $100. WMT probed that level in early June before backing down. Is another test coming?

Check out TradingView's The Leap competition sponsored by TradeStation.

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options and futures. If you're born to trade, we could be for you. See our Overview for more.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options or futures); therefore, you should not invest or risk money that you cannot afford to lose. Online trading is not suitable for all investors. View the document titled Characteristics and Risks of Standardized Options at www.TradeStation.com . Before trading any asset class, customers must read the relevant risk disclosure statements on www.TradeStation.com . System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors.

Securities and futures trading is offered to self-directed customers by TradeStation Securities, Inc., a broker-dealer registered with the Securities and Exchange Commission and a futures commission merchant licensed with the Commodity Futures Trading Commission). TradeStation Securities is a member of the Financial Industry Regulatory Authority, the National Futures Association, and a number of exchanges.

TradeStation Securities, Inc. and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., both operating, and providing products and services, under the TradeStation brand and trademark. When applying for, or purchasing, accounts, subscriptions, products and services, it is important that you know which company you will be dealing with. Visit www.TradeStation.com for further important information explaining what this means.

Walmart (WMT): Building Momentum, Targets in SightLong-Term Trend Break : Walmart (WMT) was in a strong, sustained uptrend until early 2025, indicated by the thick green channel, but then experienced a significant correction in March that broke this primary ascending channel.

Established Support Zones : Following the March decline, WMT has established a "Good support" area near 91 to 93, with "Immediate Support" now identified at 96, indicating buying interest at these levels.

Current Price Action & Recovery Attempt : The stock is currently trading around 97.70, showing a bounce from its recent lows, suggesting an attempt to regain upward momentum after forming a potential bottom.

Defined Upside Targets : Two sequential bullish targets: a "1st Target" at 100, and a "2nd Target" at 104, which coincides with the previous resistance area and potentially the upper boundary of the long-term channel.

Disclaimer:

The information provided in this chart is for educational and informational purposes only and should not be considered as investment advice. Trading and investing involve substantial risk and are not suitable for every investor. You should carefully consider your financial situation and consult with a financial advisor before making any investment decisions. The creator of this chart does not guarantee any specific outcome or profit and is not responsible for any losses incurred as a result of using this information. Past performance is not indicative of future results. Use this information at your own risk. This chart has been created for my own improvement in Trading and Investment Analysis. Please do your own analysis before any investments.

Shorting Walmart at $90 Strike: Viking Technical Raid Wielding the axe of strict technical analysis and guided by the ravens of market intuition, I’m see short potential for Walmart (WMT) targeting a $90 strike price within 1-2 weeks (by June 20-27, 2025) . Key runes of the charts foretell a storm of downside momentum . Recent price sagas reveal faltering bullish spirits, with a double top signaling weakness in the enemy’s ranks. My Viking strategy strikes with precision to shield against counterattacks. Join my Trading Den for updates on this bold raid and more technical conquests! Skål! Not financial advice; trade at your own risk.

WALMART testing its 1D MA50! Will it bounce?Walmart (WMT) hit yesterday its 1D MA50 (blue trend-line) for the first time since April 21. It appears that the rebound from the Trade War Low has turned sideways on a Double Top formation and the 1D MA50 is the first Support to be tested, with the 1D MA200 (orange trend-line) following.

This pattern resembles the August - September 2022 Bull Flag, which despite breaking below its 1D MA50, it resumed the uptrend shortly after and hit the 1.382 Fibonacci extension before the next 1D MA50 pull-back.

As a result, we expect the stock to reach $110.00 (Fib 1.382) by the end of the Summer.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

WMT: Walmart stock under pressure from tariffs.

It seems that Trump's tariffs are not very favorable for Walmart’s long-term outlook.

However, from a technical perspective, the stock is currently in a good position, and its short-term EPS forecasts are improving day by day.

I don’t recommend buying Walmart for the long term, but there might be a good buying opportunity next week.

Three U.S. Retail Kings, Three Tariff StrategiesIn an environment of trade tensions and tariffs threatening to raise costs, America’s retail giants have taken very different paths to protect their profitability. Below, we analyze how Home Depot, Costco, and Walmart have managed the latest tariffs and how this shows up in their net profits for the two most recent fiscal years.

1. Home Depot: Absorbing the Cost and Diversifying Supply

o Net profit 2023: USD 17,105 M

o Net profit 2024: USD 14,806 M (–13.5 %)

In an unusual move for the sector, Home Depot refused to pass Trump’s tariff costs onto consumers, declaring “no way” they would raise prices. Instead, they bolstered their network of professional contractors and acquired SRS Distribution, allowing them to handle large volumes at lower cost and more competitive prices. Their geographic diversification now means no country outside the U.S. accounts for more than 10 % of their sourcing.

o Q1 FY25 sales: USD 39,860 M (↑ 9 % YoY)

o Q1 FY25 net profit: USD 3,400 M (–5.6 % YoY)

o Q2 FY25 guide: sales growth +2.8 %, maintaining solid EBITDA without price hikes.

o Current share price (20/05/25): USD 377.05 (YTD +2.45 %)

o 12-month forecast range: USD 360–475; consensus target: USD 427.50.

2. Costco: Memberships as an Inflation Shield

o Net profit 2023: USD 6,292 M

o Net profit 2024: USD 7,367 M (+17.1 %)

Rather than splashy headlines, Costco sticks to its tried-and-true formula: razor-thin margins and membership fees. By keeping margins tight on high-turnover goods and offsetting with subscription revenue, the company has boosted its member base and renewals, and optimized its internal supply chain to minimize external cost impacts.

o Q1 FY25 sales: USD 60,990 M (↑ 7.5 % YoY)

o Q1 FY25 net profit: USD 1,798 M (↑ 13.1 % YoY)

o Q2 FY25 (12 weeks): sales USD 62,530 M (↑ 9.1 % YoY); net profit USD 1,788 M

o Current share price (20/05/25): USD 1,036.82 (YTD +13.43 %)

o 12-month forecast range: USD 907–1,205; consensus target: USD 1,082.14.

3. Walmart: Selective Price Tweaks and Omnichannel Push

o Net profit 2023: USD 13,670 M

o Net profit 2024: USD 15,500 M (+13.4 %)

Unlike Home Depot, Walmart has been more willing to adjust prices on tariff-hit categories, drawing some White House criticism. Still, they closed Q1 FY25 with sales of USD 165,600 M (↑ 2.5 % YoY) and net profit of USD 4,480 M (–12.1 % YoY). For Q2, they anticipate sales growth of 3.5–4.5 % versus USD 167,800 M a year ago, thanks to their e-commerce and subscription services push. Their omnichannel strategy doubles down on platform investment, “click & collect,” and expanding digital delivery and subscription offerings.

o Current share price (20/05/25): USD 97.80 (YTD +8.81 %)

o 12-month forecast range: USD 91–120; consensus target: USD 109.33.

Conclusion

Peering out the windows of their vast megastores, Home Depot, Costco, and Walmart face the same tariff storm with very different navigational charts. Home Depot chose to resist price increases, absorbing extra costs and reengineering its supply chain to limit any single foreign supplier to under 10 %—a temporary margin sacrifice for long-term stability. At the other extreme, Costco has built an impenetrable dam with its membership model and razor-thin margins, where member loyalty and a fine-tuned internal logistics engine act as a natural shield against inflation and tariffs. And in between, Walmart sharpens its selective pricing knife on tariff-hit goods while flexing full omnichannel muscle—from “click & collect” to beefing up digital subscription and delivery services. Three distinct survival stories, yet one shared endpoint: weathering the tariff tempest without losing the rhythm of their financial performance.

*******************************************************************************************

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and such should be considered a marketing communication.

All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.

Analysing the Spike in Volatility on the Walmart (WMT) ChartAnalysing the Spike in Volatility on the Walmart (WMT) Share Price Chart

On Thursday, the US retail giant reported its quarterly results — which turned out to be broadly better than expected. While total revenue was roughly in line with analysts’ forecasts, earnings per share came in higher at $0.61 versus the expected $0.57.

At the same time, Walmart CEO Doug McMillon stated on Thursday:

"We will do everything we can to keep our prices as low as possible. But given the scale of the tariffs, even at reduced levels, we won't be able to absorb all the pressure, considering the reality of tight retail margins."

This statement may have raised concerns among market participants about the company’s future earnings, contributing to Friday’s drop in the share price to $92.

It also drew the attention of the US President. On Saturday, Donald Trump said that Walmart (WMT) should “swallow the tariffs” instead of blaming them and raising prices.

In response, Walmart reiterated that it will keep prices as low as possible for as long as it can — which has always been the company’s approach.

Technical Analysis of the WMT Stock Price Chart

Looking at the broader market context, we can see that price fluctuations formed a narrowing triangle in late April — a sign that buyers and sellers had reached some agreement around a fair value of approximately $95.50.

In early May, sentiment shifted in favour of the bulls, with this level acting as support (marked by an arrow).

The earnings release triggered a spike in volatility — the ATR indicator is now at a one-month high. The Walmart stock price extremes seen at the end of last week suggest two key levels, roughly equidistant from the $95.50 axis:

→ resistance around $99 (reinforced by the psychological level of $100);

→ support around $92.

Given the above, it is reasonable to suggest that once the market has digested the news, price movements may calm down again. In that case, we may well see another narrowing triangle form on the WMT chart — slightly above the previous one.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

April 2025 Market Crash: Causes, Impact, and Strategic ResponseApril 2025 will go down in financial history as one of the most turbulent months of the past decade. A large-scale market crash, triggered by geopolitical escalation and intensified trade tensions, revealed just how fragile the global investment landscape remains—even after a relatively stable start to the year.

What Happened?

On April 6, 2025, the U.S. administration announced sweeping tariffs of up to 145% on all Chinese imports. This decision, though preceded by months of political strain, took the markets by surprise. Panic-selling ensued almost immediately. The Dow Jones plummeted over 4,000 points within two days—the steepest decline since the COVID-era crash of 2020. The S&P 500 and Nasdaq followed suit, dropping 6–9% in a matter of hours.

Asian and European indices mirrored the collapse: Japan’s Nikkei 225 fell by 7.8%, and Germany’s DAX dropped by 5.4%. The synchronized reaction emphasized the ongoing interdependence of global markets, even in an era of growing protectionism.

Why It Matters

For GeldVision clients and institutional investors worldwide, such events highlight the importance of risk-managed portfolio strategies. The April crash wasn’t solely a reaction to tariffs—it was also driven by fears of a potential recession and uncertainty surrounding central bank policies.

Another destabilizing factor was the automatic response of algorithmic trading systems, which exited positions en masse as technical indicators were breached—amplifying volatility and accelerating the selloff.

How GeldVision Responded

Since early 2025, we at GeldVision have implemented a strategy of “adaptive conservatism,” gradually reducing equity exposure in client portfolios and reinforcing positions in defensive assets such as gold, investment-grade bonds, and liquid currency instruments.

During the height of the market turmoil, our team activated internal stress protocols, including temporary order freezes on automated buy-ins and direct client communications for real-time portfolio reviews. This proactive approach allowed us to minimize losses and maintain client confidence.

What’s Next?

We expect volatility to persist at least through Q3. For investors, the key is to avoid reactive decisions and maintain a long-term perspective. GeldVision will continue to expand its macroeconomic monitoring, enhance risk models, and provide clients with the tools needed to navigate uncertain markets safely.

Quantum's Walmart (WMT) Trading Guide 4/28/25WMT’s weekly outlook balances its defensive resilience against macroeconomic headwinds, with a comprehensive synthesis of technical, market, and strategic factors guiding its trajectory for weekly options contracts. The FAME framework underscores WMT’s long-term bullish potential, driven by robust fundamentals (+5% revenue, $0.58 EPS, 21% e-commerce growth) and adaptability (AI, Walmart+), positioning it as a resilient player in a risk-off regime. However, elevated yields (10-year 4.255%, 20-year 4.738%, 30-year 4.721%) and a stable DXY at 99.58 amplify tariff pressures and margin concerns, capping upside and reinforcing a cautious stance. A tactical long bias is favored for weekly contracts, targeting a bounce from $94.36 to $96.47–$98.50, with a short stance viable below $88.50 if support fails.

Technical implications highlight bullish momentum on daily (RSI ~40, Stochastic ~28) and weekly (RSI ~44, Stochastic ~32) timeframes, with oversold conditions signaling a rebound potential for weekly contracts if $94.36 holds. Monthly neutral momentum (RSI ~50) suggests consolidation, requiring a breakout above $96.47 to confirm bullish strength. This supports a short-term bounce but advises monitoring for sustained moves.

Market influence implications reflect a risk-off environment, with high yields and a stable DXY increasing import costs, particularly amid tariff uncertainty from WMT’s upcoming Trump meeting. The VIX at 24.84 amplifies volatility, favoring WMT’s defensive appeal but heightening risks. WMT’s Q3 FY25 strength and e-commerce growth provide stability, supporting resilience near $94.36.

OFD summary and implications reveal bearish pressure from Vanna (-$0.04), Charm (-$0.02), and DEX (-$0.06), driven by put-heavy flow and hedging demand tied to tariff fears. However, GEX (+$0.08) at the $95 strike pins price, stabilizing volatility and supporting a neutral-to-bullish bounce for weekly contracts if $94.36 holds, aligning with oversold technicals.

Edge insights bolster the case for a bounce, with institutional buying at $94–$95 signaling accumulation, defensive retail sector strength outperforming cyclicals, and low short interest (1.4%) offering squeeze potential above $96.47. These factors enhance confidence in a tactical long bias for weekly contracts, provided support holds.

Strategic outlook implications emphasize consolidation near $95.09, with $94.36 as a critical pivot. A break below risks $88.50, driven by tariff fears and bearish options flow, while a move above $96.47 targets $98.50, fueled by oversold signals and institutional support. The VIX at 24.84 and put-heavy options flow underscore volatility, but WMT’s defensive positioning mitigates downside, favoring a bounce in a risk-off regime.

In summary, WMT’s weekly outlook hinges on defending $94.36, with oversold technicals, GEX pinning, and institutional buying supporting a bounce to $96.47–$98.50 for weekly contracts. Tariff risks, high yields, and DXY stability maintain a risk-off backdrop, capping upside and requiring vigilance for a break below support, which could shift bias to bearish. This balanced approach leverages WMT’s defensive strengths while navigating weekly volatility, aligning with Buffett’s preference for resilient businesses with tactical opportunities.