Mid-term uptrend starts: 333.5-348.2 or higher

Hello, traders.

If you "Follow", you can always get new information quickly.

Please click "Boost" as well.

Have a nice day today.

-------------------------------------

(BCHUSDT 1D chart)

The M-Signal indicators on the 1M, 1W, and 1D charts are showing an upward trend in a convergent state.

Accordingly, if the price is maintained above 333.5-348.2, it is expected to continue the uptrend in the mid- to long-term.

If the uptrend continues,

1st: 473.4-480.4

2nd: 590.6

You should respond depending on whether there is support near the 1st and 2nd above.

If it falls below 333.5, you should check if it is supported around 294.6.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- Here is an explanation of the big picture.

I used TradingView's INDEX chart to check the entire range of BTC.

I rewrote it to update the previous chart while touching the Fibonacci ratio range of 1.902 (101875.70) ~ 2 (106275.10).

(Previous BTCUSD 12M chart)

Looking at the big picture, it seems to have been maintaining an upward trend following a pattern since 2015.

In other words, it is a pattern that maintains a 3-year bull market and faces a 1-year bear market.

Accordingly, the bull market is expected to continue until 2025.

-

(Current BTCUSD 12M chart)

Based on the currently written Fibonacci ratio, it is displayed up to 3.618 (178910.15).

It is expected that it will not fall again below the Fibonacci ratio of 0.618 (44234.54).

(BTCUSDT 12M chart)

Based on the BTCUSDT chart, I think it is around 42283.58.

-

I will explain it again with the BTCUSD chart.

The Fibonacci ratio ranges marked in the green boxes, 1.902 (101875.70) ~ 2 (106275.10) and 3 (151166.97) ~ 3.14 (157451.83), are expected to be important support and resistance ranges.

In other words, it seems likely that they will act as volume profile ranges.

Therefore, in order to break through these ranges upward, I think the point to watch is whether they can receive support and rise near the Fibonacci ratios of 1.618 (89126.41) and 2.618 (134018.28).

Therefore, the maximum rising range in 2025 is expected to be the 3 (151166.97) ~ 3.14 (157451.83) range.

In order to do that, we need to see if it is supported and rises near 2.618 (134018.28).

If it falls after the bull market in 2025, we don't know how far it will fall, but based on the previous decline, we expect it to fall by about -60% to -70%.

Therefore, if it starts to fall near the Fibonacci ratio 3.14 (157451.83), it seems likely that it will fall to around Fibonacci 0.618 (44234.54).

I will explain more details when the bear market starts.

------------------------------------------------------

BCHBULLUSDT trade ideas

Bitcoin Cash, 200% In 3 WeeksThis is my idea, Bitcoin Cash will grow some 100-200% within the next 2-3 weeks, what do you think?

Sounds-looks possible?

It would have to be a very strong rise but I think it is possible maybe a bit longer but for higher prices.

The first target here for a long-term higher high and the higher in years sits at $993. The next target is $1,439. The All-Time High is $1,650 and we know there will be a new All-Time High in 2025.

So maybe 200% in two weeks is too much for Bitcoin Cash because it is too big, but this based only on left brain logical thinking. Bitcoin Cash can grow 200% in the coming weeks. 2-3 weeks. It can happen fast and then after a strong retrace additional but long-term growth. Makes sense?

It can happen. Cryptocurrency is wild and while it has been slow for years that's only because these were the years of slow. When it goes fast it is the time of being fast and all can happen in a flash. By the time we try to act or react it is already too late and the action has gone off the chart.

It is a guess, a prediction. I don't know if it will grow 200%, 300% or 500% but I know for certain it will be going up.

The consolidation period is over. This week is the fifth week since the correction low.

The market is bullish now and the next advance will produce the highest prices since November 2021.

It will be easy for Bitcoin Cash to grow by 200%. A new All-Time High will be very interesting, it's been so long.

Are you ready for what the market is preparing?

I hope you are.

Namaste.

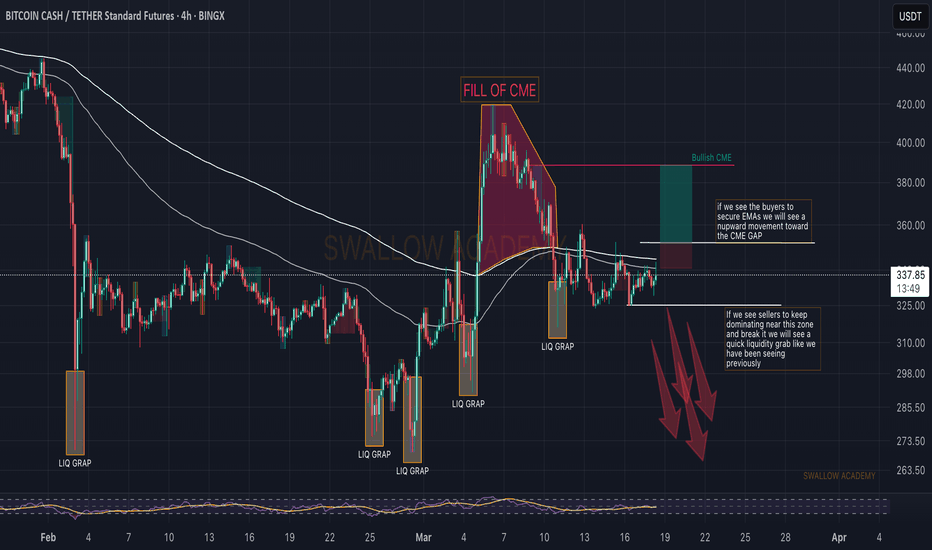

Bitcoin Cash (BCH): Seeing Good Shorting OpportunityBitcoin Cash has a good chance to start falling since we recently got rejected from the resistance zone while also filling the bullish CME gap.

If we see the next 4-hour candle or the candle after that to be with a strong red body, then we will have more confirmation of sellers' dominance, which then would mean a movement to the 200 EMA line (near the support zone).

From there we might break the zone and if we break the next target would be near $316, but this will be taken as an option only if we see a clean breakdown!

Swallow Academy

Bitcoin Cash —An Opportunity That Cannot Be MissedBitcoin Cash already grew quite a bit between June 2023 and April 2024, total growth from bottom to top amounts to 699%, but this is not all.

Right now the conditions are perfect for the continuation of this long-term bullish phase. The bear market bottom was hit in June 2022, after an entire year of sideways action, Bitcoin Cash broke up and produced the chart that we are looking at now. It has been a sequence of higher highs and higher lows.

Between April 2024 and April 2025, we have a long-term correction, a classic ABC.

The C wave is a higher low compared to the low that was hit in August 2023. The next high is a projected higher high compared to the start of the ABC correction, April 2024. This higher high is likely to turn into a new All-Time High.

This is the last chance to enter while prices are low. Just in 2-3 weeks time, Bitcoin Cash will be trading many times higher and it will never move this low again.

Do what you have to do. Think if you have to think. Plan if planning is what you need; but, keep in mind that this is an opportunity that cannot be missed.

Namaste.

BCHUSDT 3D#BCH is going to $800?

#BCH has bounced off the support line of the bullish flag on the 3-day timeframe. It’s now facing resistance at the flag’s midline and the 3-day MA50. Consider buying and holding some #BCH. Targets:

🎯 $461.1

🎯 $526.5

🎯 $591.8

🎯 $684.9

🎯 $803.5

⚠️ Use a tight stop-loss.

BCHUSDT UPDATEBitcoin Cash (BCH) Technical Setup

Pattern: Falling Wedge Breakout

Current Price: $363.5

Target Price: $634, Target % Gain: 80.50%

Technical Analysis: BCH has broken out of a long-term falling wedge pattern on the daily chart, indicating a potential bullish reversal. Volume has picked up post-breakout, supporting the move with clear structure.

Time Frame: 1D

Risk Management Tip: Always use proper risk management.

Bitcoin Cash ($BCH) Analysis

The price has bounced strongly from the demand zone between $270 – $295, suggesting the start of a potential bullish wave. A falling wedge pattern has been broken to the upside on the weekly timeframe, which is a strong bullish signal.

Buy Zone:

Support zone between $270 – $295 offers a solid buying opportunity if retested.

Targets:

Target 1: $491

Target 2: $626

Target 3: $758

The bullish outlook remains valid as long as the price holds above the $270 support level.

Bitcoin Cash Bounces from $309 – Eyes on $500 and BeyondSET:BCH is showing a strong reversal from the long-term ascending support trendline, holding above a key zone around $309. This bounce aligns with a historical support level and confirms buyer interest.

The structure remains intact within a descending wedge, with a potential upside move toward the long-term resistance near $480–$500. As long as price holds above $309, momentum favors bulls, and a breakout could lead toward the $600–$1,200 zone mid-term.

DYOR, NFA

BCH/USDT "Bitcoin Cash vs Tether" Crypto Heist (Swing / Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the BCH/USDT "Bitcoin Cash vs Tether" Crypto Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk Yellow ATR Line. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe nearest or swing low or high level for pullback entries.

Stop Loss 🛑:

📍 Thief SL placed at the recent/swing low level Using the 4H timeframe (300.00) Day/Swing trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 390.00 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸BCH/USDT "Bitcoin Cash vs Tether" Crypto Market Heist Plan (Day / Swing Trade) is currently experiencing a bullishness,., driven by several key factors.☝☝☝

📰🗞️Get & Read the Fundamental, Macro, COT Report, On Chain Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

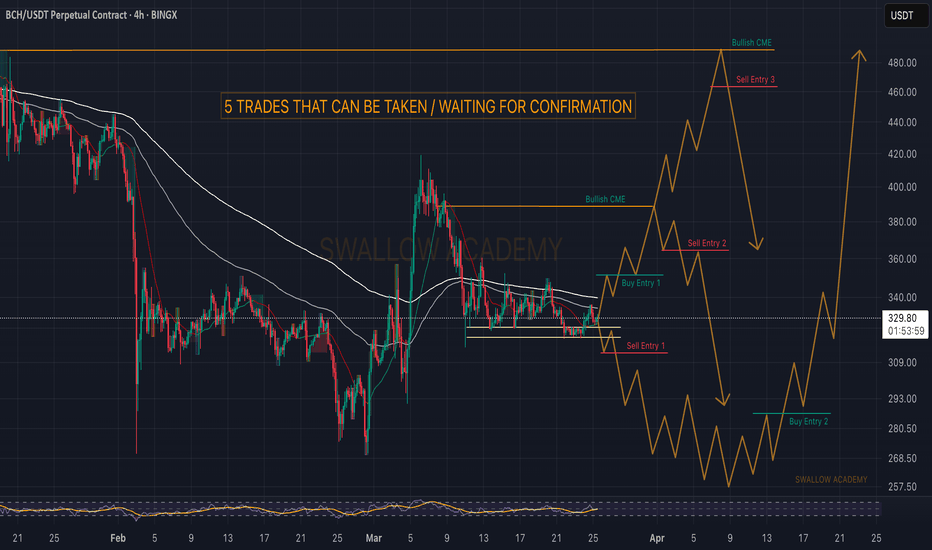

Bitcoin Cash (BCH): 5 Possible Trades That Can Be TakenWell, BCH coin has 2 bullish CME gaps that we have not yet filled while price is still below the 200EMA struggling to breakout from it.

With lots of uncertainty on the chart currently, we have put 5 possible trades that we are going to look for on Bitcoin Cash.

Buy Trades: Possible Moves

Buy Entry 1: Once we see a breakout from the 200EMA line and we see a successful re-test of it, we are going to look for long up until the first bullish CME near $385.

Buy Entry 2: If we see markets to dip more, then BCH will follow with testing to local lows, where we will be looking for some kind of market structure break to occur, which would give us the confidence for upward movement.

Sell Trades: Possible Moves

Sell Entry 1: If we see a breakdown from local support at $320 and sellers manage to secure it with proper re-test, we will be seeing a dip towards the $275.

Sell Entry 2: Once we see the fill of bullish CME and first signs of weakness, we are going to look for market structure breaks on smaller timeframes like 30M, where then we would be looking for movement towards the 200EMA (for a quick re-test).

Sell Entry 3: If we see a huge optimistical push currently that would break both Bullush CMEs and reach the highest one, then we will be looking for a quick rejection there without any MSB to form, just pure volatility hunting!

Get ready, and let's see what we will end up with.

Swallow Team

Bitcoin Cash (BCH): Good R:R Trades Can Be Taken Near 200EMABitcoin Cash coin is currently trading below branch of EMAs where recently we had quick fill of bullish CME gap above the EMAs.

As there are still a lot of uncertainties on the market, we are not going to rush into any trade here yet but rather prepare ourselves for both scenarios.

Both setups we see are with good R:R, What do you think based on the current market state? Where will we head?

Swallow Team

Bitcoin Cash (BCH): Bearish CME + Lower Liquidation ZoneWe are seeing an unfilled bearish CME gap on BCH coin, which might send the price even lower.

We are looking for the CME gap to be filled, whereupon seeing further pressure from sellers, we are going to look for a possible breakdown to form there, which then would send the price to our next target zone at $276.

Swallow Academy

BCH/USDT: Ideal Selling OpportunitySignal Overview

📈 Symbol: BCH/USDT

⏱️ Timeframe: 1h

📊 Market Sentiment: Fear (Fear & Greed Index: 43)

🎯 Analysis Score: Buy: 45.9, Sell: 9.7, Confidence: 229.3%

🕒 Last Data Update: 2025-04-12 14:00:00 (50.7 minutes ago)

Technical Analysis

RSI in extreme overbought territory: 84.90

Price approaching critical resistance level: 330.2092

Very high confidence signal

Risk Management (Sell Position)

Entry Point: 327.3723 (326.8814 with slippage and fees)

Stop Loss: 332.4284 (-1.70%)

Exit Strategy:

Target 1: 313.1862 (4.09%) - 50% position

Target 2: 304.6748 (6.70%) - 30% position

Target 3: 297.6020 (8.87%) - 20% position

Risk/Reward Ratio (Target 1): 2.81

Suggested Position Size: 129.6263 BCH

ATR (Average Volatility): 3.3707 (1.03%)

Additional Recommendations

This is an ideal setup with an excellent risk-to-reward ratio. The RSI is showing extreme overbought conditions while price approaches a significant resistance level, creating a prime selling opportunity. Always implement proper risk management and avoid risking more than 2.0% of your capital on this trade. Commitment to the exit strategy is crucial for maximizing profit potential.

Trade Rationale

The technical indicators strongly suggest BCH is overextended in the short term. With RSI at 84.90, we're seeing extreme overbought conditions that historically precede corrections. The price is approaching key resistance at 330.2092, which provides an ideal entry for a short position. The tiered take-profit strategy allows for capturing gains at different price levels while maintaining a favorable risk-to-reward profile.

BCH DAILY ANALYSISHi friends,

In today's analysis, we pay attention to BCH in the daily time frame.

We have a significant daily support level at the price of $260.

We have a local resistance area for $321, which is good for entering long positions.

The main major daily resistance is at the price level of $404. We also have a daily resistance trend line, which has three touches, and it's confirmed.

In recent days, the trading volume has decreased in this area, which somehow indicates that it might be a pullback of the current downtrend.

$BCH Rebounds Strongly – Is a Breakout Toward $540 Coming?SET:BCH is showing a strong bullish reversal from a key ascending trendline on the weekly chart. After retesting the support zone near $250, the price bounced with 9% gains, signaling renewed interest. The structure forms a symmetrical triangle, and BCH is now eyeing resistance near $309. A breakout could target the $440–$540 zone.

This move aligns with Bitcoin’s current consolidation at higher levels. If BTC remains strong in Q2 2025, BCH could follow with further upside. Holding the $225–$250 support is crucial to maintain this bullish setup.

DYOR, NFA

Bitcoin Cash: Your Altcoin ChoiceNotice, the lowest price in more than a year and yet, there is no increase in trading volume. Lower low and no higher bearish volume bars is a signal of weakness for the current trend. This means that the current bearish move lacks force. It is drying out. It is reaching its end. It is done. And that's great for us.

I am doing the daily timeframe so focusing mainly on present action. There was a major low in August 2024 followed by a bullish wave. Yesterday produced a lower low, a long-term low but the action closed above the August 2024 low. This means that buyers were ready and waiting for those selling at the low. Those that sold at a strong support, lost their coins. Buyers got a great entry price and are accumulating, waiting to see if more bears will sell so they can buy everything up. If bears sell, good for the bulls as they will get good prices once more before a massive bullish wave. This is not between you and me, this is a battle between whales.

Regardless of your beliefs and what you think will happen with the tariffs, the government and Trump, Bitcoin is going up. Bitcoin will grow and as Bitcoin grows it will take the entire Altcoins market with it to the moon and beyond. That's the situation we find ourselves in right now. It is something that is good, trust.

The best time to buy is when prices are low.

Notice the chart. The peaks tend to last only a few days. The time to sell.

But look at support... It tends to go for long. The market only gives a few days to sell, but plenty of time to buy —accumulate— and hold.

The price that is active now was activated in early February, more than two months ago. So the peak is valid for only 1-2 days, yet the support-buy is valid for months.

That's the signal. Sell when prices are high, buy when prices are low.

Namaste.

BCHUSDTmy entry on this trade idea is taken from a point of interest below an inducement (X).. I extended my stoploss area to cover for the whole swing as price can target the liquidity there before going as I anticipate.. just a trade idea, not financial advise

Entry; $210.0

Take Profit; $374.9

Stop Loss; $157.8

bchusdt is getting ready for the big dump???Hello, friends, to answer the above question, we need to check the chart. In the 4-hour chart, we see a strong downward trend and a slightly complicated correction, which can be a sign of the beginning of a price drop to lower levels in case of a strong failure of the price support at the level of $315. In addition, a negative hidden divergence in rsi increases the probability of its occurrence. If the price breaks the level of 355 upwards, this possibility will be ruled out.