BCHUSD - Falling Wedge Recovery at the middle of the falling wedge

This recovery allowing price to break out and retest the initial price high (horizontal dotted line)

I consider the vertical dotted line the middle of the overall larger pattern

Retest of previous high during this bull run

Daily chart

BCHUSD.P trade ideas

Bitcoin Cash Faces Pressure: Will $300 Hold or Break ?

Downtrend Confirmation: The price recently broke below the mid-Bollinger Band (20-day SMA), signaling bearish momentum.

Lower Bollinger Band Touch: The price recently reached the lower band, suggesting oversold conditions or a continuation of the downtrend.

Volume Spike in Down Move: Increased volume during the price drop indicates strong selling pressure.

Support Around $300: The price has recently bounced from near $300, a psychological and historical support level.

Resistance Near $380-$400: The mid-Bollinger Band and previous price rejections suggest resistance in this range.

Bullish Reversal: If BCH can reclaim the mid-Bollinger Band ($380 area) and hold, it may trigger a move toward the upper band ($480+).

Further Downside: A failure to hold $300 may open the door for further declines toward $280 or lower.

Consolidation Phase: If BCH stabilizes between $300-$380, sideways movement may occur before a new breakout.

BCH , sleeping giant Slowly stabilising on the support and getting ready for the throw, I bet the move will be harsh and fast , in the chart I appointed three tps to show safe places to unload but will try to chase the move and update in the path , the fact is I feel we bottomed out and next will be non stop gains for this lovely dinosaur.

BCH/USD: Preparing for a BreakoutThe chart shows the formation of a symmetrical triangle after a sharp price drop. This typically signals a potential breakout in one direction.

Key levels:

• Support level: $321

• Resistance level: $339

Possible Scenarios:

1. Breakout Upwards: If the price consolidates above $339, we could see a rise towards the $370-$390 range.

2. Breakout Downwards: If the price falls below $321, we might see a drop towards the $290-$270 zone.

What to Consider:

• Trading Volume: Watch for an increase in volume during the breakout to confirm the direction.

• Fundamental Factors: Keep an eye on crypto market news that might influence the move.

My Approach:

I will act only on confirmed breakouts to avoid false signals.

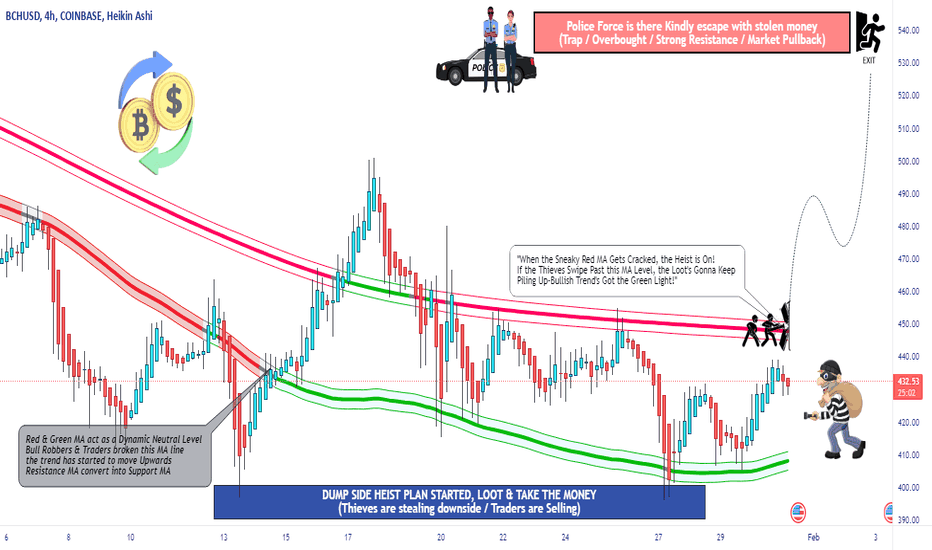

BCH/USD "Bitcoin Cash vs US Dollar" Crypto Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the BCH/USD "Bitcoin Cash vs US Dollar" Crypto market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (450.00) then make your move - Bullish profits await!"

however I advise placing Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Using the 4H period, the recent / nearest low or high level.

Goal 🎯: 530.00 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

The BCH/USD market is currently experiencing a mix of bullish and bearish signals. Here's a breakdown of the fundamental, macroeconomic, COT, and market sentiment factors influencing the pair:

🟣Fundamental Analysis

Bitcoin Cash Price: The current price of Bitcoin Cash is around $428.79 USD, with a market capitalization of $8.50 billion USD.

Transaction Costs: Bitcoin Cash transactions are usually much cheaper compared to Bitcoin, due to its greater scalability.

🔵Macroeconomic Analysis

Global Economic Trends: The ongoing global economic recession, particularly in the European continent, has led to increased interest in cryptocurrencies as haven assets.

Inflation Rates: The impact of inflation rates on the BCH/USD pair is currently neutral, with no significant changes in the inflation outlook.

🟢COT Analysis

Speculative Positions: Speculative traders are net long on the BCH/USD pair, indicating a bullish sentiment.

Commercial Traders: Commercial traders are net short on the pair, indicating a bearish sentiment.

🟡Market Sentiment Analysis

Client Sentiment: 52% of client accounts are short on this market, indicating a bearish sentiment.

Technical Analysis: The Relative Strength Index (RSI) is at 46.79, indicating a neutral trend.

Market Positioning: The BCH/USD pair is currently overbought, with a possibility of a price correction.

🟤Upcoming Predictions

Short-Term Forecast: Analysts predict a 25% gain for Bitcoin Cash before heading for a correction.

Long-Term Forecast: The Bitcoin Cash price prediction for 2025 and 2030 is bullish, with expected growth in the cryptocurrency market.

Based on these factors, the BCH/USD market is likely to experience a bullish trend in the short term, followed by a correction. However, the long-term forecast remains bullish, driven by the growing adoption of cryptocurrencies and the increasing scalability of the Bitcoin Cash network.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤗

BCH/USDT Short Trade Setup – Key Levels!Here’s the **BCH/USDT Short Trade Setup** based on the chart:

---

**🚨 📉**

- **SL (Stop-Loss):** 447.86 🔴

- **Entry:** 439.38 🟡

- **T1 (Target 1):** 433.46 🟢

- **T2 (Target 2):** 424.99 🟢

👉 Ensure confirmation of breakdown and rejection at key resistance levels before entering. Manage your risk effectively! 💹

#BCHUSDT #CryptoTrading #ShortTrade #TechnicalAnalysis #TradingSetup #CryptoMarket #RiskManagement

BCH long trade Setup!Here’s the same breakdown of your **long trade setup** with emojis for a visually engaging explanation:

---

### **📊 Trade Setup:**

1. **🎯 Entry Point:**

Entered after a **breakout** 🚀 above the trendline resistance, showing bullish momentum 📈.

2. **🛑 Stop Loss (SL):**

Set at **$454.05** 🔻, just below the support level to limit risk ⚠️.

3. **🏆 Target Levels (T1 & T2):**

- **Target 1 (T1):** **$472.10** 🥇, the first resistance zone.

- **Target 2 (T2):** **$483.03** 🥈, a higher resistance for extended gains 📊.

4. **📐 Risk/Reward Ratio:**

The trade has a **favorable risk-to-reward ratio** ⚖️, offering solid profit potential 💰.

---

- **Breakout** occurred after forming **higher lows** 📶, indicating buyers are in control 🟢.

- Green candlesticks ✅ confirm upward momentum 🌟.

- **Volume (if analyzed):** Supports the breakout for stronger conviction 🔍.

---

### **📌 Plan for Execution:**

- Monitor the price action near **T1** 🧐 to secure **partial profits** 💵 or tighten your stop loss.

- If bullish momentum continues strongly 🌟, hold for **T2**, but **trail your stop loss** to lock in profits 🔒.

Good luck with your trade! 🚀📈 Let me know if you need further support! 😊

Bitcoin Cash golden cross and January 20thBitcoin Cash golden cross is a buy signal before January 20th. When a 100-day moving average crosses above a 200-day moving average, it's commonly referred to as a "golden cross". Indicating a potential bullish signal, suggesting a possible shift from a bearish trend to a bullish trend in the market. In 2023 BCH went from a low on January 20th to a high of + 214%. In 2024 BCH went from a low on January 20th to a high of + 207%. Is the 3rd time a charm? If BCH can go +200% from January 20th 2025 the high would be around 1300 per Bitcoin Cash!

Trade idea:

Long = sma100

stop = sma200

profit = 1300

BCH/USD "Bitcoin Cash vs USD" Crypto Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the BCH/USD "Bitcoin Cash vs USD" Crypto market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. Be wealthy and safe trade.💪🏆🎉

Entry 📈 : You can enter a Bull trade at anypoint,

however I advise placing Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Using the 4H period, the recent / nearest low or high level.

Goal 🎯: 250.00 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

Warning⚠️ : Our heist strategy is incompatible with Fundamental Analysis news 📰 🗞️. We'll wreck our plan by smashing the Stop Loss 🚫🚏. Avoid entering the market right after the news release.

Fundamental Outlook 📰🗞️

Based on the fundamental analysis, the BCH/USD is expected to move in a bullish direction.

Here are some key factors that support this prediction:

Increasing adoption: Bitcoin Cash is gaining traction as a payment method, with more merchants and businesses accepting it as a form of payment.

Improving scalability: The Bitcoin Cash network is undergoing significant upgrades to improve its scalability, which is expected to increase its appeal to users and investors.

Growing developer community: The Bitcoin Cash developer community is growing, with more developers contributing to the project and improving its functionality.

Partnerships and collaborations: Bitcoin Cash is forming partnerships with other companies and organizations, which is expected to increase its visibility and adoption.

Regulatory environment: The regulatory environment for cryptocurrencies is becoming more favorable, with more countries and governments recognizing the potential of Bitcoin Cash and other digital assets.

Some upcoming events that could impact the price of BCH/USD include:

Bitcoin Cash halving: The Bitcoin Cash halving is expected to occur in April 2024, which could lead to a significant increase in price as the supply of new coins is reduced.

Upgrades and improvements: The Bitcoin Cash network is expected to undergo significant upgrades and improvements in the coming months, which could increase its appeal to users and investors.

Partnerships and announcements: Bitcoin Cash is expected to announce new partnerships and collaborations in the coming months, which could increase its visibility and adoption.

Market Sentiment:

Bullish sentiment: 70%

Bearish sentiment: 30%

Neutral sentiment: 0%

Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

Take advantage of the target and get away 🎯 Swing Traders Please reserve the half amount of money and watch for the next dynamic level or order block breakout. Once it is resolved, we can go on to the next new target in our heist plan.

Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

BCH/USD Eyeing 1M PP Test, Caution AdvisedHello,

COINBASE:BCHUSD is currently a strong buy, with no significant bearish resistance in sight. It's poised to retest the 1M pivot point (PP) once again. However, caution is warranted—if the 1M PP faces rejection, the price is likely to test the 1Y PP soon after. Should the 1Y PP act as resistance, a significant downside could follow. For now, the market awaits the outcome of the 1M PP test.

No Nonsense. Just Really Good Market Insights. Leave a Boost

TradeWithTheTrend3344

What's Flowing: BCHUSD (CRYPTO)COINBASE:BCHUSD / BITKUB:BCHTHB

Flowing to the upside with bulls stepping up the pressure all day.

On the daily, BCHUSD & BCHTHB trades at a discount to Fair Value.

However, on the lower time frames it's trading at Fair Values or above.

Give this trade some time to pull back and catch a sizable deal off the near term support level. .

Loving the fact that this deal can bring us between 9.48% ^ 12.42%.

BCH/USD "Bitcoin Cash vs USD" Crypto Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the BCH/USD "Bitcoin Cash vs USD" Crypto market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. Be wealthy and safe trade.💪🏆🎉

Entry 📈 : You can enter a Bull trade at anypoint,

however I advise placing Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Using the 2H period, the recent / nearest low or high level.

Goal 🎯: 510.00

Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

Warning⚠️ : Our heist strategy is incompatible with Fundamental Analysis news 📰 🗞️. We'll wreck our plan by smashing the Stop Loss 🚫🚏. Avoid entering the market right after the news release.

Fundamental Outlook 📰🗞️

Considering these factors, the BCH/USD pair may experience a Bullish trend in the short-term, driven by:

Increasing adoption and usage of BCH, driven by its faster transaction times and lower fees.

Improving blockchain development and scalability.

Growing merchant acceptance and user adoption.

Bullish Factors:

Increasing adoption and usage of BCH, driven by its faster transaction times and lower fees.

Improving blockchain development and scalability.

Growing merchant acceptance and user adoption.

Potential for increased institutional investment and mainstream recognition.

Competitive advantages over other cryptocurrencies, such as faster transaction times and lower fees.

Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

Take advantage of the target and get away 🎯 Swing Traders Please reserve the half amount of money and watch for the next dynamic level or order block breakout. Once it is resolved, we can go on to the next new target in our heist plan.

Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

Bitcoin’s Influence on Cryptocurrencies!

### **1. Bitcoin as Market Driver**

Bitcoin, as the benchmark cryptocurrency, sets the tone for the crypto market:

- **Bullish Bitcoin**: Boosts demand for altcoins.

- **Bearish Bitcoin**: Triggers sell-offs across the market.

### **2. Key Observations**

- **Bitcoin (BTCUSD)**: Consolidating in a triangle, indicating a potential breakout or breakdown that could influence the market.

- **PEPE**: Highly volatile, likely to amplify Bitcoin’s movements.

- **Bitcoin Cash (BCHUSD)**: Correlated with Bitcoin due to its historical link, mirroring its trends.

### **3. Why It Matters**

Bitcoin drives liquidity, market sentiment, and altcoin performance. A breakout impacts the entire market, making it essential to track Bitcoin’s price action for broader crypto trends.

🚀📊

**Why This Chart is Important**

Bitcoin's price movements dictate market sentiment and liquidity flows, influencing altcoins like PEPE and Bitcoin Cash.

**Conclusion**

A Bitcoin breakout could drive altcoin rallies, while a breakdown might trigger market-wide sell-offs, making it critical to monitor closely.

BCHUSD: Key Level for Bullish MomentumHello,

COINBASE:BCHUSD has experienced a notable drop, but for further upward momentum, it’s crucial to see a cross and sustained hold above the 1M Pivot Point (PP), with the price maintaining a stable position above this level. If this occurs, further upside potential is likely. Despite the recent decline, the long-term outlook remains bullish. However, a significant number of sellers are entering the market, speculating that the downtrend may persist.

No Nonsense. Just Really Good Market Insights. Leave a Boost

TradeWithTheTrend3344

BCHUSD "Bitcoin Cash" Crypto Market Heist Plan on Bearish Side🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical analysis🔥, here is our master plan to heist the BCHUSD "Bitcoin Cash" Crypto market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 👀 So Be Careful, wealthy and safe trade.💪🏆🎉

Entry 📉 : You can enter a trade anywhere,

however I advise placing sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest high level should be in retreat.

Stop Loss 🛑: Using the 2H period, the recent / nearest high level.

Goal 🎯: 480.00

Scalpers, take note : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

Warning⚠️ : Our heist strategy is incompatible with Fundamental Analysis news 📰 🗞️. We'll wreck our plan by smashing the Stop Loss 🚫🚏. Avoid entering the market right after the news release.

Take advantage of the target and get away 🎯 Swing Traders Please reserve the half amount of money and watch for the next dynamic level or order block breakout. Once it is resolved, we can go on to the next new target in our heist plan.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂