AMD trade ideas

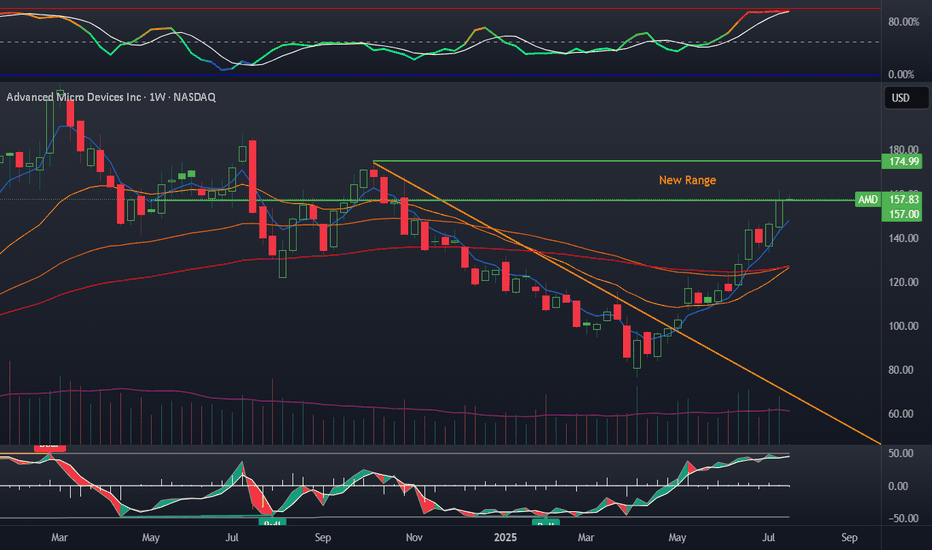

Amd - New all time highs will follow!🪠Amd ( NASDAQ:AMD ) rallies even much further:

🔎Analysis summary:

After Amd perfectly retested a major confluence of support a couple of months ago, we saw a textbook reversal. This retest was followed by a rally of more than +100% in a short period of time. But considering all the bullish momentum, Amd is far from creating a top formation.

📝Levels to watch:

$200

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

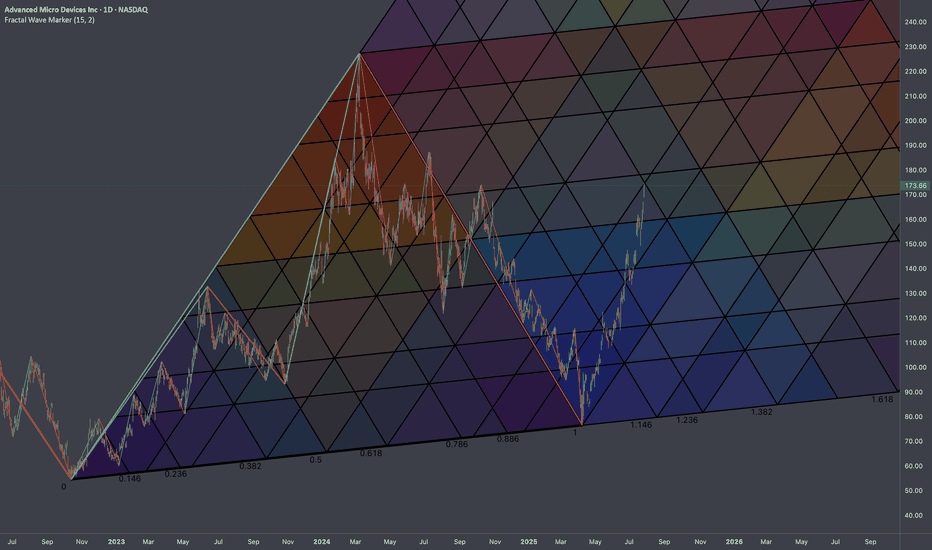

AMD Projection and Entry PointThis is speculation just like before, which played out very well so this is me having another shot at it.

Going off of the prior cycle AMD went through and comparing it to the one it's currently in, you can see a lot of similarities.

Learning from it's past and seeing how it likes to react to certain Fib levels, you can see that the 76.40% has been respected as a major level of resistance which resulted in its short retracement back in June '23 , It also acts as a very strong level of support as shown in August '24.

Assuming AMD rejects at the current 76.40% level again, using the prior 76.40% you can see it aligns perfectly with the golden ratio I have setup as my buy entry.

It all lines up too perfectly that in my mind, I'm certain it will play out. But of course it's all speculation, and the markets do as they please.

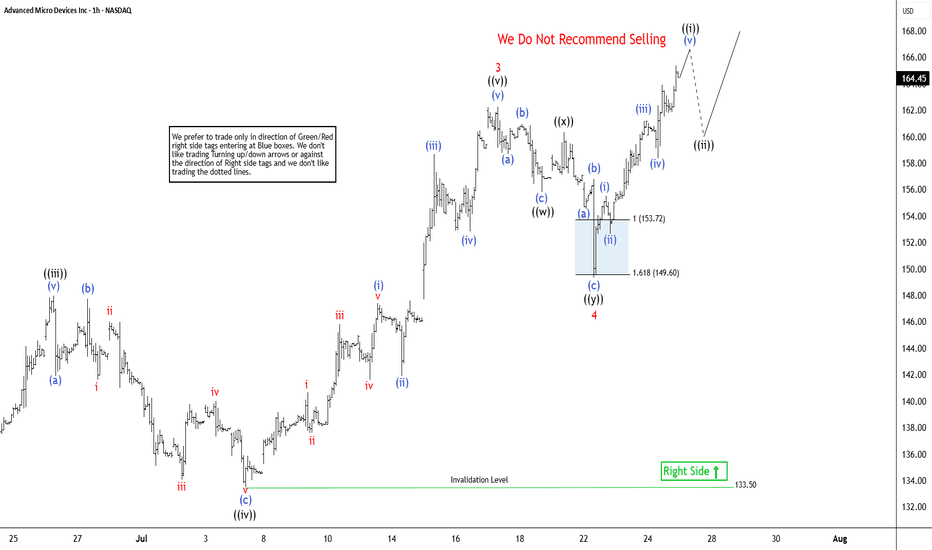

Elliott Wave Outlook: AMD Expects Pullback Soon Before RallyThe Advanced Micro Devices Inc., (AMD) favors rally in impulse Elliott Wave sequence from 4.09.2025 low & expect upside in to 168.36 – 190.36 to finish it. Impulse sequence unfolds in 5, 9, 13, 17…., swings & ends with momentum divergence. In daily, it ended pullback in 3 swings at 75.22 low in blue box area from March-2024 high. It is trading higher in nest & expect 13 swings to finish the impulse ((1)) before correcting next. Currently, it favors rally in 7th swing in daily & expect end soon in to 165.63 – 179.16 area before correcting in (4) as 8th swing. In 4-hour, it ended (1) of ((1)) at 97.91 high, (2) at 83.75 low in 4.21.2025 & favors rally in (3) as extended wave. Within (3), it placed 1 at 122.52 high, 2 at 107.09 low, 3 at 162.36 high, 4 at 149.34 low of 7.22.2025 & favors rally in 5. It is showing higher high since April-2025 low.

Below 3 high of 162.36, it ended 4 pullback in double three correction at 149.34 low. It ended ((w)) at 155.81 low, ((x)) at 160.34 high & ((y)) at 149.34 low. Above 4 low, it favors rally in ((i)) of 5 in to 165.44 – 170.43 before correcting next. Within ((i)), it ended (i) at 155.53 high, (ii) at 152.66 low, (iii) at 161.20 high, (iv) at 158.36 low & favor higher in (v). It appears three swings in (v) & expect pullback before final push above 161.52 low before correcting in ((ii)). Alternatively, the current cycle from 4 low can be 5 of (3) before it corrects in (4). In either the case, the next pullback should remain supported. In 4-hour, it is trading in 11th swing & expect pullback in 12th swings later before final rally. We like to buy the pullback in 3, 7 or 11 swings at extreme area for the upside in ((1)).

“AMD Breaks Out — Triangle Setup in Action”

📈 Trade Snapshot:

AMD breaks a tight triangle range with momentum. A clean move above $180.82 puts $182.48 in sight.

🎯 Plan:

→ Entry: $179.53

→ SL: ~$173.00

→ Target: $182.48

📌 Clear structure, low-risk entry, breakout confirmed. Let it run.

📋 Hashtags:

#AMD #BreakoutTrade #ChartSetup #TechnicalAnalysis #ProfittoPath #SwingTrade #PriceAction #SmartMoney

AMD WEEKLY TRADE SIGNAL (7/31/25)

### 🚀 AMD WEEKLY TRADE SIGNAL (7/31/25)

📈 **MARKET SNAPSHOT**

🟢 Daily RSI: **86.0** 🔥

🟢 Weekly RSI: **80.4**

📊 Volume: 🔺 1.5x (Institutional surge)

💬 Call/Put Ratio: **1.90**

🌪 Gamma Risk: **HIGH (1DTE)**

🧠 Sentiment: **Extremely Bullish** across all models

---

💥 **TRADE IDEA**

📍 Ticker: **\ NASDAQ:AMD **

📈 Direction: **CALL (LONG)**

🎯 Strike: **\$190.00**

💵 Entry: **\$0.51**

🎯 Target: **\$0.90** (+75%)

🛑 Stop Loss: **\$0.30**

📆 Expiry: **Aug 1 (Friday)**

📊 Confidence: **85%**

⏰ Entry: Market Open (Time-sensitive!)

---

🧠 **STRATEGY CONTEXT**

✅ Bullish momentum from AI sector hype

✅ Institutional call buying volume spiking

⚠️ 1DTE = High Gamma Risk = TRADE FAST OR DON’T TRADE

⚠️ Manage decay & exit early if momentum stalls

---

📌 Signal Posted: 2025-07-31 @ 12:17 PM ET

\#AMD #OptionsAlert #AITrade #WeeklyOptions #TradingViewViral #1DTE #GammaSqueeze

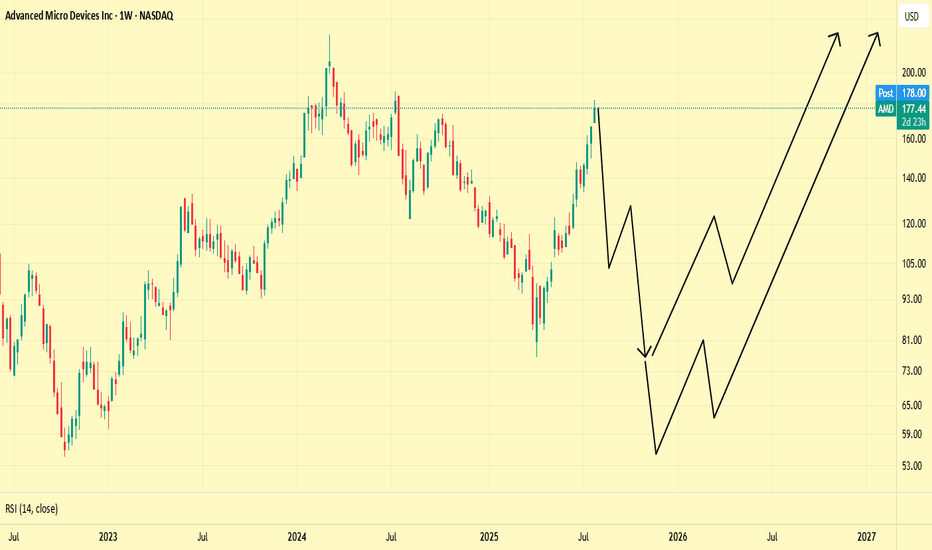

Quick draw upI did quick and simple T/A and in my opinion seems to be the likely outcome. EMA lines are about to cross, it has made a lower low, which has now flipped the Fibonacci and likely to get rejected at the 61.80% - 50% range. The path lines aren't placed specific to the timeframes so ignore that it stretches way into 2025.

AMD we have made it at 170 USD guys! TSXGANG! 📊 AMD Stock Technical Analysis

🧠 Head and Shoulders Pattern

- This chart shows a classic head and shoulders formation:

- Left Shoulder: First peak around ~$172

- Head: Highest peak near ~$183

- Right Shoulder: Second peak returning to ~$178

🔎 This pattern often signals a potential reversal in an uptrend—investors might expect selling pressure ahead if confirmed.

📉 Sell Zone 📍

- 💸 Highlighted zone: $174–$184 USD

- 🚨 Considered an overbought region—ideal for profit-taking or short positions

Current price: $178.82 USD 📌 (+$5.16 / +2.97%)

This price lands right in the sell zone, suggesting caution as upside might be limited short-term.

🔄 Retest Zone (Support) 📍

- 🛡️ Marked between $161–$172 USD

- 🤝 A potential buy zone where price could stabilize or rebound

If AMD pulls back, this is where buyers might re-enter the market for long positions.

🧪 Trend Indicators & Sentiment

- 📈 Recent bullish move (+2.97%) shows strength—but could also be testing resistance

- 🔁 Watch for confirmation of either a breakout above $184 or a pullback to retest support

- 🧭 Overall sentiment looks cautiously optimistic but technically fragile near the upper resistance

🧠 Final Thoughts 💬

This chart analysis suggests AMD may be approaching a turning point. Traders should keep an eye on volume, macro tech trends, and market reactions in the coming sessions.

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations.

Thank you!

Subcribe to TSXGanG! 🧠🎯

AMD Weekly Trade Alert (2025-07-29)

**🔥 AMD Weekly Trade Alert (2025-07-29) 🔥**

💹 *Momentum Confirmed. Calls Loaded. Let’s Ride.*

📈 **Key Bullish Signals**

✔️ Daily RSI: **83.2** (Rising)

✔️ Weekly RSI: **79.9** (Rising)

✔️ Call/Put Ratio: **2.03** 🧨

✔️ Volatility: Low (VIX = 15.2)

⚠️ Volume Weak (0.9x) – But not a dealbreaker.

---

**🎯 TRADE SETUP**

🔹 **Ticker**: \ NASDAQ:AMD

🔹 **Strategy**: Weekly Naked Call

🔹 **Strike**: \$185C

🔹 **Entry**: \$0.66

🔹 **Profit Target**: \$1.32 (100%)

🔹 **Stop Loss**: \$0.33

🔹 **Expiry**: 2025-08-01

🔹 **Size**: 3 Contracts

🔹 **Confidence**: 75%

---

**🧠 WHY THIS WORKS**

🔋 Momentum → STRONG

💰 Institutions are loading up calls

🧘 VIX = calm

⚡ Short gamma risk = fast payoff or cut

---

📢 **Watchlist it. Trade it. Exit fast.**

💬 Comment “🔥AMD” if you’re in.

🔁 Repost if you see \$190 coming.

\#AMD #OptionsTrading #CallOptions #TradingView #WeeklySetup #MomentumPlay #BullishSignal #MarketMomentum

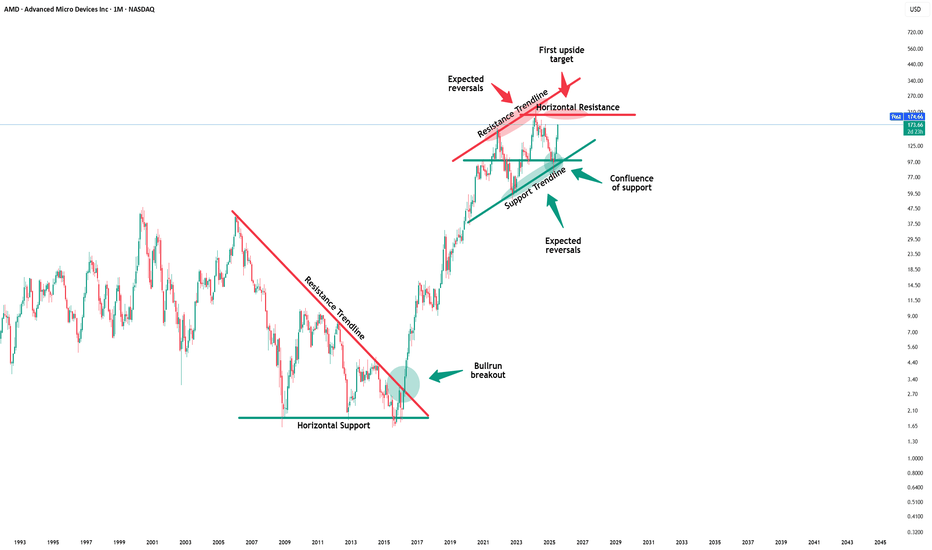

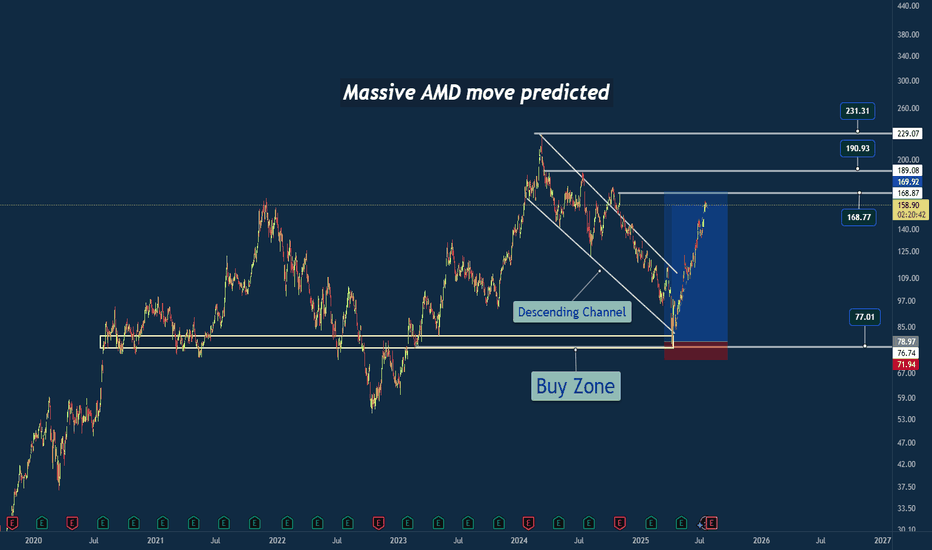

$AMD supercycle ; PT $300-350 by 2027- NASDAQ:AMD has likely entered a supercycle and we have entered Agentic AI world where inferencing is the main area of investment.

- Model Training is still important but we have entered a stage where lot of open source models and many proprietary vendors are close to each other when it comes to performance.

- Companies are trying to monetize their investments and one critical thing is model inference i.e making predictions.

- NASDAQ:AMD is poised for the agentic ai boom and therefore next 2 years are golden years for $AMD.

AMDthe weekly price action of Advanced Micro Devices Inc (AMD):The stock is trading near a critical resistance zone marked with a rectangular box just below $180.In the past, this area acted as a rejection point, evident from prior pullbacks when the stock neared these levels.

The chart reflects a larger declining channel. Current price action shows AMD approaching the upper boundary of this channel, which may act as dynamic resistance.

If AMD breaks above the $180 resistance convincingly, there’s potential for the stock to aim for higher targets, such as the next major zone ($240).

Failure to break above $180 may lead to a retest of lower levels, potentially near $140 or the breakout zone ($100-$120).

AMD: Potential Mid-Term Reversal from Macro SupportPrice has reached ideal macro support zone: 90-70 within proper proportion and structure for at least a first wave correction to be finished.

Weekly

As long as price is holding above this week lows, odds to me are moving towards continuation of the uptrend in coming weeks (and even years).

1h timeframe:

Thank you for attention and best of luck to your trading!

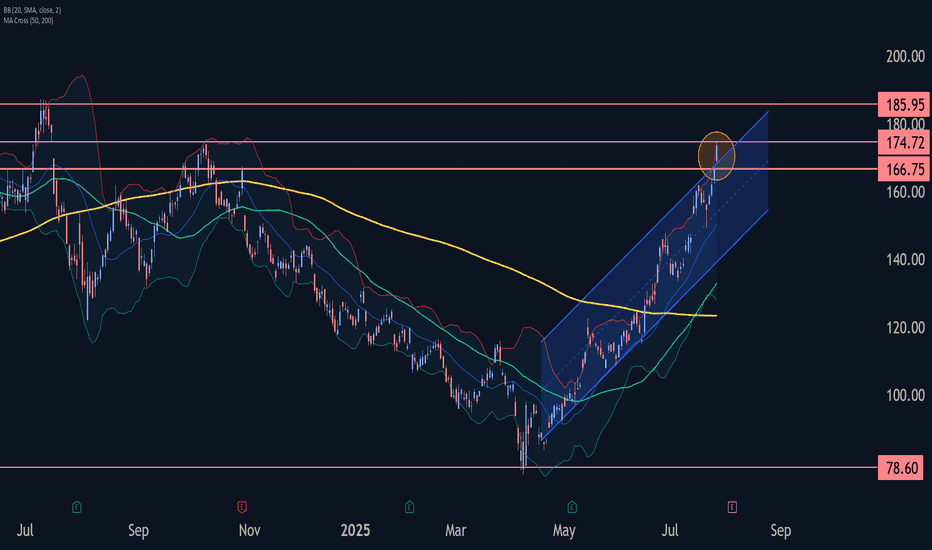

AMD Wave Analysis – 28 July 2025

- AMD broke resistance zone

- Likely to rise to resistance level 185.95

AMD recently broke the resistance zone between the resistance level 166.75 and the upper resistance trendline of the daily up channel from April.

The breakout of this resistance zone accelerated the active impulse waves 3 and (3).

Given the overriding daily uptrend, AMD can be expected to rise to the next resistance level 185.95 (former multi-month high from July of 2024).

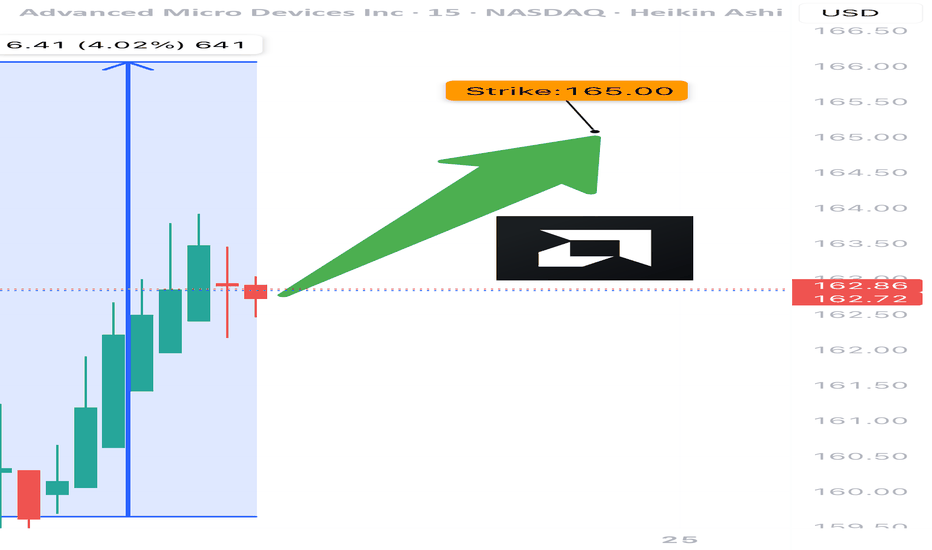

AMD TRADE ALERT (07/24)

🚨 AMD TRADE ALERT (07/24) 🚨

Options flow is screaming bullish 📈

🧠 Key Insights:

• Call/Put Ratio: 1.80 (🔥 heavy call bias)

• RSI: Daily 75.5 / Weekly 77.2 = strong momentum

• Volume = weak ⚠️ but sentiment remains bullish

• High gamma risk = explosive potential near expiry

💥 TRADE IDEA

🟢 Buy AMD $165 Call exp 7/25

💰 Entry: $0.80

🎯 Target: $1.60

🛑 Stop: $0.48

📊 Confidence: 75%

⚠️ Quick expiry = fast moves. Monitor closely.

#AMD #OptionsFlow #UnusualOptionsActivity #TradingView #OptionsTrading #BullishSetup #TechStocks #DayTrading #GammaSqueeze #OptionAlerts

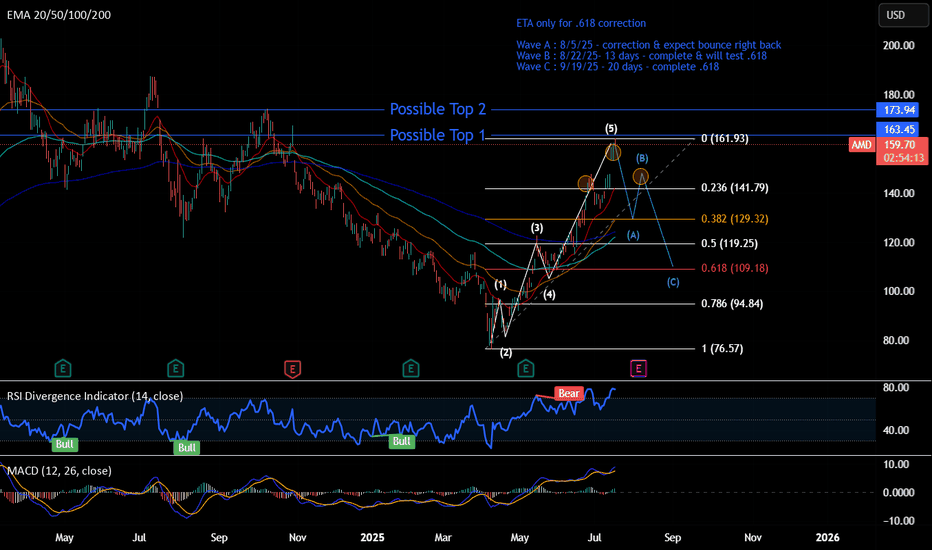

Short - AMDTime period for this play : week to months

Analysis : Elliot wave 12345 ABC. Expect hitting .618 and bounce back up to go higher.

Pattern if wave B completed : Head & Shoulder

Price Target: Wave ABC

ETA Timeline for correction. Please refer to the chart.

Upcoming events:

Tariff active on 8/1/25 - Friday

Earning on 8/5/25 - Tuesday

Top is not in yet, so 2 Possible top-in levels:

Top 1 - $163.45 : Retesting to hit 163.45, rejected, and break $158

Top 2 - $173.94 : Breaking 163.45 and reject at 173.94

=> Overall, It begins trading side way and show some weakness now.

The correction may not pull back to .618, which is the best level. Other scenarios:

- 0.5 fib, where it test wave 3

- 0.328 fib, strong bullish level if it doesn't break & go to the upside faster

AMD 1W: If Not Now — Then When?The weekly chart of AMD looks like it’s holding its breath: a well-defined falling wedge, double bottom support, and price pressing right against long-term trendline resistance. Everything’s in place — now it just needs to break and run, preferably without tripping over nearby Fibonacci levels.

The stock is trading around $114 and attempting to hold above the 50-week MA. Just ahead is the 200-week MA (~131) — not only a technical hurdle but also a psychological pivot. A move above it could reignite talk of $150+ targets.

The wedge has been narrowing since late 2024. After repeated bounces off support, price has returned to the top of the pattern. A confirmed weekly close above the wedge could trigger a real breakout. Without that — it risks yet another scripted pullback.

Key Fibonacci levels:

0.618 — $133.60

0.5 — $151.42

0.382 — $169.25

0.236 — $191.30

0.0 — $226.95 (all-time high)

The roadmap looks clean — but only if volume follows through. There are signs of quiet accumulation at the bottom, but no explosive buying just yet.

Fundamentals:

AMD delivered solid Q1 results: revenue is growing, EPS beat expectations, and margins are holding. More importantly, the company launched a new $6 billion stock buyback program — showing clear internal confidence in its long-term trajectory.

There’s also a strategic AI partnership underway with a Middle Eastern tech group. This move positions AMD to challenge not just for GPU market share, but for future AI infrastructure dominance — long game stuff.

Analyst sentiment has turned bullish again, with new price targets in the $130–150 range. All of this makes the current chart structure more than just technical noise — it’s backed by strong tailwinds.

Why I Went Long on AMD Near the 2025 Lows🔍 Reason for the Trade

This wasn’t just a “buy the dip” setup — this was a calculated trade based on strong confluence:

✅ Multi-Year Demand Zone

Price returned to a massive support level that’s held since 2020. This zone had previously triggered multiple large bullish reversals.

✅ Falling Wedge Breakout

A textbook falling wedge pattern formed during the pullback. Once price broke out, the momentum confirmed a structural reversal.

✅ Risk/Reward Optimization

I positioned my stop just under key support, with targets set at prior structure highs. The setup offered a clean 2.5:1+ R/R ratio, perfect for swing conviction.

✅ Institutional Accumulation Area

The volume and wick rejections in this zone screamed smart money stepping in. It was a classic sign of fear-based selling into patient buyers.

🧠 Lessons Reinforced

- Wait for the Zone, Then Act: Patience paid off — the best trades come from the best levels.

- Structure Over Emotion: I trusted the technical, not the bearish headlines.

- R/R Always Wins: You don’t need to be right every time, but when you’re right — let it run.

#AMD #SwingTrade #TechnicalAnalysis #SupportAndResistance #WedgeBreakout #RiskReward #PriceAction #StockMarket #TradingView #TradeRecap

AMD Don't Miss Out

### 🚀 \ NASDAQ:AMD Bullish Reversal Play — Weekly Options Setup

**🔥 Institutional Flow + RSI Momentum + Volume Surge = Opportunity**

---

📊 **Model Consensus Summary (Grok, Claude, Gemini, Llama, DeepSeek):**

* **🟢 Weekly RSI:** Climbing ⬆️ — confirms trend

* **🔴 Daily RSI:** Slight dip = caution, but **volume overrides**

* **💰 Call/Put Ratio:** 2.00 → **Big Money** loading calls

* **📈 Volume Spike:** 1.7x last week → institutional confirmation

* **🧠 AI Sector Tailwind:** Adds strong narrative fuel

---

### 🎯 Trade Setup – 5D Weekly CALL

| 🧾 Entry | 🎯 Target | 🛑 Stop Loss | 🎲 Risk/Reward | 📅 Expiry |

| -------- | --------------------------- | ------------ | --------------- | ---------- |

| \$4.40 | \$6.75 (TP1) / \$9.00 (TP2) | \$2.60 | 1:1.78 / 1:3.46 | 2025-08-08 |

**📌 Strike:** \$180.00

**🎯 Strategy:** Naked CALL (single-leg)

**⏰ Entry:** Market open

**✅ Confidence:** 75%

**⚠️ Risk Flag:** Short-term volatility from daily RSI dip

**🔍 SL based on 40% drawdown tolerance**

---

### 📣 TL;DR

> **“Smart money is early. Momentum is building. AMD could break out hard.”**

> 🔸 Weekly RSI + Volume + Calls = Setup

> 🔸 Short-dated play for aggressive profits

> 🔸 Tight stop, wide upside

---

### 💡 Tag It:

\#AMD #OptionsTrading #WeeklySetup #TradingSignals #AIStocks #InstitutionalFlow #RSI #CallOptions #MomentumPlay #TradingView #SwingTrade