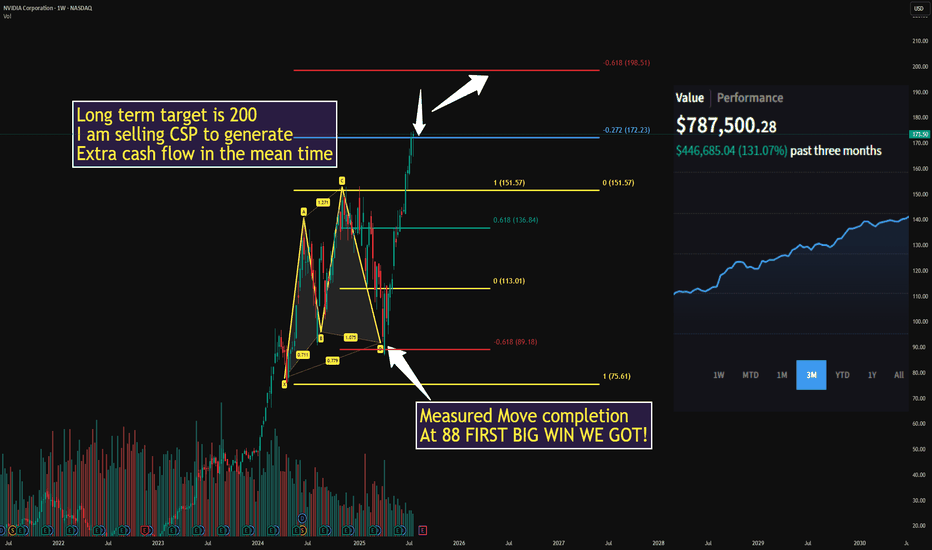

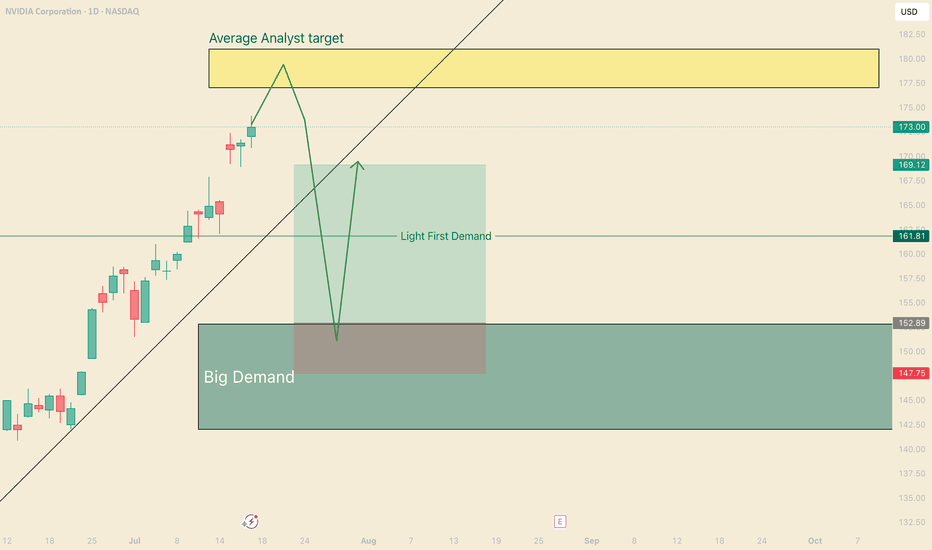

$NVDA: Cycle-Wired Levels🏛️ Research Notes

The fact that the angle of linear connection between 3rd degree points (fractal hierarchy) acted multiple amout of times as support and eventually resistance from which tariff drop happened establishing bottom and expanding from there.

That means if we were to justify the

Key facts today

In early July, Nvidia became the first publicly traded company to be valued at over $4 trillion after the removal of a block on the sale of its H20 chips to China by President Donald Trump.

Nvidia faced scrutiny from China's internet regulator over security risks tied to its H20 chip. The company denied claims of backdoors and reaffirmed its focus on cybersecurity.

Nvidia is an investor in Mistral, a French AI startup that is seeking to raise $1 billion at a $10 billion valuation to support the development of its Le Chat chatbot and large language models.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

2,983.524 CLP

71.87 T CLP

128.70 T CLP

23.41 B

About NVIDIA

Sector

Industry

CEO

Jen Hsun Huang

Website

Headquarters

Santa Clara

Founded

1993

FIGI

BBG01NBNRBP4

NVIDIA Corp. engages in the design and manufacture of computer graphics processors, chipsets, and related multimedia software. It operates through the following segments: Graphics Processing Unit (GPU) and Compute & Networking. The Graphics segment includes GeForce GPUs for gaming and PCs, the GeForce NOW game streaming service and related infrastructure, Quadro and NVIDIA RTX GPUs for enterprise workstation graphics, virtual GPU, or vGPU, software for cloud-based visual and virtual computing, automotive platforms for infotainment systems, and Omniverse Enterprise software for building and operating metaverse and 3D internet applications. The Compute & Networking segment consists of Data Center accelerated computing platforms and end-to-end networking platforms including Quantum for InfiniBand and Spectrum for Ethernet, NVIDIA DRIVE automated-driving platform and automotive development agreements, Jetson robotics and other embedded platforms, NVIDIA AI Enterprise and other software, and DGX Cloud software and services. The company was founded by Jen Hsun Huang, Chris A. Malachowsky, and Curtis R. Priem in April 1993 and is headquartered in Santa Clara, CA.

Related stocks

99% of people buying $NVDA don't understand this:🚨99% of people buying NASDAQ:NVDA don't understand this:

NASDAQ:GOOGL : “We’re boosting AI capex by $10B.”

Wall Street: “Cool, that’s like $1B or 0.06 per share for $NVDA.”

So from $170.50 at the time of news to $170.56 right?

No.

NASDAQ:NVDA trades at 98× earnings. So that $0.06? Turns in

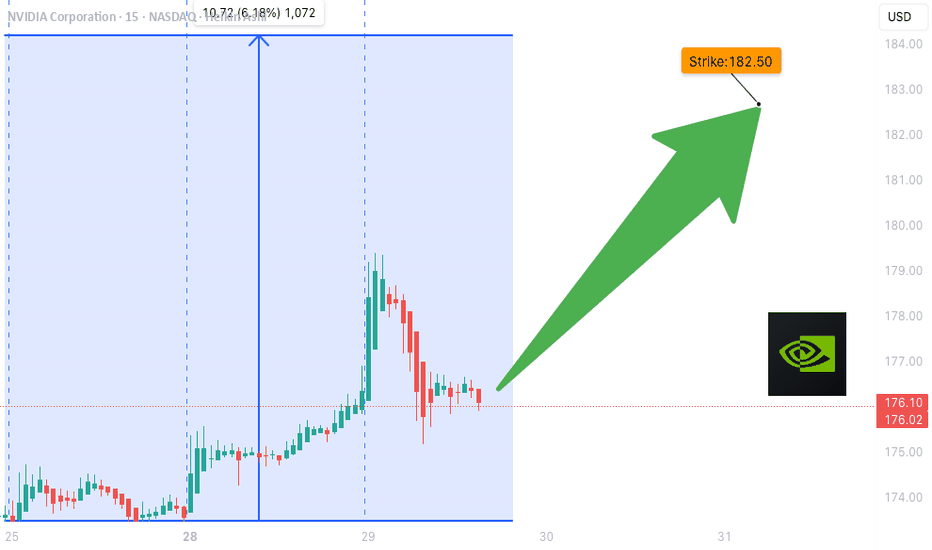

NVDA Bullish Weekly Trade Setup** – 2025-07-29

📈 **NVDA Bullish Weekly Trade Setup** – 2025-07-29

🚀 *"Momentum meets money flow!"*

### 🔍 Market Snapshot:

* 💥 **Call/Put Ratio**: 2.47 → Bullish sentiment confirmed

* 🧠 **RSI**: Rising on Daily & Weekly → Momentum building

* 🔕 **Low VIX**: Favors call strategies (cheap premiums)

* ⚠️ **Caution*

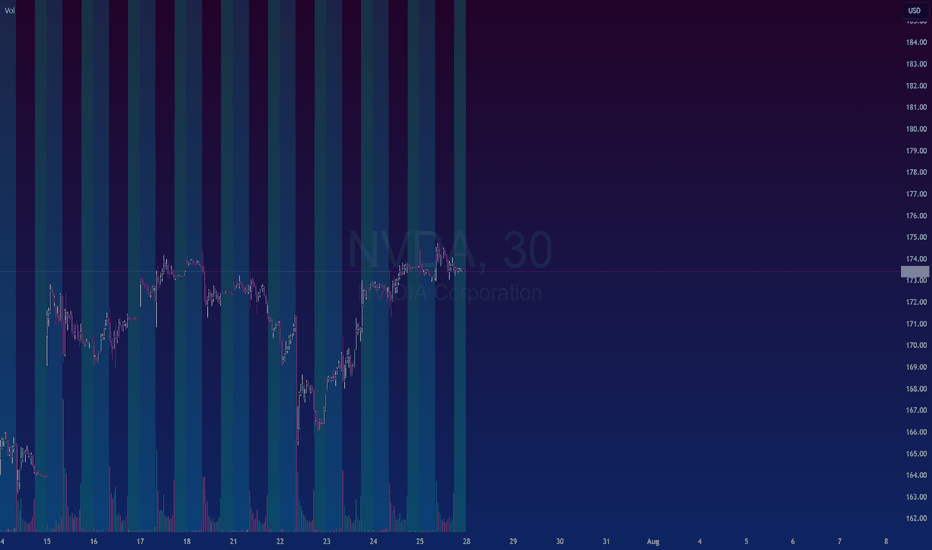

Nvidia Just Under Major SupportNvidia seems to have been pulled down by the Dow just like Apple as both are just under major support. I'm sorry for my previous Nvidia chart that drew support near 140, I recognize where I screwed up, but this chart should be good. Fortunately actual 117 support wasn't that far below and my NVDA is

NVIDIA Riding the 50 EMA — Trend Still IntactNVDA continues to respect the rising channel while price holds above the 50, 100, and 200 EMAs — with each 50 EMA touch offering solid entries.

📌 Bullish EMA structure: 20/50/100/200 stacked clean

📌 50 EMA = key support and entry zone

⏱️ Timeframe: 1H

#nvda #stocks #ema #swingtrading #bullishtrend

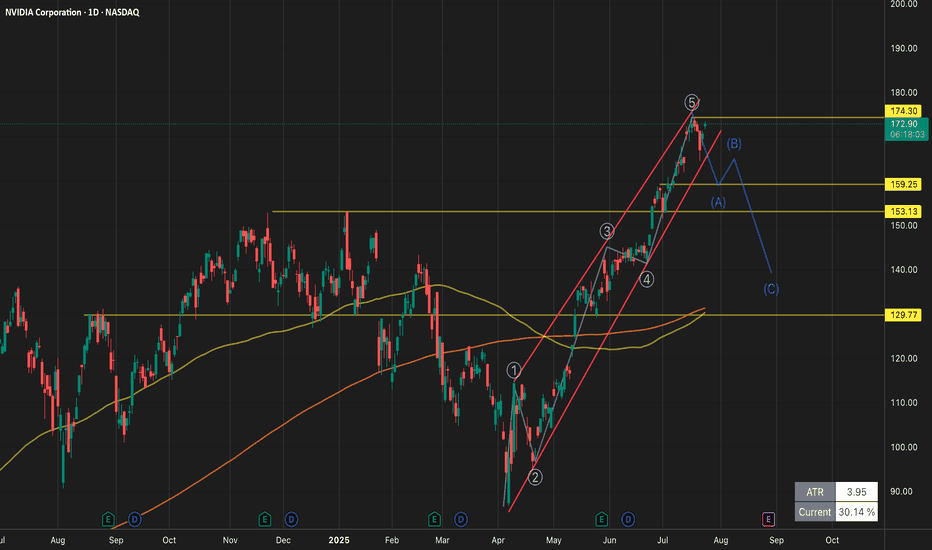

NVDA-the AI TitanNVIDIA (NVDA) continues to dominate the AI semiconductor space and remains one of the strongest momentum names in the market. After reaching new highs, price action is now offering a clean multi-tiered entry opportunity for swing traders positioning for the next leg up.

Entry Points

✅ $160 – Breako

Catch the bounce on NVDAHi, I'm The Cafe Trader.

We’re taking a deeper dive into NVIDIA (NVDA) — one of the leaders in the MAG 7 — with a short-term trade setup you can apply to both shares and options.

Setup Context:

NVDA is pushing into all-time highs, and we’re now approaching the average analyst price target (around

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

NVDA4971919

NVIDIA Corporation 3.7% 01-APR-2060Yield to maturity

6.00%

Maturity date

Apr 1, 2060

NVDA4971918

NVIDIA Corporation 3.5% 01-APR-2050Yield to maturity

5.94%

Maturity date

Apr 1, 2050

NVDA4971917

NVIDIA Corporation 3.5% 01-APR-2040Yield to maturity

5.35%

Maturity date

Apr 1, 2040

US67066GAN4

NVIDIA 21/31Yield to maturity

4.62%

Maturity date

Jun 15, 2031

US67066GAE4

NVIDIA 2026Yield to maturity

4.35%

Maturity date

Sep 16, 2026

NVDA4971916

NVIDIA Corporation 2.85% 01-APR-2030Yield to maturity

4.10%

Maturity date

Apr 1, 2030

NVDA5203204

NVIDIA Corporation 1.55% 15-JUN-2028Yield to maturity

3.96%

Maturity date

Jun 15, 2028

See all NVDACL bonds

Curated watchlists where NVDACL is featured.

Frequently Asked Questions

The current price of NVDACL is 168,290.000 CLP — it has decreased by −4.45% in the past 24 hours. Watch NVIDIA CORP stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BCS exchange NVIDIA CORP stocks are traded under the ticker NVDACL.

NVDACL stock has risen by 0.34% compared to the previous week, the month change is a 17.03% rise, over the last year NVIDIA CORP has showed a 52.89% increase.

We've gathered analysts' opinions on NVIDIA CORP future price: according to them, NVDACL price has a max estimate of 244,140.63 CLP and a min estimate of 97,656.25 CLP. Watch NVDACL chart and read a more detailed NVIDIA CORP stock forecast: see what analysts think of NVIDIA CORP and suggest that you do with its stocks.

NVDACL reached its all-time high on Aug 2, 2024 with the price of 500,000.000 CLP, and its all-time low was 10,000.000 CLP and was reached on Nov 18, 2024. View more price dynamics on NVDACL chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

NVDACL stock is 7.84% volatile and has beta coefficient of 2.24. Track NVIDIA CORP stock price on the chart and check out the list of the most volatile stocks — is NVIDIA CORP there?

Today NVIDIA CORP has the market capitalization of 4,139.42 T, it has increased by 7.05% over the last week.

Yes, you can track NVIDIA CORP financials in yearly and quarterly reports right on TradingView.

NVIDIA CORP is going to release the next earnings report on Aug 27, 2025. Keep track of upcoming events with our Earnings Calendar.

NVDACL earnings for the last quarter are 771.43 CLP per share, whereas the estimation was 701.98 CLP resulting in a 9.89% surprise. The estimated earnings for the next quarter are 974.89 CLP per share. See more details about NVIDIA CORP earnings.

NVIDIA CORP revenue for the last quarter amounts to 41.96 T CLP, despite the estimated figure of 41.27 T CLP. In the next quarter, revenue is expected to reach 44.62 T CLP.

NVDACL net income for the last quarter is 17.88 T CLP, while the quarter before that showed 21.79 T CLP of net income which accounts for −17.92% change. Track more NVIDIA CORP financial stats to get the full picture.

Yes, NVDACL dividends are paid quarterly. The last dividend per share was 9.37 CLP. As of today, Dividend Yield (TTM)% is 0.02%. Tracking NVIDIA CORP dividends might help you take more informed decisions.

NVIDIA CORP dividend yield was 0.03% in 2024, and payout ratio reached 1.16%. The year before the numbers were 0.03% and 1.34% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 2, 2025, the company has 36 K employees. See our rating of the largest employees — is NVIDIA CORP on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. NVIDIA CORP EBITDA is 84.05 T CLP, and current EBITDA margin is 63.85%. See more stats in NVIDIA CORP financial statements.

Like other stocks, NVDACL shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade NVIDIA CORP stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So NVIDIA CORP technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating NVIDIA CORP stock shows the neutral signal. See more of NVIDIA CORP technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.