Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

4.46 USD

12.44 B USD

57.40 B USD

1.64 B

About Oracle Corporation

Sector

Industry

CEO

Safra Ada Catz

Website

Headquarters

Austin

Founded

1977

FIGI

BBG004BWKB10

Oracle Corp. engages in the provision of products and services that address aspects of corporate information technology environments, including applications and infrastructure technologies. It operates through the following business segments: Cloud and License, Hardware, and Services. The Cloud and License segment markets, sells, and delivers enterprise applications and infrastructure technologies through cloud and on-premise deployment models including cloud services and license support offerings. The Hardware segment provides infrastructure technologies including Oracle Engineered Systems, servers, storage, industry-specific hardware, operating systems, virtualization, management, and other hardware-related software. The Services segment offers consulting, advanced support, and education services. The company was founded by Lawrence Joseph Ellison, Robert Nimrod Miner, and Edward A. Oates on June 16, 1977 and is headquartered in Austin, TX.

Related stocks

ORCL heads up at $212 then 220: Double Golden Fibs may STOP runORCL has been flying off the last Earnings report.

About to hit DUAL Golden fibs at $212.67-220.21

Ultra-High Gravity objects in its price-continuum.

It is PROBABLE to consolidate within the zone.

It is POSSIBLE to reject and dip to a fib below.

It is PLAUSIBLE but unlikely to blow thru them.

.

M

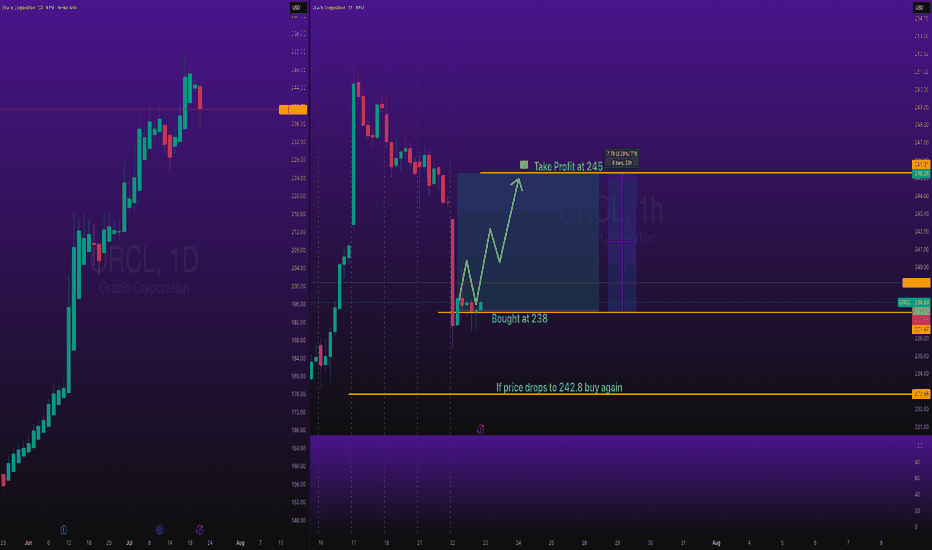

Weekly Stock Pick: ORCL (Update)Hello Traders!

I'm providing an update to the ORCL trade idea from Monday July 21st. Here's what I'm watching:

- Price to open lower from Monday's close

- Rebalancing in the highest daily Bullish Order Block near $239

- A hammer or dojji candle on higher volume

- Potential confluence with the dail

Weekly Stock Pick: ORCL Continues the Trek HigherHello Traders!

As part of my weekly equity trade analysis, I will be uploading my recordings of what I am seeing and intending to trade for the week. A quick summary of what's in the video is as follows:

- ORCL has been a headliner stock for the last couple months since its earnings, fueled by mom

ORCL SELL SELL SELL NEVER EVER EVER EVER UNDER ANY CIRCUMSTANCE DO YOU BUY A STOCK WITH AN 89 RSI!!! NEVER ORCL is a strong sell here, once it corrects it might be a buy again based off the blowout earnings and forecasts. But today, we be way ahead of ourselves boys and girls. We should easily retrace to fib .5 $1

While You Were Watching NVIDIA, Oracle Quietly Ate the BackendEveryone's chasing the AI hype but Oracle is one of the only companies selling the picks and shovels behind the scenes.

While headlines focus on NVIDIA, Meta, and ChatGPT, Oracle has been building the back-end massive AI-ready data infrastructure, hyper scale cloud partnerships, and GPU clusters fe

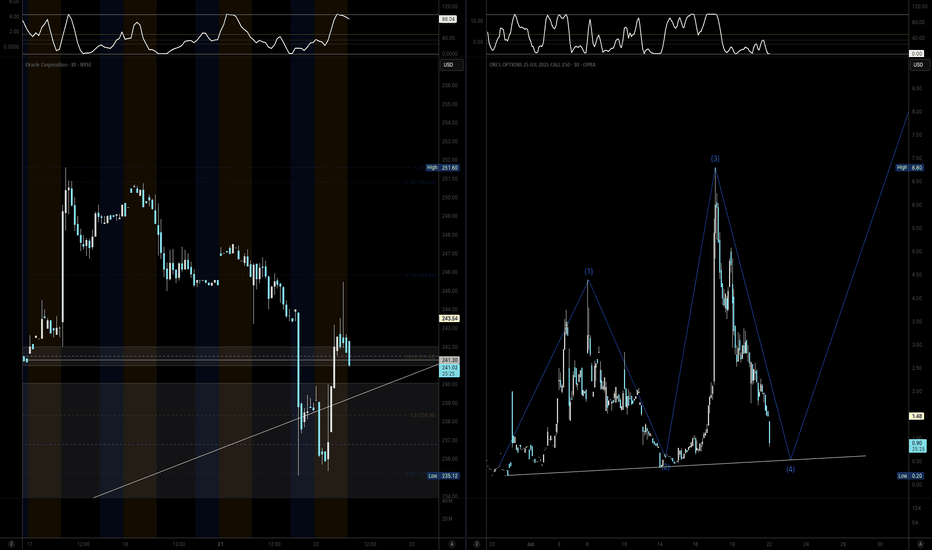

Oracle: Out of Fuel Oracle (ORCL) just hit its limit. The bullish momentum is gone — RSI was over 70, Bollinger Bands were stretched, and there was no volume to back it up. No fuel left.

It’s now pulling back right from the 0% Fibonacci level, confirming the move. This looks like the start of a technical reversal.

Ke

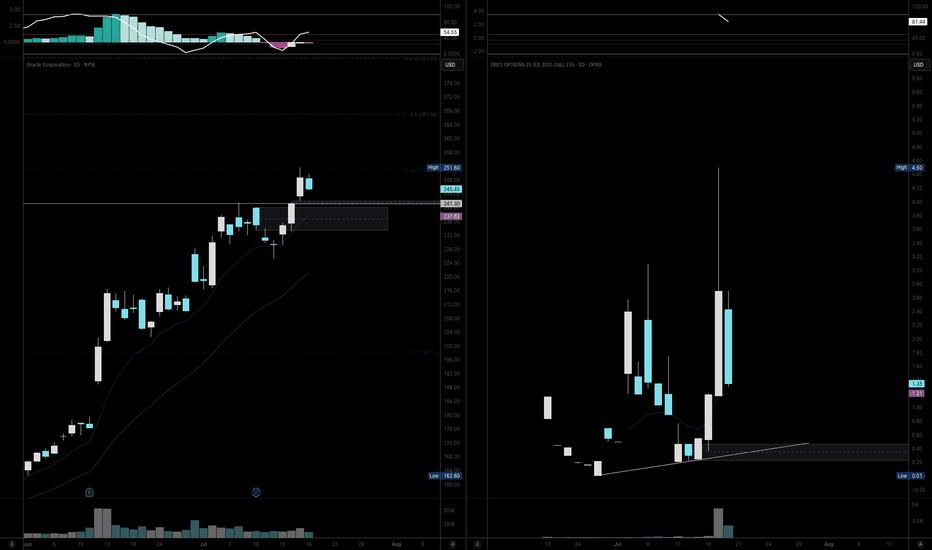

ORACLE Can you foresee it at $2000??Oracle (ORCL) is having perhaps the most dominant recovery from Trump's Tariff lows out of the high cap stocks, trading comfortable on new All Time Highs.

This is no surprise to us, as like we've mentioned countless times on our channel, we are currently at the start of the A.I. Bubble and heavy te

Safe Entry OracleStock In Up-Movement.

P.High (Previous High) is Safe Entry.

Note: 1- Potentional of Strong Buying Zone:

We have two scenarios must happen at The Mentioned Zone:

Scenarios One: strong buying volume with reversal Candle.

Scenarios Two: Fake Break-Out of The Buying Zone.

Both indicate buyers step

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

ORCL4972631

Oracle Corporation 3.6% 01-APR-2050Yield to maturity

7.02%

Maturity date

Apr 1, 2050

ORCL4972632

Oracle Corporation 3.85% 01-APR-2060Yield to maturity

7.00%

Maturity date

Apr 1, 2060

ORCL5153814

Oracle Corporation 4.1% 25-MAR-2061Yield to maturity

6.93%

Maturity date

Mar 25, 2061

ORCL5153813

Oracle Corporation 3.95% 25-MAR-2051Yield to maturity

6.82%

Maturity date

Mar 25, 2051

US68389XBJ3

ORACLE 16/46Yield to maturity

6.78%

Maturity date

Jul 15, 2046

ORCK

ORACLE 17/47Yield to maturity

6.69%

Maturity date

Nov 15, 2047

ORCH

ORACLE 15/55Yield to maturity

6.69%

Maturity date

May 15, 2055

US68389XBF1

ORACLE 15/45Yield to maturity

6.60%

Maturity date

May 15, 2045

ORCL5902732

Oracle Corporation 5.5% 27-SEP-2064Yield to maturity

6.41%

Maturity date

Sep 27, 2064

ORCL5153812

Oracle Corporation 3.65% 25-MAR-2041Yield to maturity

6.38%

Maturity date

Mar 25, 2041

US68389XAW5

ORACLE 14/44Yield to maturity

6.37%

Maturity date

Jul 8, 2044

See all ORCL bonds

Curated watchlists where ORCL is featured.

Frequently Asked Questions

The current price of ORCL is 249.79 USD — it has increased by 16.89% in the past 24 hours. Watch ORACLE CORP stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BCS exchange ORACLE CORP stocks are traded under the ticker ORCL.

We've gathered analysts' opinions on ORACLE CORP future price: according to them, ORCL price has a max estimate of 315.00 USD and a min estimate of 175.00 USD. Watch ORCL chart and read a more detailed ORACLE CORP stock forecast: see what analysts think of ORACLE CORP and suggest that you do with its stocks.

ORCL reached its all-time high on Jul 17, 2025 with the price of 249.79 USD, and its all-time low was 31.36 USD and was reached on Jul 9, 2013. View more price dynamics on ORCL chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

ORCL stock is 14.45% volatile and has beta coefficient of 1.48. Track ORACLE CORP stock price on the chart and check out the list of the most volatile stocks — is ORACLE CORP there?

Today ORACLE CORP has the market capitalization of 686.53 B, it has increased by 2.33% over the last week.

Yes, you can track ORACLE CORP financials in yearly and quarterly reports right on TradingView.

ORACLE CORP is going to release the next earnings report on Sep 15, 2025. Keep track of upcoming events with our Earnings Calendar.

ORCL earnings for the last quarter are 1.70 USD per share, whereas the estimation was 1.64 USD resulting in a 3.50% surprise. The estimated earnings for the next quarter are 1.48 USD per share. See more details about ORACLE CORP earnings.

ORACLE CORP revenue for the last quarter amounts to 15.90 B USD, despite the estimated figure of 15.58 B USD. In the next quarter, revenue is expected to reach 15.04 B USD.

ORCL net income for the last quarter is 3.43 B USD, while the quarter before that showed 2.94 B USD of net income which accounts for 16.72% change. Track more ORACLE CORP financial stats to get the full picture.

Yes, ORCL dividends are paid quarterly. The last dividend per share was 0.50 USD. As of today, Dividend Yield (TTM)% is 0.74%. Tracking ORACLE CORP dividends might help you take more informed decisions.

ORACLE CORP dividend yield was 1.03% in 2024, and payout ratio reached 39.16%. The year before the numbers were 1.37% and 43.15% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 2, 2025, the company has 162 K employees. See our rating of the largest employees — is ORACLE CORP on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. ORACLE CORP EBITDA is 24.23 B USD, and current EBITDA margin is 42.21%. See more stats in ORACLE CORP financial statements.

Like other stocks, ORCL shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade ORACLE CORP stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So ORACLE CORP technincal analysis shows the strong buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating ORACLE CORP stock shows the strong buy signal. See more of ORACLE CORP technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.