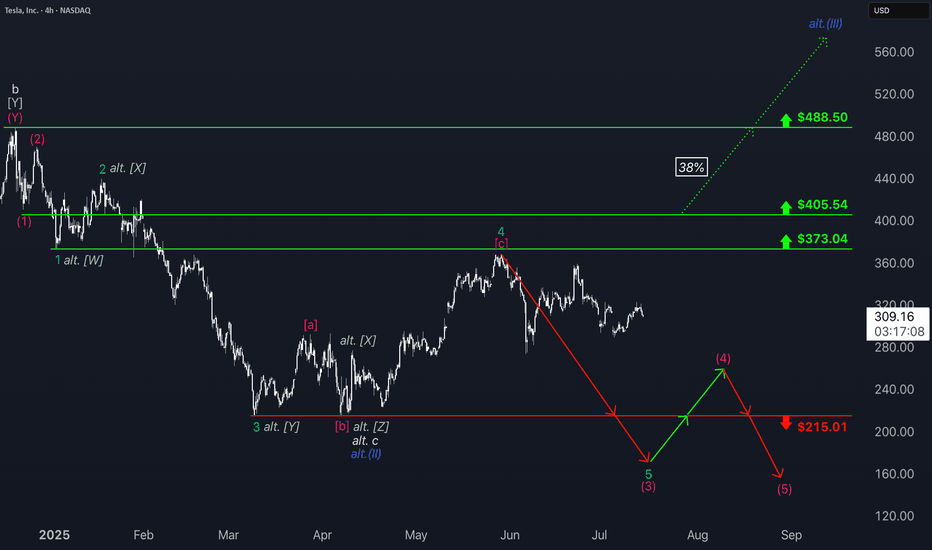

TSLA 4H Analysis – Bearish Reversal Setup📈 Trade Plan Summary

• Entry Range: 316 to 332

• Target 1: 280

• Target 2: 250

• Stop Loss: 370

⸻

📉 Type of Trade:

This appears to be a short (sell) position, since your targets are below the entry point.

⸻

✅ Risk Management Check

Let’s consider your worst-case entry (i.e., highest point i

Key facts today

Tesla will report Q2 earnings next week, with analysts expecting strong overseas sales to boost revenue. A weakening U.S. dollar may also positively impact Tesla's financial results.

Concerns arise over Tesla's low-cost model delay past the U.S. EV tax rebate deadline on September 30, leading to speculation about reliance on pre-buy incentives in Q3.

On July 18, 2025, Tesla shares rose 3% after the U.S. imposed a 93.5% anti-dumping duty on specific graphite imports from China, raising total tariffs to 160%.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

1,895.234 CLP

7.12 T CLP

97.50 T CLP

2.80 B

About Tesla

Sector

Industry

CEO

Elon Reeve Musk

Website

Headquarters

Austin

Founded

2003

FIGI

BBG01NBNS1Q4

Tesla, Inc. engages in the design, development, manufacture, and sale of electric vehicles and energy generation and storage systems. It operates through the Automotive and Energy Generation and Storage segments. The Automotive segment includes the design, development, manufacture, sale, and lease of electric vehicles as well as sales of automotive regulatory credits. The Energy Generation and Storage segment is involved in the design, manufacture, installation, sale, and lease of solar energy generation, energy storage products, and related services and sales of solar energy systems incentives. The company was founded by Jeffrey B. Straubel, Elon Reeve Musk, Martin Eberhard, and Marc Tarpenning on July 1, 2003 and is headquartered in Austin, TX.

Related stocks

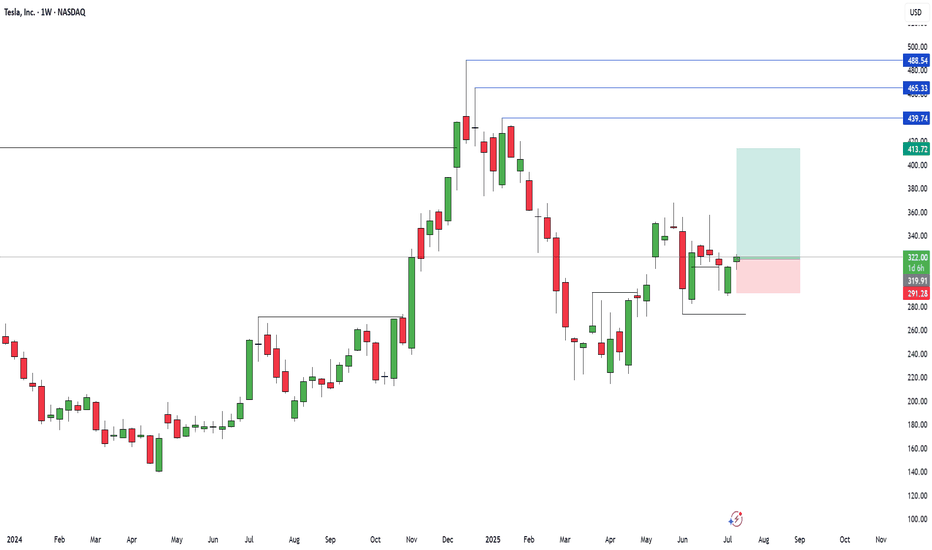

Tesla (TSLA) 1-hour chartTesla (TSLA) 1-hour chart im provided, here are the key bullish target points indicated by the chart analysis:

📈 Bullish Target Points (Upside Levels):

First Target Point:

🔹 Around $338.00 – $340.00

This level is marked as the initial breakout target, likely based on recent price structure and res

Tesla: Still Pointing LowerTesla shares have recently staged a notable rebound, gaining approximately 10%. However, under our primary scenario, the stock remains in a downward trend within the turquoise wave 5, which is expected to extend further below the support level at $215.01 to complete the magenta wave (3). This move i

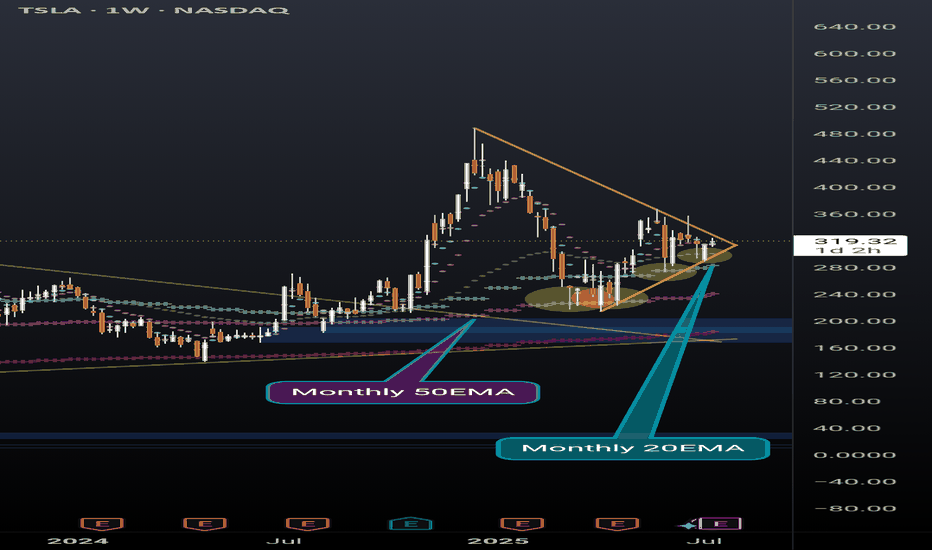

TSLA weekly coiling into something powerfulNever doubt the power of TSLA. Recently broke out of a huge pennant, and now nearing the end of another pennant while simultaneously holding support above the daily 20EMA(overlayed on this weekly chart).

Also recently found support off of the monthly 20EMA (overlayed on this weekly chart) and took

Classic accumulation, manipulation and trend @ TSLA.Looks like someone knows something, or is it just me hallucinating. Can't be both :D

Please see the chart for pattern analysis of what it seems to be a accumulation followed by manipulation, and now the stock is looking for its trend. Whatever happens, I think we are going to see a big move either

Tesla -> The all time high breakout!🚗Tesla ( NASDAQ:TSLA ) prepares a major breakout:

🔎Analysis summary:

Not long ago Tesla perfectly retested the major support trendline of the ascending triangle pattern. So far we witnessed a nice rejection of about +50%, following the overall uptrend. There is actually a quite high chance th

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

TSLA4317805

Tesla Energy Operations, Inc. 5.45% 17-DEC-2030Yield to maturity

11.26%

Maturity date

Dec 17, 2030

TSLA4296328

Tesla Energy Operations, Inc. 5.45% 16-OCT-2030Yield to maturity

10.51%

Maturity date

Oct 16, 2030

TSLA4290558

Tesla Energy Operations, Inc. 5.45% 01-OCT-2030Yield to maturity

9.82%

Maturity date

Oct 1, 2030

TSLA4247202

Tesla Energy Operations, Inc. 5.45% 21-MAY-2030Yield to maturity

9.30%

Maturity date

May 21, 2030

TSLA4286421

Tesla Energy Operations, Inc. 5.45% 17-SEP-2030Yield to maturity

8.52%

Maturity date

Sep 17, 2030

TSLA4324758

Tesla Energy Operations, Inc. 4.7% 14-JAN-2026Yield to maturity

8.01%

Maturity date

Jan 14, 2026

TSLA4231716

Tesla Energy Operations, Inc. 5.45% 23-APR-2030Yield to maturity

7.89%

Maturity date

Apr 23, 2030

TSLA4250220

Tesla Energy Operations, Inc. 5.45% 29-MAY-2030Yield to maturity

7.67%

Maturity date

May 29, 2030

TSLA4313161

Tesla Energy Operations, Inc. 5.45% 03-DEC-2030Yield to maturity

7.43%

Maturity date

Dec 3, 2030

TSLA4222068

Tesla Energy Operations, Inc. 5.45% 19-MAR-2030Yield to maturity

7.39%

Maturity date

Mar 19, 2030

TSLA4265473

Tesla Energy Operations, Inc. 5.45% 16-JUL-2030Yield to maturity

7.00%

Maturity date

Jul 16, 2030

See all TSLACL bonds

Curated watchlists where TSLACL is featured.

Frequently Asked Questions

The current price of TSLACL is 275,722.000 CLP — it hasn't changed in the past 24 hours. Watch TESLA INC stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BCS exchange TESLA INC stocks are traded under the ticker TSLACL.

TSLACL stock has fallen by −5.48% compared to the previous week, the month change is a −11.06% fall, over the last year TESLA INC has showed a 18.27% increase.

We've gathered analysts' opinions on TESLA INC future price: according to them, TSLACL price has a max estimate of 476,644.42 CLP and a min estimate of 109,628.22 CLP. Watch TSLACL chart and read a more detailed TESLA INC stock forecast: see what analysts think of TESLA INC and suggest that you do with its stocks.

TSLACL reached its all-time high on Dec 18, 2024 with the price of 481,000.000 CLP, and its all-time low was 167,030.000 CLP and was reached on Jun 14, 2024. View more price dynamics on TSLACL chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

TSLACL stock is 13.34% volatile and has beta coefficient of 1.75. Track TESLA INC stock price on the chart and check out the list of the most volatile stocks — is TESLA INC there?

Today TESLA INC has the market capitalization of 993.61 T, it has increased by 10.83% over the last week.

Yes, you can track TESLA INC financials in yearly and quarterly reports right on TradingView.

TESLA INC is going to release the next earnings report on Jul 23, 2025. Keep track of upcoming events with our Earnings Calendar.

TSLACL earnings for the last quarter are 257.39 CLP per share, whereas the estimation was 394.29 CLP resulting in a −34.72% surprise. The estimated earnings for the next quarter are 375.79 CLP per share. See more details about TESLA INC earnings.

TESLA INC revenue for the last quarter amounts to 18.43 T CLP, despite the estimated figure of 20.28 T CLP. In the next quarter, revenue is expected to reach 20.97 T CLP.

TSLACL net income for the last quarter is 389.90 B CLP, while the quarter before that showed 2.31 T CLP of net income which accounts for −83.12% change. Track more TESLA INC financial stats to get the full picture.

No, TSLACL doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jul 19, 2025, the company has 125.67 K employees. See our rating of the largest employees — is TESLA INC on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. TESLA INC EBITDA is 12.06 T CLP, and current EBITDA margin is 13.44%. See more stats in TESLA INC financial statements.

Like other stocks, TSLACL shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade TESLA INC stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So TESLA INC technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating TESLA INC stock shows the strong sell signal. See more of TESLA INC technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.