Warren Buffet and UPSHello I am the Cafe Trader.

There have been some wild days, and it's not over. Amidst all the stormy seas, and the major successes, I wanted to bring to your attention a stock that I think is becoming of great value.

UPS has been getting beat down for over three years, why?

Beatdown

- Trump Tariffs contributing to China slowdown. (35% of deliveries comes from China).

- Guidance downgraded due to uncertainties with the macroglobal scale, "spooking investors".

- UPS cutback dealings with amazon to increase profitablity (but also reducing volume and revenue.)

Just to name a few...

If such bad news, why buy?

Fundamentally their business model is strong, and the dividend is PAYING.

Dividends and Warren Buffett.

Buffett is still known to use a model by his mentor, Benjamin Graham. (if you don't know, take a little youtube shallow dive).

This has been used to build a large portion of how buffet evaluates a stock. Using his formula, the Maximum intrinsic value of UPS is $69.87

As of writing this article, UPS sits roughly 21% higher than that number. If we get close, even the fundamentalists may have a hard time passing this up.

Dividends

At 1.68 Dividend a quarter, that put's UPS at almost 7.91% yield!

So my thought process is; even if you lose 8% from Graham's buy price, you make up on the dividend in a year. (although I would be surprised if it touched that golden zone).

TLDR LONG TERM

Aggressive buy: $88 (we are below that right now)

Great Price: $75.50 - 80.50

Graham's STEAL: $71 or Below.

NOTE: Graham took other things about a stock into consideration as we, as you should as an investor. This article is meant to assist your own DD.

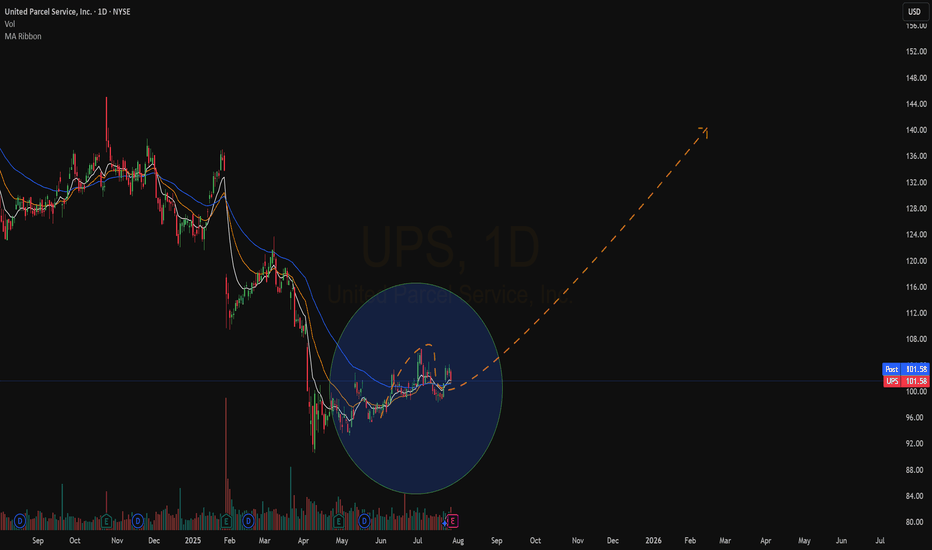

-Since this is charted on a weekly chart I have charted a probable 4-6 month swing. (almost 50% gain).

-It really does depend on where this bounces, we have already broke through some major levels.

-I have a feeling UPS drivers might be cashing out their 401k and panic selling.

That's all for UPS!

I hope you enjoyed the article, thank you for your time.

If you enjoyed please consider a follow and a boost!

@thecafetrader

UPSCL trade ideas

Positioning UPS Long Amid Global Logistics Tailwinds Current Price: $103.56

Direction: LONG

Targets:

- T1 = $106.00

- T2 = $108.00

Stop Levels:

- S1 = $101.00

- S2 = $99.50

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to identify high-probability trade setups. The wisdom of crowds principle suggests that aggregated market perspectives from experienced professionals often outperform individual forecasts, reducing cognitive biases and highlighting consensus opportunities in United Parcel Service Inc. (UPS).

**Key Insights:**

United Parcel Service Inc. is in a prime position to benefit from ongoing bullish sentiment in the broader equity markets. As global trade momentum gains strength, the logistics sector—particularly UPS—stands to capture value from increasing international shipping demand and rising domestic delivery requirements. The company’s strong fundamentals, coupled with bullish technical price action, present an attractive long-term growth opportunity.

UPS’s recent consolidation below a key resistance level is indicative of potentially higher breakout levels next week, provided broader economic resilience persists. Upside catalysts include favorable earnings forecasts and resolution of international trade deals, both of which may attract institutional investors toward logistics stocks like UPS. Additionally, the company could benefit from sector rotations into large-cap value plays amid market diversifications away from technology-heavy equities.

**Recent Performance:**

The stock has been consolidating near its current price level of $103.56, after experiencing a moderate recovery from earlier lows near the $100 range. This steady upward trend indicates gradual confidence among traders as UPS maintains its leadership position within logistics and freight services. With resistance levels at $105, subsequent breakout potential could lead to higher prices in the forthcoming sessions.

**Expert Analysis:**

Analysts remain optimistic about UPS’s capability to capitalize on emerging trends, including reaccelerating global trade and increased e-commerce penetration. Technical studies reveal upside divergence in recurring price movements and volume accumulation, suggesting an imminent rally back to its previous highs. Expert sentiment suggests that regular upward price action could position UPS as a prominent logistics equity benefitting from broader economic activity and capital inflows into its sector.

**News Impact:**

UPS’s role in enhancing international logistics networks places it as a top contender for benefiting from trade agreement developments between the U.S. and EU. Also, the upcoming earnings season is critical, as positive reports across the S&P 500 would likely drive sentiment and support upward progression in its stock price. UPS’s exposure across e-commerce and freight delivery ensures robust prospects amid current global volatility, further providing potential tailwinds to its long opportunities.

**Trading Recommendation:**

Given its technical consolidation near $103.56 and key resistance levels above, traders should position long with a first target at $106.00 and a second target at $108.00. Stops at $101.00 and $99.50 ensure risk management while allowing room for volatility. With positive fundamental drivers, UPS represents a high-conviction opportunity amidst macroeconomic strength and evolving logistics demand.

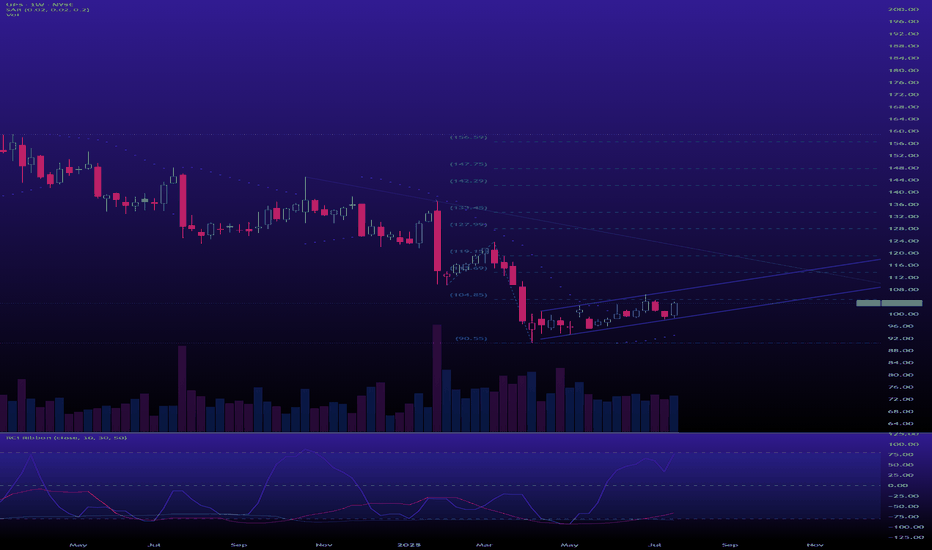

UPS is currently in the Wyckoff Accumulation Phase### **Wyckoff Phase: Accumulation**

1. **Prior Downtrend:** The weekly chart (left) clearly shows a prolonged and significant downtrend through 2024 and into early 2025. This fulfills the "Markdown" phase that precedes accumulation.

2. **Stopping Action and Base Formation:** The daily chart (right) shows that the steep decline halted around March-April 2025. The price then rallied automatically and has since been consolidating sideways. This sideways trading range, following a major downtrend, is the hallmark of the Accumulation phase, where "smart money" may be absorbing shares and building a cause for a future rally.

3. **Confirming Indicators:** The "Neutral" rating from the technicals gauge confirms the current lack of a strong trend. Furthermore, the positive performance in the last week (+1.45%) and month (+3.62%) shows that selling pressure has subsided and short-term demand is emerging, which is consistent with the early stages of accumulation.

### **Suggested Option Strategy: Poor Man's Covered Call (PMCC)**

Given the analysis that UPS is building a base in an Accumulation phase (implying a neutral to bullish long-term outlook), a **Poor Man's Covered Call (PMCC)**, also known as a long call diagonal debit spread, is a suitable strategy.

This strategy allows you to establish a bullish position with less capital than buying 100 shares, while potentially generating income during the expected consolidation period.

**How it Works:**

This is an advanced strategy and should be approached with a full understanding of the risks.

1. **Buy a Long-Term, In-the-Money (ITM) Call:** Instead of buying 100 shares of UPS, you buy a single call option with a long time until expiration (e.g., 6-12 months). Choosing an in-the-money strike (a strike price below the current stock price) makes the option behave more like the stock.

2. **Sell a Short-Term, Out-of-the-Money (OTM) Call:** Against your long call, you sell a call option with a near-term expiration (e.g., 30-45 days) and a strike price that is above the current stock price.

**Goal of the Strategy:**

The objective is for the short-term call you sold to decrease in value faster than your long-term call due to time decay (theta). Ideally, the short call expires worthless, and you keep the premium. You can then repeat the process by selling another short-term call, continuously reducing the net cost of your long-term bullish position while you wait for the stock to potentially begin its "Markup" or uptrend phase.

***

*Disclaimer: This information is for educational purposes only and is not financial advice. Options trading involves significant risk and is not suitable for all investors. You should consult with a qualified financial professional before making any investment decisions.*

Things are looking UPSUnited Parcel Service served as one of our canaries in the coal mine, signalling that the real economy was much weaker than what the Biden administration was reporting. The figures presented were positively skewed, masking the harsh reality that we were all facing difficult times.

We recognized the head and shoulders topping pattern and warned that an economic disaster was approaching us. This ultimately led to the Trump tariff panic that caused the collapse of equities.

The thesis indicated a lack of confirmation regarding rising index prices; however, consumers were feeling the pressure, which manifested in reduced consumption and, consequently, fewer deliveries.

A modern Dow Theory if you will.

As we near new peaks in the stock market, I am convinced that our economy is on a much more solid foundation, poised to benefit Main Street instead of just a handful of monopolistic tech giants. Since equities are forward-looking, stocks are anticipating an exhilarating 2026!

I believe UPS will confirm this economic recovery as we head towards my long anticipated and forecast DOW JONES price of 64,000 likely by 2030.

Trading Analysis for United Parcel Service**Current Price:** $98.92

**Direction:** **LONG**

**LONG Targets:**

- **T1 = $103**

- **T2 = $105**

**Stop Levels:**

- **S1 = $97**

- **S2 = $95**

---

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to identify high-probability trade setups. The wisdom of crowds principle suggests that aggregated market perspectives from experienced professionals often outperform individual forecasts, reducing cognitive biases and highlighting consensus opportunities in United Parcel Service.

**Key Insights:**

UPS benefits from its position as a global leader in logistics and package delivery, especially as key economies worldwide continue to strengthen post-pandemic recovery. The broader transportation sector is experiencing tailwinds due to improved consumer demand and B2B shipments, which provides a favorable backdrop for UPS to capitalize on higher network efficiency and cost controls. Analysts acknowledge that while economic uncertainties persist, UPS’s diversified operations and strategic initiatives, such as investments in automation and infrastructure, position it to maintain competitive advantages.

**Recent Performance:**

In recent weeks, UPS has showcased resilience in volatile market conditions. The stock is trading near its multi-week high, reflecting positive sentiment from both retail and institutional traders. Technical indicators, such as the Relative Strength Index (RSI) at 52.14, suggest neither overbought nor oversold conditions, providing room for continued upward price movement. Despite market uncertainty, the consistent recovery of the transportation and logistics sector has supported UPS, with gains evident in its last quarterly report.

**Expert Analysis:**

Analysts are optimistic about UPS's near-term prospects given its strong operating metrics, cost-cutting strategies, and focus on service improvements. Many experts cite favorable macroeconomic trends, including easing inflation, strong consumer spending, and robust e-commerce activity, as key growth drivers for the company. Furthermore, UPS's valuation, in comparison to its industry peers, appears attractive considering its cash flow strength and dividend-paying history. Technical signals such as a bullish crossover in the moving averages further bolster confidence in a moderate upside scenario.

**News Impact:**

Recent developments, including UPS’s strategic expansion into healthcare logistics, have been well-received by investors. This shift could open access to high-margin business opportunities in medical storage and delivery, which lends long-term growth potential. Additionally, global supply chain improvements and easing raw material costs contribute to optimism around future operating efficiencies. Traders are also paying attention to the upcoming earnings report, which is anticipated to reflect strong seasonal performance and may serve as a stock price catalyst.

---

**Trading Recommendation:**

The strong mix of technical, fundamental, and macroeconomic factors suggests a bullish outlook for United Parcel Service. With momentum indicators supporting upside potential and the stock trading below estimated intrinsic value, traders can consider LONG positions targeting $103 (T1) and $105 (T2), with stops placed at $97 (S1) and $95 (S2). UPS remains well-poised to benefit from improving operational efficiencies, increased network demand, and favorable industry trends, making it a promising candidate for a long-term investment strategy.

```

$UPS going UP : FY25 FORECAST 147% +++in the wake of the potential end of the US 🇺🇸 assets market

I want to continue this post i made last year

If it breaks the trendlines I'm higher for longer till my target

For now I'm long till it breaks that point is it doesn't its going down

With the rest of the country

Whats the Chinese ups?

United Postal Service | UPS | Long at $92.00The United Postal Service NYSE:UPS finally closed out the last remaining price gap on the daily chart (since 2020) and entered my "crash" simple moving average zone. With a P/E of 15x, earnings forecast growth of 8.12% per year, and a dividend over 6%, NYSE:UPS "may" be a good buy and hold through these tumultuous economic/trade war times. I wouldn't place a continued price drop near $75-$85 out of the question, but I'm not in the game of calling bottoms.

At $92.00, NYSE:UPS is in a personal buy zone. Word of caution: if this stock really tanks due to trade issues and massive recession, $50s...

Targets:

$108.00

$120.00

$133.00

OptionsMastery: In a MONTHLY demand on UPS!🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

UPS looking DOWNSNice head and Shoulders on the United Parcel Service

#UPS and FEDEX are the new dow transport indicator.

An underlying determinant of how the consumer is faring

Since the US is a consumer economy and Online shopping is the majority of retail

if we see new highs on the Indicies, and the home delivery carriers continue to deteriorate

it would give your non confirmation Top

Similar to Dow theory of new High's in the Industrials , but the transports lagging and indeed falling.

Selling Pressure Ahead as UPS Approaching Key ResistanceUPS, after breaking below the critical support, is currently trading within a descending channel, indicating the potential validity of a long-term downtrend. At present, the price has once again approached the resistance at the 38.2% Fibonacci level. This is expected to generate significant selling pressure, resulting in a downward push in price. Considering the 3-day chart, the drop could be relatively substantial. The final downside target is identified at the 78.6% Fibonacci level, which corresponds to the $120 mark.

However, a breakout above the channel would serve as a strong warning sign for sellers. If the price manages to produce a new higher high thereafter, it is likely that bulls will regain complete control. Nonetheless, at the moment, bears are clearly dominating the market. Therefore, we are currently initiating our short position.