btcusd Ah, you're likely interested in liquidity in the context of this Bitcoin chart! Here's what we can infer about potential liquidity based on your setpoint:

* Above the Resistance Zone (around 95,878): The red resistance zone often coincides with areas where sellers are likely to have limit orders placed. If the price breaks above this zone, it could trigger those orders, leading to a burst of selling volume and potentially a sharp move downwards. This area could represent a pool of sell-side liquidity.

* Below the Support Level (around 93,919): Similarly, the black support line might attract buyers looking to enter the market or add to their positions. If the price breaks below this level, it could trigger stop-loss orders from buyers, resulting in significant selling pressure and a rapid price decline. This area could represent a pool of buy-side liquidity.

* Areas of Consolidation: The sideways price action within the range defined by your support and resistance levels suggests periods where buying and selling forces are relatively balanced. These periods can build up liquidity as more orders accumulate within that range. A breakout from this consolidation could then trigger a significant move as this built-up liquidity is absorbed.

* "BUY" Signals and Liquidity: Your "BUY" signals might be strategically placed to anticipate moves that could tap into existing liquidity. For example, a buy signal near the support level could be aiming to capitalize on a bounce driven by buy-side liquidity.

In essence, your support and resistance levels are key areas to watch for potential liquidity grabs. A break beyond these levels could indicate a significant influx of volume as resting orders are triggered.

Keep an eye on how the price interacts with these zones and any significant volume spikes that might confirm the triggering of liquidity.

Is there a specific type of liquidity you're interested in, or perhaps how to trade around these levels?

BEARUSD trade ideas

BTC showing a Bull Flag PatternBTC showing a Bull Flag Pattern if this pattern works we can see BTC retest level at 105k for now btc must hold support area at 92k level

A bullish triangle breakout above resistance could signal further upward movement

Conclusion:

Bullish Outlook: If Bitcoin breaks through the $95,000-$100,000 resistance, it could continue moving toward $110,000 and higher, assuming volume remains strong.

Bearish Reversal Risk: If Bitcoin fails to maintain momentum and drops below the support zone around $90,000, a pullback toward $80,000 or lower could be likely.

With Bitcoin trading at $93,852, this represents a significant price level. Let’s dive into a technical analysis based on this new price point. Here's how we can break it down:

1. Price Action Overview:

Current Trend: Given that Bitcoin is trading above $90,000, it’s in a very strong bullish phase (assuming this price is recent and not a flash spike). Bitcoin has likely been in an uptrend for some time if it's at this price point.

Price History: Look back at recent highs and lows. Is $93,852 a new all-time high? If so, it may suggest a continuation of the bullish trend or a potential retracement (correction).

2. Support and Resistance Levels:

Support Levels:

$85,000 - $90,000: This could serve as a near-term support level, as psychological levels tend to hold. Watch for price action around this level to see if it holds.

$80,000: A previous significant level, possibly acting as a major support.

Resistance Levels:

$95,000 - $100,000: These could be the next key resistance levels. If Bitcoin has not yet reached $100,000, it’s likely to encounter some selling pressure around this psychological threshold.

All-Time High: If this is the highest price Bitcoin has reached (or is close), it may face resistance as traders take profits.

3. Technical Indicators:

Moving Averages (MA):

50-Day MA: If Bitcoin is above the 50-Day Moving Average (likely the case if it’s at $93,852), this indicates a short-term bullish trend.

200-Day MA: If Bitcoin is significantly above the 200-Day MA (possibly $50,000–$60,000, depending on the trend), this suggests that the long-term trend is still bullish.

Crossovers: If the price is above both MAs, the trend is solidly bullish. A potential golden cross (50MA crossing above the 200MA) would further validate this upward trend.

Relative Strength Index (RSI):

RSI at 70 or above: If the RSI is near or above 70, Bitcoin may be entering overbought territory. This could signal that the price might face some retracement or consolidation.

RSI at 50-70: This indicates healthy momentum, and Bitcoin is still in an uptrend without signs of being overextended yet.

MACD (Moving Average Convergence Divergence):

Bullish Crossover: If the MACD line is above the signal line, it indicates positive momentum and buying pressure.

Bearish Crossover: If the MACD crosses below the signal line, it may suggest a slowdown or potential pullback. Look for any divergence between price and MACD, as it may signal an upcoming reversal.

Volume:

Increasing Volume: If Bitcoin is moving up with increasing volume, this suggests strong market participation, which is a good sign for the uptrend continuing.

Decreasing Volume: If volume is tapering off during an uptrend, this might indicate weakening momentum, and a reversal or consolidation might be coming.

4. Chart Patterns:

Bullish Continuation Patterns:

Look for bull flags or ascending triangles. These patterns indicate that after a period of consolidation, Bitcoin might continue its upward trajectory.

Reversal Patterns: If Bitcoin is forming head and shoulders, double top, or bearish divergence with high RSI, that could signal a potential reversal or correction in the near future.

5. Sentiment and Market Conditions:

Fear and Greed Index: If the Fear & Greed Index is in the “Extreme Greed” zone, this might indicate that the market is overbought, and a short-term correction could be on the horizon.

On-Chain Data: Look for any data showing whether large players (whales) are buying or selling at these levels. If whales are accumulating, it might suggest continued bullishness.

6. Potential Price Targets:

Upside Potential:

$95,000 - $100,000: This is likely the next resistance zone. If Bitcoin breaks through this range with strong momentum, it could be headed towards $110,000 or even higher, depending on how the market reacts.

Downside Risk:

$85,000 - $90,000: These levels might act as strong support. If Bitcoin breaks below $90,000, the next level of support would be around $80,000.

If it falls below $80,000, this would signal a deeper correction, and we would need to watch for further support at $70,000 and $60,000.

7. Fundamental Factors to Consider:

Global Market Sentiment: Bitcoin’s price is often influenced by traditional financial markets, especially during macroeconomic events (inflation data, interest rate changes, etc.). Pay attention to how equities, gold, and other assets are performing, as Bitcoin often moves with these.

Regulation News: Any regulatory developments, especially in the US or Europe, can have a major impact on Bitcoin’s price.

Institutional Adoption: News of large institutions or corporations adopting Bitcoin can drive the price higher. Similarly, any reports of significant sell-offs by large holders can trigger a downward price movement.

Fearless Bulls Bought the Dip! The 75-80K range finally delivered as a strong support zone — just as anticipated.

Back in January, I marked this area as "A Sweet Spot to Pull Back," and today’s price action validates that foresight.

What's even more impressive? Bitcoin absorbed the selling pressure on both April 3rd and 4th like a champ.

Now, the 400-day EMA is stepping up as dynamic support, adding further conviction to the bullish case.

Long trade

Trade Overview: BTCUSD – Long Position

Entry Price: 94,355.20

Take Profit: 95,775.76 (+1.51%)

Stop Loss: 93,945.35 (–0.43%)

Risk-Reward Ratio (RR): 3.51

🕚 Entry Time: 11:45 AM (New York Time)

📅 Date: Saturday, 26th April 2025

🌍 Session: NY AM

🧭 Entry Timeframe: 15-Minute TF

Reasoning Narrative

BTCUSD formed a bullish falling wedge structure on the 15-minute timeframe, signalling a likely breakout to the upside. Price action respected the wedge boundaries with multiple touches before showing a compression toward the apex, hinting at an imminent move.

TA for FX,Indices and many More!(Week 17,28Apr25)Hello fellow traders , my regular and new friends!

Which pairs or instruments should we keep a look out for?

For me I am looking at :

potentially more pullback (down) on EURUSD and the majors.(stronger USD)

SNP might have a day or 2 of upside and pullback (chance for long on the change in daily trend)

Potential H&S on EurGbp and Gold.

BTC to see potential long if there's decent pullback.

NFP this week, BOJ interest rate release as well! Take note!

Do check out my recorded video for more insights!

Do Like and Boost if you have learnt something and enjoyed the content, thank you!

-- Get the right tools and an experienced Guide, you WILL navigate your way out of this "Dangerous Jungle"! --

btc . w4 - wknd . SHORT but cautious - yet paytientfriday plan, was to SHORT (see prvs post)

sell zone

starts . friday open

ends . monday open

entry . 95.542

sl . -2.62%

10 sell orders . 1.52% spread

tp1 . 91.642 . +3.99%

funding . +0.01%

we are according to plan + collecting funding

tp1 adjusted to moderate, since bullish outlook coming from april.

tp2 . +10.11%

Bitcoin sell technical analysis Description:

Bitcoin is rejecting major resistance near $94,000 after forming a bearish engulfing candle on the 4H chart.

• Key Resistance: $94,000–$95,000 zone rejected with strong selling pressure.

• RSI Divergence: Bearish divergence between price and RSI confirms weakness.

• Break of Support: Price broke minor support at $92,800, shifting short-term structure bearish.

• Moving Averages: Trading below the 50 EMA on the 4H chart, signaling bearish momentum.

Sell Setup:

• Look for entries around $93,500–$94,000 (retest zone).

• Stop-loss above $95,000.

• TP1: $91,000

• TP2: $88,500

Bitcoin is showing clear signs of a pullback — sellers are currently in control.

Bitcoin & Tariffs 📉 In the short term, Trump's proposed tariffs add to the current risk-off sentiment—ETF flows, correlations with stocks, and macro uncertainty are already weighing on Bitcoin.

🗣 While debates rage on about whether tariffs will hurt importers or exporters or whether Trump will roll back some after negotiations, one thing is certain: inflation. And inflation is historically a positive for $BTC.

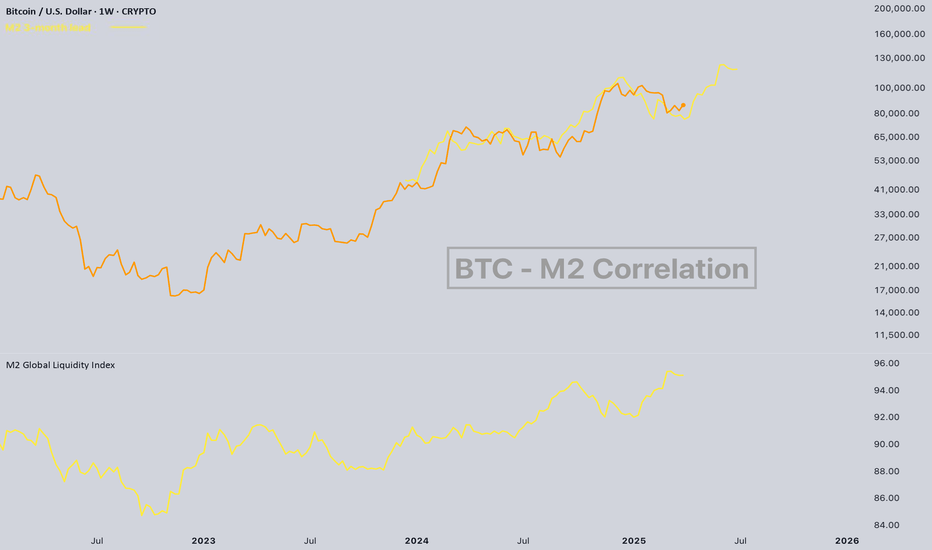

🌊Liquidity injections, growth of money supply (M2) and potential QE will follow as a weak economy struggles with disrupted supply chains—another long-term positive for Bitcoin

⚖️ During trade wars and geopolitical uncertainty, investors run to gold. With Bitcoin’s correlation to gold, this could be another tailwind

💡 So while tariffs may be a short-term drag, structurally, they are bullish for Bitcoin in the long run. You also need to remember that quite a lot of negativity is already built into the price, and if there is no new round of counter-tariffs, positive sentiment may appear sooner.

Weekly Support for BitcoinYou can check this Chart for your referrence we have weekly support around price 85k level if this level can hold or stay for 1 month we are surely Bullish for bitcoin.

As of April 26, 2025, Bitcoin (BTC) is trading at approximately $94,032 USD, reflecting a slight decrease of about 1.1% over the past 24 hours. Despite this minor dip, Bitcoin has experienced a notable upward trend, gaining nearly 10% over the past week and approaching the significant $95,000 resistance level.

Fundamental Analysis

The recent surge in Bitcoin's price is influenced by several factors:

Geopolitical Developments: A recent call between U.S. President Donald Trump and Chinese President Xi Jinping to discuss trade tariffs has positively impacted market sentiment, contributing to a rally in risk assets, including cryptocurrencies.

Institutional Interest: The Federal Reserve's rollback of certain regulations has made it easier for Wall Street institutions to engage with Bitcoin and other cryptocurrencies, potentially increasing institutional investment.

Forbes

Market Predictions: Notable figures like Robert Kiyosaki have set optimistic price targets for Bitcoin, with Kiyosaki predicting it could reach $180,000 to $200,000 by the end of 2025.

Binance

However, technical analysis indicates that Bitcoin is forming a bearish triangle pattern, suggesting potential resistance around the $95,000 mark. If the price fails to break through this resistance, it could lead to a short-term pullback.

In summary, while Bitcoin's current trajectory is upward, investors should remain cautious and monitor both technical indicators and geopolitical developments that could influence its price movement.

If you like my content Analysis Please follow me :) Thank you for support I'll be giving more daily updates on this page if I got more followers here By the way I started Crypto Trading since 2014 11 Year's now in this Trading Journey I would like to give more Idea's for you guys

BTCUSD: Trading Signal From Our Team

BTCUSD

- Classic bearish pattern

- Our team expects retracement

SUGGESTED TRADE:

Swing Trade

Sell BTCUSD

Entry - 95407

Stop - 99310

Take - 88838

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

Bitcoin at Key Decision Point – Two Scenarios in PlayBitcoin is approaching a major trendline resistance after a strong rally.

At this stage, I see two possible scenarios:

1️⃣ Scenario 1 (More Likely):

Price could reject from this resistance zone, triggering a pullback toward the lower blue trendline support. This move would sweep liquidity, reset the market, and set up the next bullish leg.

2️⃣ Scenario 2:

If bulls manage to break above the resistance without a deeper pullback, we could see a continuation toward new all-time highs around 114k.

However, given the extended rally and weakening momentum, a correction first seems more natural.

⚡ I'm watching for reaction around the resistance and the orange zones for confirmation.

Patience is key — no need to chase!

BTCUSD – Long Trade Setup !📈🟢

Asset: Bitcoin / U.S. Dollar (BITSTAMP: BTCUSD)

Chart: 30-Min Timeframe

Pattern: Bullish pennant breakout setup

🔹 Entry: ~$94,200 (breakout + structure support)

🔹 Stop-Loss: ~$93,000 (below pennant and trendline)

🔹 Take Profits:

TP1: ~$95,500 – Near upper channel

TP2: ~$97,000 – Measured breakout target

⚖️ Risk-Reward Calculation

– Risk per Trade: ~$1,200

– Reward to TP2: ~$2,800

– R:R Ratio: ~1:2.3 ✅

🧠 Technical Highlights

– Strong pennant consolidation after big rally

– Higher lows holding tight on 30-min frame

– Clean breakout expected above $94,500

– Previous breakout patterns confirmed bullish continuation

Bitcoin(BTC/USD) Daily Chart Analysis For Week of April 25, 2025Technical Analysis and Outlook:

Bitcoin experienced a significant rally in this week's trading session, breaking through all identified Mean Resistance levels: 86400, 90600, and 94500. This breakout led to the completion of the Interim Coin Rally at 88400. As a result, the newest identified Interim Coin Rally at 95000 has also been completed, indicating a possible pullback to the Mean Support at 92000 and a further decline potential toward an additional Mean Support target at 88500. However, it's important to recognize the chance of upward momentum emerging from a retest of the completed Interim Coin Rally at 95000, which could advance toward the next Interim Coin Rally at 100000.

BTC is ready to blast

1. Here VOLUME totally compressed in 4 hrs time line chart and price is consolidating some what.

2.rsi is not breaking 60 level and adx is smoothed above 25 level

3.ketller channel is showing for not over bought or not oversold zone

conclusion : if price is break 96000 level it will move to monthly and quarterly resistant 102500 and this will be its first stop

This setup reflects a classic smart money concept, liquidity engineering followed by a return to inefficiency. The trade idea rests on the premise that markets rarely move in a straight line and often seek to rebalance themselves after aggressive trends. By allowing price to sweep the highs, fill the imbalance, and re-establish support, we can position ourselves with the trend in a favorable risk-reward context. The bias remains bullish, but execution depends on price reaction at key levels and confirmation of intent.

Bitcoin (BTC/USD) - Cup and Handle Breakout🔍 Pattern Identified: Cup ☕ & Handle 🏆 Pattern

🕒 Timeframe: 1-Hour Chart (1H)

💥 Breakout Level: Around $95,000

🎯 Projected Target: $97,073.75

📈 Technical Overview:

Bitcoin formed a rounded cup showing accumulation at lower levels.

After completing the cup, a small pullback (handle) indicated a healthy consolidation.

A strong breakout above the neckline resistance confirms the bullish pattern.

⚡ Actionable Insights:

As long as the price stays above the neckline, momentum remains positive.

A breakout generally leads to a strong continuation rally towards the projected target.

📊 Watch for volume confirmation for added strength.

⚠️ Caution if price slips back below the neckline – breakout may invalidate.

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Bitcoin reaches $110,000 to $113,000 then crashes 2025 (soon)A bearish divergence has appeared on Bitcoin’s weekly chart, closely resembling the setup before the 2021 crash. Based on this, along with a peak-to-peak trendline, I believe Bitcoin could climb to $110,000–$113,000 before a major correction — potentially dropping to $60,000 or, in a worst-case scenario, as low as $30,000 — before beginning its next upward surge.

$BTC Positive Scenario & Recovery Strength... 4/26/2025CRYPTOCAP:BTC Positive Scenario & Recovery Strength...

50-D SMA: Cleared

38.2% of the recent decline ($88,506): Cleared

100-D SMA: Cleared

61.8% of the recent decline ($96,904): Underway, LHU! 😅

Full recovery of the recent decline ($109,665): YTS

Positive Scenario Target ($127,845): YTS

Cheers!