Shorting Analysis on Bitcoin - Fxdollars- {15/04/2025}Educational Analysis says that BTCUSD may give countertrend opportunities from this range, according to my technical analysis.

Broker - BITSTAMP

So, my analysis is based on a top-down approach from weekly to trend range to internal trend range.

So my analysis comprises of two structures: 1) Break of structure on weekly range and 2) External pushback to fill the remaining fair value gap

Let's see what this pair brings to the table for us in the future.

Please check the comment section to see how this turned out.

DISCLAIMER:-

This is not an entry signal. THIS IS ONLY EDUCATIONAL PURPOSE ANALYSIS.

I have no concerns with your profit and loss from this analysis.

I HAVE NO CONCERNS WITH YOUR PROFIT OR LOSS,

Happy Trading, Fx Dollars.

BEARUSD trade ideas

BTCUSD 4H FORECAST PREDICTION Hello Guys I Hope you're all well

Hey there our Global forex community charts on btcusd on 4hTF looking for vertical zone on Monday our prediction was buy side and now seems going on top to bottom still running on our prediction as we say and we hope we can hit our target to this weekend

Hope you guys all well thanks

BTCUSD INTRADAY Oversold bounce back capped at 88,000Recent price action in Bitcoin (BTCUSD) suggests an oversold bounce, with resistance capping gains at the 88,000 level. The continuation of selling pressure could extend the downside move, with key support levels at 80,850, followed by 77,500 and 74,420.

Alternatively, a confirmed breakout above 88,000, accompanied by a daily close higher, would invalidate the bearish outlook. In this scenario, Bitcoin could target 90,540, with further resistance at 91,890.

Conclusion:

The price remains below pivotal level, with 88,000 acting as a key resistance. Failure to break above this level could reinforce downside risks, while a breakout could shift momentum back in favour of bulls. Traders should watch for confirmation signals before positioning for the next move.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

BITCOIN (BTCUSD): Waiting For BreakoutIt appears that ⚠️BITCOIN is getting ready for a potential upward movement.

Upon analyzing the daily chart, I spotted a falling wedge pattern and a confirmed breakout above its upper boundary.

The final hurdle for buyers is the resistance level between 8,7478 and 88799 on a daily chart.

If the bulls are able to surpass and close above this level, it will be a significant bullish signal.

This could lead to a continuation of the bullish trend, possibly reaching the next resistance level.

Bitcoin, Gold, S&P 500 and InflationBitcoin, Gold, S&P 500 and Inflation

This is a 3 year view (2022 - 2025 to date), 1 week comparison chart of Bitcoin, Gold, S&P 500 and US cumulative rate of inflation. The most interesting part of this analysis to me is that the S&P 500 bounced off the cumulative rate of inflation slope. I did not know that until after I set up the comparison.

Gold = +80%

BTCUSD = +50%

S&P 500 = +19%

US cumulative rate of inflation:

2022 = +6.5%

2023 = +3.4%

2024 = +2.9%

3 yr = +10.8%

2025 = +2.4% forecast

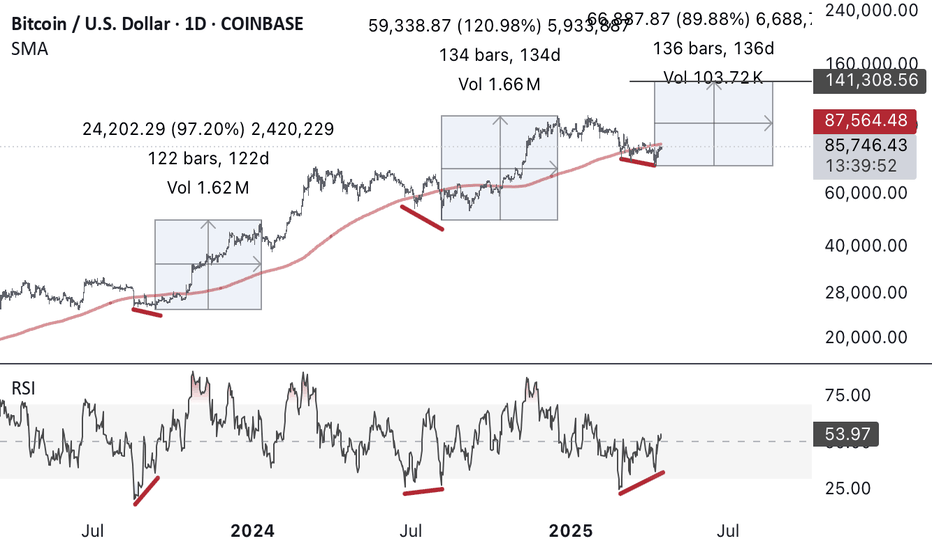

Bitcoin Above The 50 MABitcoin has climbed back above the 50-day moving average (blue line) – a level it hasn’t closed above since January. That alone is notable – it marks a potential shift in momentum after months of trending beneath it. That said, the 200-day moving average (red line) still looms above as overhead resistance and hasn’t been tested on this push yet.

Price action has been constructive off the lows, with higher highs and higher lows forming over the past two weeks. Volume has picked up modestly, though not convincingly, suggesting the rally is cautious rather than euphoric. The $73,835 support level continues to hold firm as the critical line in the sand below.

It’s too early to declare a trend reversal, but closing multiple daily candles above the 50 MA would be a positive signal for bulls. Keep an eye on the 200 MA just above – cracking that level would open the door to more aggressive upside.

Bitcoin breaks resistance trend lineIn another sign of recovery, Bitcoin is trying to break away from a key short-term resistance trend line that has been in place since the cryptocurrency topped out in January this year at above $109K.

BTC/USD has already reclaimed a few short-term levels such as FWB:83K and moved above the 21-day exponential moving average to provide the first objective bullish signal.

More work is still needed before we get the all-clear, with the 200-day average and more importantly a key resistance range around $90K (specifically in the $88.8K to $91.2K range) to contend with.

Still, we have a few tentative signs of a possible reversal, which is evidenced across risk assets including major stock indices.

By Fawad Razaqzada, market analyst with FOREX.com

BTCBTC oversold on daily timeframe formed regular bullish divergence.

Tariff war makes perfect panic selling.

Last 2 times it happen price went up almost 2x.

Price was grabbing liquidity under 200 day MA.

It was good place to add spot for long term hold.

Now expecting some good times ahead, if something terrible doesn’t happen.

BITCOIN is kissing a critical resistance zone.BITCOIN is kissing a critical resistance zone.

Bitcoin is currently kissing a critical resistance zone, hovering around the $85,500 level. This region aligns closely with a descending trendline that has historically capped BTC rallies, and this test comes after a sharp recovery from a local low near $74,000, a drop that was triggered in tandem with broader risk-asset selloffs following U.S. tariff announcements and rising global macroeconomic tension.

Technical Analysis

The descending trendline (marked in blue on the chart) acts as a key resistance.

A daily close above $85,800 - $86,200 could confirm a breakout, potentially paving the way for a fresh attempt toward the $90,000 psychological level.

Conversely, failure to break and hold above this resistance could cause a rejection and pullback.

Immediate downside support lies at the previous local low (~$74,000), and below that, the next strong support zone is around $69,000 (yellow block on chart).

Fundamental Backdrop

Bitcoin continues to be driven by macroeconomic news, institutional flows, and growing ETF inflows.

If fundamentals remain bullish, including continued institutional accumulation, favorable regulatory developments, or increased on-chain activity, they could fuel momentum for a breakout.

The market doesn’t reward assumptions — it rewards preparation.

Whether it’s a breakout or a pullback, risk management should always come first. As always, protect your capital before thinking of profit. Use stop-losses, scale your entries, and avoid over-leveraging in volatile zones like this.

What’s your take on BTC at this juncture?

Do you see a breakout brewing, or is this another trap for over-leveraged bulls?

Let’s discuss

April 14 Bitcoin Bybit chart analysisHello

It's a Bitcoinguide.

If you have a "follower"

You can receive comment notifications on real-time travel routes and major sections.

If my analysis is helpful,

Please would like one booster button at the bottom.

Here is the Bitcoin 30-minute chart.

There is no Nasdaq indicator announcement today.

I created a strategy based on the possibility of a strong decline in Tether dominance centered on the Gap section at the bottom of Nasdaq and Bitcoin.

*One-way long position strategy when the red finger moves

1. 83,690.8 dollars long position entry section / cut-off price when the green support line is broken

2. 85,772.3 dollars long position 1st target -> Top 2nd -> Good 3rd target.

If the strategy is successful, I have indicated the long position re-entry section.

Today, it is best to maintain the purple support line

because it maintains the mid-term pattern and the daily candle bottom section.

The mid-term pattern can be broken from the 1st section,

and it can be a sideways market until the 2nd section,

and it can decline step by step from the bottom -> 3rd section.

Up to this point, I ask that you simply use my analysis for reference and use only.

I hope that you operate safely with the principle of trading and cut-off price.

Thank you.

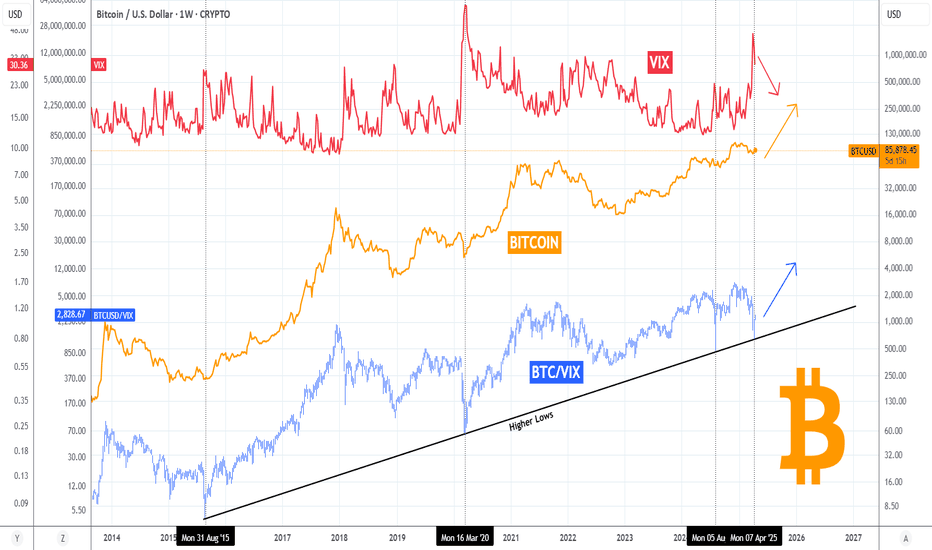

BITCOIN's ultimate VIX bottom signal-Last time gave +100% profitBitcoin (BTCUSD) is attempting to make yet another green day, yesterday not only did it close above its 1D MA50 again but was also the 4th green day in the last 6. This attempt is showing that the trend is gradually shifting again towards long-term bullish but today we'll present to you another one, this time in relation to the Volatility Index (VIX).

BTC's (orange trend-line) recent rise is naturally on a negative correlation with VIX (red trend-line) which is currently pulling back after it's most aggressive spike since the COVID flash-crash (March 2020).

Their ratio BTCUSD/VIX (blue trend-line) made a very interesting contact with the Higher Lows trend-line that has been holding since the August 24 2015 Low, which was the bottom of the 2014 Bear Cycle. Since then it made Higher Lows on March 16 2020, August 05 2024 and the most recent, April 07 2025. Every time it was a bottom indication and a massive rally followed. The 'weakest' of all was the previous one, which 'only' gave a +105% rise approximately. Based on that, there is no reason not to expect BTC to hit at least $150k by the end of this Bull Cycle.

Do you think that's a plausible target? Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

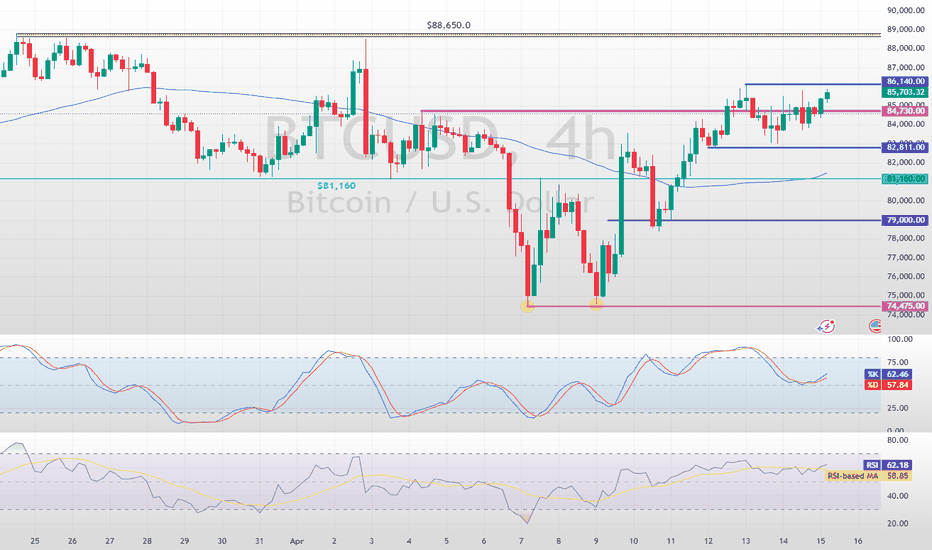

BTC/USD Rejected at Supply Zone –Major Levels to Watch This WeekBitcoin is currently trading around $85,773, showing strength but facing stiff resistance near the $87,100 supply zone. Let's break down what the chart is telling us and why this week could be critical for price direction.

Key Levels:

Supply Zone: $86,800 - $87,500 → Price has been rejected here multiple times. This is the sell wall.

Immediate Support: $82,882 → A break below could trigger a sharper move down.

Major Demand Zone: $75,800 - $76,800 → Strong buyer interest in this region, marked by volume and past rejections.

Other Key Levels:

$83,547 – Mid-range support/resistance

$78,552 – Potential bounce zone if breakdown occurs

Price Action Insights:

BTC is consolidating just below a major resistance.

Volume is drying up near the top, suggesting either a breakout trap or an impending move down.

Arrows indicate potential liquidity zones where smart money could sweep price before reversal.

Scenarios:

1. Bullish Breakout: Clean candle close above $87,100 with retest → Target $89,000 - $90,000

2. Bearish Rejection: Strong rejection from supply zone → Watch $82,882 and $78,552 for reaction

3. Liquidity Sweep Play: Price spikes above supply to trap longs, then dumps hard → common before major macro news

Fundamentals to Watch:

U.S. economic data releases (highlighted on the chart – April 15 & 17)

Any shift in Fed tone or inflation data could trigger volatility.

Will BTC break above or fall back into the range?

Comment your bias below!

Like & follow for real-time updates and setups!

Bitcoin daily Raising wedge🧠 Chart Breakdown – BTC/USD (Daily)

📉 Pattern: Falling Wedge

BTC has been moving within a falling wedge, a bullish reversal pattern.

The wedge is now broken to the upside, signaling a potential trend reversal or continuation of the larger uptrend.

📈 Breakout Confirmation

Price broke above the wedge and closed strong, suggesting buying momentum is returning.

Breakouts from falling wedges typically aim for a measured move equal to the height of the wedge — potentially sending BTC higher.

🟦 Support Zones

$77,936 – Previously a strong support/resistance flip zone.

$74,402 – A key structural level. Price tested and bounced here before breakout.

Both zones acted as a springboard for the recent bullish move.

🟪 Resistance Zones

$95,000 – A prior top before the correction began. Likely to act as resistance again.

$105,000 – Final major resistance before potential new all-time highs.

📊 Volume

Noticeable spike in volume during breakout – confirms strong bullish interest and validates the wedge breakout.

📉 RSI (Relative Strength Index)

RSI is at 53.81, climbing steadily, and crossing above the moving average.

Indicates increasing bullish momentum, but not yet overbought — still room to grow.

✅ Conclusion / Trade Idea

BTC has broken out of a falling wedge, with momentum building.

Bullish targets:

$95,000 first

$105,000 next

Invalidation zone: Below $74,000, where the breakout would be considered failed.

🔔 Final Thoughts

This chart signals a bullish continuation for BTC as long as price holds above the wedge and support zones. Ideal for position trades or swing entries, especially on retests of breakout levels.

HOW BTC GONNA BE 1M IN 2 YEARS

HI.

Gotcha..

Without filling the dots on fundamental n value etc.

I am over simplifying this idea in 2 lines.. uptrend support n resistance line on MoM

Don't get excited becoz it's only 10X on 1:1

and 2-3 years 1000 days..

Few conditions before you make a move.. ( follow and share ) :)

:- you should have a plan

:- you can start slowly (it's going to be long ride brother & sister)

:::::PM me.. I will give you my mind for free.. ( caveat emptor )

Please don't trust me.

I'm not a guru.

If it clicks.. go for it

Bitcoin Bulls Pave Path to $100,000FenzoFx—Bitcoin is trading bullishly, staying above the 50-period SMA and the 81,160 support. Currently, it hovers around $85,650, testing resistance.

As long as prices hold above 81,160, the next target could be $88,650. However, if bears push below $82,811, consolidation may occur, with support at 81,160.

Trade BTC/USD swap-free, effortlessly. >>> FenzoFx Decentralized Forex Broker

BITCOIN is kissing a critical resistance zoneBITCOIN is kissing a critical resistance zone.

Bitcoin is currently kissing a critical resistance zone, hovering around the $85,500 level. This region aligns closely with a descending trendline that has historically capped BTC rallies, and this test comes after a sharp recovery from a local low near $74,000, a drop that was triggered in tandem with broader risk-asset selloffs following U.S. tariff announcements and rising global macroeconomic tension.

Technical Analysis

The descending trendline (marked in blue on the chart) acts as a key resistance.

A daily close above $85,800 - $86,200 could confirm a breakout, potentially paving the way for a fresh attempt toward the $90,000 psychological level.

Conversely, failure to break and hold above this resistance could cause a rejection and pullback.

Immediate downside support lies at the previous local low (~$74,000), and below that, the next strong support zone is around $69,000 (yellow block on chart).

Fundamental Backdrop

Bitcoin continues to be driven by macroeconomic news, institutional flows, and growing ETF inflows.

If fundamentals remain bullish, including continued institutional accumulation, favorable regulatory developments, or increased on-chain activity, they could fuel momentum for a breakout.

The market doesn’t reward assumptions — it rewards preparation.

Whether it’s a breakout or a pullback, risk management should always come first. As always, protect your capital before thinking of profit. Use stop-losses, scale your entries, and avoid over-leveraging in volatile zones like this.

What’s your take on BTC at this juncture?

Do you see a breakout brewing, or is this another trap for over-leveraged bulls?

Let’s discuss

Secure ptofits of LONG📊 BTC Daily Chart – In-Depth Analysis (as of Apr 15, 2025)

🔍 Overview

You're holding a long position from below $80K, still active but now at a +5-6% gain, while TP is placed around 88.3K, close to a key resistance and trendline confluence. Let's break this all down and answer your core question: Is it wise to secure profits now even if TP hasn't been reached?

⚒️ BitcoinMF PRO & Fisher Confirmation

The BitcoinMF PRO indicator has been delivering precise entries/exits—highlighted with green "Long" and red "Short" tags.

Your current active long was marked by BitcoinMF PRO near the lower end of the descending channel with Fisher Transform at a local bottom, signaling an extremely oversold bounce zone.

The Fisher is curling up from a "super low" region, meaning it is entering mid-zone. This reduces risk-reward from here for new longs—good reason to lock partial profits.

📉 Technical Chart Structure Breakdown

🔺 Linear Regression Channels:

BTC is now trading near the top of the smaller descending red channel, nearing rejection territory.

Also, it’s approaching the bottom half of the broader dark blue ascending channel = resistance cluster zone.

🔁 Elliott Wave Structure (Possibly Ending Wave 4)

This looks like a potential 3 → 4 → 5 wave structure unfolding.

Wave 3 likely bottomed near $71K- FWB:73K , and this long is likely part of Wave 4 retracement. If correct, Wave 5 may resume down again unless invalidated above $88.3K.

🔸 Fibonacci Watch:

0.5 Fib retracement from recent swing high to low is around $84.2K-$85.5K—you’re sitting on it right now.

0.618 Fib confluence is ~$88.5K, right where TP is set. That zone is statistically known for rejections. This is another reason to secure a chunk of profit now.

📉 Volume & Sentiment

Volume is weak on this rally, indicating a lack of conviction.

Fear & Greed Index (live: ⚠️ around 72 – greed zone) is starting to lean hot.

Market sentiment is optimistic, and price is hovering just below known short zones.

🏦 Whale Activity, Exchange Inflows & CME Gap

Whale wallets have shown mild accumulation at lower levels (~ FWB:73K -$75K), but no aggressive buying up here.

Exchange inflows are increasing slightly – suggesting some may be getting ready to sell into this strength.

✅ CME Gap around $66K is still unfilled. Historically 90% of gaps fill. Keep that in your long-term radar.

🔄 Long vs Shorts Ratio (Bybit + Binance)

On both Bybit and Binance, Longs > Shorts by ~58/42 – minor imbalance. Suggests majority is positioned long, slightly raising correction risk.

✅ Final Strategic Take

❗ Why You Should Secure Profits Now:

Price is at a resistance confluence zone (Fib + LR + sentiment).

The move has already run +5-6%, and even if price doesn’t touch TP at 88.3K, greed could erase that unrealized profit quickly.

If this is just Wave 4, the next move could be a final push down to $70K or lower (Wave 5).

Volume divergence + rising inflows = risk is increasing.

Locking at least 50-70% now is smart trader psychology. You can always re-enter.

🔮 Most Probable Next Move: 6.8 / 10 – Mild Up, Then Pullback

BTC has 69% probability of testing $86.5K–$88.5K, but rejection is very likely there.

After that, we could see a pullback to $80K–$82K.

Extreme bullish continuation (above $90K) currently has <20% probability unless macro/Fed/etc. change.

📌 Action Recommendation:

📈 Secure partial profits immediately.

🧠 Move stop-loss to breakeven or slightly in profit to protect the rest.

🛑 Avoid FOMO-ing into new longs now – let the chart confirm breakout first.

🧠 Ancient Wisdom:

In Pirkei Avot (Ethics of the Fathers), Rabbi Tarfon said:

“The day is short, the work is great… and the reward is much, but the Master is insistent.”

In trading terms: The market doesn’t owe you your TP. Secure reward when the work is done. Don’t overstay your welcome.

for more follow links in profile

BTC/USD Daily Technical Outlook – Approaching Cycle Top?Bitcoin is currently trading around $85,500, maintaining short-term bullish momentum within a well-formed ascending structure on the daily chart. The price is now entering a mid-phase rally, with a clear target of $98,000, a key resistance level that coincides with the upper boundary of a rising wedge formation and historical trend extension zones.

Key Technical Levels:

Immediate Resistance: $88,800 (local supply zone)

Major Target Zone: $97,000–$98,000 (macro resistance + psychological round number)

Short-Term Support: $82,000

Key Breakdown Level: $78,500

While the momentum suggests BTC may continue to push higher in the near term, the $98,000 resistance is likely to act as a distribution zone, where buying may slow and profit-taking increases. This level could falsely signal a breakout, leading to a spike in retail long positions before the market enters a longer-term correction phase.

If rejection occurs at or near $98,000, BTC could begin a multi-month correction, with the primary downside target set at $49,000 by July 2025. This level aligns with previous weekly support, volume profile lows, and would represent a typical deep retracement following a major cycle top.

Outlook:

Near-term bias: Bullish toward $98,000

Macro bias: Bearish reversal expected from resistance zone

Cycle correction target: $49,000 (Q3 2025)

Is BTC set to hit 90K before dropping?#BTC has been range-bound on the weekly , recently forming an SFP below the range low but failing to close below the Feb and Mar 10th lows. Could we see an SFP above the RH ($90K) before moving lower, potentially toward the FWB:65K -$72K target? That remains to be seen. The HTF MS remains bearish, and until it shifts, the risk to the downside is high. For a bullish shift on the weekly, we need weekly closes above $94000. Until then, downside risk persists.

On LTF/MTF: I update my analysis regularly, but for now, I’m considering a few scenarios:

👉a. BTC could bounce from an 18H HOB if the 2H HOB breaks, potentially aligning with USDT.D hitting a 23H HOB at 5.62%. This might form a DB at a 22H PHOB at 5.35%, or USDT.D could target a 12D demand or a 22H HOB at 5.15%.

👉b. BTC might bounce, breaking the current 21H OB, and reach the HTF supply at $90K, while USDT.D takes the 23H PHOB and possibly the 22H HOB before rising to 5.77%-6.01%.

Also note, the daily close below the $84600 SH shows weakness on the chart. There’s little to do until we either reach $72K or see an MS shift, which could open risky upside trades. These are risky because we haven’t taken the liquidity needed for higher prices. MT also mentioned that higher prices without key level breaks are likely a bull trap. Avoid heavy trades until direction is clear.

Until then, we focus on taking LTF scalp trades 🤝

BTCUSD is expected to break through 88800On the daily chart, BTCUSD rebounded from a low level, and the price has broken through the downward trend line resistance. Currently, we can pay attention to the support near 83,000. If it does not break, we can consider buying. The upper resistance is around 88,800. After breaking through, the upper resistance is around 92,000.

BTCUSD 30M CHART PATTERNThis chart illustrates a triple top pattern for BTC/USD on the 30-minute timeframe—a classic bearish reversal signal.

Here's a quick breakdown:

Red Arrows / Top Zone: Three clear attempts to break resistance around the 85,900 level, all failing, which defines the triple top.

Support Zone: Horizontal red line around 83,300 indicates a strong support level.

Entry Idea: The chart suggests shorting from the resistance zone (where the price currently is).

Stop Loss: Slightly above the resistance (above 85,900).

Take Profit: Near the support zone (~83,300), completing the expected drop.

Summary: It's a high-risk short-term short setup with clear risk management. If BTC breaks above the resistance instead, it would invalidate the pattern and trigger the stop loss.

Want help setting up a trade plan or calculating risk/reward for this?