BEARUSD trade ideas

Why is BTC losing volume?!After establishing a new higher high on the rally, we have run into an old bearish zone from April 2nd and losing gas. This is about the end of this bullish cycle is seems and we are getting hourly chart candle indications of this.

As you see there is a small bit to go before we can establish ourselves back above the bearish fair value gap (balance).

Apparently this bearish FVG was still chock full of pending shorts. We are getting multiple failures to displace above highs I was triggered short.

As we close below the highest bullish candle, we should see a mass closing of longs from its low. First target is the inefficient range below (blue) around 84K

I believe we must go back to around the50% Fib retracement range as always and correct all imbalances and collect all lows within that range. Therefore I am short after the 11p candle pushed up out of the 10p candle but failed to close above.

As always I use failure displacement as a cue to look for a good LTF entry 🫡

4H Review shows massive bearish imbalance:

Bitcoin Getting Ready to DropNow that Bitcoin has entered the top area of the last stage of the 1hr UP move is time to analyze the chart again and the read is as follow. Within the next six 1hr candles price will start to drop to go and test the $83465 area then pause or make a failed little bounce to then continue lower to the 2nd stage which is the $82645 once it gets there we'll take another look .

At present, a selling phenomenon has emergedAt present, a selling phenomenon has emerged😰, and a large number of traders are waiting for the market to open⏰.

When other markets open on Monday, the situation of a large amount of capital flowing out to other trading fields also deserves attention. 😟

Especially the flows to the XAU/USD and USOIL markets, or other foreign exchange markets. 💱 The movement of funds to these areas might be influenced by economic news, geopolitical events, or simply portfolio re - balancing by investors. 📰

💰💰💰 BTCUSD 💰💰💰

💰💰💰 BTCUSD 💰💰💰

🎯 Sell@84000 - 84500

🎯 TP 82500 - 81500

Recently, the market has been extremely volatile 😱, which has led to the clearing of many traders' accounts or significant losses 😫. You can follow my signals and gradually recover your losses and achieve profitability 🌟💪.

Traders, if you're fond of this perspective or have your own insights regarding it, feel free to share in the comments. I'm really looking forward to reading your thoughts! 🤗

BTCUSD: Will Go Up! Long!

My dear friends,

Today we will analyse BTCUSD together☺️

The recent price action suggests a shift in mid-term momentum. A break above the current local range around 83,753.33 will confirm the new direction upwards with the target being the next key level of 85,164.89 and a reconvened placement of a stop-loss beyond the range.

❤️Sending you lots of Love and Hugs❤️

Short - term Upside & Mon. Outflow RiskAnalysis of the Price Trend of Bitcoin 📈: Short - term Upward Expectations 💰 and the Risk of Capital Outflow on Monday 💸

The current price of BTC is at 84,500 points. 📊

Considering various factors comprehensively, there is a possibility that the price will rise to around 86,500 points tomorrow. 🚀 This could be due to factors like positive market sentiment or recent trends in the cryptocurrency space. 💰

However, when other markets open on Monday, the situation of a large amount of capital flowing out to other trading fields also deserves attention. 😟

Especially the flows to the XAU/USD and USOIL markets, or other foreign exchange markets. 💱 The movement of funds to these areas might be influenced by economic news, geopolitical events, or simply portfolio re - balancing by investors. 📰

💰💰💰 BTCUSD 💰💰💰

🎯 Buy@84000 - 84500

🎯 TP 85500 - 86500

Recently, the market has been extremely volatile 😱, which has led to the clearing of many traders' accounts or significant losses 😫. You can follow my signals and gradually recover your losses and achieve profitability 🌟💪.

Traders, if you're fond of this perspective or have your own insights regarding it, feel free to share in the comments. I'm really looking forward to reading your thoughts! 🤗

BTC REBOUND? 〉$140,000 NEXTAs illustrated, I'm visualizing what the next impulsive wave could look like.

Price has broken out of a major daily trend line.

It makes sense for the week to have started trading lower to find it's low and potentially bounce with strength sometime this coming up week and into the next.

The next pivot area is between the $82,000 - $80,000 range based on previous week's lows and daily low levels.

An interesting buy opportunity is forming and the potential entry is illustrated as the "pivot area" marked in yellow.

Then we have a major pivot range near the $100,000 psychological price.

.

This could be a price where some short term traders get out "in case it's just a pull back before a collapse" type of decision.

We can't ignore how much price consolidated between 100,000 and 96,000; and so that is the next stepping stone for BTC before breaking to ATH's of at least $120,000.

My personal target is set at the 161.8% extension level as illustrated.

--

GOOD LUCK!

Persa

Holding here a little longer and there is a potential for an upHolding here a little longer and there is a potential for an uptrend

The market is getting oversold long term, but we still have to watch out because in bearish scenarios the market goes oversold beyond parameters, but if we see some holding of resistance then we can assume that there is no interest to continue to sell and we should be buying for a long, however waiting for a full bounce is the safer route since there is no risk involve.

On the other hand catching an accumulation early could potential increate profit margins.

My plan is to buy the 74-75k line and put a good stop loss, I will fully go in once the price start moving up.

My get off targets are 80-81k and if that holds then it moves up to the 88-90k line once again.

Mastering Volatile Markets: Why Patience is Your Biggest Edge█ Mastering Volatile Markets Part 3: Why Patience is Your Biggest Edge

If you've read Part 1 about position sizing and Part 2 on liquidity , then you already know how to adapt to the mechanics of volatile markets. The next great tool in your arsenal will be patience.

Your biggest opponent in wild markets is your own mind.

In volatile markets, your emotions can easily get the best of you. Fear of missing out (FOMO) is one of the most dangerous emotions that drives poor decisions.

█ FOMO (Fear of Missing Out) Hits Hardest in Volatile Markets

Wild price swings, like 300-500 point moves in the Nasdaq or Bitcoin jumping $1000 in seconds, can make it feel like easy money is everywhere.

You can quickly get the overwhelming temptation to chase moves , especially when it seems like you're missing every opportunity.

This is where most traders lose.

Let me state some harsh truths that I had to learn the hard way through many losses:

Volatility doesn't equal opportunity.

Fast moves don't mean easy trades.

Most wild price moves are designed to trap liquidity and punish impatience.

The true reality is that the market wants you to overreact in these conditions.

It wants you to buy after a big move.

It wants you to short after a flush.

It thrives on you being emotional, chasing, and reacting.

Because reactive traders = liquidity providers for smart money.

Every single trader has made this mistake — not just once, but over and over again. Jumping into the market after a big move, hoping it will continue… but what usually happens? The market snaps back and stops you out.

Can you relate? Share your story or experience with this in the comments below!

█ What Experienced Traders Do Instead

⚪ They Know the First Move is Often the Trap

Breakout? Expect a fakeout.

Breakdown? Expect a snapback.

New high? Watch for stop hunts.

New low? Watch for a flush.

Effectively speaking, pro traders don't chase the market. We wait for stop hunts to complete, liquidity grabs to finish, price to return into their zone, and for confirmations before entering the market.

⚪ They Train Patience Like a Skill

Professional traders aren't more patient because they're "special." We are patient because we’ve learned the hard way that chasing leads to pain.

⚪ They Know When Not to Trade

It is bad to trade when there’s no clear structure, no clean confirmation, if the spread is too wide or when the liquidity is too thin.

Instead, pro traders let the market come to them , not the other way around.

⚪ They Turn FOMO into Confidence

Instead of saying, "I'm missing the move…" , I recommend you think:

"If it ran without me — it wasn't my trade."

"If it comes back into my setup — now it's my trade."

█ So, what have we learned today?

Volatility triggers FOMO. FOMO triggers bad decisions. Bad decisions trigger losses.

To win long-term, you must stay calm, selective and professional. Let other traders be emotional liquidity. That's how you survive volatile markets.

█ What We Covered Already:

Part 1: Reduce Position Size

Part 2: Liquidity Makes or Breaks Your Trades

Part 3: Why Patience is Your Biggest Edge

█ What's Coming Next in the Series:

Part 4: Trend Is Your Best Friend

-----------------

Disclaimer

The content provided in my scripts, indicators, ideas, algorithms, and systems is for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or a solicitation to buy or sell any financial instruments. I will not accept liability for any loss or damage, including without limitation any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, backtest, or individual's trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs.

What to expect from the markets this weekWith markets taking a break from the US and China going off on each other for 5 days straight, investors are bracing for a potentially turbulent week ahead.

Cryptocurrencies seem to have recovered a large chunk of their losses from the first week of April, but how long can we expect this upward reversal to last?

Well, if we're being realistic, not long . If you take a look at the price charts of most cryptocurrencies, you'll notice a common theme: we're in a mid- to long-term downtrend.

If you've been trading cryptocurrencies (or any other type of security) for a while, you're probably familiar with the saying that goes “ The trend is your friend ”. With that in mind, if you're looking to hold any short-term crypto trades, shorts might offer better, less-risky opportunities.

Now's not the time to panic and FOMO into the market. Big players are still looking to shake weak hands out of the market. My advice: Observe market fluctuations through the first days of the week before committing your money to any trade.

69K Or 95kI think this is a crucial time for crypto, both technically and fundamentally, but I’ll be focusing on the technical side. Price needs to break above the upper resistance trend line for btc to break out of a descending channel. If btc fails to break above the channel, then it may head for a double bottom or back down to the support trend line of the descending channel. My thoughts are we will see a break out soon, but that’s only my opinion and not a fact.

B/$This is my expectation for next week

The waves have shifted a bit, but the direction is the same for now

...

I will open positions against the trend in both directions and rely on the reversal to take me to +

It is unlikely that we will see a price above 100k in the next month.

I think the range will continue for a long time.

Time to get Bitcoin Range in perspective again -where are we ?

This chart clearly shows us where BTC PA is in relation to the ATH it created in Early 2025.

PA sits just above centre line of current Lower range box.

There is still a Long way to go, against some strong resistance, to get back into the upper Range box and to that ATH line

We will manage it, I have no doubt about that But we may get to top of current Range box and be rejected before that time comes.

There are a number of different scenarios that exist right now and it is next to impossible to pin point when we may reach higher, to a New ATH.

My Feeling is that we will hit top of this current range box in the near future ( in april )

From that point, we have to weigh up the Macro and Sentiments of Markets and see.

But for now, Bitcoin PA is with Strength and has tha bility to reach higher.

I am still Bullish fora Cycle ATH in Q4

Bitcoin Cyclical Pattern Analysis: 2017 vs 2025-2026The charts provide compelling evidence of fractal patterns between Bitcoin's 2017 bull run and the current 2025 cycle, revealing both striking similarities and meaningful differences in market behavior.

Key Similarities

Both periods display remarkably similar structural patterns with consistent sequence of movements:

Initial pulldowns (~34% in 2017 vs ~33% in 2025)

Series of uptrends followed by corrective pullbacks

Progressive upward momentum with higher highs and higher lows

Similar number of major price waves (four significant uptrends in each case)

Key Differences

Timeframe Extension: The 2025 cycle shows significantly extended durations compared to

2017

Initial pulldown: 3 weeks (2017) vs 21 weeks (2025) – 7x longer

First major uptrend: 12 weeks (2017) vs 11 weeks (2025) – similar duration

Second uptrend: 12 weeks (2017) vs 14 weeks (2025) – slightly longer

Overall cycle progression is approximately 2-3x longer

Magnitude Reduction: The 2025 cycle shows diminished percentage movements:

First major uptrend: 230% (2017) vs 120% (2025) – roughly half

Second uptrend: 172% (2017) vs 85% (2025) – roughly half

Final uptrend: 253% (2017) vs 125% (2025) – roughly half

Technical Analysis Support

This pattern correlation would likely be supported by other technical indicators:

Bollinger Bands would show:

Similar pattern of band expansion during strong directional moves

Band contraction during consolidation periods before breakouts

2025 likely exhibiting less volatility (narrower bands) but with similar repeating patterns of price touching upper bands during uptrends and lower bands during corrections

Ichimoku Cloud would demonstrate:

Similar cloud breakout patterns preceding major uptrends

Price respecting key Ichimoku components (Tenkan-sen, Kijun-sen) as support/resistance

2025 showing extended time within the cloud during longer consolidation periods

Similar bullish/bearish crossovers of the conversion and base lines, but occurring over longer timeframes

Predictive Value

This comparative lens offers valuable predictive power for several reasons:

Market Psychology Consistency: Despite Bitcoin's maturation, market psychology (fear, greed cycles) remains remarkably consistent, expressed through similar percentage retracements and fractal patterns.

Macro Context Integration: The longer durations and reduced volatility in 2025 reflect Bitcoin's increased market capitalization and institutional adoption, creating a logical evolution of the same underlying patterns.

Specific Forecasting Application: If the pattern correlation holds, we might anticipate:

The current cycle extending into mid-2026

One more major uptrend followed by a 30-40% correction

A final explosive move of approximately 125-150%

Total cycle appreciation significantly less than 2017 but still substantial

Risk Management Framework: These patterns provide clear pivot points for position sizing and risk management, with defined percentage targets and timeframes.

This analysis suggests we're witnessing an evolved expression of the same market dynamics that drove the 2017 cycle, with the extended timeframes and reduced percentage movements reflecting Bitcoin's maturation as an asset class while maintaining its fundamental cyclical character.RetryClaude can make mistakes. Please double-check responses.

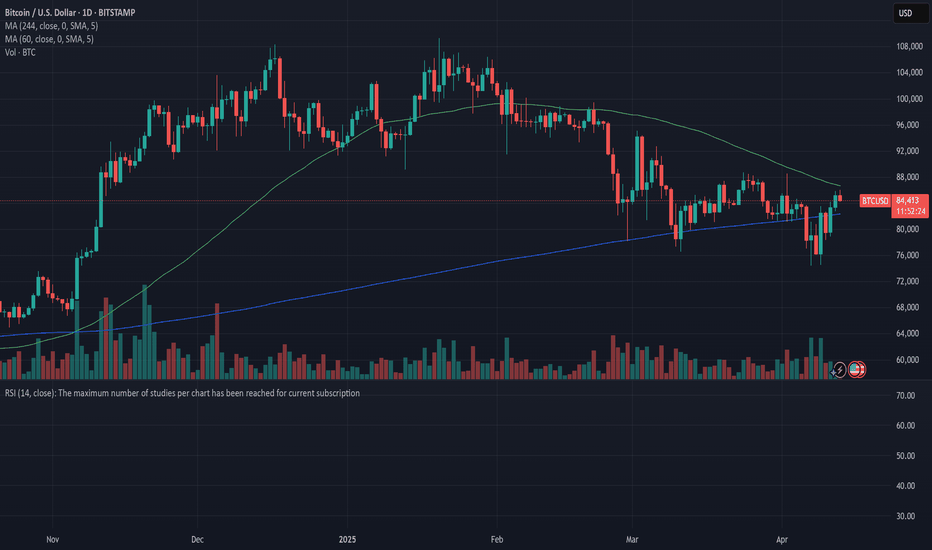

Bitcoin: it’s a crossDuring the first week of the general market sell-off, two weeks ago, the crypto market was sort of left behind investors' attention. However, the previous week brought some negative movements at the beginning of the week, which were diminished as of the weekend. The problem of margin calls from other traditional markets affected the crypto market at the start of the week. BTC reached its lowest weekly level at $74.860. The second half of the week was supported by news of tariffs delay for 90 days, in which sense, the market optimism was back, as well as the price of BTC. At the Saturday trading session, BTC tested the resistance line at $85K.

The RSI is still struggling to pass the 50 level. During Saturday, RSI reached the 52 level, but it still does not provide a clear signal that the market is heading toward the overbought market side. The most important weekly development was with MA 50 and MA 200 lines. These two MAs created a cross, where MA 50 crossed the MA 200 from the upper side and is currently moving below the MA200 level. In a technical analysis this is called the “dead cross” indicating probability that the uptrend is exhausted.

The current general volatility in markets might still not be over, simply because it is driven by Government narrative related to tariffs, which is quite changeable on a daily basis. Markets have never been happy with uncertainty. To which extent this uncertainty will be transferred to the crypto market is hard to predict at this moment. Some indications of the recovery are modestly seen on charts. However, the question at this moment is whether this is a sustainable recovery? It is positive that BTC headed to test the $85K resistance level. In case that it is broken to the upside, the BTC will seek higher grounds, around the $ 87K and $90K resistance. However, the move toward the opposite side might bring BTC back toward the $ 83K or $80K support levels. Both options are currently open, because the market is not driven by actual sentiment, but the fear of potential consequences from tariff wars.

Bitcoin's Bounce, Your Weekly Scoop on the Bullish Surge !The market has unfolded as anticipated, aligning with our projections.

Short-Term Outlook: Expect a relatively narrow trading range this week due to the absence of major news catalysts.

Bullish Perspective: We maintain a bullish stance, targeting a price range of $88,000–$92,000.

Local Bottom Confirmation: Bitcoin appears to have established a local bottom. Notably, it diverged from Ethereum, which recorded lower lows, while Bitcoin resisted forming a new low.

Technical Analysis: Last week, Bitcoin respected a daily bullish order block, resulting in a strong upward move.

Key Support Level: This week, an inverse fair value gap (FVG) on the daily chart around $82,400 is expected to act as a liquidity zone and support, with price likely to tap this level and rebound higher.

Thank you for your support! Stay tuned for more insights and drop a Like if you loved it 🚀

What now BTC?This fibonacchi spiral i drew on #bitcoin chart based on nikkei crash, says many things. Look, how this fib. spiral played out perfectly on #btcusd .Spiral revels the confirmation of grand correction of summer 2024, the top of the elections rally in Jan 2025 and price declinations to present. Now, #btc price is about to decide the the path. An incoming trend reversal or correction continuation to 66K?

Well.. There are some positive and negative facts on market. To think positive, 74K may be the tariff capitulation played in, markets eager to normalize, gold top may be in etc. A bullish divergence has formed in lower time frame CRYPTOCAP:BTC chart.

So, BTC must crush 91K with permanent daily and weekly closes. Losing 73K will deepen the correction.

Not financial advice.

Bitcoin following 2013-2017 Fractal UPDATE - have we left it ?This chart remains unchanged from the last time I posted it except for the addition of that yellow Dashed Arrow

As we can see, PA fell below the Fractal in Late February and ever since, we have ranged further away from it.

Does this mean we have left the fractal we have been on since November 2021 ?

Not really.

PA fell below it in 2022 due to pressures from Interest rates making companies collapse and sentiment being negative.

We have fallen below it this time purely because PA was so overbought, it needed to recover.

This can be very clearly seen on the Weekly MACD, where in 2024, we ranged for months because of the same reason.

See how on the weekly MACD, how once we reached near Neutral, we bounced back up to a New ATH and, ever since, BTC PA has ranged while waiting for the MACD to cool off..

And now we are there. MACD is in the bounce zone and has shown some strength in the last few days.

So, The Fractal

For PA to get back above that Fractal, we need PA to make a very strong push higher. and as you can see from the Bold Arrow, this is achievable by end of May if PA rises Strong and continually

form here.

I am not to sure this will happen.

We have so many Macro events destabilising the markets...

I am more inclined to think PA will hit that circle , and we will likely follow the Dashed Arrow to a cycle ATH of near 300K, by the end of the year at the latest.

This is the Path of safety.

Things can always change for the better or for the worse and so we have to be ready for all occasions.

But BULLISH is the word - BUT BITCOIN ON SPOT, HOLD IT AND RELAX