BEARUSD trade ideas

BTCUSD: Wait for a pullback and then be bullishBitcoin's price continued its upward trend today with a relatively significant increase, and the trading volume also remained at a high level, indicating a high level of attention and participation in Bitcoin in the market, and investors are relatively optimistic about its future trend.

BTCUSD Trading Strategy

buy @ 92000-92200

sl 91300

tp 93500-93800

Waiting patiently to go long on pullbacks or short at high levels can be profitable.

If you want to learn more trading insights, you can check my profile to find the content you're interested in.👉👉👉

BTC NEXT MOVE?🚀 Bitcoin (BTC) Market Update

We are expecting a small dip in Bitcoin's price, potentially down to the 89,000–90,000 USD zone. From that level, we anticipate a strong rally toward 101,000 USD, as highlighted in the chart.

📈 This move could also lead Bitcoin toward making a new all-time high!

Stay patient and follow the setup carefully.

Bitcoin Analysis Anticipated Bullish Rebound Toward $95,000! This 15-minute Bitcoin (BTC/USD) recent price action around key support and resistance zones. After a sharp dip to the lower green support area (~$92,500), the price is showing signs of a bullish reversal. The forecasted trajectory (highlighted in yellow) anticipates a corrective move before resuming an upward climb toward the $95,000 resistance target. Previous consolidation phases and a breakdown from a rising wedge pattern are also noted, suggesting a technical recovery is underway. Traders are watching for confirmation of this bullish setup.

BTC/USD Price Action Update – April 22, 2025📊BTC/USD Price Action Update – April 22, 2025

🔹Current Price: 88,162.24

🔹Timeframe: 15M

📌Key Demand Zone (Support):

🟢88,157–88,460 – Clean Breaker Block (ideal for bullish re-entry on retest)

🟢85,500–86,500 – Higher Timeframe Demand Zone (strong base for major bullish leg)

📌Key Resistance Level:

🔴88,778 – Short-Term Structural High (key breakout point)

📈Bullish Outlook:

Price is consolidating below the 88,778 resistance. A clean candle break and close above this level can open the door to a bullish continuation, targeting the 89,500–90,000 range. Ideal entry on a pullback to 88,157–88,460 if demand holds.

📉Bearish Outlook:

If price fails to break and hold above 88,778, watch for signs of rejection. A bearish break below 88,157 could lead to a deeper retracement into the 85,500–86,500 zone.

⚡Trade Setup Tip:

✅Wait for a confirmed break and retest of 88,778

✅Watch price action at 88,157 for continuation or rejection

✅Use a tight SL and manage risk around news volatility

#BTCUSD #BitcoinTrading #CryptoPriceAction #SmartMoneyConcepts #BreakOfStructure #ForexAndCrypto #IntradayTrading #FXFOREVER #MarketUpdate #SupplyAndDemand #BitcoinUpdate

Bitcoin reaches $110,000 to $113,000 then crashes 2025 (soon)A bearish divergence has appeared on Bitcoin’s weekly chart, closely resembling the setup before the 2021 crash. Based on this, along with a peak-to-peak trendline, I believe Bitcoin could climb to $110,000–$113,000 before a major correction — potentially dropping to $60,000 or, in a worst-case scenario, as low as $30,000 — before beginning its next upward surge.

BTC KNOCKING ON HEAVEN'S DOORBitcoin is really knocking on the door of major resistance here, testing the key level at $88,804 for the second day in a row. What makes this even more notable is the backdrop – equities have been under pressure, yet Bitcoin is showing strong divergence and relative strength.

We saw a breakout through descending resistance yesterday, backed by a meaningful increase in volume – a solid signal that buyers are stepping up. Price is comfortably holding above the 50-day moving average, and the 200-day MA is now flattening out just below resistance, giving bulls a potential momentum shift.

A daily close above $88,804 would break the bearish market structure with a higher high and open the door to a more extended move. For now, this is an encouraging chart.

Bitcoin Elliott Wave Macro Update – Wave (5) 🟢 Macro Structure Since November 2022

Since the bottom in November 2022 (~15.5K), Bitcoin has been unfolding a clean impulsive structure, counted as:

(1) – strong breakout from the bear market lows

(2) – corrective pullback as a base

(3) – major impulsive rally with clear volume expansion

(4) – textbook correction right into the white Fibonacci zone, perfectly respected

Now, we are in Wave (5) – the final leg of this larger impulse!

🔄 Internal Structure of (4) → (5)

From the low of wave (4), the price action is developing in a classic 1-2-3-4-5 formation, where:

Wave 1 initiated the breakout

Wave 2 formed a shallow pullback

Wave 3 surged with momentum and volume

Wave 4 seems to have completed (or is finalizing now)

COINBASE:BTCUSD

Wave 5 is upcoming, potentially unfolding as an ABC structure (rather than a straight-line spike), showing a more measured grind toward the top

🔁 Cycle-Level Perspective

This entire impulse from (1) to (5) forms a macro Wave ③ in the larger Elliott Wave cycle.

Given the structure of Wave (5) so far, we may not see a vertical blow-off top but rather a controlled ABC move into the top zone.

🎯 Target Zone for Wave ③

$127,000 – $136,000

Based on Fibonacci projections of waves (1)–(3)

Strong psychological levels

Likely confluence with macro channel resistance and long-term projections

✅ Conclusion

Bitcoin is currently progressing through Wave (5) of the macro impulse that started in late 2022. The structure from Wave (4) suggests a well-organized path forward – possibly forming an ABC structure into the final high of macro Wave ③, with targets in the $127K–$136K zone. This level could mark a major turning point before a deeper corrective phase begins.

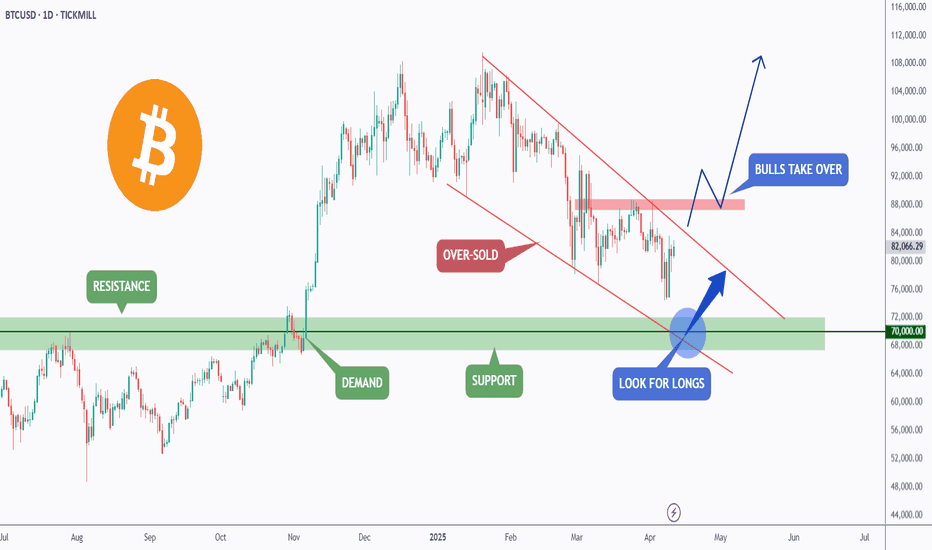

BTC - Two Bullish Scenarios...Hello TradingView Family / Fellow Traders! This is Richard, also known as theSignalyst.

📉 BTC has been overall bearish, trading within the falling channel marked in red.

The $70,000 area is a key confluence zone — it aligns with the lower red trendline, horizontal support, a psychological round number, and a potential demand zone.

📚 According to my trading style:

As #BTC approaches the blue circle zone, I’ll be looking for bullish reversal setups — such as a double bottom pattern, trendline break, and more.

🏹In parallel, for the bulls to take over long-term, and shift the entire trend in their favor, a break above the last major high marked in red at $88,888 is needed!

📚 Reminder:

Always stick to your trading plan — entry, risk management, and trade management are key.

Good luck, and happy trading!

All Strategies Are Good, If Managed Properly!

~Rich

GOLD VS BTC, who will outperform in the coming weeks?The price of gold has risen by over 20% since the beginning of the year on the commodities market, and the price of bitcoin has returned to equilibrium following a strong rebound in its price since the beginning of April. These two markets follow certain identical correlations, in particular an inverse correlation with the underlying trend of the US dollar on the foreign exchange market. For some, bitcoin has become digital gold since the development of BTC spot ETFs in the USA.

With gold's upward trend seemingly running out of steam in the short term, how can we determine which of the two assets will outperform the other over the coming weeks?

1) The BTC/GOLD ratio as a decisive barometer

Technical analysis of financial markets brings together a number of tools to study the trend and momentum of a financial asset. It also enables comparisons to be made between financial assets, and in particular between two markets.

The ratio tool is used to determine whether one asset outperforms or underperforms another. The ratio consists in creating the curve of a mathematical fraction between a numerator and a denominator, like the BTC/GOLD ratio.

If the trend of this ratio is upwards, then it is the numerator (in this example, BTC is the numerator) that is in an outperformance phase, and the denominator (GOLD in this example) that is in an underperformance phase. The reasoning is reversed if the ratio trend is bearish.

The message of technical analysis currently applied to the BTC/GOLD ratio is unambiguous, with the underlying trend of the BTC/GOLD ratio being bullish. The chart presented here shows the Japanese candlesticks in weekly data, and a double technical support has just kick-started the rise in this ratio: a bullish chartist channel and the ichimoku system cloud.

2) Bitcoin's bullish cycle linked to the halving of spring 2024 ends at the end of 2025

According to the BTC/GOLD ratio, we can therefore consider a sequence of outperformance by the bitcoin price against the gold price over the coming weeks. This anticipation seems credible, given that BTC's bullish cycle linked to the halving of the year 2024 is still far from over. In fact, bitcoin's 4-year cycle always ends at the end of the year following the halving year, i.e. at the end of 2025 for our current cycle.

3) Gold is in extreme technical overbought territory on long-term charts

Technically speaking, monthly momentum indicators are showing extreme overbought territory, which may seem excessive, but no bearish divergence has yet appeared.

We must therefore remain attentive, but not yet jump to conclusions about the end of the bullish cycle. At the current price, GOLD is clearly in a phase of high bullish maturity, and closer to the end of the bull cycle than the beginning.

DISCLAIMER:

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only. The presented idea (including market commentary, market data and observations) is not a work product of any research department of Swissquote or its affiliates. This material is intended to highlight market action and does not constitute investment, legal or tax advice. If you are a retail investor or lack experience in trading complex financial products, it is advisable to seek professional advice from licensed advisor before making any financial decisions.

This content is not intended to manipulate the market or encourage any specific financial behavior.

Swissquote makes no representation or warranty as to the quality, completeness, accuracy, comprehensiveness or non-infringement of such content. The views expressed are those of the consultant and are provided for educational purposes only. Any information provided relating to a product or market should not be construed as recommending an investment strategy or transaction. Past performance is not a guarantee of future results.

Swissquote and its employees and representatives shall in no event be held liable for any damages or losses arising directly or indirectly from decisions made on the basis of this content.

The use of any third-party brands or trademarks is for information only and does not imply endorsement by Swissquote, or that the trademark owner has authorised Swissquote to promote its products or services.

Swissquote is the marketing brand for the activities of Swissquote Bank Ltd (Switzerland) regulated by FINMA, Swissquote Capital Markets Limited regulated by CySEC (Cyprus), Swissquote Bank Europe SA (Luxembourg) regulated by the CSSF, Swissquote Ltd (UK) regulated by the FCA, Swissquote Financial Services (Malta) Ltd regulated by the Malta Financial Services Authority, Swissquote MEA Ltd. (UAE) regulated by the Dubai Financial Services Authority, Swissquote Pte Ltd (Singapore) regulated by the Monetary Authority of Singapore, Swissquote Asia Limited (Hong Kong) licensed by the Hong Kong Securities and Futures Commission (SFC) and Swissquote South Africa (Pty) Ltd supervised by the FSCA.

Products and services of Swissquote are only intended for those permitted to receive them under local law.

All investments carry a degree of risk. The risk of loss in trading or holding financial instruments can be substantial. The value of financial instruments, including but not limited to stocks, bonds, cryptocurrencies, and other assets, can fluctuate both upwards and downwards. There is a significant risk of financial loss when buying, selling, holding, staking, or investing in these instruments. SQBE makes no recommendations regarding any specific investment, transaction, or the use of any particular investment strategy.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts suffer capital losses when trading in CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Digital Assets are unregulated in most countries and consumer protection rules may not apply. As highly volatile speculative investments, Digital Assets are not suitable for investors without a high-risk tolerance. Make sure you understand each Digital Asset before you trade.

Cryptocurrencies are not considered legal tender in some jurisdictions and are subject to regulatory uncertainties.

The use of Internet-based systems can involve high risks, including, but not limited to, fraud, cyber-attacks, network and communication failures, as well as identity theft and phishing attacks related to crypto-assets.

Bitcoin will return to the moon!!BTC/USD 1D - Well as you can see price has played out exactly as we predicted yesterday providing us with an amazing push to the upside. I do however want to see price correct itself before the next push up.

I have gone ahead and marked out the order block I have in mind that I would like to see price come and clear before it continues in this hawkish way. I feel this could be a great area to get involved in those longs from.

As we know there are some great prospects for BTC so its important that we are always looking for key areas of interest for us to buy in from with this market being a bullish one.

April 22 Bitcoin Bybit chart analysisHello

It's a Bitcoinguide.

If you have a "follower"

You can receive comment notifications on real-time travel routes and major sections.

If my analysis is helpful,

Please would like one booster button at the bottom.

This is the Bitcoin 30-minute chart.

There is no Nasdaq indicator announcement.

Tether dominance is in a vertical decline.

First, I ignored Nasdaq and focused on Bitcoin based on my perspective on recent movements.

In the case of Bitcoin, I proceeded with a conservative strategy when the short-term pattern was broken.

*One-way long position strategy when the red finger moves

1. 88,211.9 dollars long position entry section / cut-off price when the green support line is broken

2. 90,418 dollars long position 1st target -> Top 2nd target

If the strategy is successful, the 1st section at the top

can be used as a long position re-entry section,

but from the Top section -> Good section, it is the center line of the weekly Bollinger Band chart,

so there is a possibility of a strong adjustment this week.

Section 1 at the top and section 2 at the bottom are extreme horizontal support sections.

If section 2 is broken, it is a section where the short-term pattern is broken,

and since the bottom touch at the bottom is the lowest point of the daily chart,

it is not good,

and since the support line is open, it can be directly connected to section 3.

Up to this point, I ask that you simply refer to and use my analysis,

and I hope that you operate safely with principle trading and loss cut prices.

Thank you.

Bitcoin bulls are on the offensive; is a correction ahead?Monthly bullish outside candle

Versus the US dollar (USD), Bitcoin (BTC) is poised to snap a two-month decline and pencil in a bullish outside candle on the monthly chart (textbook engulfing candles focus on the candle’s real bodies rather than upper/lower wicks). Additionally, it is important to observe that the Relative Strength Index (RSI) failed to break the neckline of a double-top pattern, circling above the 50.00 level and indicating bullish interest.

Daily support calls for attention

Across the page on the daily timeframe, since coming within a stone’s throw of testing support at US$73,575, BTC/USD bulls have been on the offensive. Running above the 200- and 50-day simple moving averages at US$81,139 and US$86,425, respectively, as well as trendline resistance (taken from the all-time high of US$109,580) and resistance from US$88,622 (now possible support), this has unearthed the widely watched US$100,000 barrier as a possible upside target.

With monthly flow on the verge of establishing a bullish outside candle, and scope for additional outperformance evident on the daily chart to at least US$100,000, a retest of US$88,622 as support could prompt a bullish scenario. Consequently, a possible downside move in the short term might be on the table before targeting US$100,000 as per the red arrows.

H1 ascending channel in view

On the H1 chart, price action has been carving out an ascending channel since last week, taken from US$91,713 and US$94,676. This has helped identify slowing momentum, visible through price action, which was unable to reach the upper channel on two occasions (red circles). Decreased appetite for higher levels can also be observed through the RSI trending lower since hitting highs of 82.00.

Given the above chart studies, I feel a breakout beneath the current H1 channel would help reinforce the possibility of downside towards at least H1 support at US$89,677, conveniently sited nearby daily support mentioned above at US$88,622. And, assuming a move lower to the said support area, I would then expect bulls to attempt to make a stand and aim at higher levels: at least US$100,000.

Written by FP Markets Chief Market Analyst Aaron Hill

btcusd 50% down to 50000 till end of year like 2021-2022 Bitcoin could drop -50% like in 2021-2022 Bear Market close to 40-50 000 $

One year long Bear market is possible due to economic and geopolitical turmoil by further idiotic decisions of trump administration that will surly happen many times this year

Bitcoin Waiting for Pullback into 90–92 K Entry ZoneBitcoin has just broken above its long-term downtrend and the Ichimoku cloud on the daily chart, signaling a fresh bullish regime. Here’s my game plan:

Trend & Cloud Breakout

Price closed above the red Kumo (~84.5–86.6 K) and pierced the yellow downtrend line.

Tenkan-sen (88.8 K) has crossed above Kijun-sen (84.5 K), while the Chikou Span confirmed this bullish shift.

Overbought Caution

Daily RSI14 sits at ~68 and 1-hour RSI14 is ~72, so a 1–3 day consolidation or shallow 2–3% pullback is likely.

High-Probability Entry

Entry Zone: $90 000–$92 000 (daily Tenkan/Kijun area)

Trigger: Close back above Tenkan/Kijun on your chosen timeframe (5-min for aggressive entries, 1-hr for conservative)

Stops: Just below Tenkan (5-min ≈ 90.8 K / 1-hr ≈ 90.2 K)

Targets & Management

First Target: Today’s high (~94.5 K)

Secondary Target: Psychological $100 000 once 95 K is convincingly cleared

Trail: Use your 1-hr Kijun or daily Tenkan as your stop-trailing levels

Bottom Line:

Bitcoin’s daily Ichimoku setup has flipped bullish, but RSI is overbought. I’m waiting for the textbook “breakout retest” into 90–92 K before adding new longs. A clean close above Tenkan/Kijun in that zone gives me sub-2% risk and a clear reward path toward 95–100 K. Good luck, and trade safe!