GBPUSD1! trade ideas

GBP should eventually see atleast 1.37 I think we grind in this region for a while more, and then finally rocket to atleast 1.37, potentially as far as 1.42. For now, I don't see a visit of the 1.5s on the cards. But time will tell if this evolves more bullishly than I expect

British pound analysis Good evening guys,

Ive just released 2 ideas POUND-related and now i'll explain why im bearish on gbp so far, this is a GBP FUTURE chart for the current month.

First of all, on the left chart im not using traditional candlestincks, im using the Point N' Figure chart, its a great chart for those who wanna avoid the "noise" of the market, very good on stocks as well.

We can see on these chart gbp is breaking a structure support so far and the upwave volumes are too low showing there is not too much demand for gbp.

On the middle dailychart we can see the ascending trendline and gbp is just testing it now, a breakdown will confirm bearish behaviour for gbp.

On the left chart we can see that gbp is lacking demand so far with low volume up-candles.

This is just a reflection on what we can see on the other trading ideas, gbp is bearish now.

Now the most important thing is, gbp is BEARISH NOW, what about tomorrow? tomorrow we can have some news about brexit or anything else on eurozone that can shake the market, cant we? =)

Thats why stop losses and proper money management on trades are a MUST.

When and if i have some good audience i'll create some educational posts explaining about my trading style and philosophy.

Enjoy? leave a like =]

This is just an educational post and not a trading signal.

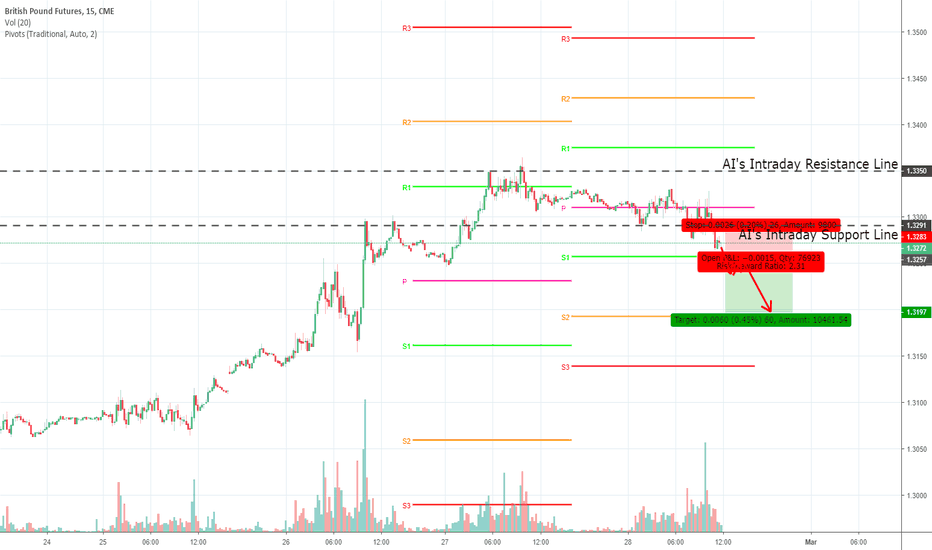

High Probability Intraday Trade Setup for British Pound FuturesThe following are trades setup ideas in 15 mins chart for Gold Oil Futures .

There are 2 distinctive dotted lines labeled as

1. AI's Intraday Resistance

2. AI's Intraday Support

These 2 Support and Resistance signal lines are generated by machine learning AI robots as a high probability trade setup for long or short.

Long Setup

If price action closed above the AI Daily support line AND above Pivot Point S1 line, the idea is to long and take profit at the AI's Intraday Resistance line .

Instead of relying on 100% discretionary (human) trading, the robots will provide trade execution plan and it is entirely up to the human trader's decision to follow.

This is highly recommended to trade during Europe and US market hours for liquidity and volume for this product.

Week Plan - At POC Chop ZoneStuck at large point of control. Fade ranges, use small stops and don't trade for large moves.

High Probability Intraday Trade Setup for British Pound FuturesThe following are trades setup ideas in 15 mins chart for British Pound Futures .

There are 2 distinctive dotted lines labeled as

1. AI's Intraday Resistance

2. AI's Intraday Support

These 2 Support and Resistance signal lines are generated by machine learning AI robots as a high probability trade setup for long or short.

If price action was below the AI Daily support line AND price closed below Pivot Point S1 line, the idea is to short and take profit at Pivot S2 and/or S3 price region.

Instead of relying on 100% discretionary (human) trading, the robots will provide trade execution plan and it is entirely up to the human trader's decision to follow.

This is highly recommended to trade during Europe and US market hours for liquidity and volume for this product.

High Probability Intraday Trade Setup for British Pound FuturesThe following are trades setup ideas in 15 mins chart for British Pound Futures.

There are 2 distinctive dotted lines labeled as

1. AI's Intraday Resistance

2. AI's Intraday Support

These 2 Support and Resistance signal lines are generated by machine learning AI robots as a high probability trade setup for long or short.

If price action was below the AI Daily support line AND price closed below Pivot Point S1 line, the idea is to short and take profit at Pivot S2 price region.

Instead of relying on 100% discretionary (human) trading, the robots will provide trade execution plan and it is entirely up to the human trader's decision to follow.

This is highly recommended to trade during Europe and US market hours for liquidity and volume for this product.

GBP SHORT to 1.2484 | BREXIT Uncertainty GBP SHORT

- Weak pound due to BREXIT

- More upcoming uncertainty with the brexit date on the 29th

- Trade war in the US creating uncertainty on global demand

hurting UK exports (excluding financial sector)

- Trade surplus likely to increase during the fall in demand

- Possible upcoming Austerity in the UK

This is my view of the GBP in the current market state, what do you think?

If you get a chance to short the GBP against safer or even major currencies then this may be the time before brexit.

Weak GBP keeps droping.looking at the GBP futures market, we have broken lower. i will scan the other GBP pairs and see if i can find a good a good opposing setup with the weak GBP. this analysis is going based on supply and demand.

PoundLooking for a rally from this spring area after showing sign of strength (SOS) in volume (marked)

British pound bear Gann fanThe bear trend started in Sept 2018 should continue after the recent swing high. Probability H. Target at the 1/2 Gann line

Week Plan - Still Waiting For Double TopImpulse still going strong - been watching for a place to fade and go short but nothing even remotely like a double top as formed.

Doing nothing until there's a big wick point north and a retest of the wick signalling a double top being made.

BRITISH POUND FUTURES (MAR 2019), 1D, CMETrading Signal

Short Position (EP) : 1.3039

Stop Loss (SL) : 1.3117

Take Profit (TP) : 1.2883

Description

B6H2019 formed Turtle Soup Sell at 1d time frame. Trade setup with Sell Stop at 0.382 Level (1.3039) and place stop after 0.618 level (1.3117). Once the position was hit, place take profit before an agreement (1.2883)

Money Management

Money in portfolio : $280,000

Risk Management (1%) : $2,800

Position Sizing

$ 0.0001 = +-$ 6.25

Commission fee = -$2.47/contract

EP to SL = $0.0078 = -$487.5/STD-contract

Contract size to open = 6 standard contracts

EP to TP = $0.0156 = +$975

Expected Result

Commission Fee = -$29.64

Loss = -$2,925

Gain = +$5,850

Risk/Reward Ratio = 1.97

Highly bearishI might stay up tonight to watch for a short on this.

I had a script fire off a bearish momentum signal and it's coming into a bounce point at the POC while also at a fib region to complete a 5 wave impulse.

Will be watching for double top type price action to get short on this with a long term target around 1.28

B61! British Pound Futures. Parabolic Short TermLooking for an end to the parabola with either a break or extension to 133 area. A break would give a good short signal to downside with 250 pips downside.

BRITISH POUND FUTURES (MAR 2019), 1D, CMETrading Signal

Short Position (EP) : 1.2971

Stop Loss (SL) : 1.3039

Take Profit (TP) : 1.2835

Description

B6H2019 formed Turtle Soup Sell at 1d time frame. Trade setup with Sell Stop at 0.382 Level (1.2971) and place stop after 0.618 level (1.3039). Once the position was hit, place take profit before an agreement (1.2835)

Money Management

Money in portfolio : $280,000

Risk Management (1%) : $2,800

Position Sizing

$ 0.0001 = +-$ 6.25

Commission fee = -$2.47/contract

EP to SL = $0.0068 = -$425/STD-contract

Contract size to open = 7 standard contracts

EP to TP = $0.0136 = +$850

Expected Result

Commission Fee = -$34.58

Loss = -$2,975

Gain = +$5,950

Risk/Reward Ratio = 1.97

BRITISH POUND FUTURES (MAR 2019), 1D, CMETrading Signal

Short Position (EP) : 1.2862

Stop Loss (SL) : 1.2907

Take Profit (TP) : 1.2772

Description

B6H2019 formed Turtle Soup Sell at 1d time frame. Trade setup with Sell Stop at 0.382 Level (1.2862) and place stop after 0.618 level (1.2907). Once the position was hit, place take profit before an agreement (1.2772)

Money Management

Money in portfolio : $280,000

Risk Management (1%) : $2,800

Position Sizing

$ 0.0001 = +-$ 6.25

Commission fee = -$2.47/contract

EP to SL = $0.0045 = -$281.25/STD-contract

Contract size to open = 10 standard contracts

EP to TP = $0.009 = +$562.5

Expected Result

Commission Fee = -$49.4

Loss = -$2,812.5

Gain = +$5,625

Risk/Reward Ratio = 1.95

#FXinsights #TradingViewTOOLKIT 4 "Diamond" Hedge Strategy B61!four "diamond" patterns developing on the weekly charts

4 "DIAMOND" HEDGE STRATEGY and short B61!

EURGBP short

GBPCAD short

GBPCHF long

GBPUSD long

GBP futures ready for correctioncorrection will be three waves ABC might retrace 50% or more of the previous wave