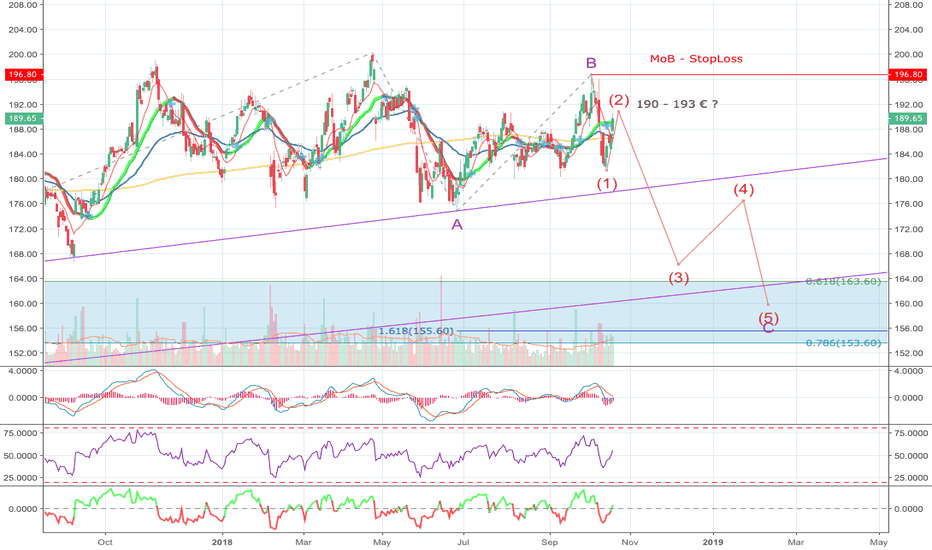

Bottom of the RangeMunich Rueck held stable this year. Now we've seen the retracement of the rise since March by almost 38 %. However a further retracement is possible I consider the chance of a recovery from here. We have reached the bottom of the trading range which we are in since April and the current level of ou

17,720 HUF

2.36 T HUF

28.73 T HUF

127.40 M

About MUENCH.RUECKVERS.VNA O.N.

Sector

Industry

CEO

Joachim Wenning

Website

Headquarters

Munich

Founded

1963

ISIN

DE0008430026

FIGI

BBG00M4DL987

Münchener Rückversicherungs-Gesellschaft AG engages in the provision of insurance and reinsurance services. It operates through the following segments: Life and Health Reinsurance; Property-Casualty Reinsurance; ERGO Life and Health Germany; EGRO Property-Casualty Germany; and ERGO International. The Life and Health Reinsurance segment includes global life and health reinsurance business. The Property-Casualty Reinsurance segment covers global property-casualty reinsurance business. The ERGO Life and Health Germany segment includes German life and health primary insurance business, global travel insurance business, and digital ventures business. The EGRO Property-Casualty Germany segment covers German property-casualty insurance business, excluding digital ventures business. The ERGO International segment focuses on primary insurance business outside Germany. The company was founded by Carl von Thieme on April 3, 1880 and is headquartered in Munich, Germany.

Related stocks

A safe gain in a few weeksI think the stock will reach its pre covid level verry soon.

I drew the bouncy ball scan on the chart. We have three lower lows, a strong support line and a strong uptrend. Additionally we have a cup with a handle. The handle is unfortunatelly not giving as much pullback as it would in a textbook e

Munich Re - Down - ShortTermThe Pacific Ring of Fire is increasing in activity. The volcanic eruptions and earthquakes and their consequences such as tsunamis have increased significantly compared to the previous two years.

At the same time, the sun is in a solar minimum.

Huge sun holes at the North + South Pole and the equato

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

MURG5416446

Munchener Ruckversicherungs-Gesellschaft Aktiengesellschaft 5.875% 23-MAY-2042Yield to maturity

5.61%

Maturity date

May 23, 2042

M

MURG3666349

Munich Re America Corporation 7.45% 15-DEC-2026Yield to maturity

4.09%

Maturity date

Dec 15, 2026

A383PL

MUNICH REINSURANCE COMPANY 2024-26.05.44 FIXED/VARIABLE RATEYield to maturity

3.99%

Maturity date

May 26, 2044

See all MUNICHRE bonds

Curated watchlists where MUNICHRE is featured.

German Stocks: Continental champs

16 No. of Symbols

See all sparks

Frequently Asked Questions

The current price of MUNICHRE is 231,000 HUF — it has increased by 1.97% in the past 24 hours. Watch MÜNCHENER RÜCKVERSICHERUNG AG ORD SHARE stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BET exchange MÜNCHENER RÜCKVERSICHERUNG AG ORD SHARE stocks are traded under the ticker MUNICHRE.

MUNICHRE stock has risen by 1.97% compared to the previous week, the month change is a 4.26% rise, over the last year MÜNCHENER RÜCKVERSICHERUNG AG ORD SHARE has showed a 40.84% increase.

We've gathered analysts' opinions on MÜNCHENER RÜCKVERSICHERUNG AG ORD SHARE future price: according to them, MUNICHRE price has a max estimate of 261,652.50 HUF and a min estimate of 195,233.02 HUF. Watch MUNICHRE chart and read a more detailed MÜNCHENER RÜCKVERSICHERUNG AG ORD SHARE stock forecast: see what analysts think of MÜNCHENER RÜCKVERSICHERUNG AG ORD SHARE and suggest that you do with its stocks.

MUNICHRE reached its all-time high on Mar 24, 2025 with the price of 232,700 HUF, and its all-time low was 60,400 HUF and was reached on Dec 6, 2018. View more price dynamics on MUNICHRE chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

MUNICHRE stock is 1.93% volatile and has beta coefficient of 0.67. Track MÜNCHENER RÜCKVERSICHERUNG AG ORD SHARE stock price on the chart and check out the list of the most volatile stocks — is MÜNCHENER RÜCKVERSICHERUNG AG ORD SHARE there?

Today MÜNCHENER RÜCKVERSICHERUNG AG ORD SHARE has the market capitalization of 28.93 T, it has increased by 0.21% over the last week.

Yes, you can track MÜNCHENER RÜCKVERSICHERUNG AG ORD SHARE financials in yearly and quarterly reports right on TradingView.

MUNICHRE net income for the last half-year is 796.42 B HUF, while the previous report showed 1.50 T HUF of net income which accounts for −46.80% change. Track more MÜNCHENER RÜCKVERSICHERUNG AG ORD SHARE financial stats to get the full picture.

Yes, MUNICHRE dividends are paid annually. The last dividend per share was 8.14 K HUF. As of today, Dividend Yield (TTM)% is 3.55%. Tracking MÜNCHENER RÜCKVERSICHERUNG AG ORD SHARE dividends might help you take more informed decisions.

MÜNCHENER RÜCKVERSICHERUNG AG ORD SHARE dividend yield was 4.11% in 2024, and payout ratio reached 46.75%. The year before the numbers were 4.00% and 44.28% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 3, 2025, the company has 43.58 K employees. See our rating of the largest employees — is MÜNCHENER RÜCKVERSICHERUNG AG ORD SHARE on this list?

Like other stocks, MUNICHRE shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade MÜNCHENER RÜCKVERSICHERUNG AG ORD SHARE stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So MÜNCHENER RÜCKVERSICHERUNG AG ORD SHARE technincal analysis shows the strong buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating MÜNCHENER RÜCKVERSICHERUNG AG ORD SHARE stock shows the strong buy signal. See more of MÜNCHENER RÜCKVERSICHERUNG AG ORD SHARE technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.