End-of-Session Market ReviewToday was a solid trading day with some interesting moves across the markets:

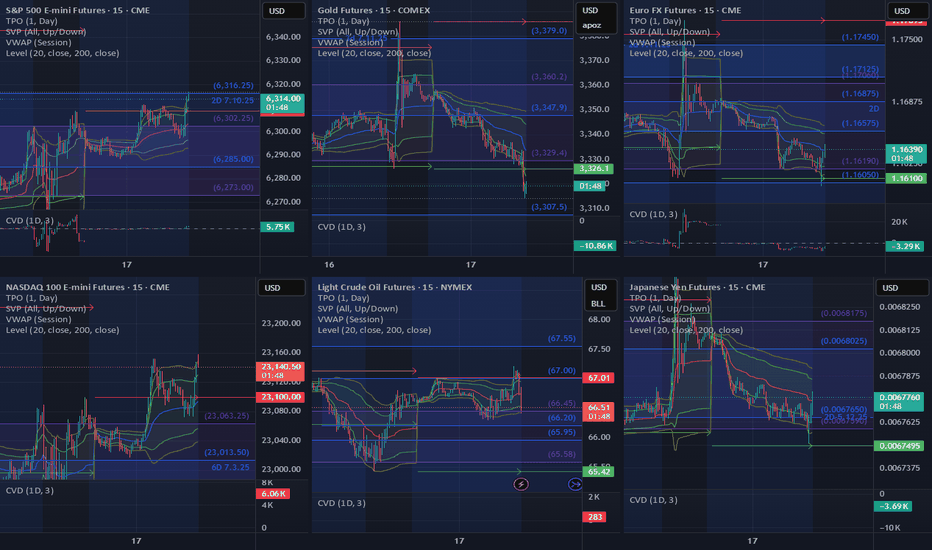

S&P 500: The market trended upwards from the open, gradually moving into and above the prior day’s value area, closing near the high of that range.

NASDAQ 100: After some initial back-and-forth, it climbed above the prio

Related futures

Opportunities Arise from Dollar WeaknessSince the dollar peaked in 2022, it has declined by 24%.

Such a decline may not seem significant for a stock, it’s a different story when it comes to currencies, especially a reserve currency for USD. US purchasing power has dropped by a quarter, meaning they will now have to pay 24% more for impor

Trading Day SummaryTrading Day Summary

Today wasn’t a winning day on the books, but it was a major win in discipline.

I hit my daily loss limit before 10 AM, stopped live trading, and switched over to paper trades to protect my capital.

The setups I took—especially in Gold and Euro—lacked full confirmation, and one

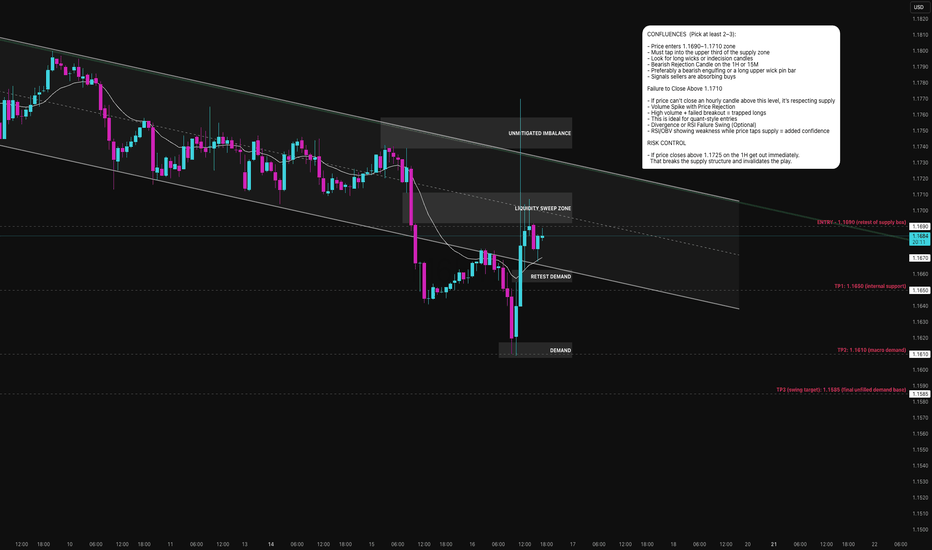

That Wasn’t a Breakout, That Was a Mugging!The Euro thought it could sneak one past the quant crowd. It creeped up into 1.1690–1.1710, broke some weak highs, and even teased a breakout. Then boom! rejected harder than a dodgy NFT pitch in 2024.

We're inside a bearish channel, mid-supply zone, and price just faked out everyone chasing the

Sell the EURO vs USD?Welcome back to the Mid-Week Analysis for Wed, July 8th.

In this video, we will analyze the following FX markets:

EURO and USD Index.

The USD is seeing some strength off the tariffs Trump is declaring... and extending the grace period again on. This dragging down the EURO a bit, as it is printing

EUR/USD (6E1!) Nears Critical Monthly Supply ZoneThe EUR/USD futures (6E1!) are currently trading at 1.1858, already inside a key monthly supply zone. With price action approaching higher resistance levels, traders should prepare for potential reversals—especially near the 1.20395 – 1.22710 range, where a major bearish reaction could unfold.

Key

Pre-Market Prep

Today, I'm narrowing down to six key markets. For the S&P, it's all about waiting for a pullback from the prior day's high or a breakout above the CVA. If it dips back inside the range, I'm ready to go short with some scalps.

For the NASDAQ, it's looking strong. I'm thinking about a long position

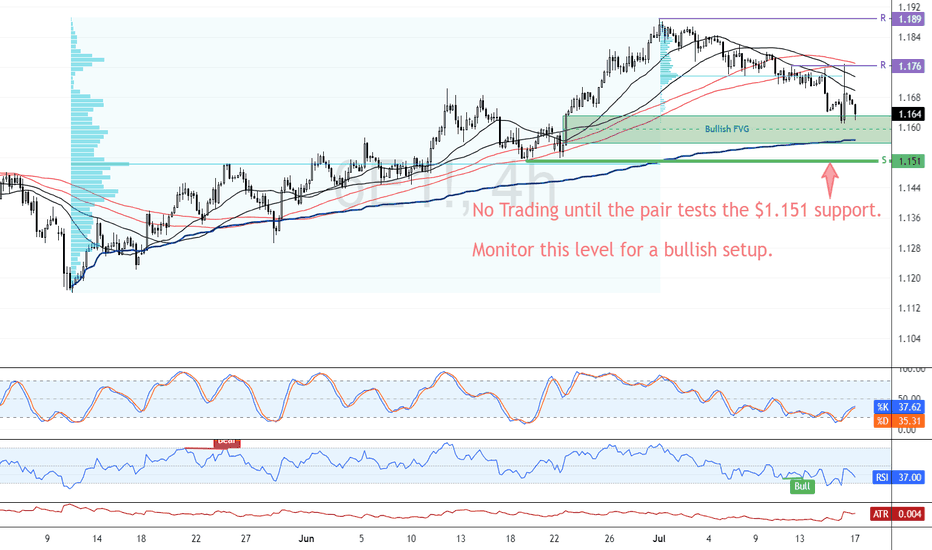

EUR/USD Resumes Bearish Trend Below $1.176FenzoFx—EUR/USD trades bearish, below the 100-SMA, and is currently testing the bullish FVG as support. Yesterday, Euro failed to pass the immediate resistance at $1.176; therefore, we expect the bearish bias to resume.

In this scenario, EUR/USD's downtrend could extend to the next support level at

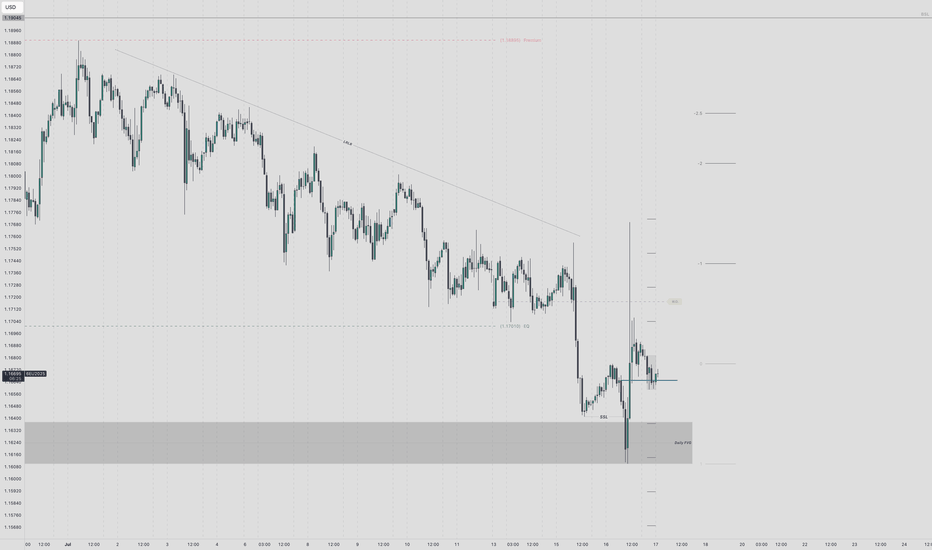

Euro LongsI've been waiting for euro to reach discount of its daily range and deliver into a daily BISI.

Mon - Wed trade lower into key arrays. Intraweek reversal confirmed with 4h and 1h CISD. Paired with Pound SMT at the daily lows.

LRLR built up from last weeks pullback. That bsl looks too obvious to me.

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of EURO/USD Futures is 1.1600 USD — it has fallen −0.62% in the past 24 hours. Watch EURO/USD Futures price in more detail on the chart.

The volume of EURO/USD Futures is 4.54 K. Track more important stats on the EURO/USD Futures chart.

The nearest expiration date for EURO/USD Futures is Jul 31, 2025.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell EURO/USD Futures before Jul 31, 2025.

Open interest is the number of contracts held by traders in active positions — they're not closed or expired. For EURO/USD Futures this number is 25.09 K. You can use it to track a prevailing market trend and adjust your own strategy: declining open interest for EURO/USD Futures shows that traders are closing their positions, which means a weakening trend.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for EURO/USD Futures. Today its technical rating is strong sell, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of EURO/USD Futures technicals for a more comprehensive analysis.