GBPUSD1! trade ideas

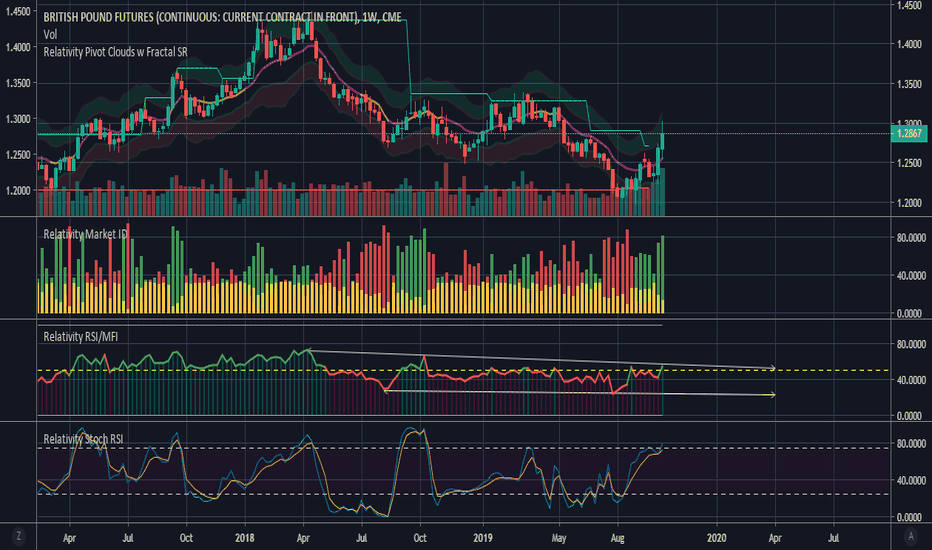

6B1! 0.382 fib retracement on the weekly - looking for a longAs the chart shows, pound futures have retraced 0.382 on the weeky chart. I am looking to see what price action will do here n the 4 hourly but would like to go long if the price can start to show some bullish momentum. Initial target would be the 1.3860 area

The Fed & BOEUS berencana mengurangi tariff produk dari china menjadi $100B (berita positif) sehingga berdampak pada keputusan the Fed yang berpotensi kuat untuk menahan suku bunga saat ini (market sudah price in).

BOE menghadapai ketidakpastian brexit dan sudah mendekati ke keputusan untuk dovish(normal).

Dari kedua kondisi tersebut, short GBPUSD lebih potensial.

BRITISH POUND : "Can't take my eyes off you."There are so many improvements to this instrument that I paused even when I saw the long signal.

Everyone's waiting for what British Pound gonna do.

I drafted the analysis three times and erased it.

I'm looking at the channel I drew on the RSI.

And on the one hand, I follow developments.

My opinion is neutral , despite positive signals in line with mixed developments.

Regards.

GBP/USD Futures. Still in uptrend?Perhaps this is not the best idea, but still. Right now I see uptrend and support near 1.3. However, 1.34 might be a strong resistance at this point. So I'm planning to buy @ 1.31-1.315, TP 1.335-1.34, SL below 1.3.

GBP should eventually see atleast 1.37 I think we grind in this region for a while more, and then finally rocket to atleast 1.37, potentially as far as 1.42. For now, I don't see a visit of the 1.5s on the cards. But time will tell if this evolves more bullishly than I expect

British pound analysis Good evening guys,

Ive just released 2 ideas POUND-related and now i'll explain why im bearish on gbp so far, this is a GBP FUTURE chart for the current month.

First of all, on the left chart im not using traditional candlestincks, im using the Point N' Figure chart, its a great chart for those who wanna avoid the "noise" of the market, very good on stocks as well.

We can see on these chart gbp is breaking a structure support so far and the upwave volumes are too low showing there is not too much demand for gbp.

On the middle dailychart we can see the ascending trendline and gbp is just testing it now, a breakdown will confirm bearish behaviour for gbp.

On the left chart we can see that gbp is lacking demand so far with low volume up-candles.

This is just a reflection on what we can see on the other trading ideas, gbp is bearish now.

Now the most important thing is, gbp is BEARISH NOW, what about tomorrow? tomorrow we can have some news about brexit or anything else on eurozone that can shake the market, cant we? =)

Thats why stop losses and proper money management on trades are a MUST.

When and if i have some good audience i'll create some educational posts explaining about my trading style and philosophy.

Enjoy? leave a like =]

This is just an educational post and not a trading signal.

High Probability Intraday Trade Setup for British Pound FuturesThe following are trades setup ideas in 15 mins chart for Gold Oil Futures .

There are 2 distinctive dotted lines labeled as

1. AI's Intraday Resistance

2. AI's Intraday Support

These 2 Support and Resistance signal lines are generated by machine learning AI robots as a high probability trade setup for long or short.

Long Setup

If price action closed above the AI Daily support line AND above Pivot Point S1 line, the idea is to long and take profit at the AI's Intraday Resistance line .

Instead of relying on 100% discretionary (human) trading, the robots will provide trade execution plan and it is entirely up to the human trader's decision to follow.

This is highly recommended to trade during Europe and US market hours for liquidity and volume for this product.

Week Plan - At POC Chop ZoneStuck at large point of control. Fade ranges, use small stops and don't trade for large moves.