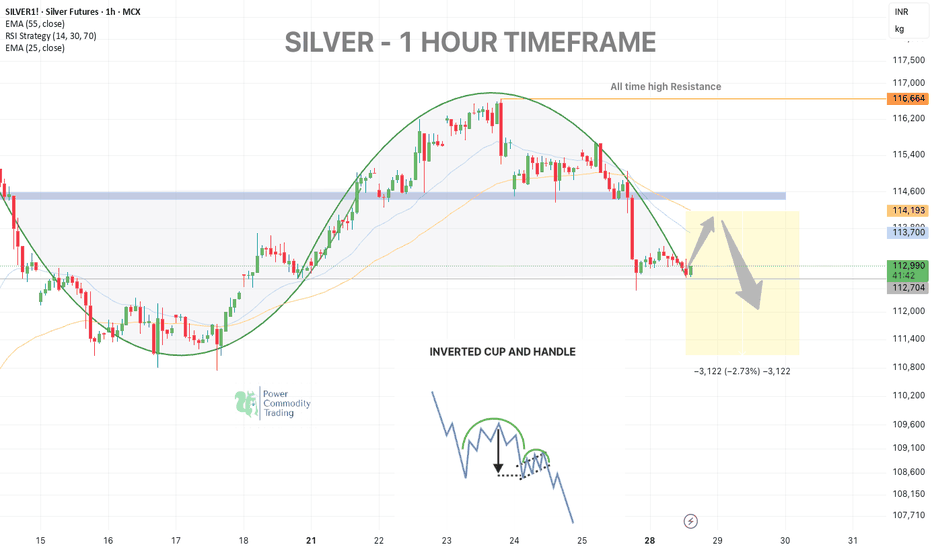

SILVER – Breakout Attempt Underway SILVER | 1H TIMEFRAME

Price is breaking out of the falling wedge + forming a cup-type rounded bottom from support.

📊 Technical Overview:

• Cup formation breakout spotted ✅

• Price attempting to sustain above falling wedge resistance

• 55 EMA & 25 EMA crossed bullish

• Volume buildup visible

•

Related commodities

Silver Near $40: Deficits and Demand Fuel the RallySilver prices surged to multi-year highs in July 2025, driven by an extraordinary convergence of bullish factors, pushing prices above $39 per ounce, levels last seen in 2011.

Silver’s rally, supported by robust industrial demand and safe-haven inflows, aligns with traditional patterns as the U.S.

SILVER WEEKLY UPDATE - Dead Cat Bounce Setup📉 SILVER – 1H TIMEFRAME - Inverted cup and handle pattern

Silver tested support around 112,800–113,000 after a rounded top formation, rejecting the key EMA zones (25 & 55) and the previous demand-turned-supply zone.

🟠 Scenario Unfolding:

Expecting a short-term bounce towards 113,750–114,200 (EMA c

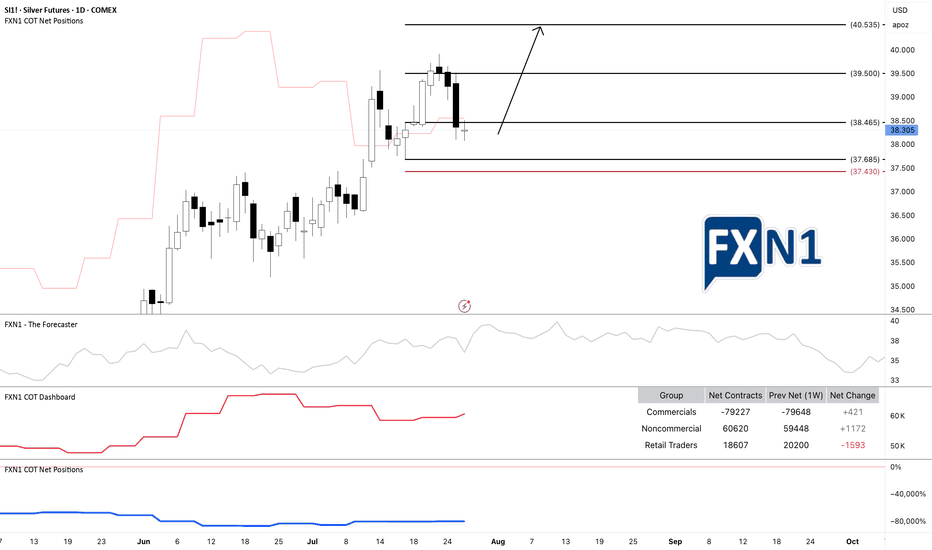

SI1!: Silver Demand Zone: Possible Bullish ContinuationI am currently observing a potential long-term continuation on SI1! Silver (XAG/USD), as the Commitment of Traders (COT) data indicates an increase in positions from both commercial and non-commercial traders. The price is approaching a demand zone on the daily chart, suggesting a possible bullish m

Speculative Silver target USD42 by November 2025Hello,

Its always a bit risky choosing a price target AND a timeframe, but here is mine, lets see how it unfolds.

Silver is looking like it is going to do a "short, sharp" correction, as the wave two correction (April to June 2025) was slow and complex. Then it will head for $42. The correction ma

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of Silver USD per ounce Futures is 38.51 USD — it has risen 0.36% in the past 24 hours. Watch Silver USD per ounce Futures price in more detail on the chart.

The volume of Silver USD per ounce Futures is 231.56 K. Track more important stats on the Silver USD per ounce Futures chart.

Open interest is the number of contracts held by traders in active positions — they're not closed or expired. For Silver USD per ounce Futures this number is 418.84 K. You can use it to track a prevailing market trend and adjust your own strategy: declining open interest for Silver USD per ounce Futures shows that traders are closing their positions, which means a weakening trend.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for Silver USD per ounce Futures. Today its technical rating is buy, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of Silver USD per ounce Futures technicals for a more comprehensive analysis.