Long for Gold: Seizing Safe-Haven Opportunities Next Week

-Key Insights: Gold is maintaining its robust uptrend as it benefits from global

economic uncertainties, making it a favored safe-haven asset. Investors are

moving towards gold due to geopolitical tensions and a volatile stock market.

The precious metal's performance is strong compared to other sectors, with a

bullish outlook supported by experts and analysts.

-Price Targets: For the upcoming week, traders should consider the following

targets and stop levels for long positions: T1 at 3155 and T2 at 3220,

indicating potential gains. Set your stop levels at S1 of 3080 and a more

conservative S2 of 3050 to mitigate risks.

-Recent Performance: Gold has showcased a strong and consistent uptrend,

distinguishing itself amidst broader market volatility. Its appeal as a safe-

haven asset has attracted investor interest, particularly as geopolitical

tensions and trade developments influence market dynamics.

-Expert Analysis: Analysts maintain a bullish perspective on gold's trajectory.

Despite warnings of possible corrections if certain resistance levels are met,

the overall sentiment is optimistic. Experts emphasize the strength of gold in

current economic conditions, underscoring its appeal.

-News Impact: Ongoing trade war developments and geopolitical tensions are

significantly impacting gold prices, reinforcing its position as a safe haven.

Investors are advised to stay informed about tariff changes and policy shifts,

which can influence demand and drive price momentum.

In conclusion, gold remains in a favorable position, driven by persistent

economic uncertainties and investor flights to safety. Targeting the specified

levels can optimize outcomes for those positioning long in the market next week.

XAUTRY1! trade ideas

GOLD - WEEKLY SUMMARY 24.3-28.3 / FORECAST🏆 GOLD – 5th week of the base cycle (15-20+ weeks). After a brief correction at the pivot forecast on March 19 (see the previous post), gold resumed its bullish trend at the extreme forecast on March 24 – the midpoint of retrograde Mercury.

⚠️ Holding the long position from the extreme forecast on March 3. The movement range to the pivot forecast on March 19 for GC futures exceeded USD12K per contract. Those who took profits, I hope you reopened long positions. The next extreme forecast for gold is April 7.

A Gold'en Newtonian Sell-Off Porjected By MedianlinesSir Isaac Newton stated the Third Law of Motion in his landmark work, Philosophiæ Naturalis Principia Mathematica (commonly called the Principia), which was first published in 1687. This law appears in Book I, in the section titled Axioms, or Laws of Motion.

(Axiom: A self-evident truth)

Newton did explicitly present it as an axiom. In fact, it's Axiom III (or Law III) of his three fundamental laws of motion. Here's how he phrased it in the original Latin and in his own English translation:

"To every action there is always opposed an equal reaction: or the mutual actions of two bodies upon each other are always equal, and directed to contrary parts."

And what does this have to do with Medianlines / pitchforks?

This tool measures exactly that: the action — and the potential reaction!

Medianline traders know that pitchforks project the most probable direction that a market will follow. And that direction is based on the previous action, which triggered a reaction and thus initiated the path the market has taken so far.

…a little reciprocal, isn’t it? ;-)

So how does this fit into the chart?

The white pitchfork shows the most probable direction. It also outlines the extreme zones — the upper and lower median lines — and in the middle, the centerline, the equilibrium.

We see an “undershoot,” meaning a slightly exaggerated sell-off in relation to the lower extreme (the lower median line). And now, as of today, we’re seeing this overreaction mirrored exactly at the upper median line!

Question:

What happened after the lower “overshoot”?

New Question:

What do you think will happen now, after the market has overshot the upper median line?

100% guaranteed?

Nope!

But the probability is extremely high!

And that’s all we have when it comes to “predicting” in trading — probabilities.

Why? Because we can’t see the future, can we?

Gold?

Short!

Looking forward to constructive comments and input from you all

Gold ExpansionCOMEX:GC1! reversed off the weekly average zone and is gradually working through that 4H FVG.

Looking for a clean break above it, then a retrace back to that zone. My target is the Daily Major Buyside Liquidity, with an eye on a potential extension toward the Weekly Average Expansion area if momentum holds.

Be the Choosy trader on Gold!Price is dragging on dropping. being very indecisive. Looks like the entire market is waiting on News to help give it a push. I need to see price break out of value before I can get a read on a sold move. in the mean time this is sclaping conditions. You can hold trades. Have to cut them short quick with this price action. Since we have some USD news tomorrow that indicates that the market might be waiting for that before proceeding on any decisions. Patience is key!

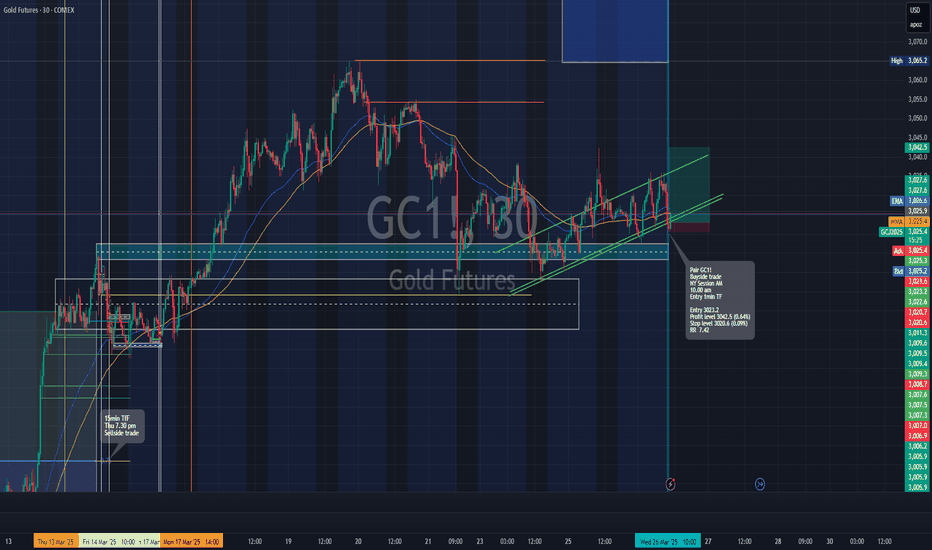

Long trade

30min TF overview

1min TF Entry

Pair GC1!

Buyside trade

NY Session AM

10.00 am

Entry 3023.2

Profit level 3042.5 (0.64%)

Stop level 3020.6 (0.09%)

RR 7.42

Reason: Looking left at previous price action and respected levels along with the Periodic Volume Profile (PVP) indicator and ascending channel seemed to suggest we were at a prime demand level indicative of a buyside trade.

GOLD TOP IS NEARGold appears to be distributing on all timeframes excepting daily , this added to the extensive media coverage recently makes me think that a significant all time top is near , gold still maintains support on all timeframes but that is probably the only thing holding it from a big crash.

Tesla es Mini Gold oil3.24. 25 in this video it looks like the Market's going up on the ES and Tesla. the oil Market has only traded a little bit lower than its recent High and it's not clear if the Market's going to make another move to a new high or if it's going to go a little bit lower and you can see that in the bars which are very narrow in their range and this looks different from when the market was actually actively going higher until it went to the end of the ABCD pattern which is a reversal pattern. Because the gold went to the end of the ABCD patterns going higher I am concerned that the Market's going to make a significant correction lower.... but I would be prepared for retest and minor Moves In the goal going higher and lower and that's what I tried to show to you in the video and I'm sorry that my presentation was so scattered and probably not easy to follow. the way you trade a market has to do with the kind of Trader you are... do you scalp a market or do you trade for longer trades. you could have made a few trades in gold and you could have made nice returns if several $1000 trades are suitable for you... and you could have traded as a buyer and a seller if you recognize the reversals.... but that is not an easy way to live. you could do it with discretion and not take every trade and if that works you may not need to take antacids and ulcer medication.... most people are not geared to that kind of trading and probably have a very low chance of being profitable. I am not a stop and reverse Trader.... but I show the patterns because I believe markets trade to the buyers and the sellers and that it is evident on a chart. if you don't care to be a stop and reverse Trader it is still to your advantage to know how markets trade and retest. to my thinking it's much better to at least know what it looks like as opposed to staring at your chart and having no real point of view other than the fact that you're not quite sure what the Market's going to do and all you can think about is losing money..... and even worse stay in a good trade too long and give all the money back because you don't know when to get out of a good trade. when you learn how to trade you still have to deal with the reversals in the market it's never going to stop... the need that you have to evaluate the price action that can work against you. my personal belief is that it's not easy to trade, I personally don't enjoy Trading but I don't mind making money if I do trade. my mission is to show you the trade location and the direction of the market. and the stop and a little Target without hitting the stop first... and if you can do that then the market should trade in your favor for at least a while and if it gets to that initial Target you have a reasonable reward and if it continues going in a Direction that could take some of your gains back.... but you haven't lost money yet.... that's okay..... it's still better than getting into markets and immediately losing money because you're not reading the market and you don't have a reasonable plan. I am sorry for my delivery during the videos... it's not intentional... and if it gets worse I'm going to have to stop. a fully intend to trade at this point Until evidence shows that I'm not trading well. I will go with the flow it's been fun.

The New week can give us a Pullback on Gold!Waiting for the bigger move and for that bigger move to happen we need a solid pill back to fill in some gaps. Focused on the patience for this in order to maximize the reward. Allow Monday and Tues to show if they will reach for the lows and set up. Logically the best entry should come after Tuesday. But you never know. Just wait for it cause price will show when it is ready.

GOLD SILVER PLATINUM COPPER: Metals Are Bullish! Wait For Buys!This is a FUTURES market outlook for the Metals, for the week of March 24-28th.

In this video, we will analyze the following markets:

GC | Gold

SIL | Silver

PL | Platinum

HG | Copper

The USD continues its bearish ways this upcoming weak. It's currency counterparts will likely see some upside this week. Especially the JPY.

Patience and an ear to the news will be the best way to approach the equity markets. The same would also apply to news sensitive commodity markets like US OIL, Gold and Silver.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

GOLD - WEEKLY SUMMARY 17.3-21.3 / FORECAST🏆 GOLD – 4th week of the new base cycle (15-20+ weeks), which began with retrograde Venus on March 3 from the extreme forecast level of October 28 (2850 on current futures). The start of retrograde Mercury had no impact on gold’s bullish trend. Mercury simply lacked the energy, as Venus is far stronger. Gold entered a correction at the pivot forecast on March 19, which I mentioned last week in the context of the stock market.

⚠️ Holding the long position from the extreme forecast on March 3. The movement range to the pivot forecast on March 19 for GC futures exceeded USD12K per contract. The next extreme forecast for gold is March 24 – the midpoint of retrograde Mercury. There is also a pivot forecast on March 27, but that is more relevant to crude.

directional zones to bias your tradeshi.

I use fibonacci zones and the concept of price expansion to draw these zones.

they help you determine which way price will go

via backtesting price can travel from one orange zone to another, with 70% accuracy, for the orange line I can only guarentee it'll touch the orange line, not follow through on there

throw on rsi and mfi and look at if both overbought or sold for an interesting zone reversal.

happy trading