BITCOIN trade ideas

Titanwhale: Interest in BTC reaches record high amid $115,000Bitcoin’s market volatility once again made headlines this week as its price dipped sharply to $115,000, marking the most significant single-week correction in nearly a year. Yet behind the price action lies a more telling development: open interest in Bitcoin futures reached an all-time high, crossing the $41 billion mark.

Analysts at Titanwhale emphasize that this dynamic reflects not panic but rather the growing institutionalization of crypto markets, where derivatives are used for strategic hedging and structured exposure.

Rising Open Interest Reflects Institutional Strategy

Despite the 12% price correction from recent highs of $131,000, institutional interest remains robust. Open interest on regulated platforms like the Chicago Mercantile Exchange (CME) surged 38% in Q3, accounting for over $9 billion of total volume.

“We’re seeing a clear shift from speculation to risk management,” said Ethan Ryu, Head of Macro Strategy at Titanwhale. “Derivatives are no longer just trading tools—they’re core components of institutional crypto portfolios.”

Leverage Risks and Market Maturity

The sharp price dip triggered over $1.2 billion in liquidations, particularly among retail traders using high leverage. Still, the overall market structure remains stable: funding rates are neutral, and the options market shows a moderate bullish bias for Q4.

“This is a textbook pullback in a bullish trend. Market structure suggests cooling—not capitulation,” Ryu noted.

Macro Forces and Bitcoin’s Outlook

The correction coincides with renewed inflation concerns and central bank uncertainty. Yet on-chain data from Titanwhale shows that long-term holders are not moving their coins, and exchange outflows suggest continued accumulation.

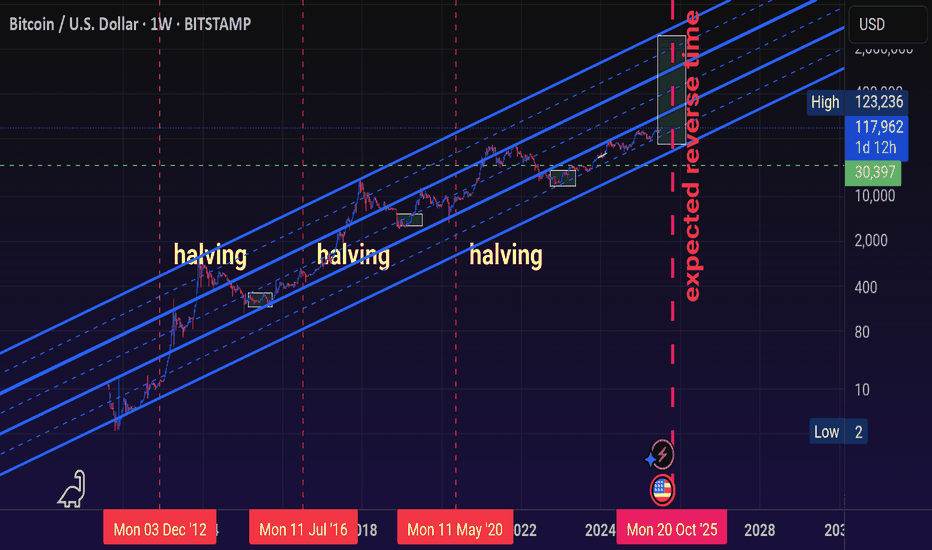

With the next Bitcoin halving in early 2026 and steady inflows into spot ETFs, analysts at Titanwhale maintain a base-case price recovery to $140,000–$150,000 by Q4 2025, assuming macroeconomic conditions stabilize.

Titanwhale’s Conclusion

The record-high open interest amid a price drop is not a contradiction—it is a sign of market maturity. Bitcoin is no longer just a speculative asset but a structural part of institutional risk strategies.

At Titanwhale, we view the current dip as a potential entry point for sophisticated investors—offering not just upside, but insight into how far the crypto market has evolved.

Is This the Ultimate Bullish Signal for BTC and XRP?In a market often driven by hype and volatility, identifying true bullish signals for digital assets like Bitcoin (BTC) and XRP can be elusive. Yet, a growing convergence of macro, regulatory, and structural market factors may now point to one of the strongest combined bullish setups for these two digital assets in recent memory.

While BTC and XRP differ significantly in purpose and infrastructure—Bitcoin as a decentralized store of value, and XRP as a bridge asset for institutional cross-border payments—they may be aligning in a way that reflects maturing investor confidence and long-term viability.

Institutional Flows Accelerate

Perhaps the clearest bullish indicator lies in the surge of institutional capital into regulated crypto products. Bitcoin ETFs have seen a resurgence in net inflows, surpassing $2.5 billion over the past 30 days, with increased allocations from pension funds and sovereign wealth managers.

At the same time, XRP’s recent regulatory clarity—following the 2023 U.S. court decision stating that XRP is not a security when traded on public exchanges—has prompted renewed interest from financial institutions exploring cross-border payment solutions.

“Regulatory clarity is acting like a springboard for XRP,” said Claire Donovan, Senior Markets Strategist at Atlantic Ridge Digital. “Meanwhile, Bitcoin’s macro narrative—scarcity in an inflationary world—continues to resonate.”

On-Chain Signals Strengthen

On-chain metrics reinforce the optimism. Bitcoin’s hash rate has reached an all-time high, a sign of miner confidence and long-term network security. Simultaneously, the percentage of BTC supply held by long-term holders (LTH) is now above 70%, suggesting strong conviction.

For XRP, active wallet growth and ODL (On-Demand Liquidity) transaction volumes have jumped significantly over the past quarter. According to data from Ripple, ODL volumes grew by 61% quarter-over-quarter—primarily driven by demand from Asia-Pacific and Latin American corridors.

“ODL is no longer experimental—it’s mission-critical infrastructure,” said Donovan. “The market is beginning to reflect that.”

Cross-Market Momentum and Retail Resurgence

Another potentially bullish alignment is emerging from the return of retail sentiment, driven by social media engagement, higher search volumes, and renewed interest in altcoins. XRP has reclaimed a top-5 position by market cap, while Bitcoin dominance remains stable despite an expanding altcoin market.

The macro backdrop also matters. With inflation stabilizing and rate cuts on the horizon in key economies, risk assets are enjoying renewed favor. Bitcoin and XRP, once viewed as speculative, are increasingly seen as part of a diversified portfolio strategy.

Final Thoughts

BTC and XRP may finally be entering a synchronized bullish phase—one rooted not in speculation, but in structural adoption and maturing market dynamics. While both assets face different headwinds, the combination of institutional inflows, regulatory clarity, and strong on-chain metrics may represent the ultimate bullish signal for the rest of 2025.

Investors would do well to watch not just price action, but the convergence of adoption, utility, and trust—elements that now increasingly support both Bitcoin and XRP.

Crypto Might Protect You from a Global Debt Crisis | OpinionAs sovereign debt levels surge and central banks struggle with inflationary aftershocks, investors worldwide are seeking new forms of financial protection. While gold and U.S. Treasuries have historically served as safe-haven assets, the current global debt structure presents unprecedented risks. In this context, cryptocurrencies — particularly decentralized, deflationary assets — may offer a unique hedge against systemic instability.

A Mounting Crisis

According to the IMF, global debt reached $315 trillion in Q2 2025, led by the U.S., China, and EU member states. Rising interest rates have pushed sovereign debt servicing costs to record highs. At the same time, inflation remains sticky, and fiscal deficits continue to expand — creating a scenario where traditional instruments may no longer preserve purchasing power.

Credit downgrades of major economies — including a recent warning from Moody’s on the UK and France — further highlight the fragility of fiat-based systems.

Why Crypto Provides an Alternative

Fixed Supply:

Bitcoin’s 21 million cap remains untouched. In an era of unlimited fiat printing, scarcity is a value proposition in itself.

Decentralization:

Cryptocurrencies operate outside centralized banking systems. In case of capital controls or currency devaluation, digital assets remain globally transferable and resistant to censorship.

Accessibility and Liquidity:

From stablecoins to DeFi protocols, crypto provides 24/7 access to financial tools — often with greater transparency than traditional banks.

Not Without Risk

Crypto remains volatile and vulnerable to regulatory shifts. The recent ETF delays by the SEC and tax crackdowns in G20 countries underscore the uncertain terrain. However, compared to the looming debt traps of fiat economies, some volatility may be an acceptable tradeoff for autonomy and deflationary exposure.

Growing Institutional Interest

Firms like Fidelity, BlackRock, and BBDelta have significantly increased their crypto allocations, particularly in ETH and BTC. Even central banks are researching CBDCs and holding digital reserves as a contingency plan.

Conclusion

While crypto isn’t a panacea, it represents a credible hedge in a world where fiat debt continues to spiral. For risk-aware investors, a balanced portfolio in 2025 likely includes a thoughtful allocation to digital assets — not for speculation, but for protection.

The debt crisis is not a distant threat. It’s unfolding now — and cryptocurrency may be one of the few tools with the potential to navigate what comes next.

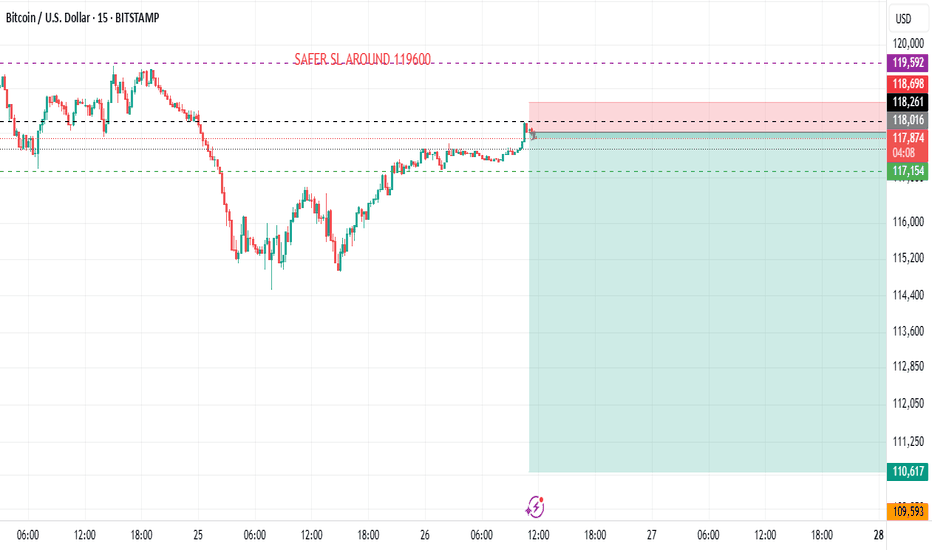

BTCUSD BUBBLE ABOUT TO BURST LOL ??? SELL SELL SELLLong term BTCUSD looks like BIG PLAYERS ARE TAKING PROFIT (about to dump this to retailers lol)

I see 15m signal sell with very good risk reward

BTCUSD its ready for correction i dont beleave we will see any NEW HIGHS from here

Let see how will pay out, only time will tell

Thanks

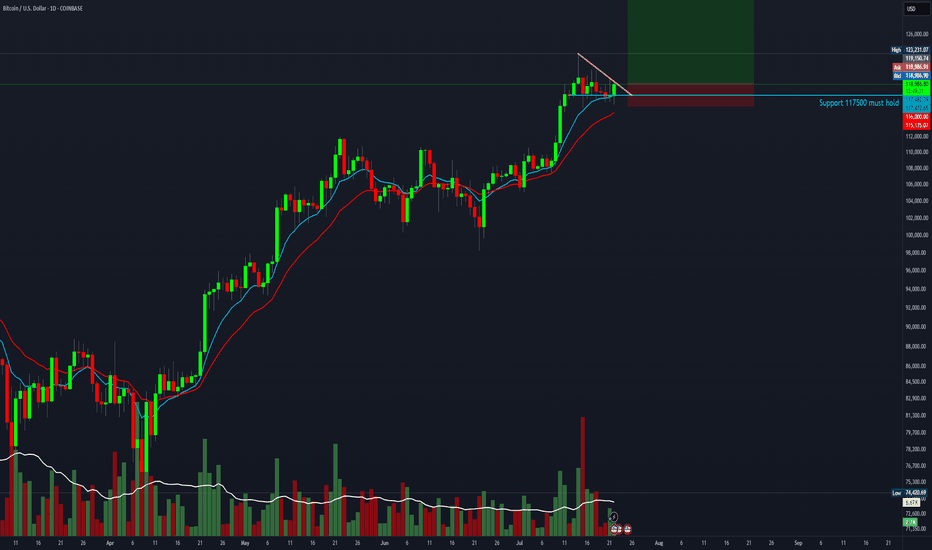

BTC – Bulls still in controlBTC is trading around 117,800 USD, well above both the EMA 50 (111,800) and the pivot level (105,300), confirming bullish dominance. Price remains below the upper Bollinger Band (123,400), leaving potential room for continuation.

Momentum stays constructive, with RSI at 60 and MACD in a strong positive zone, reflecting sustained upward pressure. As long as price holds above EMA 50 and pivot, the next upside targets lie at 123,400 and R1 at 110,000 has already been surpassed.

Volume has dropped significantly (-31%), suggesting the latest move could lack conviction or represent a pause rather than a breakout.

As long as BTC holds above 111,800, the bullish scenario remains intact.

Watch for any rejection near 123,400 or a close back below the EMA as potential invalidation signals.

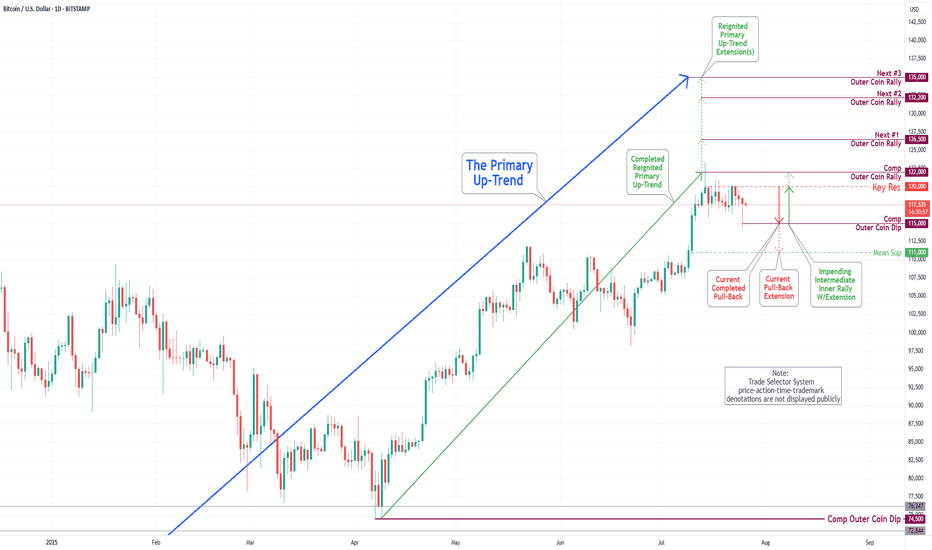

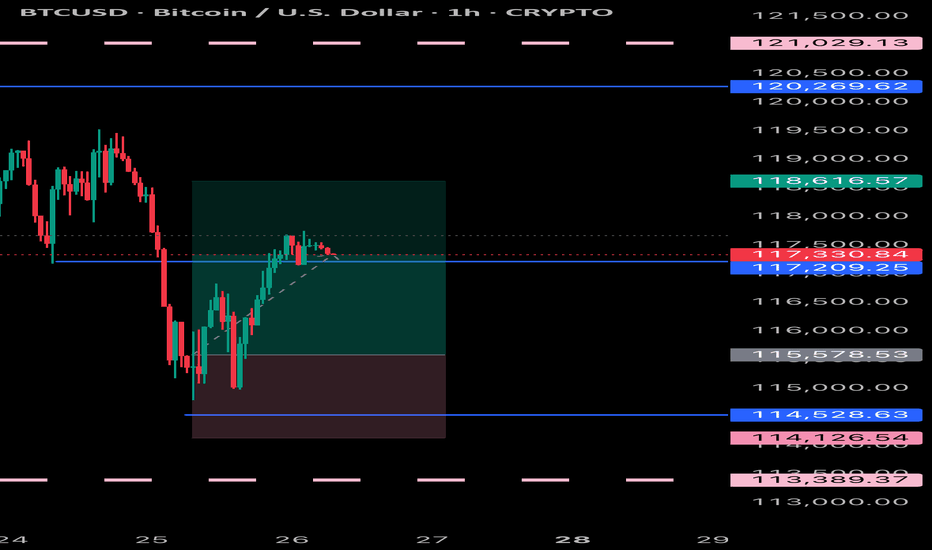

Bitcoin(BTC/USD) Daily Chart Analysis For Week of July 25, 2025Technical Analysis and Outlook:

In the trading session of the previous week, the Bitcoin market exhibited considerable volatility as it retested the Key Resistance level at 120000. On the lower end of the spectrum, the market engaged with the Mean Support levels at 117500 and 115900, culminating in the completion of the Outer Coin Dip at 115000. Currently, the coin is poised to retest the Key Resistance at 120000 once again. This anticipated rebound will necessitate a retest of the completed Outer Coin Rally at 122000. The additional target levels for the renewed Primary Up-Trend are 126500, 132200, and 135000.

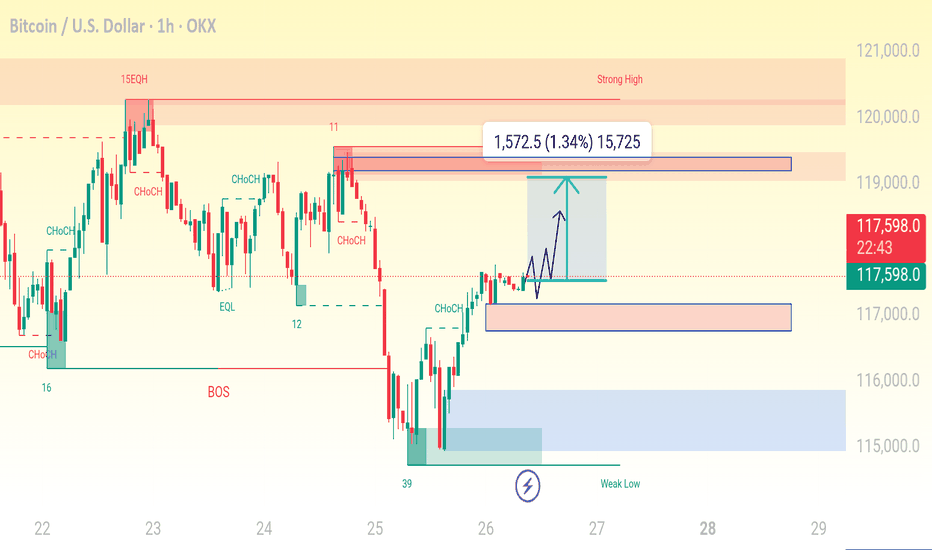

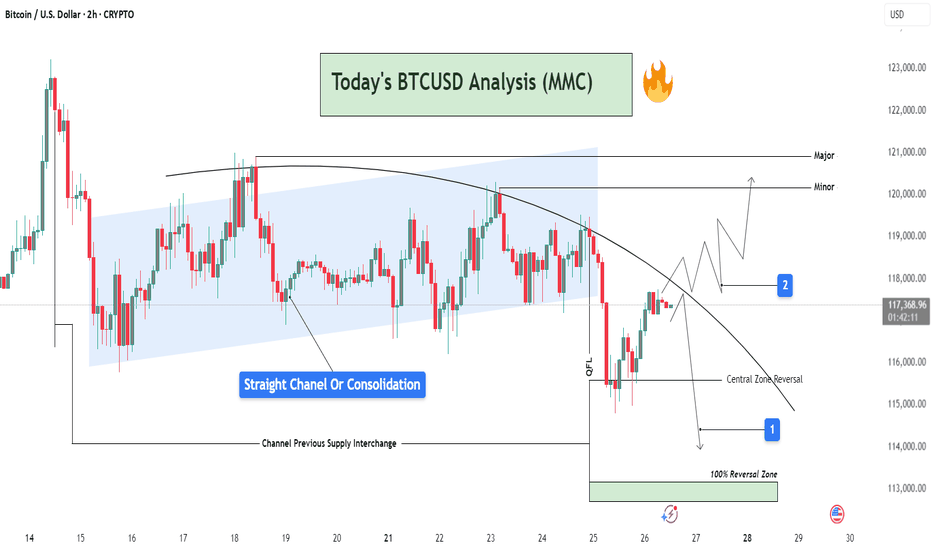

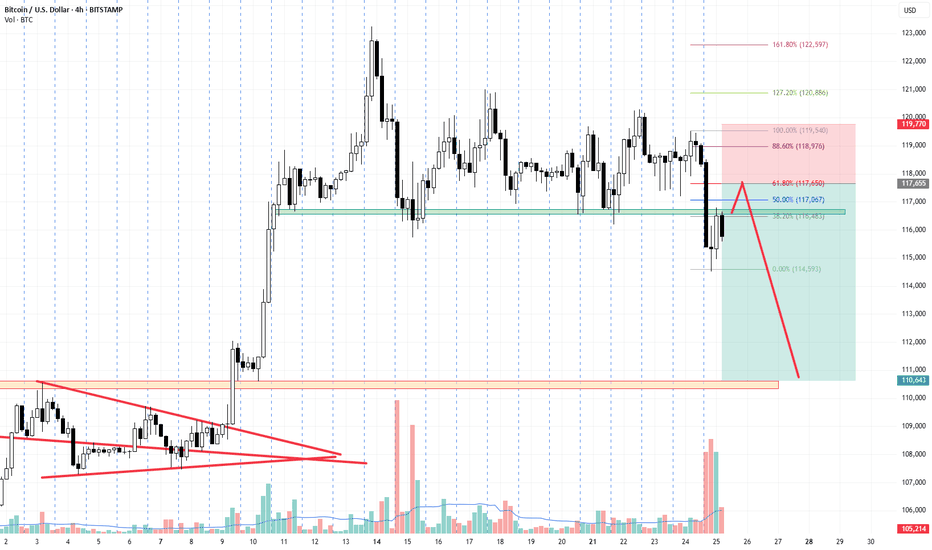

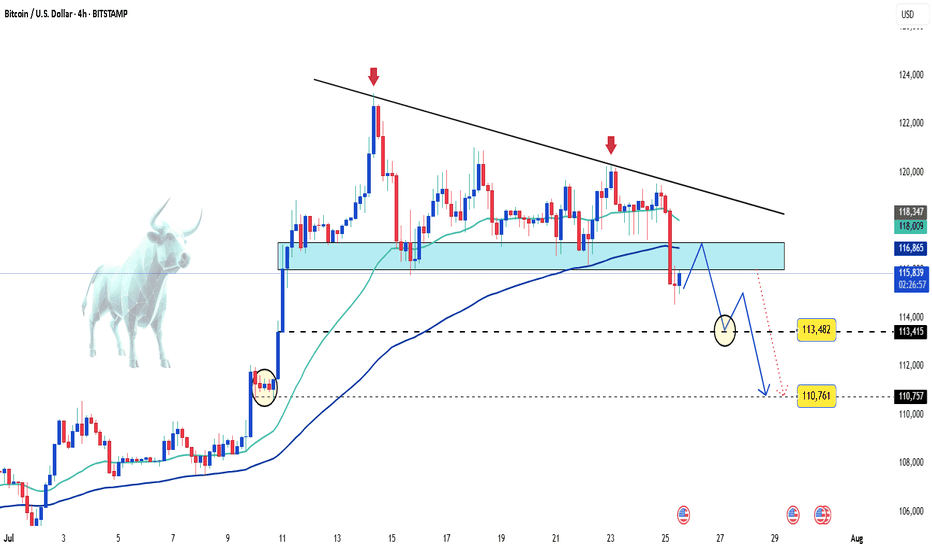

BTCUSD Analysis : Channel Break + QFL Setup | Structure Analysis📊 Chart Overview

This 2H BTCUSD chart reveals a comprehensive view of market behavior transitioning from a phase of consolidation into a potential breakout or further rejection. The price action is analyzed inside a parallel channel, transitioning into a curved resistance path, which is currently governing the market structure.

🔵 Phase 1: Consolidation Inside a Straight Channel

Price has respected a clear ascending channel (highlighted in blue) from July 16 to July 24.

This phase shows a range-bound movement with defined supply and demand zones.

Labelled as “Straight Channel or Consolidation”, this represents a potential accumulation/distribution zone.

The Channel Previous Supply Interchange marks an important S/R flip zone, now serving as a key reference for future reactions.

🔻 Phase 2: Break of Structure & Curved Resistance

Price broke down below the channel support and is now respecting a downward curved trendline.

This indicates a shift in momentum from neutral to bearish, forming lower highs.

A sharp drop occurred post-channel exit, marking a QFL (Quasimodo Failure Level) area—hinting at smart money involvement or liquidation hunt.

🔁 Reversal Scenarios & Key Levels

There are two possible future paths visualized:

🟥 Scenario 1: Bearish Continuation

Price respects the curved trendline, failing to break resistance.

A rejection near the current region (~117.5k) could lead price back toward:

Central Zone Reversal near 115,000 USD

Further into the 100% Reversal Zone (green zone) near 113,500–114,000 USD

Ideal for short entries after clear rejection confirmations.

🟩 Scenario 2: Bullish Breakout

Price breaks and sustains above the curved resistance.

Temporary resistance seen at Minor level (~120,000 USD), followed by Major resistance near 121,000 USD.

This scenario requires bullish volume and reclaim of structure, invalidating the short bias.

🧠 Strategic Viewpoint & Trade Mindset

Market is at a decision point—either confirming a bearish rejection from dynamic resistance or invalidating it for a bullish reversal.

Patience is key; wait for either:

A failed breakout attempt (short opportunity), or

A confirmed breakout and retest (long opportunity).

Use lower timeframes (15m–1h) for execution once direction is confirmed.

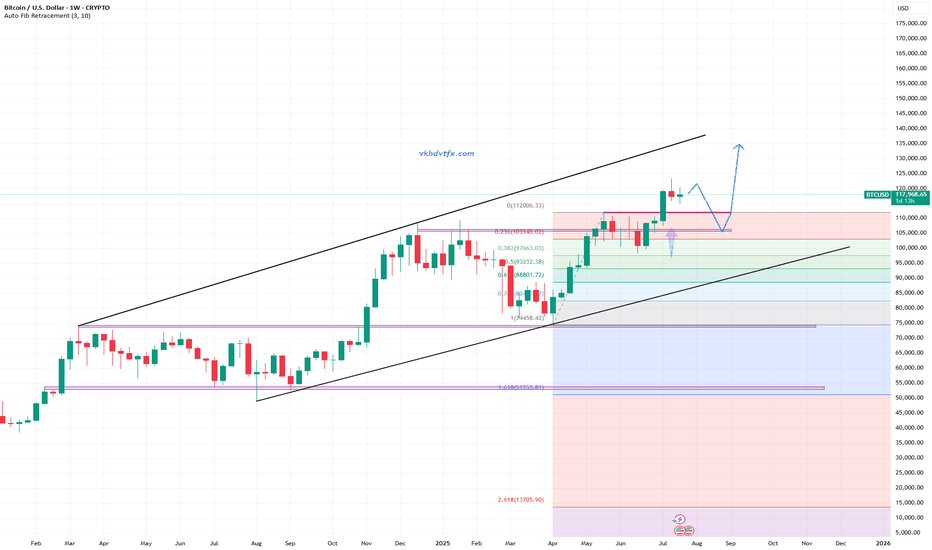

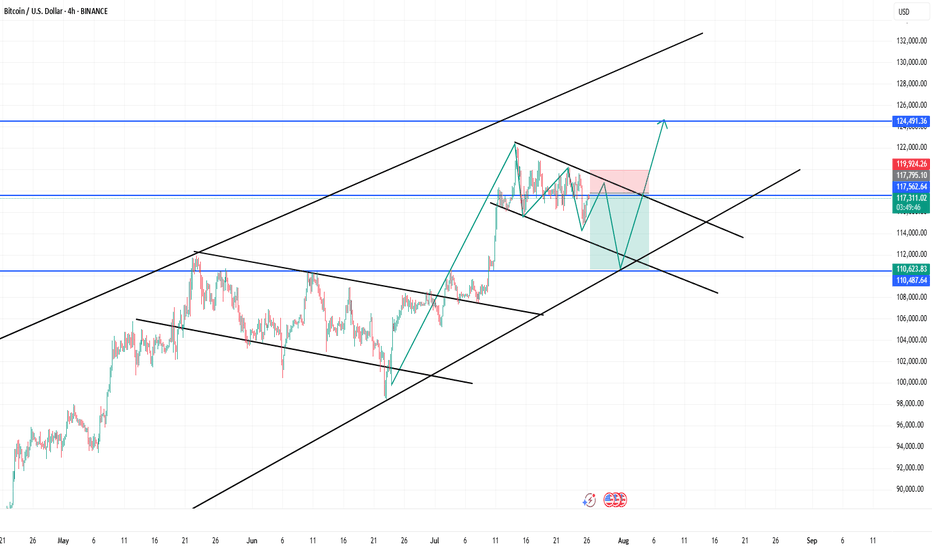

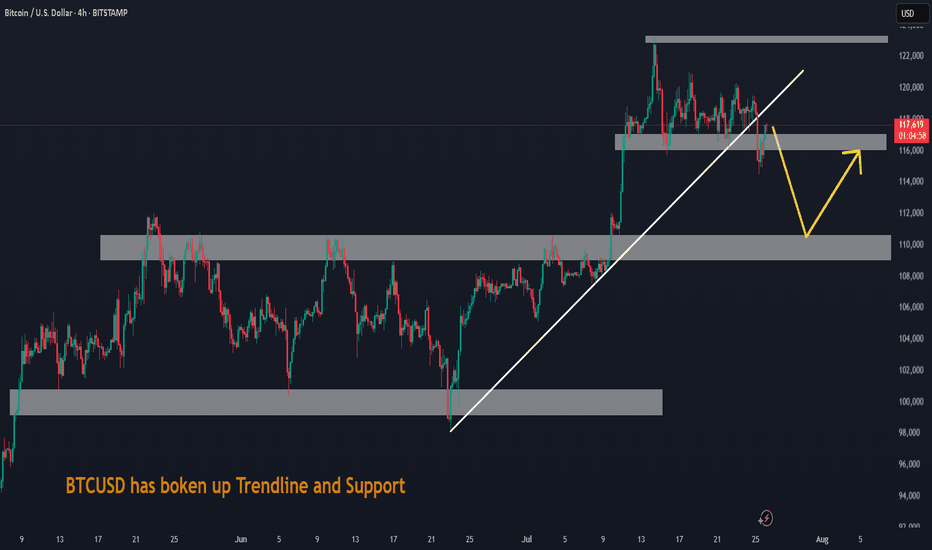

Reversal Zone: BTC Eyes $124.5K After Potential Liquidity SweepTechnical Analysis (4H Chart)

🔷 Pattern Overview:

Rising Channel: BTC is still respecting a long-term upward channel (black parallel trendlines).

Falling Wedge (Short-Term): Inside the channel, a falling wedge is forming—typically a bullish continuation signal.

The wedge is nearing completion, with a possible fakeout below support to the $110,500–$110,600 zone before a sharp rally.

✅ Price Expectation:

Bear Trap Likely: Price may dip to $110.5K support, triggering stop-losses.

Bullish Breakout Setup: If price rebounds strongly from $110K area, the wedge + channel pattern supports a move toward $124.5K–$125K.

Invalidation: Clean break below the channel and $110K could invalidate the bullish scenario.

Bitcoin Beneath the Arc of Silence - Structural Faith, Tactical?⊢

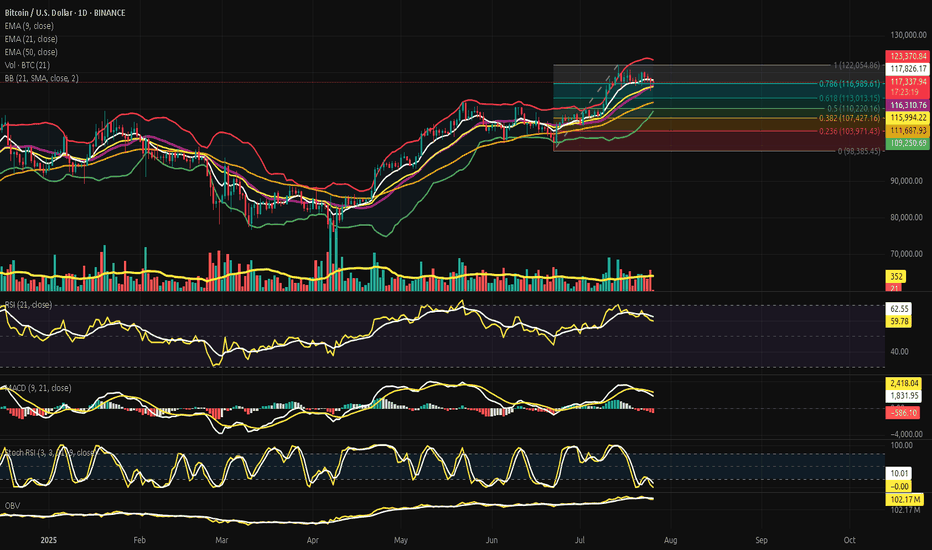

⟁ BTC/USD - BINANCE - (CHART: 1D) - (July 26, 2025).

◇ Analysis Price: $117,421.02.

⊣

⨀ I. Temporal Axis - Strategic Interval - (1D):

▦ EMA9 - ($117,842.79):

∴ The EMA9)is currently positioned at $117,842.79, slightly above the price ($117,421.02), acting as immediate dynamic resistance;

∴ Price has closed below EMA9 for multiple sessions, indicating a fading short-term momentum arc;

∴ The slope of the EMA9 is flattening, signaling an inflection zone rather than active thrust.

✴️ Conclusion: The short-term control line has been lost tactically; a sign of momentum exhaustion but not structural breakdown.

⊢

▦ EMA21 - ($116,001.77):

∴ EMA21 stands at $116,001.77, serving as an intermediate-range support below current price;

∴ The slope remains positive, providing a second-layer bullish structure after the loss of EMA9;

∴ Price has not tested EMA21 since early July - proximity implies possible gravitational pull.

✴️ Conclusion: EMA21 is the next defense line in a suspended structure, acting as the center of tactical compression.

⊢

▦ EMA50 - ($111,691.19):

∴ EMA50 sits at $111,691.19, aligned closely with the (0.236 Fibonacci) and historical cluster zone;

∴ Price has remained well above this level for over 30 sessions;

∴ The slope is clearly positive, marking macro structural support.

✴️ Conclusion: EMA50 represents the last reliable arc before macro invalidation. Its integrity maintains the long-term bullish thesis.

⊢

▦ Fibonacci Retracement:

∴ Retracement is correctly anchored: 1.0 = $122,054.86 (ATH) / 0.0 = $98,385.45 - (June 22 low);

∴ Price currently oscillates within the 0.618–0.5 zone ($113k–$110k), the classical golden pocket;

∴ The golden pocket aligns closely with EMA21 and the Bollinger mean, forming a triple confluence zone.

✴️ Conclusion: Price is inside the Fibonacci heart of reaccumulation - ideal for breakout setups or breakdown invalidation.

⊢

▦ Bollinger Bands (21, 2.0):

∴ The upper band is at $123,377.19, while the middle band rests at $116,314.72;

∴ Price is between the middle and upper bands, consolidating after rejection from the upper line;

∴ The bands are narrowing, indicating a volatility contraction cycle.

✴️ Conclusion: Bollinger geometry confirms volatility suppression, aligning with RSI and MACD flattening - a signal of impending release.

⊢

▦ RSI (21) + EMA9:

∴ RSI is at (59.99), slightly under its EMA9 - (62.59), showing momentum erosion without collapse;

∴ The RSI has declined from the high 70s in late June, signaling tactical cooling;

∴ Remaining above 50 preserves structural bullish bias.

✴️ Conclusion: RSI is in tactical descent, but not structurally bearish - neutral-to-bullish compression.

⊢

▦ MACD (9,21):

∴ MACD line is below signal line, currently at (1,841.01) vs (2,419.86), confirming a bearish cross;

∴ Histogram prints red for several sessions, with fading amplitude;

∴ Despite the crossover, MACD remains in positive territory, indicating soft correction, not trend reversal.

✴️ Conclusion: MACD confirms a tactical retracement, aligned with RSI weakness, yet within bullish context.

⊢

▦ Stochastic RSI (3, 3, 21, 9):

∴ Current value is 0.00, denoting extreme oversold conditions;

∴ Multiple sessions have closed at this level without relief;

∴ Historically, flatlines at 0.00 often precede upward jolts.

✴️ Conclusion: Stoch RSI indicates exhaustion of momentum - potential for rebound or failed bounce.

⊢

▦ Volume + EMA21:

∴ Volume on current sessions is below the 21-period EMA, confirming absence of strong sell-side dominance;

∴ No abnormal spikes or climaxes are visible - neither panic nor breakout yet;

∴ Volume profile aligns with Bollinger contraction.

✴️ Conclusion: Quiet volume supports the thesis of controlled tactical consolidation, not distribution.

⊢

▦ OBV + EMA9:

∴ OBV stands at 102.17M, flatlined with EMA9;

∴ No divergence detected relative to price;

∴ Momentum of accumulation remains static but not deteriorating.

✴️ Conclusion: OBV is in neutral stance, neither confirming breakout nor selloff - favors tactical patience.

⊢

🜎 Strategic Insight - Technical Oracle:

∴ Bitcoin is suspended in a compressed volatility range beneath its local high, resting upon layered support zones defined by EMA21, Bollinger median, and the Fibonacci golden pocket (0.618–0.5);

∴ Momentum indicators (RSI, MACD, Stoch RSI) are all in tactical decline, yet no structure has been broken - price still floats above all macro EMA's (21, 50) with OBV unshaken;

∴ The short-term weakness is absorbed within a higher-order structural integrity, suggesting latent potential awaiting a fundamental catalyst.

✴️ Conclusion: The oracle observes a coiled market, technically restrained but not structurally broken - an archetype of Strategic Suspension Beneath the Arc of Silence.

⊢

∫ II. On-Chain Intelligence - (Source: CryptoQuant):

▦ Exchange Netflow Total + 9EMA - (All Exchanges):

∴ The current netflow is (-864.6 BTC), remaining firmly below its EMA9 baseline;

∴ The 9-day moving average of netflows is flat-to-negative, signaling persistent withdrawal pressure from exchanges;

∴ Sustained negative netflows in conjunction with a stable price floor indicate non-speculative cold storage behavior.

✴️ Conclusion: Netflow structure is bearish for exchanges, but bullish for long-term price, as BTC flows into private custody.

⊢

▦ Miner to Exchange Flow + 9EMA - (All Miners):

∴ Current flow from miners hovers near 1.2K BTC/day, well below the EMA9 which trends above 3K;

∴ The flow has not pierced its EMA9 in recent weeks, despite BTC testing local highs - a strong non-distribution signal;

∴ The divergence between low miner outflows and high price resilience confirms supply-side discipline.

✴️ Conclusion: Miner flows remain suppressed beneath EMA9 - a structurally bullish posture amid local consolidation.

⊢

▦ Funding Rate + 9EMA - (All Exchanges):

∴ The funding rate is (+0.012), sitting above its EMA9, indicating a minor long bias across derivatives markets;

∴ There is no spike or deviation suggesting leveraged imbalance - the slope of the EMA9 remains shallow;

∴ Funding above EMA9, with RSI and MACD fading, implies a passively bullish positioning without euphoria.

✴️ Conclusion: Funding is technically constructive, aligned with healthy sentiment - not overheated, nor bearish.

⊢

▦ Spent Output Profit Ratio - (SOPR) + 9EMA - (Adjusted):

∴ The SOPR stands at 1.016, maintaining a position above its 9-day EMA;

∴ No dip below 1.0 has occurred in recent sessions, showing that BTC is being transacted in profit;

∴ EMA(9) acts as a median around 1.0 - a psychological pivot between profit realization and capitulation.

✴️ Conclusion: SOPR above EMA9 confirms a healthy trend, with profits being realized in harmony - not desperation.

⊢

🜎 Strategic Insight - On-Chain Oracle:

∴ All four on-chain pillars - Exchange Netflow, Miner Flow, Funding, SOPR - operate in favor of structural continuation, with none indicating exhaustion or distribution;

∴ The alignment of each indicator above or below EMA9 in the appropriate direction (accumulation vs euphoria) forms a cohesive bullish framework;

∴ The lack of pressure from miners, and the smooth funding environment, give room for technical consolidation to mature without triggering panic.

✴️ Conclusion: The oracle discerns a hidden current of strength, buried beneath the tactical mist. Structural forces remain aligned with continuation - though the flame is dimmed, it is not extinguished.

⊢

⧉ III. Contextvs Macro-Geopoliticvs - (July 25, 2025):

▦ 10:00 AM - Core Capital Goods Orders - (Durable Goods excl. Defense & Aircraft):

∴ The index, a proxy for business investment, contracted by (-0.7%) in June - the sharpest monthly decline of the year;

∴ This marks a decisive loss of momentum in private-sector expansion;

∴ While shipments rose slightly (+0.4%), the delta is attributed to inflation, not demand.

✴️ Conclusion: The business sector shows signs of hesitation, reinforcing the case for policy accommodation.

⊢

▦ 14:30 PM - Trump's Visit to the Federal Reserve - (Rare Executive Intervention):

∴ President Trump visited Powell directly, urging him to cut interest rates to "save the American engine";

∴ Powell responded with a carefully chosen phrase: “The country is doing really well” - read by markets as passive affirmation;

∴ This act marks a rare intrusion into Fed independence, adding political volatility to monetary policy expectations.

✴️ Conclusion: The Fed is now politically cornered, caught between inflation resilience and political coercion.

⊢

▦ 16:00 PM - Market Response & Euphoria Spike:

∴ U.S. indices - S&P 500, Nasdaq, Dow Jones - all reached all-time highs on the back of Powell's phrase and Trump’s pressure;

∴ Approximately 80% of S&P companies beat earnings expectations, providing fuel to the narrative;

∴ Market interpreted silence as assent, reactivating the “Fed put” theory.

✴️ Conclusion: Markets responded as if Powell had already signaled rate cuts, despite no formal commitment.

⊢

▦ 18:00 PM - Rate Cut Probability Assessment - (CME/FedWatch):

∴ Probability of a rate cut in September rose to (61.8%), precisely echoing the Fibonacci retracement now governing Bitcoin price;

∴ This alignment signals macro-on-chain-temporal resonance;

∴ Powell reiterates data dependency - no promises, but full optionality.

✴️ Conclusion: The macro veil is thin - policy pivot is anticipated, but not yet manifest. Tactical patience is vital.

⊢

🜎 Strategic Insight - Macro Oracle:

∴ Economic data weakens subtly;

∴ Political pressure intensifies;

∴ Market euphoria resurfaces on whispers, not substance.

∴ The silence of Powell is being interpreted, not spoken - a dangerous act of collective projection.

✴️ Conclusion: The Fed speaks in veils - and markets trade in illusions. The macro climate is now psychologically unstable, but not yet structurally broken.

⊢

𓂀 Stoic-Structural Interpretation:

▦ Structurally Bullish - Tactically Suspended:

∴ Price action remains well supported above all macro EMA's (21, 50), the OBV is intact, and no distribution signals are present;

∴ Momentum indicators (RSI, MACD, Stoch RSI) confirm a tactical cooldown, not collapse;

∴ On-chain fundamentals (Netflows, Miner Behavior, SOPR, Funding) remain constructively aligned.

✴️ Conclusion: Structurally, the market preserves a bullish foundation, while tactically locked in volatility suppression and directional indecision.

⊢

▦ Tactical Range Caution:

∴ Resistance: $123,377.19 (Upper BB), then $126,000 (local expansion);

∴ Pivot: $117,800 (EMA9) / $116,000 (EMA21);

∴ Support: $113,013.15 (Fibonacci 0.618), $111,691.19 (EMA50), then $107,400 (macro reversal threshold).

✴️ Conclusion: Tactical range is compressed within a ($116K-$123K) gate. Below $111K triggers macro risk.

⊢

◩ Codicillus Silentii - Strategic Note:

∴ In the breath between policy and projection, the markets chant futures yet unspoken.

BTC rests not in fear, nor in hope - but in silence.

✴️ Final Seal: The arc is intact. The veil has not fallen. Patience is power.

⊢

⧉

· Cryptorvm Dominvs · MAGISTER ARCANVM · Vox Primordialis ·

⚜️ ⌬ - Silence precedes the next force. Structure is sacred - ⌬ ⚜️

⧉

⊢

▒₿▒ BITCOIN FORECAST | 6HR ▒₿▒Hello @everyone. Long time. . . I was on a 3 year spiritual journey. I am back now and have many good things in the works. Who took my (non-financial) advice 3 years ago when I called the low of $15K a year in advance? And who believed me that it would go to $150K once we hit that $15K low? Who believes me now? Are you still thinking we've topped? Or do you think we have our $150K target in sight?

Have a look at this 6 HR Forecast. We have a low coming around AUG 8TH at $108K. And the most notable ATH of $151K around SEPT 5TH.

This is it. The playbook years in advance. I have never asked for anything or tried to sell you anything. It's all been done from a position of "paying it forward". Please, if you've taken my advice do the same.

I first bought Bitcoin in 2011. Was part of the MT GOX hack. And have had many ups and downs since then. One thing has never changed. . . And that is that Bitcoin is King. It's an asset class and a hedge against inflation. We're seeing this happen more now than ever. It's only got inflation as the halvings continue. The inflation rate of Bitcoin since/after this last halving is 0.84%. Bitcoin is up over 120-Million percent since 2011. Look at the BTC 6 MONTH candle chart and you'll see what Crypto asset you want to be in. Bitcoin is the only crypto asset.

When I first bought BTC it wasn't possible to purchase on an exchange with a debit card. I had to buy Linden Dollars from "Second Life" (which didn't always work because I had to deal with International Payment Processors due to US restrictions), then convert them to BTC on Mt Gox. Hardware wallets were not a thing. Now you can setup your bank account to auto buy on Coinbase and others. It's easier than ever. Store your coins on a hardware wallet and stay protected from the next FTX or hack.

This is the asset of the future. The "Digital Gold". I've seen the future and it runs on Blockchain and digital/virtual currency. A Super Artificial Intelligence will run and optimize all of our systems. Voting, assets, deeds, ownership and more will all be on a public blockchain ledger.

DEMATERIALIZATION/VIRTUALIZATION

INFORMATION & MEDIA

Music

We had music being played using metal, tin and wax in the 1800's, then mid 1900's we went to Vinyl and later in the late 1900's we went to plastic cassettes. And in 1990 - 2000 we had the CD which used laser optics to play the music. Effectively digitizing it. Then of course the MP3 player which was the next evolution in digitization. But where are we now? We are still in a type of digitization however it's evolved also. We are in a virtualization, where the music is not stored on the device itself, it's stored on servers which host the data to be accessed in the cloud/virtually.

You see the progression?

Metal/Wood > Vinyl/Plastic > Plastic/Digital > Metal/Digital > Virtual

(Or even further simplified on a higher level it would be Thoughts > Things > Digital > Virtual >)

What else has taken this path?

Movies

Metal/Wood - Film Projectors & Metal Reels

Plastic - Video Cassettes

Plastic/Digital - Optical Discs

Metal/Digital - Personal Digital Devices

Virtual - Cloud-Based Streaming

Books & The Written Word

Metal/Wood - The Printing Press

Paper/Plastic - Paperback Books

Plastic/Digital - Digital Archives on Discs

Metal/Digital - Handheld E-readers

Virtual - Cloud Libraries & Audiobooks

Money & Finance

Metal/Wood - Gold & Silver Coins (and even wooden coins)

Plastic - Payment Cards

Plastic/Digital - Secure Chip Cards

Metal/Digital - Mobile & Digital Wallets

Virtual - Digital/Crypto Currencies

This is the natural progression path. Are you the one still listening to cassette tapes while the MP3 player exists? Are you still using a physical thing while the virtual exists? (Nostalgia aside.)

NOW IS THE TIME!

Gold has been virtualized and it's called Bitcoin. While trading at 1,200,000 times more than it was 14 years ago it still has not yet realized it maximum value. In the past Gold and Silver were taken and bank/promissory notes were given in exchange. In fact it became illegal to not exchange your Gold and Silver for Dollars in the US. (1933 with the issuance of Executive Order 6102 by President Franklin D. Roosevelt.) The Dollar has no cap and is no different than Doge in that sense. BTC has a cap and a proof of work concept just like Gold. If you need to pay for things convert your BTC when you need to but holding or planning on making money off any other crypto currency that does not provide a base layer for our new virtualized financial infostructure it will not happen.

BITCOIN IS FINANCIAL LIBERATION FOR YOU, YOUR FAMILY, FRIENDS AND LEGACY.

BTC is up 3,000% in the past five and half years alone.

That's a 5.45 X Multiple per year. 545% growth rate compared to the unlimited and inflationary Dollar. Why not setup a reoccurring dollar cost average automatic purchase? We live in a day of virtualized programable currency, why not convert vapor currency to digital gold with the few clicks?

I am not a financial advisor. I am a Bitcoin Maximalist. Trade at your own risk. Assume your own responsibilities.

I have a big project I'm working on right now but also working on some TV Indicators in the background. I will share them with you all once I'm done testing them.

DISCLAIMER

I AM NOT A FINACIAL ADVISOR, NOR AM I YOURS. THIS IS NOT FINANCIAL ADVICE. MEARLY DOODLINGS ON A MATHMATICALLY DRIVEN GRAPHICAL INTERFACE, TRACKING AN INVISIBLE 256BIT MILITARY-GRADE ENCRYPTED ASSET. . . FOR ENTERTAINMENT/AMUSEMENT PUROSES ONLY. ENJOY!

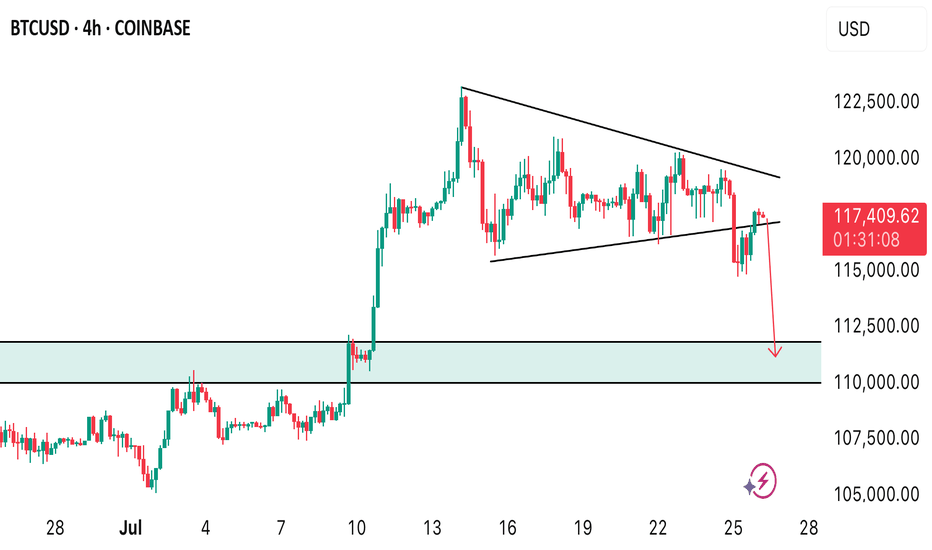

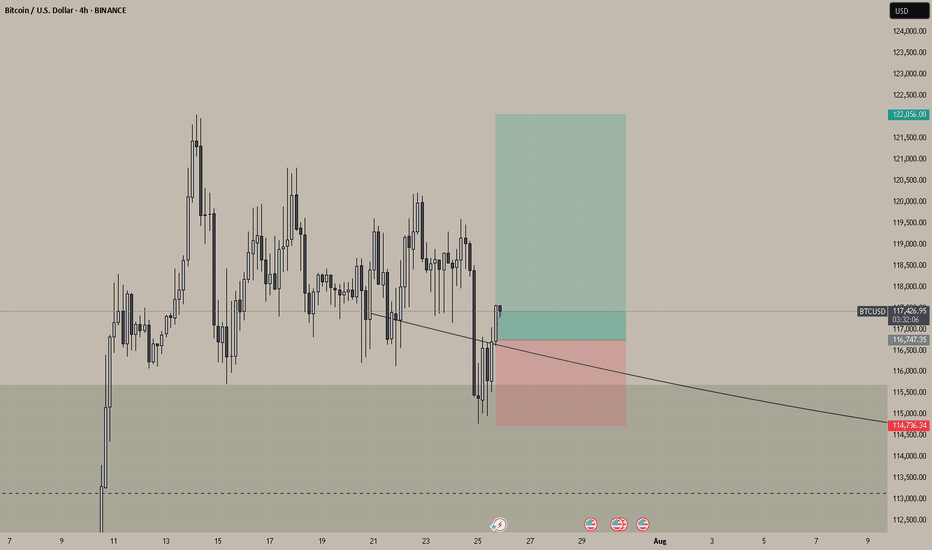

Bitcoin on the edge – Is a sharp drop coming?Bitcoin is keeping investors on edge as price action remains volatile and primed for an explosive move once news or capital flows ignite the market.

🌍 Latest market updates:

– Whales are back in accumulation mode, with on-chain data showing large wallets growing rapidly.

– The U.S. government has just transferred a significant amount of BTC to exchanges — is a dump coming?

– U.S. spot Bitcoin ETFs are witnessing record inflows after CPI came in lower than expected, fueling hopes that the Fed will pause further rate hikes this year.

📉 Technical outlook:

– On the H4 chart, BTC formed a tightening wedge pattern, which has now broken to the downside.

– A steep drop toward the 113,000 to 110,000 USD zone is entirely possible.

This looks like a classic break-retest setup — a golden window for strategic entries. If sell volume surges, it could be the perfect moment for bears to strike.

Stay sharp — and good luck!

going lower or bouncing on resistance? market is respecting key support/resistance or channel boundaries. These points often become decision zones where big moves occur.

Signs this could be a fakeout:

BTC wicks above a resistance or below a support with little follow-through

Volume spikes only on the wick, then dies quickly

Price reverses back into the range soon after breaking it

If BTC recently broke a trendline with low volume, it smells like a trap move — a liquidity grab.

If it’s testing support again after failing to rally, and volume is increasing on red candles, a leg down is possible.

However, macro trend is still up unless we lose a major higher low (say, sub-$60k or sub-$56k depending on your chart).

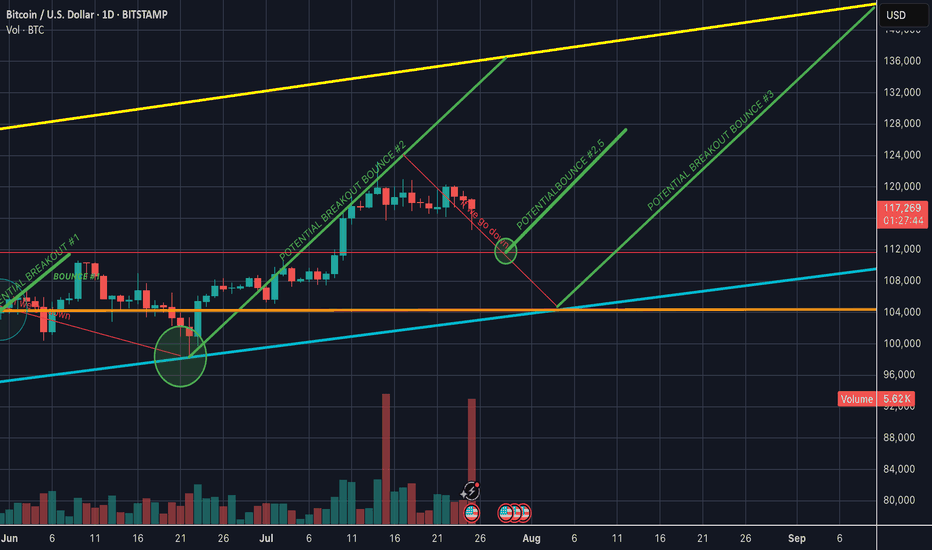

BTC LONG SWING ENTRY OFF PREVIOUS LOW AREASWe are looking to make a BTC long entry on previously supported levels using just chart analysis. Looking at a rebound on a daily actual range trade where add on possible reversal and scale out into the a new local high.

In short, buying the gold, adding in the blue, scaling out into the green.

As you can see been a while so playing this small, getting back into the action