BITCOIN trade ideas

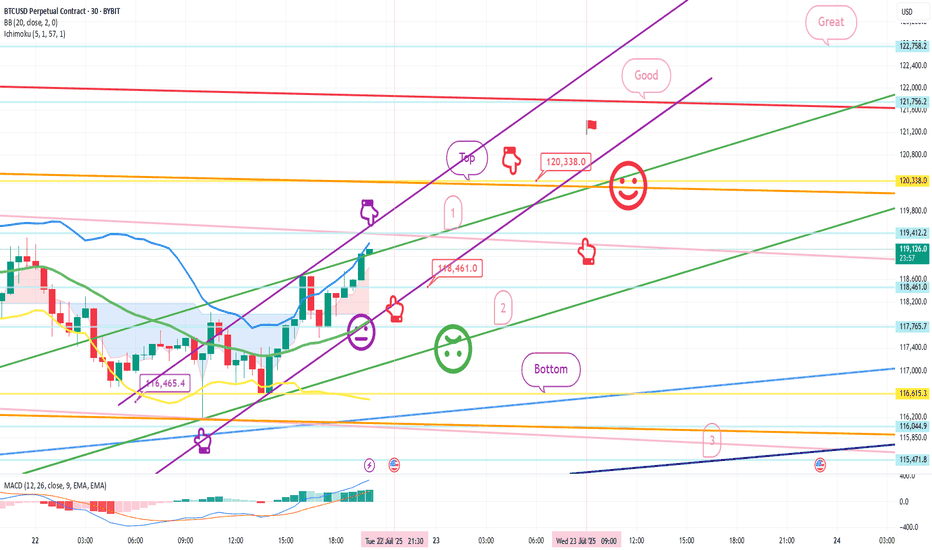

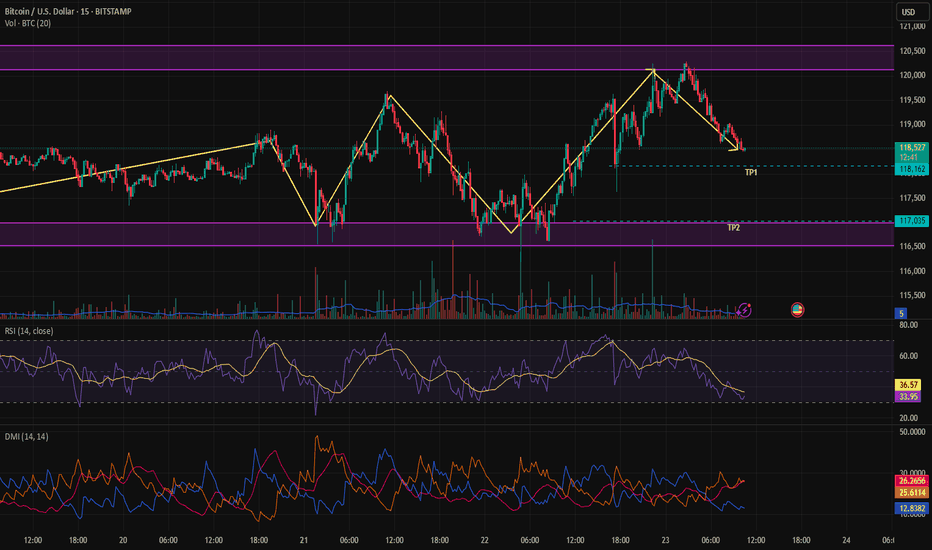

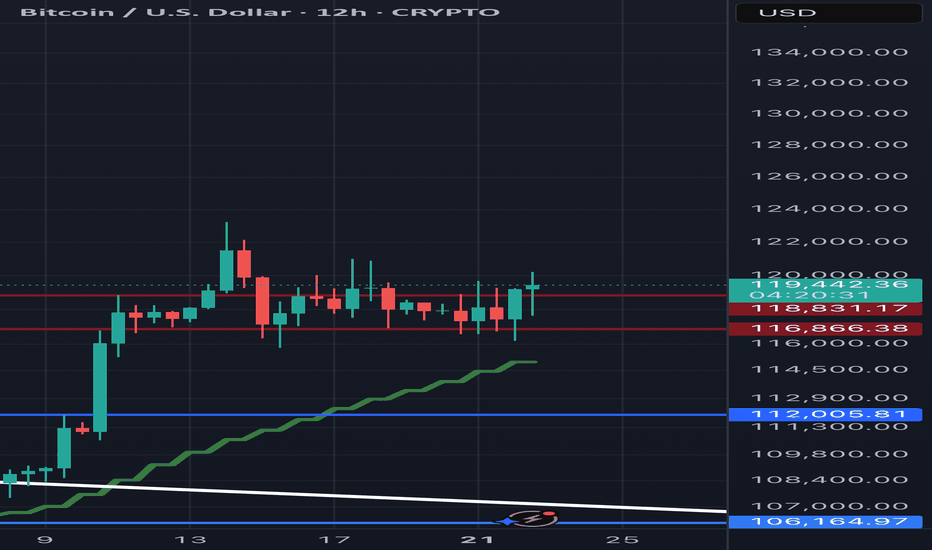

July 22 Bitcoin Bybit chart analysisHello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

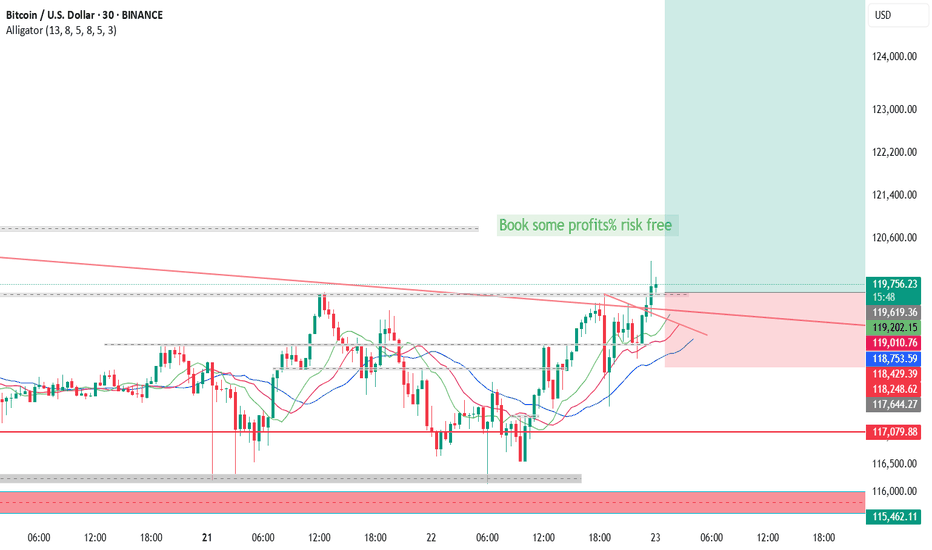

This is Bitcoin's 30-minute chart.

Nasdaq indicators will be released at 9:30 in a little while.

Although Bitcoin's mid-term pattern is broken,

it looks like a strong upward trend based on signals and candlestick positions.

In the case of Nasdaq, the 6-hour and 12-hour charts MACD dead cross is in progress,

and even if there is no plunge and only a sideways movement,

it seems likely that today's strategy will be successful.

In the bottom left, from the analysis article on the 18th,

the final long position entry point of $116,465.4 Bottom

is connected as is.

*Red finger movement path

One-way long position strategy

1. $118,461.9 long position entry section / green support line breakout, stop loss price

2. $120,338 long position 1st target -> Good, Great in order of target price

See the 1st section at the top as a touch section for an upward wave rather than a short position entry,

and if this section breaks through right away, an upward trend can be connected.

If the purple parallel line support line is maintained without breaking away,

there is a possibility of a vertical rise.

If the top section is touched,

after the first liquidation,

it would be good to use the 1st section to re-enter a long position.

The 2nd section at the bottom is important,

and if it is pushed to this section according to the movement of Nasdaq today,

it can fall strongly.

Please check the real-time support line shape.

From the breakout, Bottom -> 3 sections are open.

If you touch the 3rd section after tomorrow, the mid-term pattern will be restored.

This is the 12+ day section.

Up to this point, I ask that you simply use my analysis for reference and use only.

I hope that you will operate safely with the principle of trading and stop loss.

Thank you.

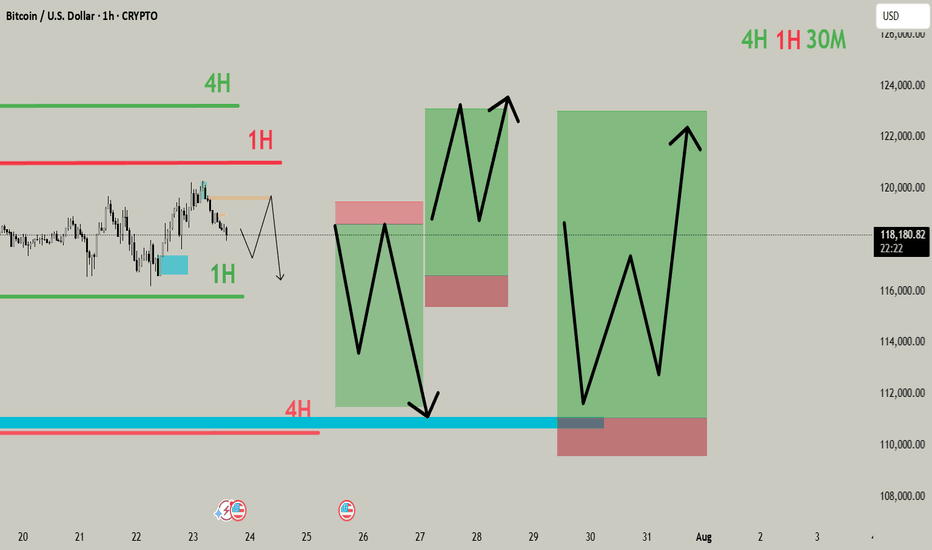

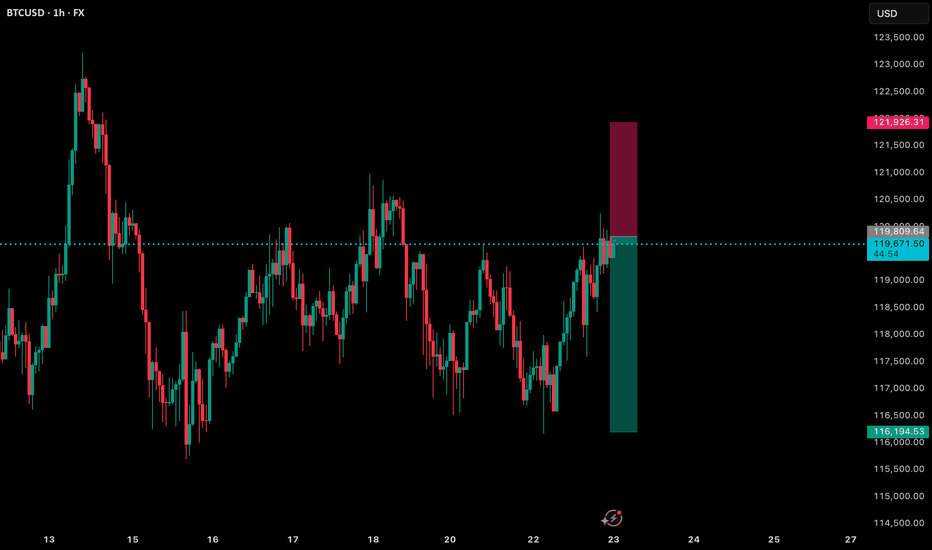

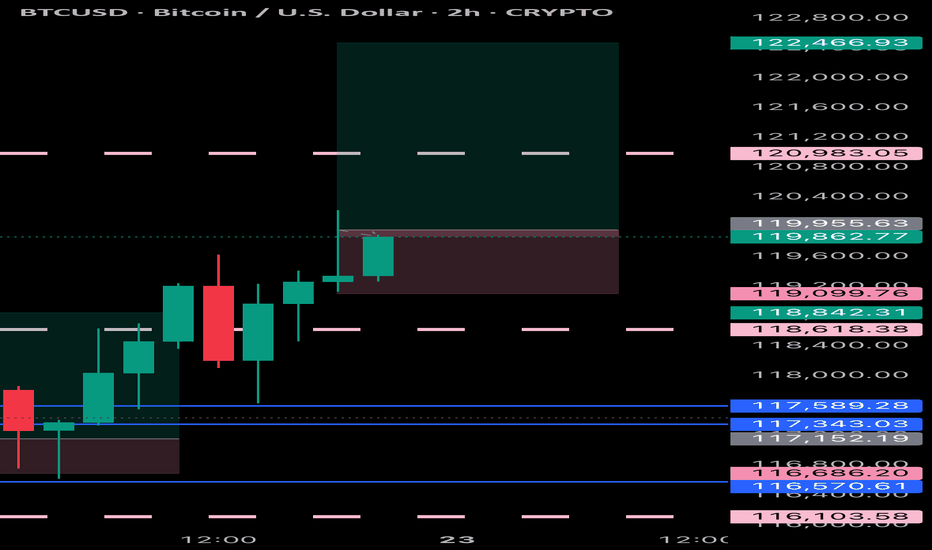

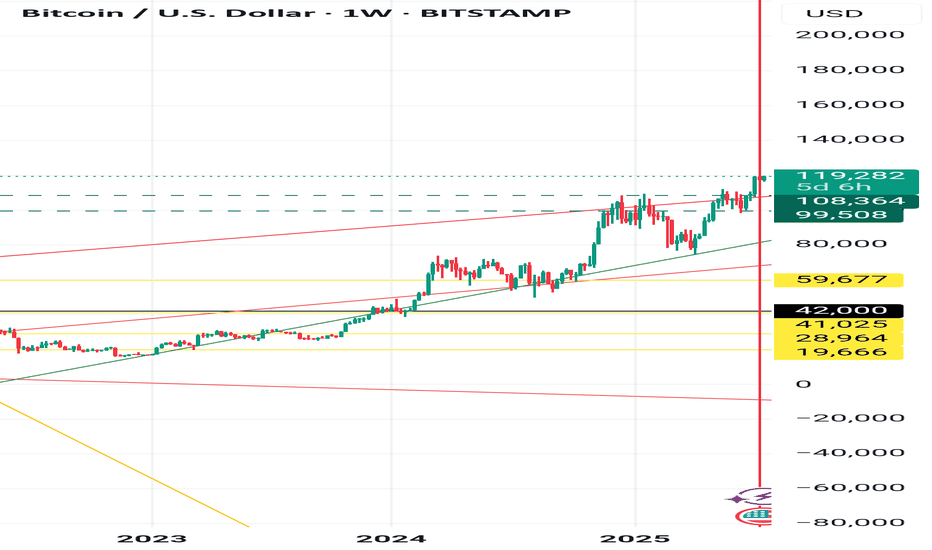

BITCOIN - Entry on basis of Internal CHOCH & (Demand/supply).1. Trade Prediction Breakdown

Current Price: ~117,967

Short-Term Bias (1H):

Expecting a minor pullback/retrace toward a small 1H supply (orange line), then a drop.

This internal structure sets up a CHOCH.

Mid-Term Setup:

Price is projected to dip into the 4H demand zone (~112,000–114,000), confirming a bullish mitigation zone.

After demand is tapped → Expect bullish BOS (Break of Structure) to resume higher timeframe uptrend.

Entry Logic:

Aggressive Entry: Sell from 1H supply (small RR setup).

Main Entry: Buy from 4H demand after price shows bullish internal structure (e.g., bullish CHOCH or BOS on LTF like 15M/30M).

🧠 Key Concepts Applied:

Concept How it's used in this chart

CHOCH Signals potential reversal in short-term structure

Supply Zone (1H) Short entry trigger area

Demand Zone (4H) Expected strong bounce area

Internal Structure Used to time entries and CHOCHs

External Structure Governs overall trend and swing direction

✅ Final Trade Idea Summary:

🔽 Short-Term Sell from 1H supply zone.

📉 Target = 4H Demand Zone (112k–114k).

🔼 Buy from 4H Demand after confirmation (expecting strong upward rally).

🎯 Final target = 122k+ area (based on external bullish structure).

Let me know if you want this turned into a trade journal

Protect Capital First, Trade SecondIn the world of trading, mastering technical analysis or finding winning strategies is only part of the equation. One of the most overlooked but essential skills is money management. Even the best trading strategy can fail without a solid risk management plan.

Here’s a simple but powerful money management framework that helps you stay disciplined, protect your capital, and survive long enough to grow.

✅1. Risk Only 2% Per Trade

The 2% rule means you risk no more than 2% of your total capital on a single trade.

-Example: If your trading account has $10,000, your maximum loss per trade should not exceed $200.

-This protects you from large losses and gives you enough room to survive a losing streak without major damage.

A disciplined approach to risk keeps your emotions under control and prevents you from blowing your account.

✅2. Limit to 5 Trades at a Time

Keeping your number of open trades under control is essential to avoid overexposure and panic management.

-A maximum of 5 open trades allows you to monitor each position carefully.

-It also keeps your total account risk within acceptable limits (2% × 5 trades = 10% total exposure).

-This rule encourages you to be selective, focusing only on the highest quality setups.

Less is more. Focus on better trades, not more trades.

✅3. Use Minimum 1:2 or 1:3 Risk-Reward Ratio

Every trade must be worth the risk. The Risk-Reward Ratio (RRR) defines how much you stand to gain compared to how much you’re willing to lose.

-Minimum RRR: 1:2 or 1:3

Risk $100 to make $200 or $300

-This allows you to be profitable even with a win rate below 50%.

Example:

If you take 10 trades risking $100 per trade:

4 wins at $300 = $1,200

6 losses at $100 = $600

→ Net profit = $600, even with only 40% accuracy.

A poor RRR forces you to win frequently just to break even. A strong RRR gives you room for error and long-term consistency.

✅4. Stop and Review After 30% Drawdown

Drawdowns are a part of trading, but a 30% drawdown from your account's peak is a red alert.

When you hit this level:

-Stop trading immediately.

-Conduct a full review of your past trades:

-Were your losses due to poor strategy or poor execution?

-Did you follow your stop-loss and risk rules?

-Were there changes in the market that invalidated your setups?

You must identify the problem before you continue trading. Without review, you risk repeating the same mistakes and losing more.

This is not failure; it’s a checkpoint to reset and rebuild your edge.

Final Thoughts: Survive First, Thrive Later

In trading, capital protection is the first priority. Profits come after you've mastered control over risk. No trader wins all the time, but the ones who respect risk management survive the longest.

Here’s your survival framework:

📉 Risk max 2% per trade

🧠 Limit to 5 trades

⚖️ Maintain minimum 1:2 or 1:3 RRR

🛑 Pause and review after 30% drawdown

🧘 Avoid revenge trading and burnout

Follow these principles and you won't just trade, you'll trade with discipline, confidence, and longevity.

Cheers

Hexa

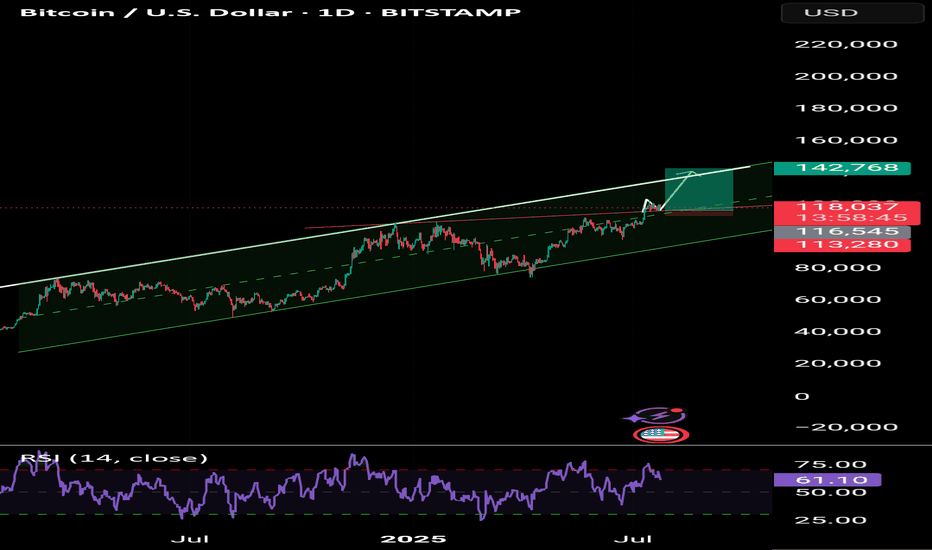

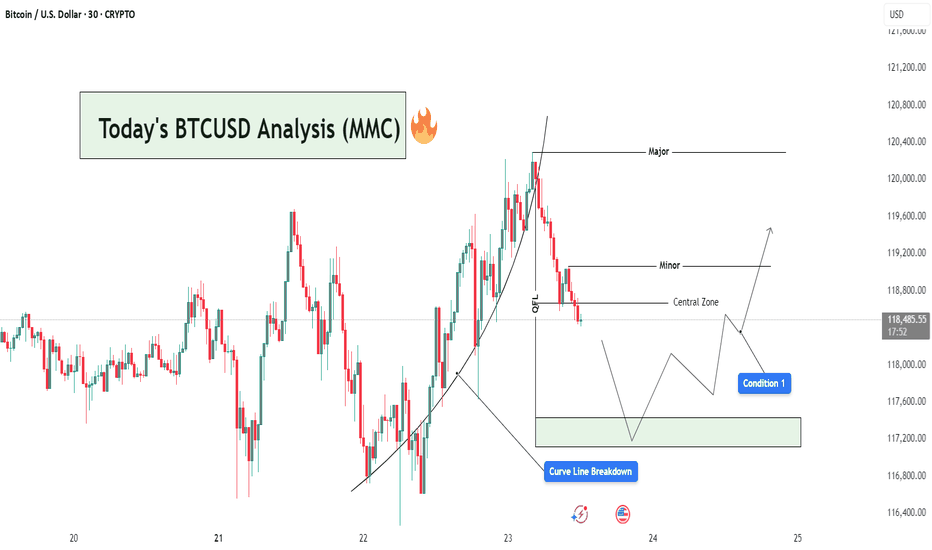

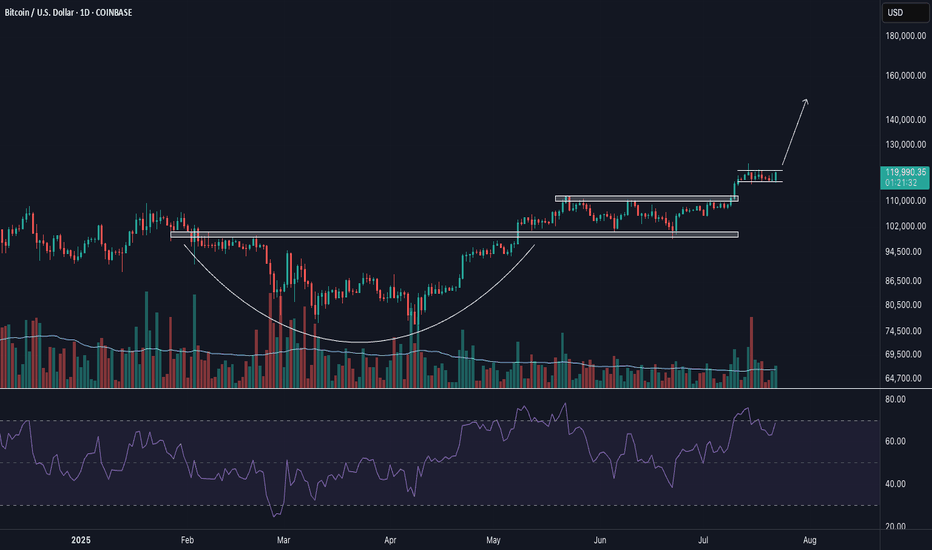

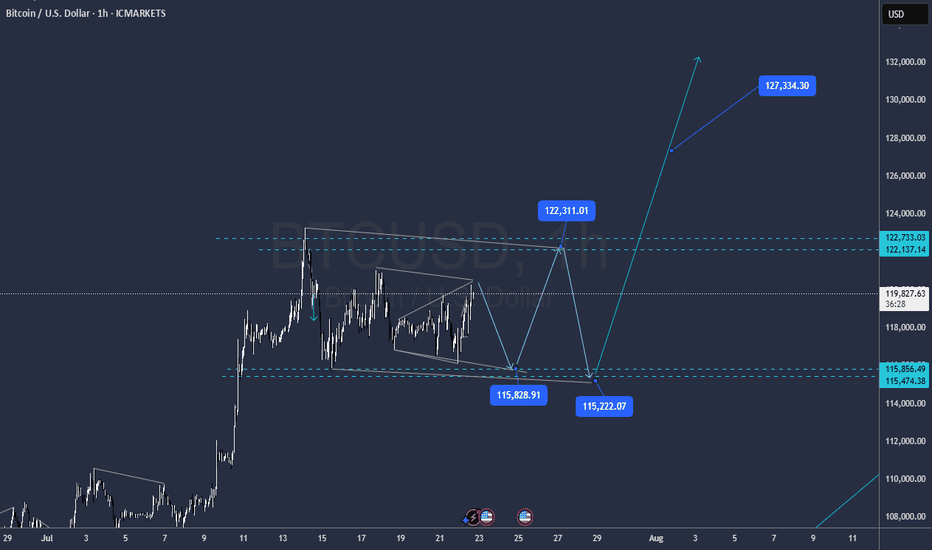

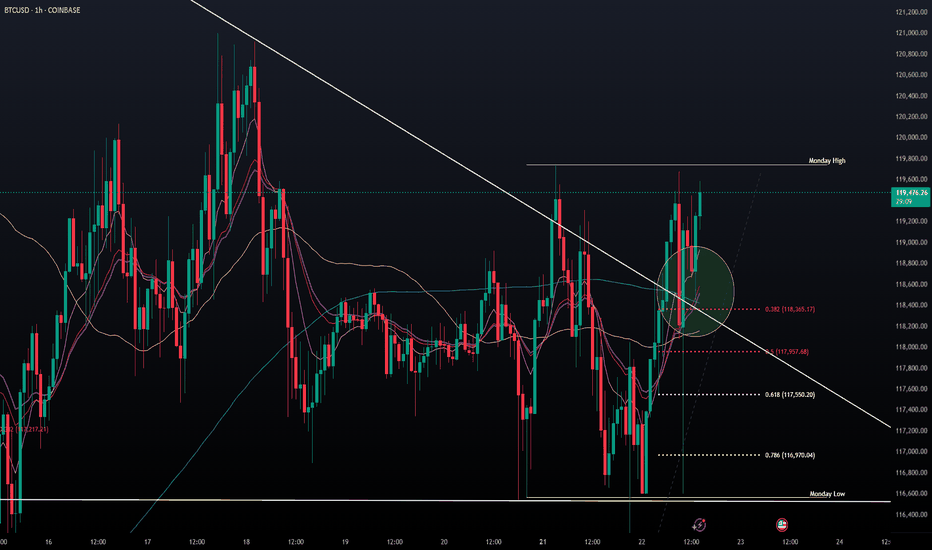

BTCUSD Analysis : Curve Line Breaked and Move Towards Target📊 Market Overview:

BTCUSD has recently completed a strong bullish leg, following a parabolic curve formation that led price into a Major Resistance Zone near the $120,400 level. This rally aligns with MMC principles where price forms momentum-driven structures before reaching high-liquidity zones (often ending in exhaustion).

📍 1. Curve Line Support & Breakdown – A Shift in Sentiment

Your chart shows a clear Curve Line that supported the bullish impulse. Price respected this dynamic support throughout the uptrend until a Curve Line Breakdown occurred—marking the first sign of bullish weakness.

In MMC strategy, this curve structure breakdown is critical:

It tells us the accumulation → expansion → exhaustion cycle is ending.

The market is likely entering retracement or distribution phase.

Price often seeks lower equilibrium, typically around the Central Zone.

🧠 2. QFL Zone (Quick Flip Level) – The Hidden Base

Immediately after the curve broke, price moved toward the QFL level, which represents a demand base from earlier structure. This zone acts as a short-term support and often produces a reactive bounce (but not always a reversal).

Watch closely:

If price respects this zone → temporary relief bounce

If it fails → we’ll likely see full test of Central Zone or lower demand levels

🟩 3. Central Zone – The MMC Decision Area

The Central Zone is a key horizontal level on your chart, defined between ~$117,300 and ~$118,200. This zone is marked based on:

Previous structure

Volume clusters

Demand imbalance

Why is this zone important?

It serves as the balance point between buyers and sellers.

A bullish reaction here could re-initiate a move toward Minor Resistance (~$119,200).

A failure to hold could open the door for deeper retracement toward the green demand box (~$117,200 or below).

🔄 4. Two Primary MMC-Based Conditions to Watch:

✅ Condition 1: Bounce from Central Zone

Price reacts from within the Central Zone

Forms bullish structure (double bottom, bullish engulfing, or reversal wick)

Short-term target becomes Minor Resistance (~$119,200)

If volume increases and price breaks above Minor, continuation toward Major is possible

❌ Condition 2: Breakdown & Bearish Continuation

Price fails to hold within Central Zone

Bearish structure forms (e.g. lower highs, breakdown candles)

Clean move expected toward next liquidity pocket at $117,200–$116,800

This would confirm market shifting into bearish control

📌 5. Minor vs Major Levels – Key Zones

Minor Resistance (~$119,200): Short-term target if bounce occurs

Major Resistance (~$120,400): Liquidity sweep zone, strong supply

Green Demand Box (~$117,200): If Central Zone fails, this becomes next bounce zone

📘 Final Thoughts:

This is a classic MMC setup in real-time:

Curve Formed → Broke

OFL + Central Zone → Now being tested

Next move depends on confirmation from buyers or sellers at Central Zone

Don’t trade emotionally — let price action give you confirmation before taking any positions. Watch the Central Zone behavior closely and manage risk based on scenario outcomes.

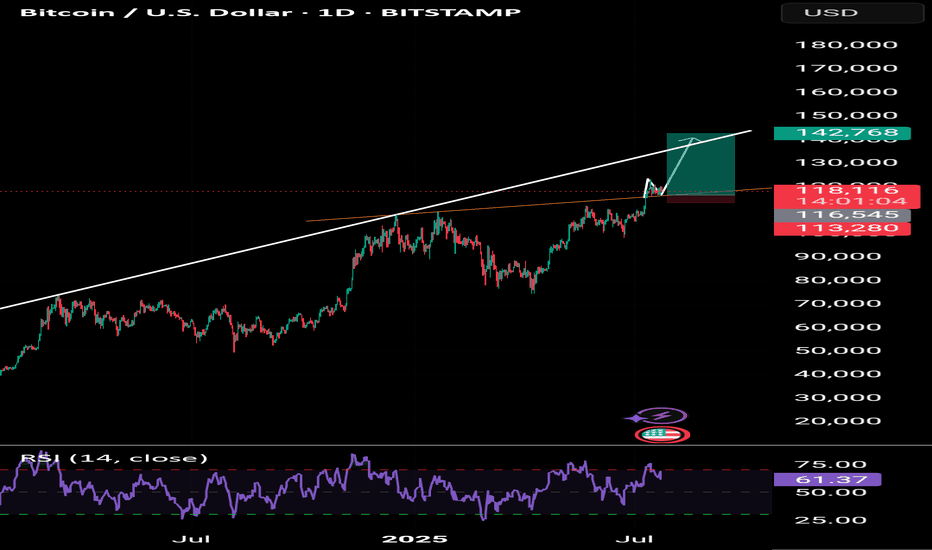

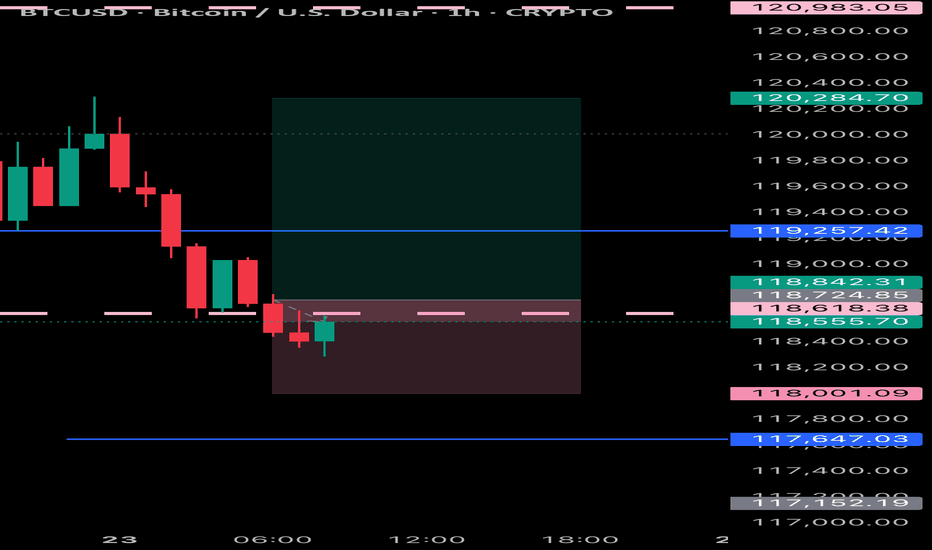

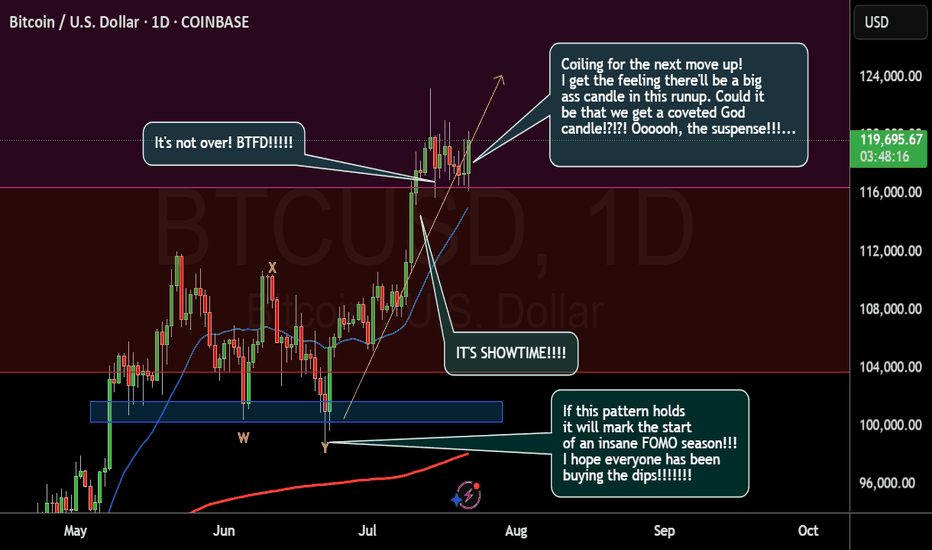

Price is approaching the bottom of the rangeAs mentioned in our previous analysis, the price had reached the top of the range. At that stage, we had two options: wait for a confirmed breakout to the upside, or take a reactive position anticipating a move toward the bottom. Now, we are seeing price action moving toward the lower boundary of the range.

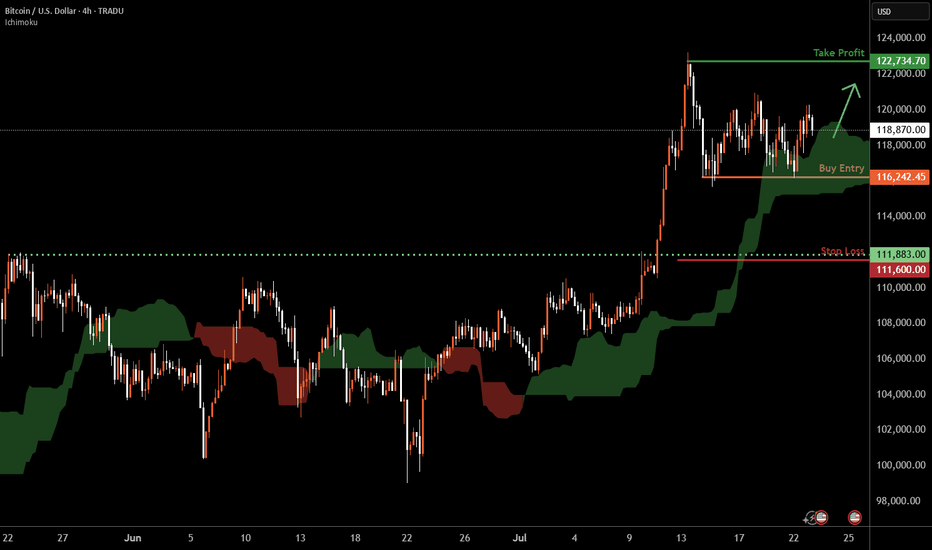

Bitcoin H4 | Crypto to remain elevated?Bitcoin (BTC/USD) is falling towards a multi-swing-low support and could potentially bounce off this level to climb higher.

Buy entry is at 116,242.45 which is a multi-swing-low support.

Stop loss is at 111,600.00 which is a level that lies underneath a pullback support.

Take profit is at 122,734.70 which is a swing-high resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

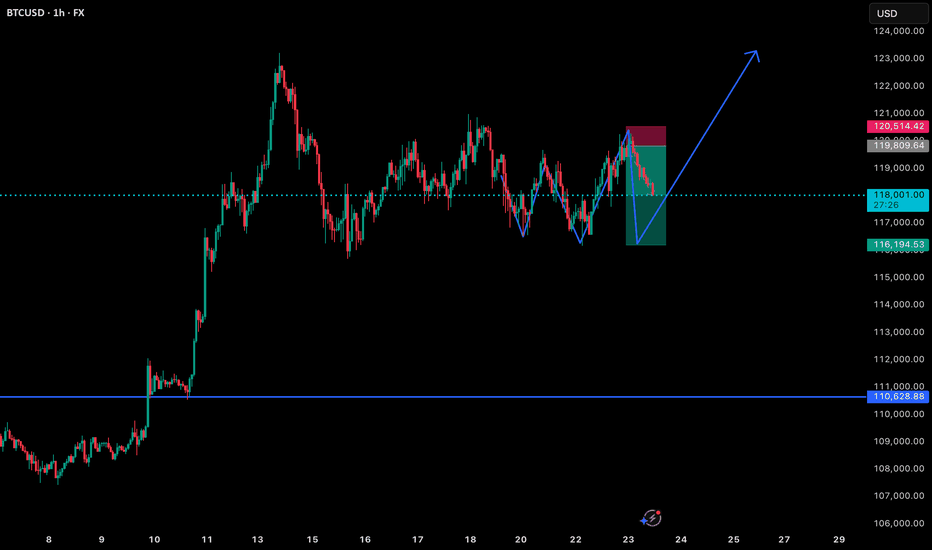

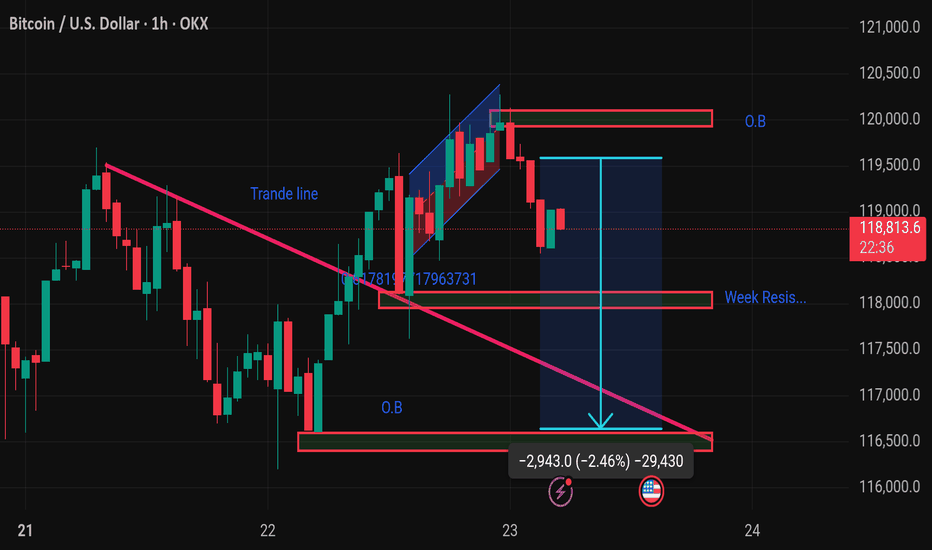

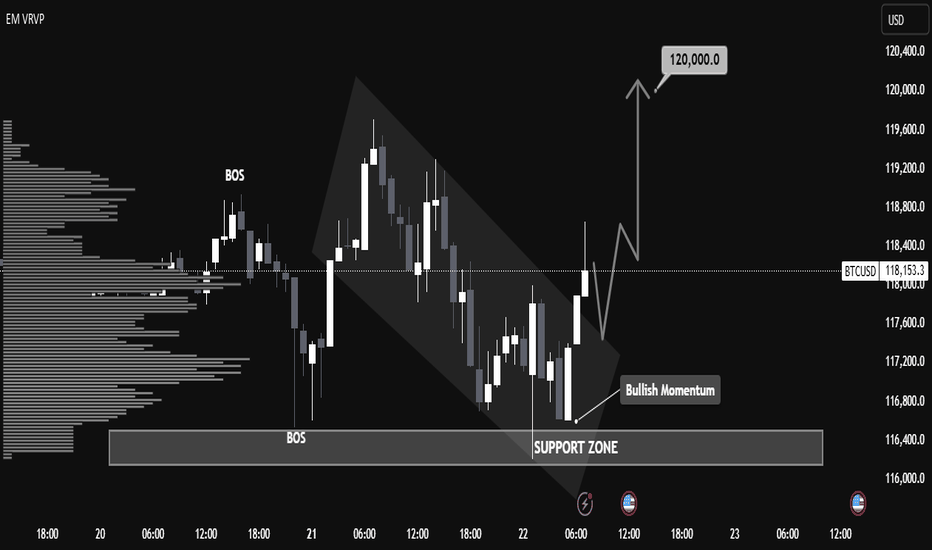

"BTC/USD Breakout Strategy: Identifying Bullish Momentum BTC/USD Technical Analysis – July 22, 2025

📈 Market Structure Overview:

The chart illustrates a recent Break of Structure (BOS) both to the upside and downside, indicating volatility and a shift in market sentiment. The price action formed a descending channel, followed by a breakout with strong bullish candles, suggesting a momentum reversal.

🧱 Support Zone (Demand Area):

Key Level: $116,400 – $116,900

This zone has acted as a strong demand level, with clear evidence of buying pressure pushing BTC higher after testing this area. The volume profile (VRVP) supports this, showing heightened trading activity at this price.

🔄 Bullish Breakout Confirmation:

A bullish breakout from the descending channel occurred just above the support zone, aligning with the label "Bullish Momentum".

The breakout candle has closed above minor resistance, which increases the probability of a trend reversal.

📍 Price Target:

The projection points toward $120,000, aligning with previous resistance and psychological round-number resistance.

This target is highlighted by an expected bullish leg after a possible retest of the breakout zone around $117,500 – $117,800.

🧭 Key Levels to Watch:

Support: $116,400 – $116,900

Retest Zone (Buy Opportunity): $117,500 – $117,800

Immediate Resistance: $118,400

Major Resistance / Target: $120,000

📊 Summary:

BTC/USD has shown a bullish reversal signal from a well-respected support zone after a descending correction phase. The current price structure, volume buildup, and breakout momentum suggest a high probability of continued upside movement toward the $120,000 mark. A successful retest of the breakout zone would provide a strategic entry for long positions with tight risk management.