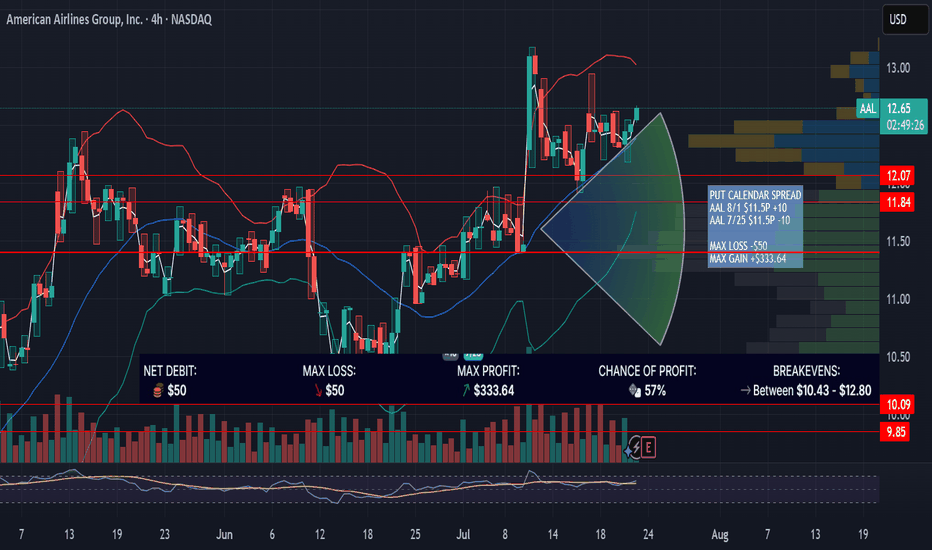

AAL PUT CALENDAR SPREAD / EARNINGSAAL is up 11% since 7/9/25 with a gap up riding on earnings of its competitor DAL. AAL earnings are in the morning on 7/24/25. Looking for a "sell the news" event with a good risk/reward options trade. This trade is designed for price to settle near the high volume node at $11.50 near expiration on 7/25/25.

PUT CALENDAR SPREAD

AAL 8/1 $11.5P +10

AAL 7/25 $11.5P -10

MAX LOSS -$50

MAX GAIN +$333.64

AAL trade ideas

$AAL – Turbulence Over? Prepping for Altitude Reclaim (13.76+ Ta✈️ 📅 Date: July 3, 2025 | 🧠 Source: VolanX Hybrid Predictor + SMC Confluence

📍 WaverVanir International LLC

🧭 Macro Backdrop

Fed on Pause, Dollar Cooling → Creates tailwinds for airlines by lowering hedging costs and boosting consumer demand.

Jet Fuel Prices Stable → Crude hovering under $85 keeps operating costs from spiking.

Summer Travel Boom → TSA throughput at 2024 highs, with international and premium segments driving demand. Domestic may lag, but offset by credit card spend rev share.

🧾 Fundamentals

✅ Q1 2025 Net Income Beat: $1.7B FCF, strong card-linked revenue via Barclays/Citi partnerships.

🔁 Deleveraging Story: Reduced net debt, capital discipline post-2023 downcycle.

🧮 P/E Compression Reversal: At 4.9x forward earnings, upside mean reversion likely.

📊 Credit Upgrade Watch: S&P hinted at revision if cash flow stabilizes above 3 quarters.

💬 Sentiment + VolanX Model

🤖 LSTM-GRU Hybrid Predictor: Signals an accelerating uptrend toward $13.70+ by early August.

📈 Model Stats: 50 Epochs | Batch 16 | 100 LSTM / 80 GRU Units | Dropout 0.3

🧠 Sentiment Score: +0.10 → Reflects mildly bullish tone from media & institutional coverage.

🧮 SMC + Fibonacci Confluence

📉 Breakout Confirmed above descending trendline & prior CHoCH zone at $11.70–11.86.

🔥 Liquidity Sweep Complete below $10.30 – smart money accumulation evident.

🎯 Next Zones:

Fibo 1.0 → $12.45

Fibo 1.236 → $13.27

🔱 Equilibrium Zone → $13.76 (main target)

Fibo 1.382 → $13.78 = institutional exit likely

🎯 Trade Plan – Probabilistic Setup

Element Value

Entry Zone $11.75–11.90

SL Below $11.10 (2.5% risk)

TP1 $12.45

TP2 $13.27

TP3 $13.76 (equilibrium)

RR Ratio ~3.8R (high-conviction)

Confidence 🔵 76% short-term uptrend probability (VolanX LSTM)

🛡️ Risk Management

Size for 0.5–1% capital risk if SL triggered.

Avoid overleveraging due to geopolitical/airline sensitivity.

Reduce exposure if $12.05 rejects on volume.

📌 Summary

AAL is breaking out of a multi-month compression with fuel prices in check, debt reduced, and passenger volume growing. VolanX AI expects a move to $13.76 with high probability—if confirmed, this trade offers strong asymmetric upside into late July / early August.

📉 Disclaimer: Not financial advice. Educational use only.

🏛 WaverVanir International LLC | AI-Driven Institutional Strategy

🔗 Follow for SMC + AI-backed trading intelligence.

American Airlines Stock Chart Fibonacci Analysis 061625Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 10.6/61.80%

Chart time frame:B

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress:A

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E) Hit the top

Stocks rise as they rise from support and fall from resistance. Our goal is to find a low support point and enter. It can be referred to as buying at the pullback point. The pullback point can be found with a Fibonacci extension of 61.80%. This is a step to find entry level. 1) Find a triangle (Fibonacci Speed Fan Line) that connects the high (resistance) and low (support) points of the stock in progress, where it is continuously expressed as a Slingshot, 2) and create a Fibonacci extension level for the first rising wave from the start point of slingshot pattern.

When the current price goes over 61.80% level , that can be a good entry point, especially if the SMA 100 and 200 curves are gathered together at 61.80%, it is a very good entry point.

As a great help, tradingview provides these Fibonacci speed fan lines and extension levels with ease. So if you use the Fibonacci fan line, the extension level, and the SMA 100/200 curve well, you can find an entry point for the stock market. At least you have to enter at this low point to avoid trading failure, and if you are skilled at entering this low point, with fibonacci6180 technique, your reading skill to chart will be greatly improved.

If you want to do day trading, please set the time frame to 5 minutes or 15 minutes, and you will see many of the low point of rising stocks.

If want to prefer long term range trading, you can set the time frame to 1 hr or 1 day.

American Airlines Group Inc.Key arguments in support of the idea.

International routes continue to show strong demand. While the U.S. domestic market is facing challenges—especially in the low-cost carrier (LCC) segment—the company is capitalizing on inbound foreign tourism. However, it's worth noting that the U.S. Travel Association (USTA) reports the opposite trend: domestic tourism demand from U.S. citizens remains strong. We expect conditions in domestic flights to improve by summer 2025. During the reporting period, American Airlines highlighted that its premium offerings continue to drive revenue growth, and demand from American travelers for international flights remains steady.

AAL continues to rebuild its indirect sales channels, which is helping to expand its flight schedule in the short term. Following an acknowledgment of operational missteps in summer 2024, this recovery is not only helping to sustain current sales levels but also enabling the airline to better monetize its loyalty program.

Progress in tariff negotiations has given the stock a strong boost. Currently, AAL shares are trading with an RSI near overbought territory. However, if political progress continues, this momentum could very well be sustained. The recent formation of a technical "double bottom" pattern supports this possibility.

The 2-month target price for AAL is $14.9. We recommend setting a stop loss at $10.4.

AAL in a massive Weekly Demand! OptionsMastery:

🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

AAL American Airlines Group Options Ahead of EarningsIf you haven`t bought the dip on AAL:

Now analyzing the options chain and the chart patterns of AAL American Airlinesprior to the earnings report this week,

I would consider purchasing the 9usd strike price Puts with

an expiration date of 2025-5-2,

for a premium of approximately $0.44.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking

I. Company Overview

American Airlines (NASDAQ: AAL) is one of the largest legacy carriers in the U.S. and globally, operating thousands of daily flights across a vast domestic and international network. It’s a key player in the post-pandemic recovery of the airline industry, though burdened by high debt and competitive pressures.

II. Fundamental Analysis

Revenue & Earnings Trends

• 2024 Revenue: $54.2 billion (+2.7% YoY)

• Net Income: $846 million (+2.9% YoY)

• Gross Margins: Relatively thin, typical of airline business models

• Q1 2025 Forecast: EPS of –$0.69, showing a 102.9% YoY decline

• Revenue Guidance: ~$12.5 billion for Q1 2025 (flat YoY)

Interpretation: While annual performance in 2024 showed moderate growth, Q1 2025 signals a troubling start, likely due to higher operating costs (especially fuel and labor), weak demand in off-peak periods, and price sensitivity from consumers.

Balance Sheet & Liquidity

• Cash & Equivalents: ~$9.4 billion (strong buffer)

• Total Debt: ~$43 billion

• Debt/Equity Ratio: Over 6.0 (very high)

Interpretation: AAL has a heavy debt load incurred largely during COVID-19, which continues to weigh on its earnings through high interest expenses. Liquidity is manageable, but the capital structure is a major risk.

III. Technical & Valuation Overview

Current Price: ~$9.46 (April 2025)

• 52-week range: $8.50 – $19.10

• P/E Ratio: ~7.3x (based on trailing earnings)

• Forward P/E: Likely higher due to expected earnings contraction

• Price/Sales: ~0.12x — suggests undervaluation compared to peers

Valuation Takeaway: AAL appears cheap on a price/sales basis, but not necessarily undervalued, as the risks (debt, declining earnings) are baked into its price. The stock is heavily cyclical and sentiment-driven.

IV. Analyst Sentiment & Forecast

Analyst Ratings:

• Consensus: Hold to Moderate Buy

• Average Price Target: ~$15.79 (66% upside from current levels)

• High Target: $26.00

• Low Target: $8.00

Key Bullish Points:

• Recovering international and business travel demand

• Higher-margin premium cabin growth

• Capacity expansion in key routes

Bearish Points:

• Debt burden and rising interest costs

• Union negotiations and wage pressures

• Vulnerability to oil price spikes and economic downturns

V. Prediction & Outlook (Short to Medium Term)

Short-Term (0–6 months):

• Volatility likely around Q1 earnings and summer travel season guidance.

• Potential range: $8.00 to $12.00

• Negative EPS in Q1 could suppress investor confidence, but any signs of strong summer bookings might reverse the narrative.

Mid-Term (6–12 months):

• If macro conditions hold steady (moderate inflation, no recession), and travel demand continues, AAL may recover to $13–$16 range.

• Debt overhang will limit aggressive upside.

• Investor focus will shift to 2025 profitability guidance and cost-cutting initiatives

VI. Investment Thesis Summary

Strengths Weaknesses

Strong brand and route network Very high debt load

Cash reserves Earnings pressure from high costs

Rebounding premium travel Thin margins, labor disputes

Bottom Line:

American Airlines is a high-risk, high-reward cyclical play. While trading at a depressed valuation, long-term upside hinges on improving operational efficiency, macroeconomic stability, and a successful summer travel season. The next 2 quarters are critical pivot points.

If you’re a speculative investor with risk appetite, a small position in AAL could pay off if travel trends stay strong. But it’s not a conservative or defensive pick.

(AAL) American Airlines "Crashing"?! Long Put Worthy?American Airline (AAL) in recent years has had major news coverage due to various collisions and other events. The technicals appear to show some strong bearish momentum forming on the 1 Week chart. Will the airline company coming crashing down? Or is this currently a discounted buying opportunity? What are your thoughts?

AAL Trade Plan – Strategic Entry & Profit Targets📊Analyzing AAL, potential entry points are identified at $11.8, $11.0, and $10.0, with profit targets at $13, $14.8, and $18. This setup considers both short-term opportunities and longer-term potential, depending on market conditions and individual risk tolerance.

🎯 Strategy:

First profit target: $13 – A reasonable short-term exit if momentum supports a rebound.

Second target: $14.8 – A mid-term level where resistance may be tested.

Final target: $18 – A more extended target, assuming a strong uptrend develops.

This plan allows for flexibility, whether you prefer to secure early gains or hold for potential larger movements. As always, market conditions and external factors should be monitored closely.

⚠️ Disclaimer: This is not financial advice. Always conduct your own research, assess risk carefully, and consult a professional if needed before making investment decisions.

AAL – 30-Min Short Trade Setup !📉 🚨

🔹 Stock: American Airlines Group Inc. ( NASDAQ:AAL )

🔹 Timeframe: 30-Min Chart

🔹 Setup Type: Bearish Breakdown Trade

📌 Trade Plan (Short Position):

🚀 Entry Below: $10.58 (Breakdown Confirmation)

⛔ Stop-Loss: $11.17 (Invalidation Level)

🎯 Profit Targets:

📌 TP1: $9.93 (First Support Level)

📌 TP2: $9.31 (Extended Bearish Move)

📊 Risk-Reward Ratio (R/R):

📈 Risk (SL Distance): $11.17 - $10.58 = $0.59 per share

📉 Reward to TP1: $10.58 - $9.93 = $0.65 (1:1.1 R/R)

📉 Reward to TP2: $10.58 - $9.31 = $1.27 (1:2.1 R/R)

🔍 Technical Analysis & Strategy:

📌 Downtrend Structure: Price continuously rejecting the descending trendline.

📌 Bearish Breakdown Confirmation: Price failing to hold above $10.58.

📌 Volume Confirmation Needed: Increased selling pressure for strong momentum.

📌 Momentum Shift Expected: Breakdown could accelerate the fall to $9.93, then $9.31.

📊 Key Levels:

🔴 Resistance: $11.17 (Stop-Loss / Invalidation Zone)

🟡 Breakdown Level: $10.58 (Entry Zone)

⚪ First Target: $9.93 (TP1 – First Support Zone)

🟢 Final Target: $9.31 (TP2 – Extended Move)

🎯 Risk Management & Trade Execution:

📊 Confirm Volume – Ensure strong selling pressure before entry.

📉 Trailing Stop Strategy: Move SL to $10.58 (breakeven) after TP1 ($9.93).

💰 Profit Booking Plan:

✔ Take 50% profit at $9.93, let the rest ride to $9.31.

✔ Adjust SL to breakeven ($10.58) after TP1 is hit.

⚠️ Fake Breakdown Risk:

❌ If price reclaims $10.58, exit early to minimize losses.

❌ Wait for strong bearish candle close below $10.58 before entering aggressively.

🚀 Final Thoughts:

✔ Bearish Setup Forming – Breakdown signals further downside.

✔ Momentum Shift Expected – Selling pressure gaining strength.

✔ High R/R Trade – 1:2.1 R/R to TP2 makes this a quality short setup.

🔗 Follow @ProfittoPath for More Trade Setups! 📈🔥

#ProfittoPath 🏆 | #AAL 📉 | #StockMarket 📊 | #ShortTrade 🚀 | #BearishSetup 💰 | #RiskManagement 🔍 | #MarketAnalysis 📉 | #SwingTrading

AAL/USD – 30-Min Long Trade Setup !📌 🚀

🔹 Asset: AAL (American Airlines Group, Inc.)

🔹 Timeframe: 30-Min Chart

🔹 Setup Type: Bullish Reversal Trade

📌 Trade Plan (Long Position)

✅ Entry Zone: Above $13.91 (Breakout Confirmation)

✅ Stop-Loss (SL): Below $13.18 (Invalidation Level)

🎯 Take Profit Targets:

📌 TP1: $14.76 (First Resistance Level)

📌 TP2: $15.84 (Extended Bullish Move)

📊 Risk-Reward Ratio Calculation

📉 Risk (SL Distance): $13.91 - $13.18 = $0.73 risk per share

📈 Reward to TP1: $14.76 - $13.91 = $0.85 (1:1.16 R/R)

📈 Reward to TP2: $15.84 - $13.91 = $1.93 (1:2.64 R/R)

🔍 Technical Analysis & Strategy

📌 Falling Wedge Breakout: Price has broken out of a falling wedge, a strong bullish reversal pattern.

📌 Support Rejection: The price tested $13.18 support and showed buying pressure.

📌 Volume Confirmation Needed: Ensure high buying volume when price holds above $13.91 to confirm bullish momentum.

📌 Momentum Shift Expected: If price remains above $13.91, it could push toward $14.76, and further to $15.84.

📊 Key Support & Resistance Levels

🟢 $13.18 – Stop-Loss / Support Level

🟡 $13.91 – Breakout Level / Long Entry

🔴 $14.76 – First Resistance / TP1

🔴 $15.84 – Final Target / TP2

📉 Trade Execution & Risk Management

📊 Volume Confirmation: Ensure high buying volume above $13.91 before entering.

📉 Trailing Stop Strategy: Move SL to entry ($13.91) after TP1 ($14.76) is hit.

💰 Partial Profit Booking Strategy:

✔ Take 50% profits at $14.76, let the rest run toward $15.84.

✔ Adjust Stop-Loss to Break-even ($13.91) after TP1 is reached.

⚠️ Fake Breakout Risk

❌ If the price fails to hold above $13.91 and drops back, exit early to avoid losses.

❌ Wait for a strong bullish candle close above $13.91 before entering aggressively.

🚀 Final Thoughts

✔ Bullish Setup – Bouncing from $13.18 support suggests a potential reversal.

✔ Momentum Shift Possible – Watch for volume confirmation.

✔ Favorable Risk-Reward Ratio – 1:1.16 to TP1, 1:2.64 to TP2.

💡 Stick to the plan, manage risk, and trade smart! 🚀📈

🔗 Hashtags for Reach & Engagement:

#StockMarket 📉 #AAL 📊 #TradingNews 📰 #MarketUpdate 🔥 #Investing 💰 #Trading 📈 #Finance 💵 #ProfittoPath 🚀 #SwingTrading 🔄 #DayTrading ⚡ #StockTrader 💸 #TechnicalAnalysis 📉 #EconomicNews 🏛️ #FinancialFreedom 💡 #MarketTrends 📊 #StockAlerts 🔔 #TradeSmart 🤓 #Bullish 🐂 #RiskManagement ⚠️ #TradingCommunity 🤝

American Airlines | AAL | Long at $13.34As the Great American Wealth Transfer happens, people are using that money to travel more (after all, few can afford to transfer that wealth into real estate). Airline data show passenger counts are increasing rapidly and with airfares expected to rise, this sector is likely to go through a long-awaited boom cycle.

Those following me know I am heavily long in airlines, cruise lines, and travel companies. With today's dip, and the long-term historical moving average starting to show upward momentum, American Airlines NASDAQ:AAL is in a personal buy zone at $13.34. A further dip to $11.00 to close the daily price gaps is also where I will be adding more.

Targets:

$15.00

$18.00

AAL to $17My trading plan is very simple.

I buy or sell when:

* Price tags the top or bottom of parallel channel zones

* Money flow spikes above it's Bollinger Bands

* Price at Fibonacci levels

So...

Here's why I'm picking this symbol to do the thing.

Price in buying zone at bottom of channels (period 100 52 & 26)

Stochastic Momentum Index (SMI) at oversold level

Money flow momentum is spiked negative and under over at bottom of Bollinger Band

Entry at $15.67, buying shares from here to $15.50

Stop loss is $15.00

Target is $17 or channel top

AAL +3% Play - Bullish Gap FillAmerican Airlines ( NASDAQ:AAL ) is showing signs of strength as it attempts to break above recent resistance. The price has been consolidating and is now pushing higher, indicating a potential move toward a gap fill.

Bias: Bullish

Target: $17.73 (~2.31% gain from $17.33)

Entry: Watching for a confirmed break and retest of resistance

Indicators: Momentum increasing, price structure improving

If the breakout sustains, a move toward the gap fill zone is possible, but I am conservatively targeting $17.73.

If the gap fills to $18.50, the potential percentage gain from $17.33 would be approximately 6.75%.

AAL Short Trade Setup (30-Min Chart)! 🚨🔥

🔍 Stock: AAL (NASDAQ)

⏳ Timeframe: 30-Min Chart

📉 Setup Type: Bearish Breakdown

📍 Trade Plan:

🔻 Entry: $17.03 (Breakdown Confirmation)

✅ Stop-Loss (SL): $17.60 (Above resistance level for risk control)

🎯 Target 1: $16.39 (Key support level)

🚀 Target 2: $15.79 (Major support zone – Extended Downside Potential)

🔹 Risk-Reward Ratio: Favorable for shorting 📊

🔹 Momentum: Strong bearish pressure and breakdown 📉

🔹 Pattern: Descending triangle breakdown

🔥 Trade Strategy & Refinements:

📊 Volume Confirmation: Ensure strong selling volume for sustained move.

📉 Trailing Stop Strategy: If price reaches $16.39, consider adjusting SL lower to secure profits.

💰 Partial Profit Booking: Take partial profits at Target 1 and let the rest drop towards Target 2.

⚠️ Watch for Fake Breakdowns: If price reclaims $17.03, exit early to minimize losses.

🚀 Final Thoughts:

✅ Bearish Pattern Confirmation – High probability of downward continuation.

✅ Strong Resistance at $17.60 – Ideal SL placement.

✅ Breakdown Momentum – Potential for a sharp decline.

Trade Smart & Stick to Your Plan! 🏆💰

Let me know if you need a more detailed breakdown! 🚀📈

#ShortTrade #StockMarket #TradingStrategy #TechnicalAnalysis #DayTrading #SwingTrading #MomentumTrading #ChartPatterns #PriceAction #BearishBreakdown #TradeSetup #StocksToWatch #StockCharts #TradingView #StockSignals #TradingPlan #MarketAnalysis #RiskReward #SupportAndResistance #ProfitToPath #TradeSmart #WealthBuilding #TradingSuccess #MoneyMoves

AAL American Airlines Group Options Ahead of EarningsIf you haven`t bought the dip on AAL:

Now analyzing the options chain and the chart patterns of AAL American Airlines Group prior to the earnings report this week,

I would consider purchasing the 18usd strike price Calls with

an expiration date of 2025-2-21,

for a premium of approximately $1.23.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

American Airlines | AAL | Long at $14.00Similar to my cruise line picks, I anticipate airlines to quite literally "take off" in the coming years as interest rates are lowered and people travel more. These two industries never quite recovered from the pandemic, but their time to do so is "likely" fast approaching.

American Airlines NASDAQ:AAL has been consolidating near my selected long-term simple moving average (SMA) for several years. Many retail investors have been beaten up by the sudden up and (especially) down price movements, but this is where larger investors gather their shares. The fact NASDAQ:AAL did not make a new low in August 2024 is a hopeful sign from a technical analysis perspective. While the price may dip to close out the new lower price gaps, I think we are nearing the "take off" zone which will be a massive break through the long-term SMA. A confirmation that something bigger is brewing would be a price move into the $15s, dip down to the $12s, and the larger move up. Regardless of trying to predict bottoms, NASDAQ:AAL is in a personal buy zone at $14.00.

Target #1 = $15.25

Target #2 = $16.55

Target #3 = $18.40

Target #4 = $27.00 (very long-term outlook...)