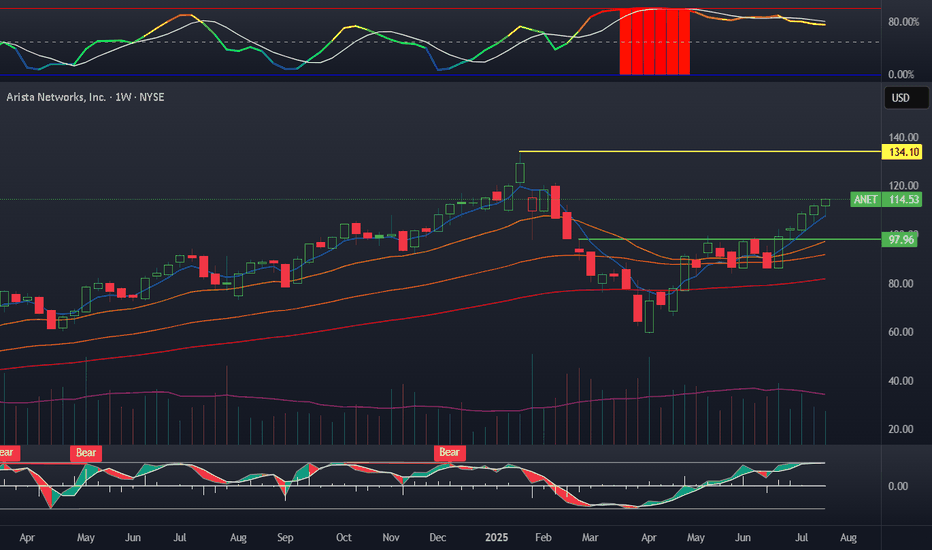

ANET new positionStarted a feeler position in ANET today with 110 shares. Sold a low delta covered call and added a CSP on the monthly a bit lower. I believe this will be the range of interest here. I wanted to slowly diversify a bit away from small caps as I have made a lot on the risk account the last two years. A

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

49.30 MXN

59.46 B MXN

146.01 B MXN

1.03 B

About Arista Networks

Sector

Industry

CEO

Jayshree V. Ullal

Website

Headquarters

Santa Clara

Founded

2004

FIGI

BBG00JZF4DF7

Arista Networks, Inc. engages in the development, marketing, and sale of cloud networking solutions. Its solutions include EOS, a set of network applications, and Gigabit Ethernet switching and routing platforms. Its product categories include Core, Cognitive Adjacencies, and Network Software and Services. The company was founded by Andreas Bechtolsheim, David Cheriton, and Kenneth Duda in November 2004 and is headquartered in Santa Clara, CA.

Related stocks

Arista Networks (ANET)_Cloud Fabric for AINYSE:ANET Price has respected the support line around $94–97, which was previously a breakout zone and now serves as a solid foundation for a potential upward move. Volume Profile shows strong interest in this range, confirming its importance.

Technical view:

• Rebound from support at $94.36 (July

Arista is the market leader in data center switching platformsArista Networks demonstrates strong financial performance, a solid growth outlook, and innovative product development, particularly in AI and cloud networking. While valuation models offer mixed signals, the company's fundamentals and strategic positioning make it a compelling consideration for inve

3 Reasons Arista Networks Could Soon Rally SignificantlyIn 2023, we covered Arista Networks NYSE:ANET , calling it part of the internet’s "bedrock" but rating it a Hold due to valuation concerns. Since then, ANET has outperformed the S&P 500, proving our call wrong.

Recently, ANET’s stock has dipped alongside broader market declines. However, we belie

Arista Networks (NYSE: $ANET): Positive Outlook Amid AI Growth Arista Networks Inc. (NYSE: ANET) closed the latest trading session at $68.67, gaining 1.48% on the day. The stock has recently experienced a steep decline from its 52-week high near $134, yet it remains a key player in the edge computing space. As of Q4 2024, 78 hedge funds held positions in Arista

Arista Networks Raises 2025 Revenue Forecast to $8.2BArista Networks, Inc. (NYSE: NYSE:ANET ) has increased its 2025 revenue outlook to $8.2 billion, marking a 17% year-over-year growth rate. This revision is driven by robust demand from Tier 1 hyperscalers and Tier 2 cloud providers adopting Ethernet-based solutions. For Q1 2025, the company expects

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where ANET is featured.

Female-led stocks: Who rules the world?

34 No. of Symbols

See all sparks

Frequently Asked Questions

The current price of ANET is 2,161.51 MXN — it has increased by 2.03% in the past 24 hours. Watch ARISTA NETWORKS, INC stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BIVA exchange ARISTA NETWORKS, INC stocks are traded under the ticker ANET.

ANET stock has risen by 2.85% compared to the previous week, the month change is a 19.62% rise, over the last year ARISTA NETWORKS, INC has showed a −66.67% decrease.

We've gathered analysts' opinions on ARISTA NETWORKS, INC future price: according to them, ANET price has a max estimate of 2,428.54 MXN and a min estimate of 1,625.26 MXN. Watch ANET chart and read a more detailed ARISTA NETWORKS, INC stock forecast: see what analysts think of ARISTA NETWORKS, INC and suggest that you do with its stocks.

ANET stock is 4.71% volatile and has beta coefficient of 2.15. Track ARISTA NETWORKS, INC stock price on the chart and check out the list of the most volatile stocks — is ARISTA NETWORKS, INC there?

Today ARISTA NETWORKS, INC has the market capitalization of 2.66 T, it has increased by 2.43% over the last week.

Yes, you can track ARISTA NETWORKS, INC financials in yearly and quarterly reports right on TradingView.

ARISTA NETWORKS, INC is going to release the next earnings report on Aug 5, 2025. Keep track of upcoming events with our Earnings Calendar.

ANET earnings for the last quarter are 13.32 MXN per share, whereas the estimation was 12.08 MXN resulting in a 10.23% surprise. The estimated earnings for the next quarter are 12.19 MXN per share. See more details about ARISTA NETWORKS, INC earnings.

ARISTA NETWORKS, INC revenue for the last quarter amounts to 41.07 B MXN, despite the estimated figure of 40.31 B MXN. In the next quarter, revenue is expected to reach 39.52 B MXN.

ANET net income for the last quarter is 16.67 B MXN, while the quarter before that showed 16.70 B MXN of net income which accounts for −0.17% change. Track more ARISTA NETWORKS, INC financial stats to get the full picture.

No, ANET doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jul 26, 2025, the company has 4.41 K employees. See our rating of the largest employees — is ARISTA NETWORKS, INC on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. ARISTA NETWORKS, INC EBITDA is 65.63 B MXN, and current EBITDA margin is 42.93%. See more stats in ARISTA NETWORKS, INC financial statements.

Like other stocks, ANET shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade ARISTA NETWORKS, INC stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So ARISTA NETWORKS, INC technincal analysis shows the buy rating today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating ARISTA NETWORKS, INC stock shows the sell signal. See more of ARISTA NETWORKS, INC technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.