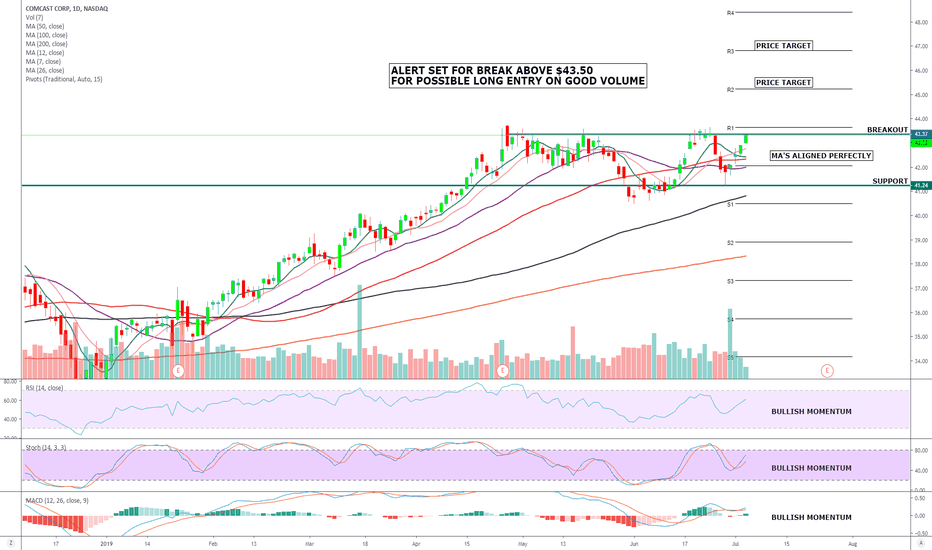

CMCSA trade ideas

COMCAST A SAFE HAVEN IN STORMY TIMES. IN TIMES OF TROUBLE COMCAST WILL BE REGARDED AS SOMEWHERE TO PARK YOUR MONEY AND WAIT FOR THE CLOUDS TO CLEAR.

INDICATORS ARE TURNING BULLISH ONCE AGAIN, BUT THERE NEEDS A SERIOUS INJECTION OF VOLUME TO BREAKOUT FROM THE CURRENT RESISTANCE.

NEXT WEEK SHOULD TEST THE STRENGTH OF INVESTORS CONVICTION AND APPETITE FOR RISK OR SAFETY.

CMCSA In the midst of an adjustment trend of downward direction 19-JUL

www.pretiming.com

Investing position: In Rising section of high profit & low risk

S&D strength Trend: In the midst of an adjustment trend of downward direction box pattern price flow marked by limited rises and downward fluctuations.

Today's S&D strength Flow: Supply-Demand strength has changed from a weak selling flow to a strengthening selling flow again.

Forecast D+1 Candlestick Color : RED Candlestick

%D+1 Range forecast: 0.6% (HIGH) ~ -0.9% (LOW), -0.1% (CLOSE)

%AVG in case of rising: 1.3% (HIGH) ~ -0.5% (LOW), 0.9% (CLOSE)

%AVG in case of falling: 0.6% (HIGH) ~ -1.1% (LOW), -0.4% (CLOSE)

Comcast holds great potential for the second half of 2019 COMCAST CORP. NASDAQ (CMCSA) HAS OUTPERFORMED ITS PEERS FOR SOME TIME AND HAS REWARDED INVESTORS WITH A 30% RETURN IN 2019 WHILE ALSO HAVING A HEALTHY DIVIDEND OF 2% .

INITIAL PANIC OVER THE SKY DEAL HAS EASED.

COMPANY IS HIGHLY DIVERSIFIED WITH MULTIPLE REVENUE STREAMS.

LOW VULNERABILITY TO TRADE DISPUTE.

GREAT TRACK RECORD OF DOUBLE DIGIT REVENUE GROWTH ANNUALLY.

VERY REASONABLE VALUATION.

STOCK IS IN A VERY BULLISH CONSOLIDATION, BREAKOUT EXPECTED VERY SOON IF THE MARKET SENTIMENT CONTINUES TO BE BULLISH

AVERAGE ANALYSTS PRICE TARGET $48.14

AVERAGE ANALYSTS RECOMMENDATION OVERWEIGHT

P/E RATIO 16.5

SHORT INTEREST 1.5%

COMPANY PROFILE

Comcast Corp. is a media, entertainment, and communications company, which engages in the provision of video, Internet, and phone services. It operates through the following segments: Cable Communications, Cable Networks, Broadcast Television, Filmed Entertainment, Theme Parks, and Corporate and Other. The Cable Communications segment provides video, Internet, voice, and security and automation services under the Xfinity brand. The Cable Networks segment consists of national cable networks, regional sports, news networks, international cable networks, and cable television studio production operations. The Broadcast Television segment includes NBC and Telemundo broadcast networks. The Filmed Entertainment segment involves in the production, acquisition, marketing, and distribution of filmed entertainment. The Theme Parks segment consists of Universal theme parks in Orlando, Florida; Hollywood, California; and Osaka, Japan. The Corporate and Other segment includes operations of other business interests, primarily of Comcast Spectacor. The company was founded by Ralph J. Roberts in 1963 and is headquartered in Philadelphia, PA

CMCSA stock price forecast timing analysis.Stock investing strategies

Read more: www.pretiming.com

Investing position about Supply-Demand(S&D) strength: In Falling section of high risk & low profit

S&D strength Trend Analysis: In the midst of a rebounding trend of upward direction box pattern stock price flow marked by limited falls and upward fluctuations.

Today's S&D strength Flow: Supply-Demand(S&D) strength flow appropriate to the current trend.

D+1 Candlestick Color forecast: GREEN Candlestick

%D+1 Range forecast: 1.0% (HIGH) ~ -0.9% (LOW), 0.3% (CLOSE)

%AVG in case of rising: 1.5% (HIGH) ~ -0.3% (LOW), 1.0% (CLOSE)

%AVG in case of falling: 0.7% (HIGH) ~ -1.5% (LOW), -0.8% (CLOSE)

Stock Price Forecast Timing Criteria: Stock price forecast timing is analyzed based on pretiming algorithm of Supply-Demand(S&D) strength.