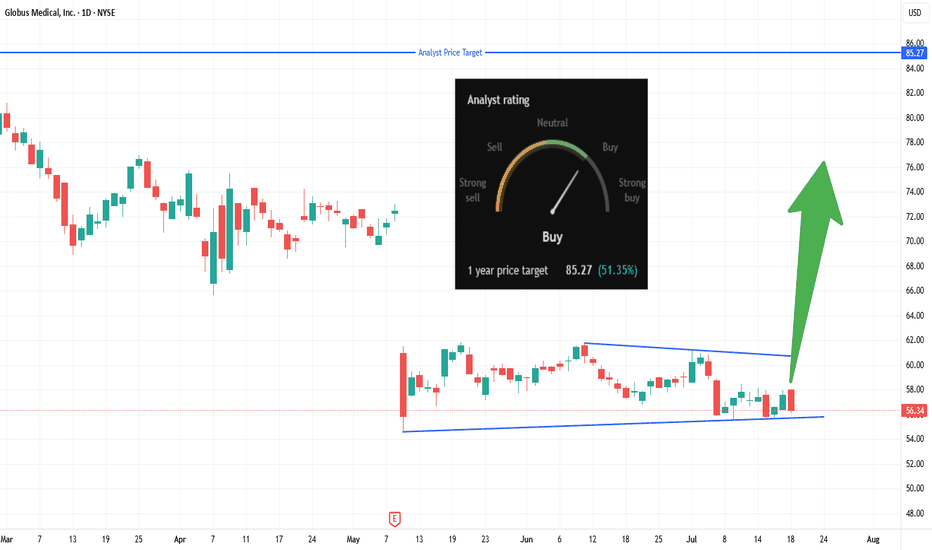

Will GMED Catch a Bid at Channel SupportTrade Summary 📝

Setup: Channel squeeze at multi-week support; volatility contracting.

Entry: Entering at market (current price ~$56.34), bottom of channel.

Stop‑loss: $55.50 (tight stop under structure).

Targets: $62 (channel top), $70+ (gap area), $85.27 (analyst 1-year target).

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

27.92 MXN

2.15 B MXN

52.53 B MXN

112.14 M

About Globus Medical, Inc.

Sector

Industry

CEO

Keith W. Pfeil

Website

Headquarters

Audubon

Founded

2003

FIGI

BBG00KVDXPD6

Globus Medical, Inc. operates as a medical device company that develops and commercializes healthcare solutions. The firm engages in developing products that promote healing in patients with musculoskeletal disorders. It classifies products into Innovative Fusion and Disruptive Technology. It operates through the United States and International geographical segments. The company was founded by David C. Paul, David D. Davidar and Andrew Iott in March 2003 and is headquartered in Audubon, PA.

Related stocks

GMED breaking out for another bullish move!Globus Medical, Inc. (GMED), a leader in musculoskeletal solutions, is currently exhibiting strong bullish signals.

The stock has maintained a steady uptrend, forming higher highs and lows on weekly charts.

Trading above its 50-day and 200-day EMAs, GMED recently witnessed a golden cross, furthe

Globus Medical: Approaching resistance, is a breakthrough comingWeekly Chart

● The stock has tested the trendline resistance multiple times.

● Currently, it is trading just below this level.

● A breakout above this resistance is anticipated in the near future.

● Following the breakout, the price may increase.

Daily Chart

● A Symmetrical Triangle pattern has

Looking for a long term entry into Globus MedicalI’m looking for a long term investment in a sea of overvalued bio & tech companies.

Globus Medical caught my eye as a potential candidate after a large dark pool sell and recent pullback in indexes

Globus Medical's index membership is Russell 1000, Russell 3000 and S&P Midcap 400.

Financial Ob

Globus Medical short term weaknessNYSE:GMED

Globus Medical reported strong quarterly results on Tuesday.

Momentum and stochastic indicator suggest short term price weakness as traders take profits.

My personal plan is to reduce holding in small increments so long as selling persists, with the

intention of buying back once the c

Triangle in GMEDScreening through many stocks this morning this was the chart the stuck out to me. A clear triangle. I will be quite surprised if it doesn't play out because of how textbook it looks. Price appears to have broken the triangle upper boundary. A close above this boundary will support continued strengt

See all ideas

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of GMED is 987.00 MXN — it has decreased by −8.36% in the past 24 hours. Watch GLOBUS MEDICAL, INC stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BIVA exchange GLOBUS MEDICAL, INC stocks are traded under the ticker GMED.

GMED stock has fallen by −7.28% compared to the previous week, the month change is a −48.24% fall, over the last year GLOBUS MEDICAL, INC has showed a −24.49% decrease.

We've gathered analysts' opinions on GLOBUS MEDICAL, INC future price: according to them, GMED price has a max estimate of 1,948.49 MXN and a min estimate of 1,206.21 MXN. Watch GMED chart and read a more detailed GLOBUS MEDICAL, INC stock forecast: see what analysts think of GLOBUS MEDICAL, INC and suggest that you do with its stocks.

GMED stock is 9.12% volatile and has beta coefficient of 0.79. Track GLOBUS MEDICAL, INC stock price on the chart and check out the list of the most volatile stocks — is GLOBUS MEDICAL, INC there?

Today GLOBUS MEDICAL, INC has the market capitalization of 137.60 B, it has decreased by −1.55% over the last week.

Yes, you can track GLOBUS MEDICAL, INC financials in yearly and quarterly reports right on TradingView.

GLOBUS MEDICAL, INC is going to release the next earnings report on Aug 7, 2025. Keep track of upcoming events with our Earnings Calendar.

GMED earnings for the last quarter are 13.93 MXN per share, whereas the estimation was 15.24 MXN resulting in a −8.60% surprise. The estimated earnings for the next quarter are 14.13 MXN per share. See more details about GLOBUS MEDICAL, INC earnings.

GLOBUS MEDICAL, INC revenue for the last quarter amounts to 12.25 B MXN, despite the estimated figure of 12.82 B MXN. In the next quarter, revenue is expected to reach 13.90 B MXN.

GMED net income for the last quarter is 1.55 B MXN, while the quarter before that showed 552.61 M MXN of net income which accounts for 179.76% change. Track more GLOBUS MEDICAL, INC financial stats to get the full picture.

No, GMED doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Aug 5, 2025, the company has 5.3 K employees. See our rating of the largest employees — is GLOBUS MEDICAL, INC on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. GLOBUS MEDICAL, INC EBITDA is 11.59 B MXN, and current EBITDA margin is 19.30%. See more stats in GLOBUS MEDICAL, INC financial statements.

Like other stocks, GMED shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade GLOBUS MEDICAL, INC stock right from TradingView charts — choose your broker and connect to your account.