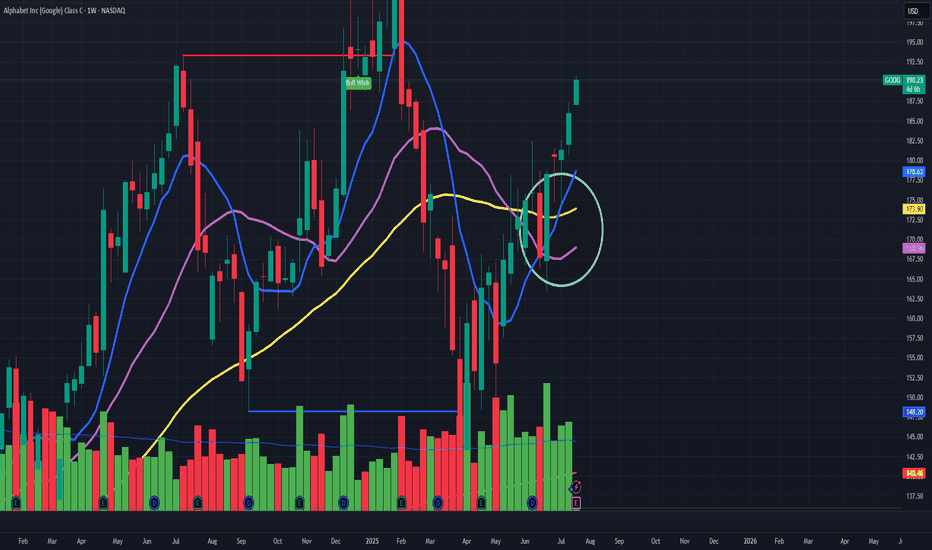

Analyzing GOOGL's Path: Breakouts and Critical Support• Strong Upward Trendline : The chart clearly displays an ascending trendline (light blue) from early April, indicating a robust bullish trend. The price has consistently found support at or near this line, reinforcing its significance as a key technical level.

• Recent Breakout and Potential Re

Key facts today

Morgan Stanley raised Alphabet's (GOOG) price target to $205, citing better innovation. Bank of America and Rothschild set targets at $210 and $215, respectively. Shares rose 2.6%.

Alphabet Inc. (GOOG) is scheduled to report its quarterly earnings on Wednesday, with a focus on insights related to demand and spending in the artificial intelligence sector.

Alphabet, Google's parent company, will report its quarterly financial results on Wednesday, with traders anticipating positive outcomes alongside Tesla and other major firms.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

185.59 MXN

2.09 T MXN

7.29 T MXN

5.80 B

About Alphabet Inc (Google) Class C

Sector

Industry

CEO

Sundar Pichai

Website

Headquarters

Mountain View

Founded

2015

FIGI

BBG00JX0QJK9

Alphabet, Inc is a holding company, which engages in the business of acquisition and operation of different companies. It operates through the Google and Other Bets segments. The Google segment includes its main Internet products such as ads, Android, Chrome, hardware, Google Cloud, Google Maps, Google Play, Search, and YouTube. The Other Bets segment consists of businesses such as Access, Calico, CapitalG, GV, Verily, Waymo, and X. The company was founded by Lawrence E. Page and Sergey Mikhaylovich Brin on October 2, 2015 and is headquartered in Mountain View, CA.

Related stocks

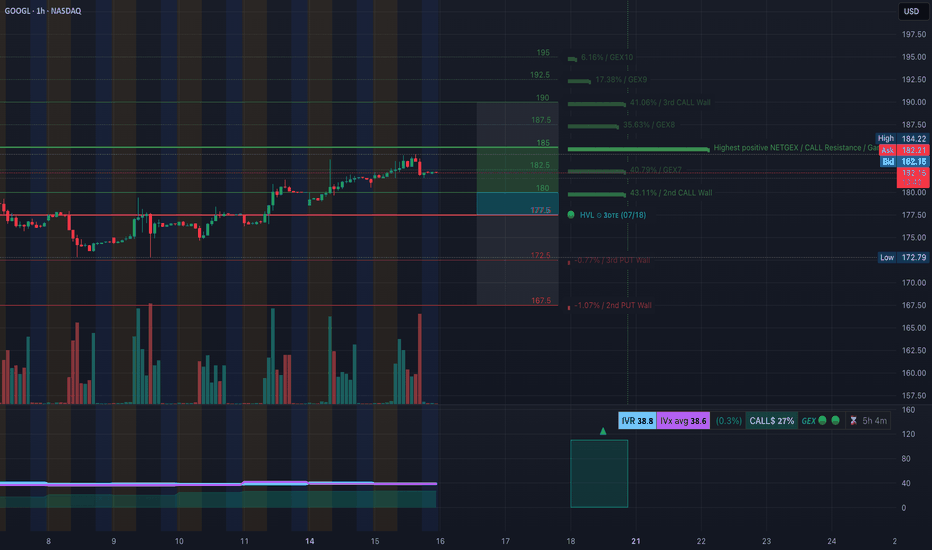

GOOGL Ready to Recharge or Break? TA for July 16📊 GEX Sentiment & Options Outlook (Based on July 15 Data)

* Key Resistance Zone:

‣ 184–185: Highest Positive NET GEX, 3rd Call Wall → Strong gamma resistance

‣ 190–192.5: Additional call wall cluster—unlikely to break without strong momentum

‣ 195: GEX10 level (top bullish magnet if a breakout trigg

Alphabet - The textbook break and retest!📧Alphabet ( NASDAQ:GOOGL ) will head much higher:

🔎Analysis summary:

If we look at the chart of Alphabet we can basically only see green lines. And despite the recent correction of about -30%, Alphabet remains in a very bullish market. Looking at the recent all time high break and retest, the

GOOGL Eyeing a Gamma Launch Above $182. for July 14🔹 GEX Options Sentiment Analysis

* Gamma Resistance Zone:

The $180 level marks the highest positive Net GEX / Call Wall, making it a magnet and potential resistance for GOOGL.

Above that:

* $182.5 = 2nd Call Wall

* $185 = 3rd Call Wall

* $186.43 is the extreme call zone from GEX

* Put Wa

GOOG - Possible Break OutHello Everyone,

Happy Sunday to All.

I would like to make a quick Analyse on GOOG. When i was scanning the stocks,i reliazed that this could be a possible breakout and could be a opportunity to buy.

This looks like a breakout and i am expecting to Re-test trend line which price level 175 $.

Then

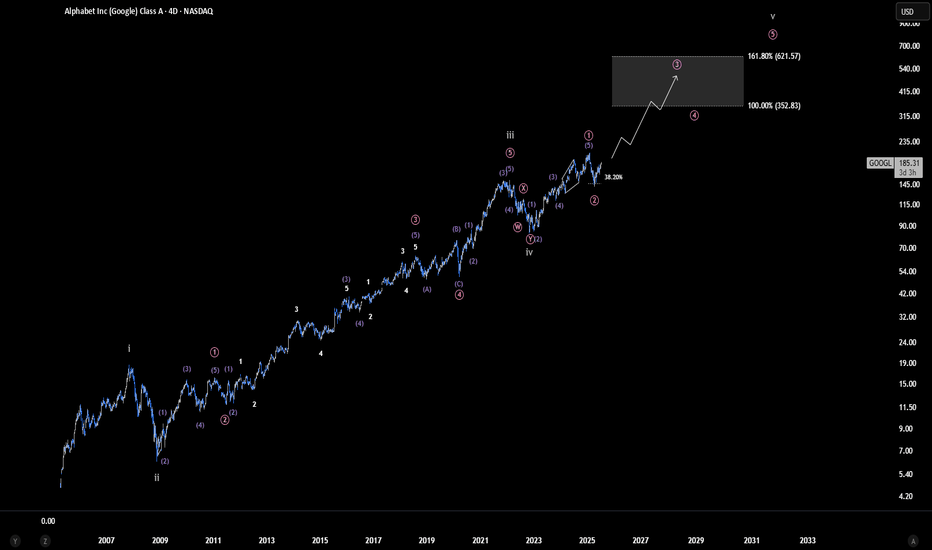

Alphabet (Google) - Ready to Surge Again? | Ew analysisWe appear to be in the final wave of a major bull run that began all the way back in 2005. If this count unfolds as expected, Google could potentially rally toward the $350–$620 range or even higher representing a gain of over 200% from current levels. This would mark the completion of the fifth and

"These 3 power signals boost the 3-step rocket booster strategy"Am lubosi forex and i would like to welcome you.This is where i share with you technical analysis strategies.

I started trading in 2017 and learning about it has not been easy.My hope for you is that this channel will shape your trading journey and help you

Find a path to making money on your own

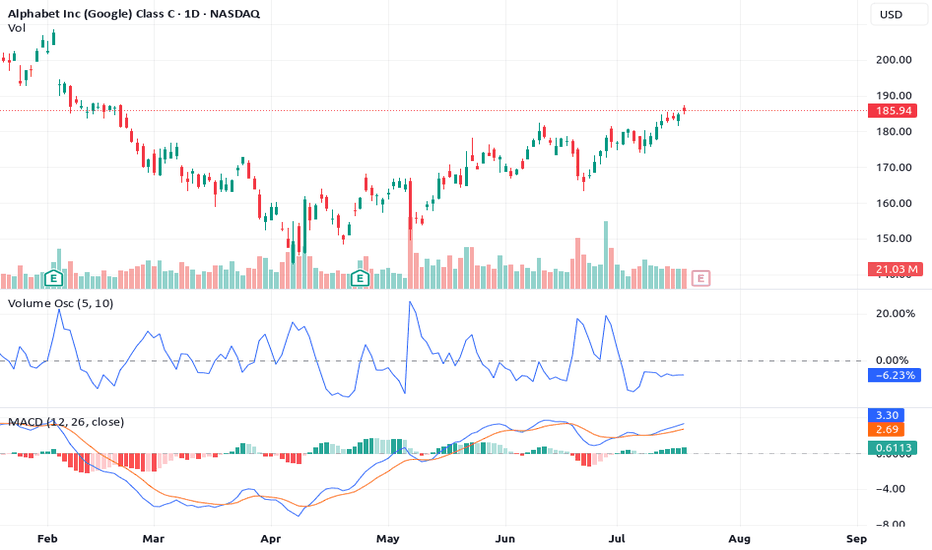

With price near $190 and strong volume, $200+ looks imminent.🔥 NASDAQ:GOOGL Weekly Chart Signals a Golden Cross

Alphabet’s (GOOG)9-week MA is crossing the 20 and 50-week MA—classic bullish setup. With price near $190 and strong volume, $200+ looks imminent.

💡 Why It’s Climbing:

- AI breakthroughs (Gemini, DeepMind)

- Google Cloud gaining traction

- Big tec

Google: Upcoming TopWe locate Google in turquoise wave 2 (of a downward impulse). In more detail, we see the stock developing a complex - - - pattern and expect turquoise wave 2 to conclude imminently with wave . All the while, the price should maintain a safe distance from resistance at $209.28. Looking ahead to tu

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US2079KAF4

ALPHABET 20/50Yield to maturity

7.04%

Maturity date

Aug 15, 2050

US2079KAG2

ALPHABET 20/60Yield to maturity

6.94%

Maturity date

Aug 15, 2060

US2079KAE7

ALPHABET 20/40Yield to maturity

6.25%

Maturity date

Aug 15, 2040

GOOG6065579

Alphabet Inc. 5.3% 15-MAY-2065Yield to maturity

5.61%

Maturity date

May 15, 2065

GOOG6065578

Alphabet Inc. 5.25% 15-MAY-2055Yield to maturity

5.47%

Maturity date

May 15, 2055

GOOG6065581

Alphabet Inc. 4.5% 15-MAY-2035Yield to maturity

4.75%

Maturity date

May 15, 2035

GOOG5025299

Alphabet Inc. 0.45% 15-AUG-2025Yield to maturity

4.70%

Maturity date

Aug 15, 2025

US2079KAD9

ALPHABET 20/30Yield to maturity

4.42%

Maturity date

Aug 15, 2030

US2079KAC1

ALPHABET 16/26Yield to maturity

4.25%

Maturity date

Aug 15, 2026

XS306443038

ALPHABET 25/54Yield to maturity

4.14%

Maturity date

May 6, 2054

XS306442783

ALPHABET 25/45Yield to maturity

4.08%

Maturity date

May 6, 2045

See all GOOGL bonds

Curated watchlists where GOOGL is featured.

Frequently Asked Questions

The current price of GOOGL is 3,546.46 MXN — it has increased by 0.53% in the past 24 hours. Watch Alphabet Inc (Google) Class A stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BIVA exchange Alphabet Inc (Google) Class A stocks are traded under the ticker GOOGL.

GOOGL stock has risen by 4.82% compared to the previous week, the month change is a 3.81% rise, over the last year Alphabet Inc (Google) Class A has showed a 11.56% increase.

We've gathered analysts' opinions on Alphabet Inc (Google) Class A future price: according to them, GOOGL price has a max estimate of 4,687.79 MXN and a min estimate of 3,000.19 MXN. Watch GOOGL chart and read a more detailed Alphabet Inc (Google) Class A stock forecast: see what analysts think of Alphabet Inc (Google) Class A and suggest that you do with its stocks.

GOOGL stock is 2.47% volatile and has beta coefficient of 0.94. Track Alphabet Inc (Google) Class A stock price on the chart and check out the list of the most volatile stocks — is Alphabet Inc (Google) Class A there?

Today Alphabet Inc (Google) Class A has the market capitalization of 42.11 T, it has increased by 2.62% over the last week.

Yes, you can track Alphabet Inc (Google) Class A financials in yearly and quarterly reports right on TradingView.

Alphabet Inc (Google) Class A is going to release the next earnings report on Jul 23, 2025. Keep track of upcoming events with our Earnings Calendar.

GOOGL earnings for the last quarter are 57.57 MXN per share, whereas the estimation was 41.47 MXN resulting in a 38.80% surprise. The estimated earnings for the next quarter are 40.82 MXN per share. See more details about Alphabet Inc (Google) Class A earnings.

Alphabet Inc (Google) Class A revenue for the last quarter amounts to 1.85 T MXN, despite the estimated figure of 1.83 T MXN. In the next quarter, revenue is expected to reach 1.76 T MXN.

GOOGL net income for the last quarter is 707.63 B MXN, while the quarter before that showed 553.26 B MXN of net income which accounts for 27.90% change. Track more Alphabet Inc (Google) Class A financial stats to get the full picture.

Yes, GOOGL dividends are paid quarterly. The last dividend per share was 4.00 MXN. As of today, Dividend Yield (TTM)% is 0.44%. Tracking Alphabet Inc (Google) Class A dividends might help you take more informed decisions.

Alphabet Inc (Google) Class A dividend yield was 0.32% in 2024, and payout ratio reached 7.46%. The year before the numbers were 0.00% and 0.00% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 21, 2025, the company has 183.32 K employees. See our rating of the largest employees — is Alphabet Inc (Google) Class A on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Alphabet Inc (Google) Class A EBITDA is 2.74 T MXN, and current EBITDA margin is 36.45%. See more stats in Alphabet Inc (Google) Class A financial statements.

Like other stocks, GOOGL shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Alphabet Inc (Google) Class A stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Alphabet Inc (Google) Class A technincal analysis shows the strong buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Alphabet Inc (Google) Class A stock shows the buy signal. See more of Alphabet Inc (Google) Class A technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.