GSK/N trade ideas

"do you need vaccine? i would have one" long wth SL under 37even without vaccine considiration, GSK is good business with price at multiyear bottom zone. Started in september trials on vaccine, later in oct progress would be more clear, still there are no factors for price go lower.

Put tight stop loss under 37.

Next support level is 35, so if 37 would be broken and retested - take short position.

GSK - Price Target: 38.00 By November 20th~GSK Stock is A bit Undervalued RIght now.. Institutions have price targets of 42~-48

back on the Covid-low-trendline .. I dont see much Downside as Compared to upside.

Dip below 35.99 ~ 35.70 range Twice , back up to 36.30 <---- 50+ cent gap ups.

With Covid vaccine News coming any day now - Its this could be the next play.

No matter which company has the vaccine - I think its likely any Big Pharma Companies

Will get some Contracts to help produce the it.

this stock is owned 77% By instutionals,

With 3m Avg. Volume of shares being traded every day (very liquid)

Whenever the Tutes' are bullish on a stock you know something big is coming!

Adios Migos and GL' trading <--- This is just my personal idea/Reference chart. If your reading, have a good day! peace.

Long and hold $GSK ($MRNA $GILD $INO $SPY $PFE $JNJ $MRK)see full chart at www.tradingview.com

GSK

Entry $39.70

Target 1 $42.45

Target 2 $45.50

Target 3 $48

stoploss 38.70

Why this play?

There are 4 general approaches to the Covid vaccine.

1.A "killed" coronavirus that will get recognized as foreign matter in the blood. (Sinovac/Dynavax)

2.Coronavirus proteins themselves, produced industrially in outside cell cultures,

which will be recognized as foreign matter in the blood. (GlaxoSmithKline/Sanofi, Novavax)

3.A different virus (human or ape adenovirus, measles, etc) that is engineered

to include genetic components coding for the SARS-CoV-2 spike proteins,

which causes the body to then produce them. (CanSino, Oxford, J&J,

Merck/Themis)

4.DNA or RNA that will be taken up by cells and will cause them to make

coronavirus proteins. (Moderna, Innovio,

BioNTech/Pfizer)

GSK is #2, there is only 1 other big company doing this approach and that is NVAX.

We are betting on the fact that if they are successful, they could have super run like NVAX.

What is GSk?

www.gsk.com

GlaxoSmithKline plc engages in the creation, discovery, development, manufacture, and marketing of pharmaceutical products, vaccines, over-the-counter medicines, and health-related consumer products in the United Kingdom, the United States, and internationally. It operates through four segments: Pharmaceuticals, Pharmaceuticals R&D, Vaccines, and Consumer Healthcare. The company offers pharmaceutical products comprising medicines in the therapeutic areas, such as respiratory, HIV, immuno-inflammation, oncology, anti-viral, central nervous system, cardiovascular and urogenital, metabolic, anti-bacterial, and dermatology. It also provides consumer healthcare products in wellness, oral health, nutrition, and skin health categories. The company offers its consumer healthcare products in the form of nasal sprays, tablets, syrups, lozenges, gum and trans-dermal patches, caplets, infant syrup drops, liquid filled suspension, wipes, gels, effervescents, toothpastes, toothbrushes, mouthwashes, denture adhesives and cleansers, topical creams and non-medicated patches, lip balm, gummies, and soft chews. It has collaboration agreements with 23andMe; Merck KGaA; Lyell Immunopharma; CEPI; Innovax and Xiamen University; VBI; Viome; Sanofi SA; CureVac; and research collaboration with Sengenics focusing on immunology. GlaxoSmithKline plc was founded in 1715 and is headquartered in Brentford, the United Kingdom.

Bullish on GSK for Positive WedgeRight now, I am bullish on $GSK and expect a breakout for the Covid19 vaccines period. I think it is also garnishing some momentum, positive sentiment and major support levels. The charting is for a positive continuation of the current wedge. That being said, everything I say is on an opinion based basis. Please proceed with caution, invest at your own discretion and do your own due diligence.

GlaxoSmithKline Plc needs one more catalyst to Breakout

Average Recommendation: HOLD

Average Target Price: 41.60

P/E ratio 17

COMPANY PROFILE

GSK is a global healthcare company which engages in researching, developing and manufacturing of pharmaceutical medicines, vaccines and consumer healthcare products. It operates through the following four segments: Pharmaceuticals, Pharmaceuticals R&D, Vaccines and Consumer Healthcare. The Pharmaceuticals segment researches, develops and makes available medicines that treat a variety of serious and chronic diseases. The Vaccines segment produces pediatric and adult vaccines to prevent a range of infectious diseases including, hepatitis A and B, diphtheria, tetanus and whooping cough, measles, mumps and rubella, polio, typhoid, influenza and bacterial meningitis. The Consumer Healthcare segment markets a range of consumer health products based on scientific innovation. The company was founded in 1715 and is headquartered in Brentford, the United Kingdom.

GlaxoSmithKline - Top of the range, limited upside.SELL – GLAXOSMITHKLINE (GSK)

GlaxoSmithKline PLC is a global healthcare company. The Company operates through two segments: Pharmaceuticals and Vaccines. The Company focuses on its research across six areas: Respiratory diseases, human immunodeficiency virus (HIV)/infectious diseases, Vaccines, Immuno-inflammation, Oncology and Rare diseases.

Fundamentals

GlaxoSmithKline has shifted strategy in recent months by increasing spend on science research and development by 12%, this has been seen by some as too little to late. AstraZeneca implemented a similar plan 5 years ago. Revenues were flat at GSK in the most recent market update. The timing of the additional investment is also under scrutiny as net debt increased from £23.9bn to £28.7bn. The share price feels a bit heavy here and it could be time to cash in.

Best Broker Target Price: 1750p (Jefferies 23/04/2019)

Worst Broker Target Price: 1575p (Deutsche Bank 08/07/2019)

Technical Analysis

The share price of GlaxoSmithKline has been trading in a huge range since mid-2015. The price has gyrated between 1227-1745 for many months and there appears to have been another failure at the upper end of the range. The week commencing 29th July 2019 ended with a inverted hammer candle, this is a bearish signal and suggests further downside could be seen in the short term. It is possible that we could see a continuation of the range.

Recommendation: Sell between 1600-1750p

Stop: 1780p

Target: 1230p

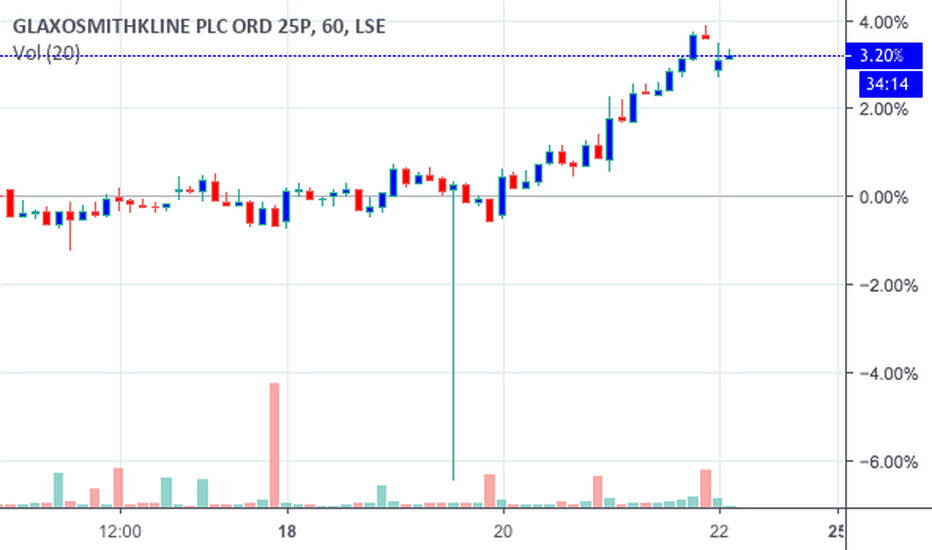

GSK: Sort opportunityAn intraday high potential, Back Tested Sort Analysis.

We ll try to enter into the correction of the uptrend movement.

DETAILS ON THE CHART

NOTE: Entry range area above the entry point, is calculated upon 80% of the recorded pullback back tested past performances

DISCLAIMER: This is a technical analysis study, not an advice or recommendation to invest money on.