JPM + $500B Capital Forecast + Banks to Profit from Tar NYSE:JPM , 4H chart

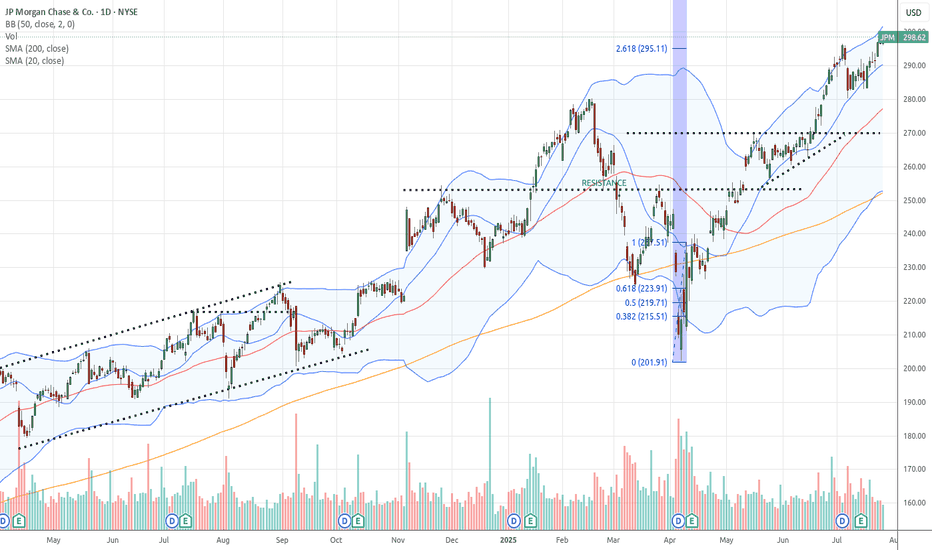

ALVO13 Insight: A strong mix of technical structure and positive fundamentals.Technical Setup (Elliott Waves):

The chart suggests a potential start of wave (5) after a completed correction (4).

Stochastic is in the oversold zone, and $280 support is holding — a key signal for

Key facts today

JPMorgan Chase shares fell 2% to 3.5% after a weak employment report, raising economic concerns, alongside a 1.6% drop in the S&P 500, indicating broader market weakness.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

366.26 MXN

1.21 T MXN

5.88 T MXN

2.77 B

About JP Morgan Chase

Sector

Industry

CEO

James Dimon

Website

Headquarters

New York

Founded

1799

FIGI

BBG00JX0P1J1

JPMorgan Chase & Co is a financial holding company. It provides financial and investment banking services. The firm offers a range of investment banking products and services in all capital markets, including advising on corporate strategy and structure, capital raising in equity and debt markets, risk management, market making in cash securities and derivative instruments, and brokerage and research. It operates through the following segments: Consumer and Community Banking, Corporate and Investment Bank, Commercial Banking, and Asset and Wealth Management. The Consumer and Community Banking segment serves consumers and businesses through personal service at bank branches and through automated teller machine, online, mobile, and telephone banking. The Corporate and Investment Bank segment offers a suite of investment banking, market-making, prime brokerage, and treasury and securities products and services to a global client base of corporations, investors, financial institutions, government and municipal entities. The Commercial Banking segment delivers services to U.S. and its multinational clients, including corporations, municipalities, financial institutions, and non profit entities. It also provides financing to real estate investors and owners as well as financial solutions, including lending, treasury services, investment banking, and asset management. The Asset and Wealth Management segment provides asset and wealth management services. The company was founded in 1968 and is headquartered in New York, NY.

Related stocks

JP Morgan Chase Stock Chart Fibonacci Analysis 073025Trading Idea

Hit the 300/261.80% resistance level.

Chart time frame:D

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress:E

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E) Hit the top

Stocks rise as they rise fro

US Banks on Fire | Revenues Soar, and So Do the ProfitsWho Needs a Recession? Banks Are Swimming in Cash!

The largest U.S. banks have reported some of their best quarterly performances in recent years, with surging trading revenues, a resurgence in dealmaking, and an overall renewal of corporate confidence playing pivotal roles. Let’s break down the k

JPM Breakout in Play – Target $295+

🧠 Chart Analysis Summary:

Pattern: Symmetrical triangle breakout has occurred. Momentum is building.

Current Price: $288.58

Breakout Confirmation: Price closed above resistance trendline (pink), signaling potential bullish move.

📊 Key Levels:

Entry Zone: $288.50–289.00

Resistance/Targets:

Mi

JPMorgan Chase Wave Analysis – 10 July 2025- JPMorgan Chase reversed from support zone

- Likely to rise to resistance level 296.00

JPMorgan Chase recently reversed up from the support zone between the support level 280.00 (former multi-month high from January), support trendline of the daily up channel from April and the 38.2 Fibonacci corr

JPM. Earnings, then a correction 255 is my target here which represents a 10-13% correction from current levels

I doubt we break below 250 before sept.. eventually this stock will head back to the bottom of its long term channel

For now I think we close this gap at 279 .. most likely a bounce will come there because of the da

JPM: Internal CadenceResearch Notes

Testing coordinates of full fractal cycle for deterministic properties. If we base our core measurements (0; 1) on that shape:

Interference Pattern I - adjusted to the angle of building blocks

Interference Pattern II

Interference Pattern III

This explains all Fibonac

JPMorgan Chase Wave Analysis – 3 July 2025- JPMorgan broke key resistance level 280.00

- Likely to rise to resistance level 300.00

JPMorgan recently broke above the key resistance level 280.00 (which stopped the earlier sharp upward impulse wave (5) in February).

The breakout of the resistance level 280.00 accelerated the active impulse w

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

J

XS1752956315

JPMorgStrucProd 100 30/07/2027 Credit Linked Notes linked to the Republic of Zambia and local bondsYield to maturity

81.04%

Maturity date

Jul 30, 2027

J

XS1879195177

JPMorgChaseBk 16/12/2025 STOXX Global Technology Select 30 EUR (Price) IndexYield to maturity

51.19%

Maturity date

Dec 16, 2025

J

JPM5902641

JPMorgan Chase Financial Co. LLC 0.0% 16-OCT-2025Yield to maturity

45.35%

Maturity date

Oct 16, 2025

J

XS1569748202

JPMorgChaseBk 15/08/2025 Consumer Staples Select Sector SPDR Fund ETFYield to maturity

43.99%

Maturity date

Aug 15, 2025

See all JPM bonds

Curated watchlists where JPM is featured.

Frequently Asked Questions

The current price of JPM is 5,465.00 MXN — it has decreased by −2.06% in the past 24 hours. Watch JP MORGAN CHASE CO stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BIVA exchange JP MORGAN CHASE CO stocks are traded under the ticker JPM.

JPM stock has fallen by −0.67% compared to the previous week, the month change is a 0.28% rise, over the last year JP MORGAN CHASE CO has showed a 38.09% increase.

We've gathered analysts' opinions on JP MORGAN CHASE CO future price: according to them, JPM price has a max estimate of 6,611.26 MXN and a min estimate of 4,533.43 MXN. Watch JPM chart and read a more detailed JP MORGAN CHASE CO stock forecast: see what analysts think of JP MORGAN CHASE CO and suggest that you do with its stocks.

JPM stock is 4.10% volatile and has beta coefficient of −4.20. Track JP MORGAN CHASE CO stock price on the chart and check out the list of the most volatile stocks — is JP MORGAN CHASE CO there?

Today JP MORGAN CHASE CO has the market capitalization of 15.19 T, it has decreased by −0.30% over the last week.

Yes, you can track JP MORGAN CHASE CO financials in yearly and quarterly reports right on TradingView.

JP MORGAN CHASE CO is going to release the next earnings report on Oct 14, 2025. Keep track of upcoming events with our Earnings Calendar.

JPM earnings for the last quarter are 98.29 MXN per share, whereas the estimation was 84.09 MXN resulting in a 16.88% surprise. The estimated earnings for the next quarter are 88.03 MXN per share. See more details about JP MORGAN CHASE CO earnings.

JP MORGAN CHASE CO revenue for the last quarter amounts to 842.47 B MXN, despite the estimated figure of 821.84 B MXN. In the next quarter, revenue is expected to reach 839.72 B MXN.

JPM net income for the last quarter is 279.72 B MXN, while the quarter before that showed 298.54 B MXN of net income which accounts for −6.30% change. Track more JP MORGAN CHASE CO financial stats to get the full picture.

Yes, JPM dividends are paid quarterly. The last dividend per share was 26.13 MXN. As of today, Dividend Yield (TTM)% is 1.83%. Tracking JP MORGAN CHASE CO dividends might help you take more informed decisions.

JP MORGAN CHASE CO dividend yield was 2.00% in 2024, and payout ratio reached 24.30%. The year before the numbers were 2.41% and 25.27% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 3, 2025, the company has 317.23 K employees. See our rating of the largest employees — is JP MORGAN CHASE CO on this list?

Like other stocks, JPM shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade JP MORGAN CHASE CO stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So JP MORGAN CHASE CO technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating JP MORGAN CHASE CO stock shows the buy signal. See more of JP MORGAN CHASE CO technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.