Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

235.32 MXN

79.39 B MXN

723.36 B MXN

224.03 M

About Lennar Corporation

Sector

Industry

Website

Headquarters

Miami

Founded

1954

FIGI

BBG00JX0P3Q9

Lennar Corp. engages in the provision of real estate related financial and investment management services. It operates through the following segments: Homebuilding, Financial Services, Multifamily, and Lennar Other. The Homebuilding segment refers to the construction and sale of single-family attached and detached homes and the purchase, development, and sale of residential land directly and through entities. The Financial Services segment focuses on mortgage financing, title, and closing services for buyers. The Multifamily segment is involved in the development, construction, and property management of multifamily rental properties. The Lennar Other segment includes funds, asset management platform, and strategic investments in technology companies. The company was founded in 1954 and is headquartered in Miami, FL.

Related stocks

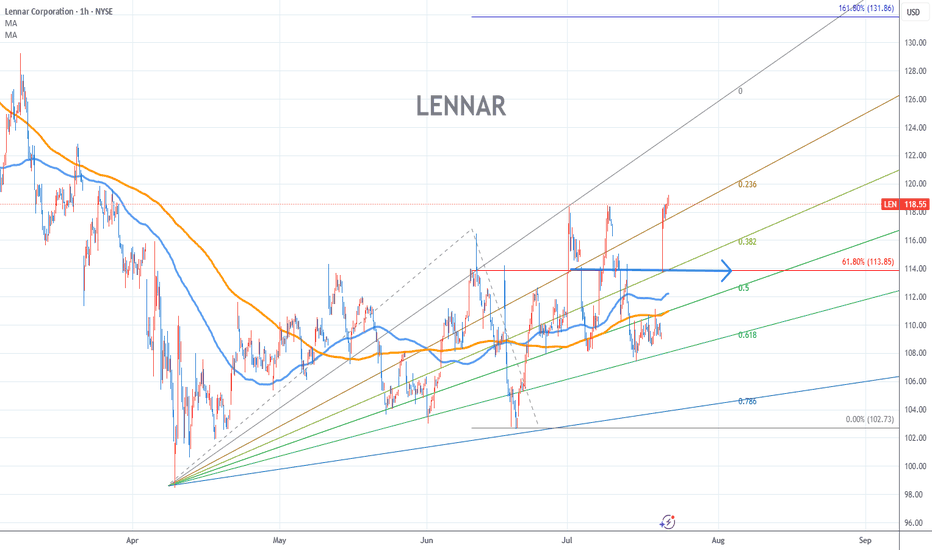

LENNAR Stock Chart Fibonacci Analysis 072225Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 114/61.80%

Chart time frame:B

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress:A

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E)

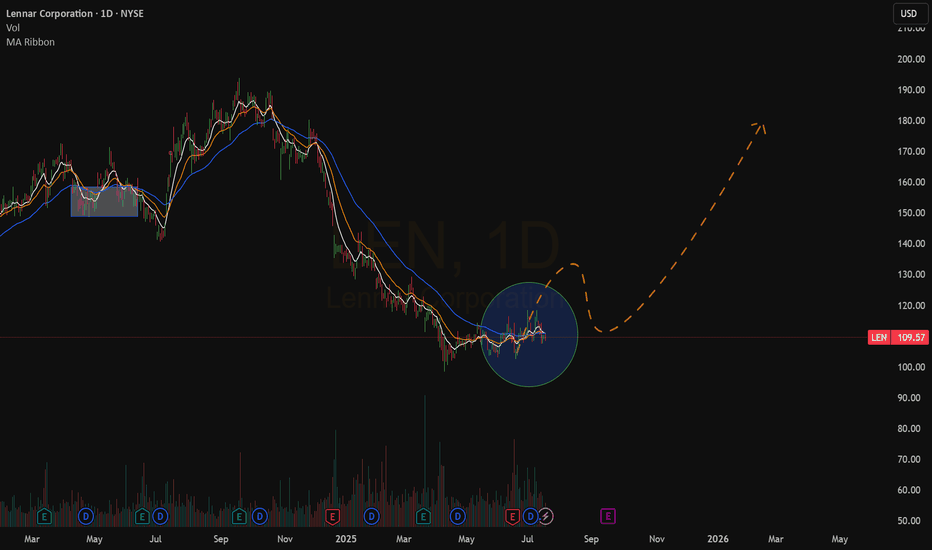

Long Opportunity Amid Resilient Housing DemandTargets:

- T1 = $109.50

- T2 = $112.00

Stop Levels:

- S1 = $105.00

- S2 = $103.22

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to identify high-probability trade setups. The

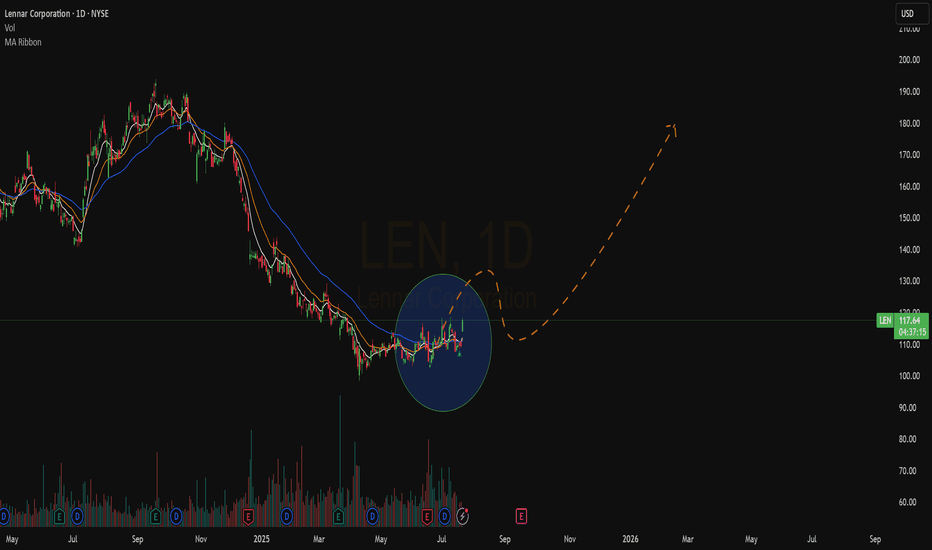

Lennar Corp | LEN | Long at $116.48Across the US, there is a pent-up demand for housing (for the vast majority of locations). While the media likes to selectively report home sales dropping for certain regions, it is more due to mortgage rates and seasonality than demand. Mortgage rates are anticipated to come down over the next 1-2

LEN to $131My trading plan is very simple.

I buy or sell when:

* Price tags the top or bottom of parallel channel zones

* Money flow spikes above it's Bollinger Bands

* Price at Fibonacci levels

So...

Here's why I'm picking this symbol to do the thing.

Price in channel zone at bottom of 26 period channel

LEN Lennar Corporation Options Ahead of EarningsIf you haven`t sold LEN before the previous earnings:

Now analyzing the options chain and the chart patterns of LEN Lennar Corporation prior to the earnings report next week,

I would consider purchasing the 170usd strike price Calls with

an expiration date of 2024-12-20,

for a premium of approxima

Lennar Corp: LONG Swing TradeThesis: Bullish Short-term

Company Profile:

Lennar Corporation develops and sells single-family and multifamily homes, along with residential land. It also provides mortgage financing, title, insurance, and closing services, and originates securitized commercial loans. Its customer base include

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where LEN is featured.

Frequently Asked Questions

The current price of LEN is 2,044.30 MXN — it has decreased by −6.74% in the past 24 hours. Watch LENNAR CORPORATION stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BIVA exchange LENNAR CORPORATION stocks are traded under the ticker LEN.

LEN stock has fallen by −4.59% compared to the previous week, the month change is a −0.57% fall, over the last year LENNAR CORPORATION has showed a −27.78% decrease.

We've gathered analysts' opinions on LENNAR CORPORATION future price: according to them, LEN price has a max estimate of 2,887.68 MXN and a min estimate of 1,781.36 MXN. Watch LEN chart and read a more detailed LENNAR CORPORATION stock forecast: see what analysts think of LENNAR CORPORATION and suggest that you do with its stocks.

LEN stock is 8.00% volatile and has beta coefficient of 0.57. Track LENNAR CORPORATION stock price on the chart and check out the list of the most volatile stocks — is LENNAR CORPORATION there?

Today LENNAR CORPORATION has the market capitalization of 554.40 B, it has decreased by −5.56% over the last week.

Yes, you can track LENNAR CORPORATION financials in yearly and quarterly reports right on TradingView.

LENNAR CORPORATION is going to release the next earnings report on Sep 17, 2025. Keep track of upcoming events with our Earnings Calendar.

LEN earnings for the last quarter are 35.21 MXN per share, whereas the estimation was 37.78 MXN resulting in a −6.78% surprise. The estimated earnings for the next quarter are 39.08 MXN per share. See more details about LENNAR CORPORATION earnings.

LENNAR CORPORATION revenue for the last quarter amounts to 162.99 B MXN, despite the estimated figure of 159.09 B MXN. In the next quarter, revenue is expected to reach 166.48 B MXN.

LEN net income for the last quarter is 9.17 B MXN, while the quarter before that showed 10.60 B MXN of net income which accounts for −13.51% change. Track more LENNAR CORPORATION financial stats to get the full picture.

Yes, LEN dividends are paid quarterly. The last dividend per share was 9.33 MXN. As of today, Dividend Yield (TTM)% is 1.73%. Tracking LENNAR CORPORATION dividends might help you take more informed decisions.

LENNAR CORPORATION dividend yield was 1.15% in 2024, and payout ratio reached 13.97%. The year before the numbers were 1.17% and 10.92% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 26, 2025, the company has 13.27 K employees. See our rating of the largest employees — is LENNAR CORPORATION on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. LENNAR CORPORATION EBITDA is 79.92 B MXN, and current EBITDA margin is 13.87%. See more stats in LENNAR CORPORATION financial statements.

Like other stocks, LEN shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade LENNAR CORPORATION stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So LENNAR CORPORATION technincal analysis shows the strong sell today, and its 1 week rating is strong sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating LENNAR CORPORATION stock shows the sell signal. See more of LENNAR CORPORATION technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.