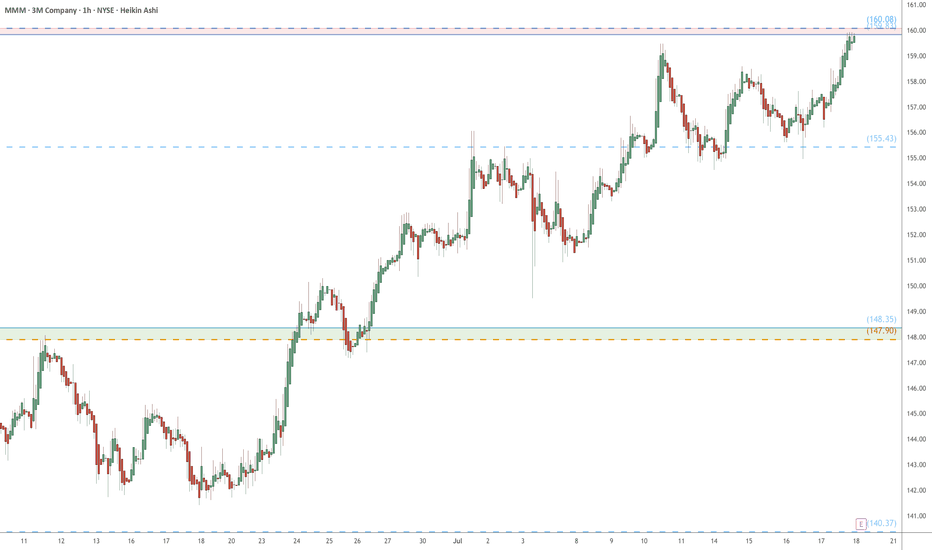

MMM eyes on $160: Resistance Zone waiting for Earnings reportMMM has been crawling off a decade long bottom.

Testing a significant resistance at $159.83-160.08

Earnings report tomorrow, so a key 24 hours here.

.

Previous analysis that caught the BREAK OUT:

Hit the BOOST and FOLLOW for more PRECISE and TIMELY charts.

========================================================

.

MMM trade ideas

Double Calendar Option Spread on MMMUsing a double calendar spread to profit from price movement in either direction after earnings announcement in 3 days time (18 July) for MMM.

These trades can be extremely profitable if one expects movement after earnings.

Selling both a Put and Call at high (pre-earnings IV) makes this option trade relatively cheap, since the purchase for the other Call and Puts are after earnings announcement with lower IV

Selling a Call with Strike $167 for 18th July

Selling a Put with Strike $145 for 18th July

Buying a Call with Strike $175 for 29 Aug

Buying a Put with Strike $140 fro 29 Aug

Total net debit and max loss $125 for 1 contract

Max profit $ 287

For more details on these type of Option trades you can search for Strategic Options Trader on Substack

3M - LTF Successful RetestWe have seen a liquidity zone form for the past year and finally we are looking at a successful retest. Given this holds as a new buying zone then our next target would be $170-$174 followed by the ATH around $216.

If price fails to hold this liquidity zone as new support and price closes back below $154 then this would be a failed breakout.

MMM - 5 months HEAD & SHOULDERS CONTINUATION══════════════════════════════

Since 2014, my markets approach is to spot

trading opportunities based solely on the

development of

CLASSICAL CHART PATTERNS

🤝Let’s learn and grow together 🤝

══════════════════════════════

Hello Traders ✌

After a careful consideration I came to the conclusion that:

- it is crucial to be quick in alerting you with all the opportunities I spot and often I don't post a good pattern because I don't have the opportunity to write down a proper didactical comment;

- since my parameters to identify a Classical Pattern and its scenario are very well defined, many of my comments were and would be redundant;

- the information that I think is important is very simple and can easily be understood just by looking at charts;

For these reasons and hoping to give you a better help, I decided to write comments only when something very specific or interesting shows up, otherwise all the information is shown on the chart.

Thank you all for your support

🔎🔎🔎 ALWAYS REMEMBER

"A pattern IS NOT a Pattern until the breakout is completed. Before that moment it is just a bunch of colorful candlesticks on a chart of your watchlist"

═════════════════════════════

⚠ DISCLAIMER ⚠

Breakout Area, Target, Levels, each line drawn on this chart and any other content represent just The Art Of Charting’s personal opinion and it is posted purely for educational purposes. Therefore it must not be taken as a direct or indirect investing recommendations or advices. Entry Point, Initial Stop Loss and Targets depend on your personal and unique Trading Plan Tactics and Money Management rules, Any action taken upon these information is at your own risk.

═════════════════════════════

3M is skyrocketing againAfter a period of sideways trading, 3M has clearly shown where its resistance levels are—and this is dynamite for traders. If the price breaks above the current resistance, we could be in for a very interesting rally, especially if it also surpasses the previous all-time high at 165.

This offers a great opportunity to enter a position in 3M with the potential for a 10% or greater profit in just a few weeks, while keeping your stop loss at 2-3%.

This trade can be done with minimal risk. To learn more about the strategy, follow ;)

Going Long on MMMMMM chart displays a bullish candlestick today (June 11, 2025) with the short term GMMA bouncing off from the Long term GMMA. VStop (10 d length, Source: Close; Multiplier 1) indicates a bullish nature.

One could go Long at the end of the day by placing a Stop order 5c above the high and a SL at 142.65, which is 5 cents below the low of the current LOW. Exit at 2x the risk taken.

THis is not an investment idea and this is no guarantee this trade will result in a Profit.

3M Wave Analysis – 21 May 2025

- 3M reversed from multi-month resistance level 154.00

- Likely to fall to support level 145.00

3M recently reversed down from the multi-month resistance level 154.00 (which has been reversing the price from the end of January) intersecting with the upper daily Bollinger Band.

The downward reversal from the resistance level 154.00 formed the daily Japanese candlesticks reversal pattern Evening Star.

Given the strength of the resistance level 154.00 and the overbought daily Stochastic, 3M can be expected to fall to the next support level 145.00.

3M short idea A major part of our US30 analysis is to carefully analyze the 30 companies that take part of the dow jones I made the list on my notes and will now be giving my insight of where these companies should be heading in the short future.... ill say something they're not going up for sure!!!!

Second trade paper trading Bought 1 contract then bought 9 more when it went in my direction.

Looked at smaller timeframes for entry (15m, 5m etc and I looked at higher time frames for the trend such as 4hr and 1hr.

Waited for confirmations and then entered the trade.

Sold put and made $.

Second day in the row.

Entered: 11am and Exit: 2:00pm

Goal: keep studying, practicing and earning.

Trade had some reversals and scary moments.

Why Did 3M Stock Soar Despite Tariff Clouds?Shares of industrial giant 3M Co. experienced a significant rally following the release of its first-quarter 2025 financial results. The surge was primarily driven by the company reporting adjusted earnings and total net sales that exceeded Wall Street's expectations. This performance signaled a stronger operational footing than analysts had anticipated.

The positive results stemmed from several key factors highlighted in the report. 3M demonstrated solid organic sales growth and achieved notable adjusted operating margin expansion. This margin improvement reflects the effectiveness of management's ongoing cost-cutting initiatives and strategic focus on operational efficiency, contributing directly to double-digit growth in earnings per share during the quarter.

While the company did warn about potential future impacts on 2025 profit due to rising global trade tensions and tariffs, management also detailed proactive strategies to mitigate these risks. Plans include supply chain adjustments, pricing actions, and leveraging their global manufacturing network, potentially increasing U.S. production. The company maintained its full-year adjusted earnings guidance, notably stating that this outlook already incorporates the anticipated tariff effects. Investors likely responded positively to the combination of strong quarterly performance and clear actions to address identified headwinds.

3M Wave Analysis – 27 March 2025

- 3M reversed from resistance area

- Likely to fall to support level 147.00

3M recently reversed down from the resistance area between the key resistance level 154.00 (which has been reversing the price from the end of January) and the upper daily Bollinger Band.

The downward reversal from this resistance area created the two consecutive Japanese candlesticks reversal patterns Doji – which highlights the strength of this resistance level.

Given the strength of the resistance level 154.00 and the overbought daily Stochastic, 3M can be expected to fall to the next support level 147.00 (low of the previous correction 2).

3M: Higher High ExpectedAt the start of the year, MMM continued to rise higher before the rally temporarily transitioned into a consolidation phase. February brought slight downward pressure, but after a brief spike back to $141 last week, buying interest returned noticeably. This triggered a strong upswing, with the stock gaining nearly 10% in just a few trading days. As a result, we have identified an internal five-wave structure within the turquoise wave 5 and now primarily assume that the magenta wave is already unfolding. This wave should extend further upward, marking the completion of the broader magenta wave (1). Afterward, we anticipate a significant wave (2) correction, which could also begin earlier. In this 35% likely alternative scenario, the stock would experience a premature sell-off below the $131.40 support, with wave alt.(2) eventually reaching our magenta Target Zone between $106.04 and $86.20.

MMM Technical Outlook: Potential Buy SetupMMM is in a strong bullish uptrend after finding support around the 76 zone in March 2024. The stock has posted positive earnings for four consecutive quarters, meeting expectations. Trading above the daily trendline, it's likely to fill the gap formed after January earnings, setting up a new higher low.

Entry Suggestions:

Buy 1: 142.5

Buy 2: 135.5

Stop Loss (on closing basis): 124

For exits, consider a tiered approach. In the near term, aim to book profits around 154.4 and 172. Looking ahead, there's potential for further gains with targets at 182 and 215, although these may take longer to materialize. A weekly bearish divergence is forming and could influence price action around the upcoming earnings on April 29. Until then, the price seems well-positioned to hit the initial targets, making this an attractive trading opportunity.

Happy trading!

Larger corrective structure over, impulse move upNYSE:MMM has been on a corrective phase since 29 Jan 2018 peaks and it has been on a extended double three corrective wave based on the weekly chart shown. Furthermore, the stock has also broken out of the corrective descending channel, which marks the end of the corrective move. Currently, the stock is preparing for its 5th wave impulse move and should see strong action up towards 168.00. Golden cross of the EMAs can be seen also.

Price action

Daily price action is showing bullish momentum as well after breaking above the pennant and prices are trending above all the ichimoku.

Momentum

Long-term MACD signal line is likely to perform a crossover.

The stochastic Oscillator (62, 12, 12) rose, showing strong bullish pressure

The rate of change managed to rise sharply above the zero line.

Volume and Trend strength are in a healthy stage. Both are displayed by volume and Directional movement index.

Is it time for a leap on MMM?🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

3M (MMM): Patience Before Next StepsWall Street analysts estimate that 3M will report quarterly earnings of $1.66 per share next week, reflecting a significant 31.4% year-over-year decline. Revenues are projected at $5.79 billion, down 27.7% compared to the same quarter last year.

As we mentioned previously, we have not yet set a clear limit for 3M and continue to monitor its chart closely. The current structure suggests that the alternative scenario, where wave 1 is positioned higher, appears increasingly likely. However, a significant surge beyond this point does not seem probable at this time.

We’re keeping a close watch to determine where this wave 1 establishes its top before making any further moves. Patience remains key as we refine our conclusions on NYSE:MMM ’s next steps.