MSFT trade ideas

MSFT GEX Breakdown: Heavy PUT Signals Danger Below 380!🔮 Options GEX (Gamma Exposure) Insights – MSFT:

🟥 PUT Domination Increasing

* Highest negative GEX sits around 380–375, making this a critical gamma support zone where dealers are heavily hedged long gamma.

* If MSFT breaks below 380, expect amplified sell pressure as dealers adjust hedges, possibly triggering a quick flush to 360, where another GEX wall sits.

🟩 CALL Walls Stack at Resistance

* CALL Walls are stacked between 395, 397.5, and 400, forming a firm gamma ceiling.

* The highest positive net GEX resides near 395–400, making upward movement difficult unless IV spikes and hedging flips.

📉 GEX Sentiment Summary:

* IVR: 50.3 → Volatility expectations remain moderate.

* IVx: 35.3, trending –7.75% lower, suggests option pricing is cooling — but this can rapidly reverse if support fails.

* PUTs dominate at 35.8%, implying dealers are short gamma and could accelerate moves if price breaks either direction — especially down.

🎯 GEX Game Plan:

* Below 380: Watch for a sharp selloff toward 375, then 360 if flow intensifies.

* Above 390: Limited upside until 395–400 clears — CALL resistance is thick, expect rejection unless news or volume surge.

🕰️ Technical Analysis – 1H Chart (Supports the GEX View)

* Trendline Breakdown: Price has slipped below a rising wedge, and EMAs are flattening out — bearish.

* VWAP Rejection: Price is struggling under VWAP, showing institutional sell pressure.

* MACD: Flat but negative, trending under zero — no momentum shift yet.

* RSI: Below 45 and falling — still no divergence or strength building.

Support/Resistance Key Levels:

* Support: 380 (first GEX wall), 375 (heavy PUT support), then 360 (final wall).

* Resistance: 390 (VWAP area), 395–400 (dense CALL walls).

🧠 Final Thoughts:

MSFT is coiling near a high-risk gamma zone. With dealers holding heavy short gamma below 380 and no clear bullish reclaim on the chart, downside remains open. Bulls need to reclaim 390+ fast — or risk a gamma-led liquidation flush to 375 or lower.

This is a GEX-driven chart — the technicals merely confirm what options flow already warns: the path of least resistance is likely down, unless a surprise reversal ignites above 390.

This analysis is for educational purposes only and not financial advice. Always manage risk and confirm setups with price action.

Elliott Wave Analysis Signals Gains in Microsoft (MSFT)The short-term Elliott Wave outlook for Microsoft (MSFT) paints a bullish picture, suggesting the stock has room to climb after a key low at $338 on April 7, 2025. This level marked the end of a corrective phase, known as wave (II), following a decline that began on July 5, 2024. That selloff unfolded in a three-wave pattern, a hallmark of a correction rather than a bearish trend. Notably, the final leg of this decline, starting from the December 12, 2024 high, didn’t reach a typical Fibonacci extension (1.618), reinforcing the idea that the market remains bullish on Microsoft.

Since hitting the $338 low, Microsoft has rallied in a five-swing pattern, a structure called a motive sequence, signaling potential for further gains. The rally’s first leg, wave (1), peaked at $373.65, followed by a dip to $346.75 in wave (2). The stock then surged to $393.23 in wave (3), with a brief pullback to $367.80 in wave (4). Now, Microsoft is likely nearing the end of wave (5), completing a larger wave ((1)).

Looking ahead, a wave ((2)) pullback is expected to correct the rally from April 7, but as long as the $338 low holds, any dips should find support in a three-, seven-, or eleven-swing pattern, setting the stage for more upside. This suggests short-term pauses but a continued upward trend for Microsoft, making it a stock to watch for bullish opportunities.

MSFT at a Key Inflection Point! Will This Breakout Hold?Technical Analysis (1H):

* Trend Structure: MSFT is trading within a clean ascending channel. Price is currently hugging the upper trendline resistance, with higher lows confirming strong intraday buyer interest.

* Volume: Buying volume picked up significantly during the breakout on April 10 and has since stabilized as price consolidates near resistance — a healthy sign of continuation if bulls hold.

* RSI: RSI is trending above the midpoint and gradually rising, but not overbought — signaling room to move higher without immediate exhaustion.

* Key Resistance:

* 392.92 — Local high. If broken, potential to run toward 400 and 405.

* Gamma Wall sits at 405, which aligns with highest positive NETGEX and may act as a magnet for price.

* Support:

* 377.50 — Nearest support from HVL (High Volume Level) and Gamma Support.

* 367.80 / 348.29 — Stronger downside zones if price fails the channel.

GEX & Options Flow Insights:

* GEX Walls:

* 405 = Highest Positive NETGEX / Gamma Wall.

* Multiple call walls layered at 400, 405, and 410 — creating a strong bullish magnet above.

* Put walls concentrated below 377.5, but gamma intensity is lower until 355.

* Options Oscillator:

* IVR: 64.8 — moderately elevated.

* IVx avg: 46 — showing increasing volatility expectations.

* Put Positioning: 44.9% — almost evenly balanced with calls, slight lean toward downside hedging.

* GEX Sentiment: 🟡🔴🟢 — Mixed, but still slightly favorable for upside as long as 377.5 holds.

Trade Scenarios:

📈 Bullish Setup:

* Entry: Break above 393–395 with strong volume.

* Target: 400 → 405 (gamma magnet zone).

* Stop: Below 386 (channel midline break).

📉 Bearish Setup:

* Entry: Breakdown below 377.5 support.

* Target: 367.8 → 348.2

* Stop: Above 386 to avoid getting trapped by a bounce.

Option Trade Suggestion:

* Directional Call Debit Spread (Apr 17 expiry):

* Buy 395c / Sell 405c

* Risk-defined setup aligned with gamma wall targets.

* If bearish: Consider 375p / 360p put spread if MSFT rejects 393 and breaks below 377.5.

Final Thoughts:

MSFT is sitting on a powder keg of potential. Price is coiled under a resistance zone where gamma exposure aligns with bullish targets. If macro sentiment aligns, the breakout toward 400–405 could trigger a short-term momentum rally. But failure to hold the channel would mean a quick retest of 377–367 range.

This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage risk appropriately.

Margin Meltdown & the Golden Surge: How Tech Cracks Fueled Gold?Margin Meltdown & the Golden Surge: How Tech Cracks Fueled Gold’s Breakout in April 2025

Fear-Driven Flight to Gold is Real

If margin calls continue and top stocks like Microsoft and NVIDIA keep showing weakness:

• Expect more bond market stress

• A persistently weak dollar

• And a sustained gold rally

Gold is the cleanest beneficiary of the current chaos. Every chart, every data point, every political move validates it.

////////=====////////

What’s Happening in the Stock Market and Trump’s Tariffs – Simple Summary (Updated & Validated)

1. Margin Loans:

Many investors borrowed money using their stock portfolios as collateral. For example, if someone owns $100,000 in Microsoft stock (now trading at $388.45), they could borrow up to 90% of that value — $90,000 — and use it to buy other stocks like NVIDIA ($110.93).

2. Margin Calls:

When the market fell earlier this month, Microsoft and NVIDIA dropped sharply. Brokers issued margin calls, forcing investors to either deposit more funds or sell off assets to cover their positions.

3. Forced Selling:

As stocks fell further, more investors were forced to liquidate. This increased selling pressure pushed prices down even harder.

4. Vicious Cycle:

The deeper the drop, the more margin calls got triggered, which led to even more forced sales — a self-perpetuating loop of destruction.

5. Bond Selling Instead of Stocks:

Some investors didn’t want to sell their stock positions and instead began selling bonds to raise cash — including even U.S. Treasuries.

6. Bond Market Shock:

This rare, broad-scale bond selloff shook up the entire fixed-income market — everything from corporate to government bonds dumped.

7. Rising Yields:

As bond prices fell, yields spiked. But this wasn’t due to strong growth — it was pure fear-driven liquidation.

8. Unexpected Dollar Weakness:

Usually, during times of crisis, the dollar strengthens. But not this time. The U.S. dollar fell, while currencies like the euro and Swiss franc gained. The Chinese yuan stayed weak under its own pressures.

9. Trump’s Reaction:

In response to the chaos, Trump’s administration paused tariffs for 90 days — a political move under pressure. But the damage to market psychology was already done.

10. Tax-Loss Harvesting by Smart Investors:

During the crash, savvy investors sold declining stocks like Microsoft to lock in tax deductions, then bought similar alternatives like NVIDIA to stay in the market while writing off losses.

Impact on Gold (XAU/USD) – Real-Time Validation

As of April 12, 2025, Gold (XAU/USD) is trading at:

$3,235.91 (+$60.13 for the day | +12.02% over the past month)

Let’s validate the theory with what actually happened:

1. Gold vs. Stocks and Bonds:

While Microsoft and NVIDIA were collapsing earlier this month, gold surged. This shift confirms a flight to safety — gold became the preferred hedge during equity and bond volatility.

2. Falling Dollar = Bullish for Gold:

With the dollar under pressure, gold became cheaper in foreign currencies — driving international demand and pushing prices even higher.

3. Rising Yields – But Driven by Panic:

Normally, higher yields compete with gold. But this time, yields rose because bonds were being dumped, not because of economic strength. That fear drove even more capital into gold.

4. Policy Uncertainty:

Trump’s late response and inconsistent trade policies fueled further market unease. That pushed more investors toward gold as a non-political store of value.

5. Liquidity Crunch Risk:

Some gold may have been sold during the panic to raise quick cash, but overall, the trend shows that gold held firm and then broke out even harder — a textbook crisis hedge move.

Real Example: Microsoft and NVIDIA Margin Trap

Let’s walk through the actual setup:

• An investor owns $100,000 in Microsoft (MSFT at $388.45).

• They take a $90,000 margin loan to buy NVIDIA (NVDA at $110.93).

• Early April:

• MSFT dropped below $320.

• NVDA fell under $100.

This triggers:

• Margin calls.

• Forced selling of both positions.

• Possibly even bond liquidation.

• And systemic panic across portfolios.

Result?

• Tech sold off.

• Bonds dropped.

• Yields rose.

• Dollar weakened.

• Gold exploded.

///////======//////

Impact on Gold (XAU/USD): Real Events, Real Movement

• Microsoft & NVIDIA Down: Confirmed panic in tech.

• Bond Selloff = Higher Yields: But from fear, not confidence.

• Weaker Dollar: Confirmed.

• Gold Breakout: Real.

• RSI above 70

• ADX shows trend strength

• Volume surging

• Price broke $3,200 and held

Gold moved exactly how a textbook safe haven asset should behave in this

//////======///////

XAUUSD market behavior and trader mindset:

1. Monday: Continuation After Breakout (Euphoria Phase)

Psychological Insight:

Traders and institutions are chasing momentum. After a clean breakout, FOMO kicks in, especially for those who missed the first leg. They buy pullbacks aggressively, creating a bullish Monday.

Projection: Bullish continuation

Range: 3,230 – 3,270

Bias: Buy dips

Reason: Momentum from last week’s breakout still pushing higher. RSI >70 but not topping, and no reversal pattern on daily chart. Weak USD persists.

2. Tuesday: Pullback from Overextension (Reality Check)

Psychological Insight:

Once price pushes too far, short-term traders start locking profits. This creates a dip. But smart money (institutions) sees the pullback as cheap entry — especially with no bearish reversal confirmation.

This is textbook reaccumulation psychology.

Projection: Intraday pullback, then bounce

Range: 3,250 – 3,280

Bias: Buy on VWAP pullback

Reason: Small retracement likely due to overextension. Support at VWAP (~3,219). Bullish engulfing pattern might trigger dip-buyers.

3. Wednesday: Retest / Breakout (Conviction Phase)

Psychological Insight:

After a healthy pullback and hold, traders regain confidence in the trend. Breakout traders load in here — and weak shorts get squeezed. This is where bullish conviction peaks, triggering high-volume moves.

Projection: Breakout attempt

Range: 3,265 – 3,310

Bias: Scalpers can long breakout

Reason: If momentum holds, this is likely the day gold retests highs and pushes through short-term resistance (~3,300 psychological + fib extension zone).

4. Thursday: Sideways Chop (Indecision / Distribution)

Psychological Insight:

Market participants are split. Some want to hold into the weekend; others fear a Friday sell-off.

You see hesitation, tighter ranges, and volume drop-off — classic signs of short-term indecision and distribution by early buyers.

Projection: Consolidation / Sideways

Range: 3,280 – 3,310

Bias: Neutral-to-bullish

Reason: After a breakout, price typically stalls for distribution/re-accumulation. Expect reduced volatility unless triggered by macro news (watch bond yields).

5. Friday: Final Move (Greed vs. Fear Showdown)

Psychological Insight:

End-of-week decisions are all about book-squaring. If the week was strong and the narrative holds, we get greedy breakouts into the weekend.

If uncertainty creeps in (e.g. Fed noise, geopolitical tension), profit-taking overrides conviction, leading to a dip.

Projection: Second leg breakout or profit-taking

Range: 3,270 – 3,330

Bias: Depends on Thursday’s behavior

Scenario 1: If Thursday consolidates tightly, breakout possible.

Scenario 2: If extended already, profit-taking dip possible into close.

/////=====/////

Weekly Summary:

• High probability: Gold hits $3,300 – $3,330 this week

• Support zones: $3,219 (VWAP), $3,175 (previous breakout zone)

• Resistance zones: $3,298 (fib cluster), $3,330 (round number magnet)

This projection isn’t just TA — it’s behavioral trading at its core, based on how traders actually react:

• FOMO,

• profit-protection,

• fear of reversal,

• and end-of-week positioning.

Every day’s move is driven by human emotion wrapped around market structure.

Immediate leap on MSFT! 🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

MICROSOFT On 4th largest correction in 15 years. Buy or trap?Microsoft (MSFT) has corrected by -26.50% from its All Time High (ATH), representing the 4th biggest correction since June 2010, which was the first pull-ack after the historic 2008 Housing Crisis.

At the same time the 1W RSI hit the 30.00 oversold limit for the first time since that low of June 2010! Not even the Housing bottom didn't exhibit such low 1W RSI.

All while the current Tariff War correction stopped a little before testing the 1W MA200 (orange trend-line), which has been the long-term Support since 2011 and was last hit (for the 2nd time during that time span) in December 2022 during the previous Inflation Crisis.

As a result, this is a unique long-term buy opportunity for such a tech giant. The 2010 rebound hit the 0.786 Fibonacci level before pulling back while the rally that was initiated after the 2022 Inflation Crisis bottom reached +117.45%.

Based on the above, we have a medium-term Target on MSFT at $440 (Fib 0.786) and a long-term at $700 (+100%).

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Microsoft MSFT - What`s next?I mentioned a month ago this is a short for me, well dynamics changed in a very quick way, yes went went to a recession before tarrifs were done. But with the tarrfis the dynamics changed quickly. If tarrifs are resolved a huge uptrend is possible, if not resolved then it is not clear what the market will do so what`s the answer where we are going? At the moment NOWHERE. No hedgefunds are shorting at the moment due to high risk of liquidation if Trump posts something new, but also nobody wants to buy at this moment a lot because if he continues after the 90 days (except china) the gloabal tarrifs market drop is possible. But important to say there is much less risk on the downside than on the upside at this moment. Biggest risk was that europe punishes the American IT industry which would hit MSFT and AAPL the hardest, but this risk is now very low. So at this moment. Nobody wants to buy and nobody wants to sell until time comes and if nothing important happens I do think only then we will see what will happen. Slightly more bullish than bearish atm but only minimal. No data, no trade.

Microsoft Regains Top Spot as Most Valuable Company Microsoft Corp. (NASDAQ: NASDAQ:MSFT ) has reclaimed its place as the world’s most valuable public company. The tech giant now holds a market capitalization of $2.64 trillion, surpassing Apple Inc. (NASDAQ: NASDAQ:AAPL ), which fell to $2.59 trillion.

Apple’s sharp decline followed a major 23% sell-off over four days. This came after President Trump announced sweeping new tariffs. These tariffs hit countries like China, India, Vietnam, and Brazil. Apple’s heavy reliance on these regions for manufacturing intensified investor concerns.

Meanwhile, Microsoft appears less exposed to tariff risks. Analysts say the company remains a stable large-cap stock during ongoing market volatility. Microsoft previously held the top spot briefly last year but was overtaken by Apple and Nvidia (NASDAQ: NASDAQ:NVDA ), now ranked third at $2.35 trillion.

Technical Analysis

Microsoft’s stock is trading at $383.15, up 8.06%, with a high of $387.07 so far today. The price rebounded sharply from the support level near $345. This zone had previously acted as resistance in late 2021 and early 2022. It now serves as strong support. The volume spike confirms buyer interest at this level.

The projected path shows a potential bounce toward $468, the recent high. If the trend holds, Microsoft may attempt a new all-time high.

Consider Long Position on MSFT Amid Strategic Partnerships - KeyMicrosoft's resilience in the tech sector is supported by strong liquidity and

quality. Strategic partnerships in data centers, like its link with AMD, enhance

its stability against market downturns. Watching reversal signals is crucial for

identifying recovery phases.

- Price Targets: For a long position, consider

Target 1 (T1) at $368 and Target 2 (T2) at $370.

Use Stop Levels at $325 (S1) and $310 (S2) to manage risk and define exposure.

- Recent Performance:

Microsoft has been affected by a downturn, similar to other tech firms, though

it remains relatively stable given its strategic positioning and strong market

presence. - Expert Analysis: Analysts observe potential reversal signals,

pegging Microsoft's strength on partnerships and its role within the tech

ecosystem. This could cushion the company amidst broader market challenges and

provide potential recovery. - News Impact: Geopolitical developments have

temporarily affected MSFT due to tariff-related fears. However, sentiment around

Microsoft's 50th anniversary might spur speculative interest, adding nuanced

layers to investor sentiment this week.

MSFT Teetering at Breakdown! Options Say THIS Might Be Next🔥 MSFT Teetering at Breakdown! Options Say THIS Might Be Next 👀

Post-crash volatility could offer traders a pivotal edge. Let’s dig in.

🔍 Technical Analysis (SMC & Price Action) – 1H Chart

MSFT is trading inside a clear descending channel and just printed a Break of Structure (BOS) below 367.22, confirming bearish dominance. A supply zone sits between 367 and 385, where prior price rejections occurred. Immediate support is now around the 355–359 area, aligned with the lower channel and prior BOS zone.

MACD remains bearish, with no bullish crossover in sight.

Stoch RSI is deep in oversold territory, beginning to hook upward — this suggests a possible relief bounce or minor consolidation incoming.

📊 Options Sentiment (GEX, IVR, Oscillator)

* The highest negative NET GEX sits at 365, acting as strong PUT support and a short-term magnet.

* Below that, heavy PUT Walls stack up at 355, 350, and 340 — setting up a staircase for potential bearish continuation if bulls fail to hold 359.

* CALL resistance walls lie at 380, 400, and 405 — difficult levels for any rally to reclaim without a sentiment shift.

* Gamma exposure (GEX) remains solidly red, reflecting strong dealer hedging activity to the downside.

* IVR is elevated at 138.2, with IVx at 58.3.

* Options flow is bearish with only 14.7% CALLS — confirming traders are not bidding up upside bets this week.

🧠 Market Thoughts & Outlook

MSFT, like much of tech, is absorbing post-crash stress from Trump tariff news. Institutions are defensively positioned. Options data suggests strong gamma pressure and dealer hedging — a sign that bounces may be sold into. Unless the macro narrative improves, MSFT is at risk of further drawdowns.

📉 Trade Scenarios

Bearish Setup (Primary Bias):

Entry around 359–360 if price gets rejected at this zone.

Targets are 355 → 350 → 340.

Stop above 365 (which is also where the highest negative NET GEX sits).

Bullish Reversal Scenario (Low Probability):

If MSFT reclaims 367 with strength, look for moves toward 380 and possibly 385.

This would need strong volume and macro improvement.

⚠️ Investor Suggestion

For long-term investors, this may be a watchlist zone, not a buy zone — yet. Wait for bullish divergence in MACD/Stoch RSI, reclaim of 367, or an improvement in the options positioning and news sentiment.

Key Levels to Watch:

* Immediate support: 355–359

* Key resistance: 367 and 380

* Breakdown targets: 350 and 340

* Gamma wall: 365 (Put Support), 405 (Call Resistance)

🧭 Final Thoughts

MSFT is teetering at a major level. The market is not showing confidence yet, and options sentiment suggests downside still has fuel. Trade reactively, not emotionally — and size down in volatility.

🔻 This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage risk before trading.

MSFT Under Pressure: Will Gamma Support at $370 Hold?

🧠 Market Context:

Following the Trump tariff announcement, risk-off sentiment is dominating tech. MSFT, while usually defensive within mega-cap tech, has cracked below its short-term HVL and is now testing a key gamma pivot zone at $370, right where the PUT Support is clustered.

📊 Technical Analysis (1H Chart)

Structure:

* Price has formed a lower high and broke down from the $377.50 HVL area.

* Multiple rejections near $387–390, which aligns with GEX call resistance.

* It's now hugging $370, a key support level that could turn into a breakdown zone if breached.

Levels:

* Support:

* 🔹 $370 = PUT Support (Gamma Cluster)

* 🔹 $367.24 = recent low

* 🔹 Below $367, air pocket to $360 zone

* Resistance:

* 🔺 $375 = minor supply & failed bounce spot

* 🔺 $377.50 = HVL

* 🔺 $385–390 = heavy call resistance

Indicators:

* Elevated selling volume on each lower high suggests distribution.

* If $370 fails to hold, expect continuation toward $367 and possibly $360.

🔥 GEX & Options Flow Analysis

GEX Map:

* GEX: 🔴🔴🔴 → Dealers short gamma below $375

* Put Support:

* $370 = Highest Gamma PUT Support

* $367.24 = Real market low from March 28–29 selloff

* Call Walls:

* $385–390 = Dealer sell zone

* $392 = Gamma ceiling

* $396 = Major rejection level from recent highs

Options Oscillator:

* IVR 71.2 → Traders are buying volatility, indicating fear.

* IVx avg 32.3 vs IVx 3.32% → Still rising vol, near-term bearish bias

* PUT$ 10% → Surprisingly low, but this could reflect late hedging, not bullishness.

🧭 Trade Scenarios

🐻 Bearish Breakdown:

* Entry: Break and close below $370

* Target: $367 → $360

* Stop: $374 (tight risk control)

* Confirmation: Watch SPY and QQQ breakdowns in sync.

🐂 Bullish Gamma Bounce:

* Entry: Hold above $370 + reclaim $375

* Target: $385 → $390 (scalp target)

* Stop: Close under $369

🧠 Summary:

MSFT is hanging by a thread — the $370 zone is the battle line. GEX shows it as a PUT-heavy support, but with dealers short gamma, any break could cascade into forced sell hedging.

A bounce could trigger a dead cat rally toward $385, but bulls will need to reclaim $377.50 to make that happen.

⚔️ Trade Idea:

Buy $365P (1-week expiry) if $370 breaks with volume

Buy $385C only on confirmed reclaim of $377.50 + strength in QQQ

This is a dealer-controlled zone, so price will likely whip around until gamma flips.

Disclaimer: This breakdown is for educational purposes only. Always trade with proper risk management and do your own research.

MSFT long pre-market at 374.47As those who follow me know, NASDAQ:MSFT is one of my favorite stocks to trade. It boast a return/day held that all-time is about 5x the average daily return for the market. I've literally never lost a trade involving MSFT, and I don't think this will be the first time. I'm fully expecting this one to take longer than the 9 trading days average, but it could always flip in a day, too.

Another fun fact - MSFT just recorded its 4th consecutive monthly decline. That's only happened twice in the last 39 years. The last time it did was in 2008 and 12 months later it was up over 50%. Not looking to be in the trade for that long, obviously, but someone might be interested in that nugget. BTW - the time before that was 2005 and it was up 12 months later then, too, just not as significantly.

I'll add to my position strategically, given the downtrend in MSFT and the market, and I will use FPC (first profitable close) to exit any lot on the day it closes at any profit.

As always - this is intended as "edutainment" and my perspective on what I am or would be doing, not a recommendation for you to buy or sell. Act accordingly and invest at your own risk. DYOR and only make investments that make good financial sense for you in your current situation.

Microsoft - A Little Lower And Much Higher!Microsoft ( NASDAQ:MSFT ) is about to retest strong support:

Click chart above to see the detailed analysis👆🏻

In mid 2024 Microsoft perfectly retested the previous channel resistance trendline and the recent weakness has not been unexpected at all. However the overall trend still remains rather bullish and if Microsoft retests the previous all time high, a significant move will most likely follow.

Levels to watch: $350

Keep your long term vision!

Philip (BasicTrading)

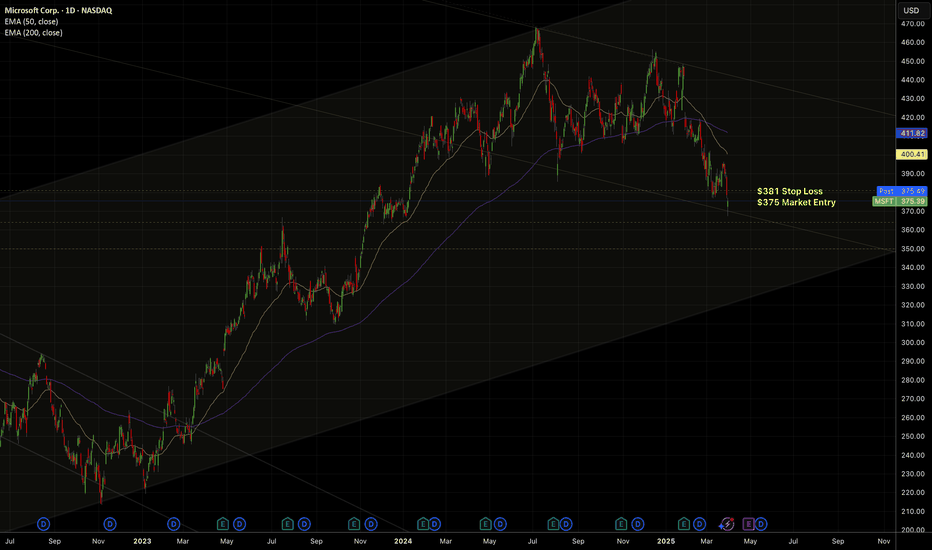

MSFT Short – Death Cross Confirmed | Breakdown Targeting $345🔻 **Trade Idea: SHORT MSFT**

I'm shorting Microsoft after a confirmed **death cross** on the daily chart (50 EMA crossed below 200 EMA), signaling long-term weakness.

### 📉 Structure:

- Breakdown of support at $384

- Clean retest + rejection at $377

- Lower highs and lower lows in play

- Volume spike on breakdown confirms seller strength

### 🎯 Trade Plan:

- **Entry**: $375–377 zone

- **Stop**: $381 (above last swing high)

- **Targets**:

- TP1: $364 (prior base)

- TP2: $357 (structural low)

- TP3: $345 (macro demand zone / 200W EMA)

### 🧠 Thesis:

- MSFT has transitioned from distribution to downtrend

- EMAs are bear-aligned

- Rejection confirmed on intraday wick + volume

- R:R = 3:1+ with clear invalidation

> "We don't chase weakness — we short structure when the market begs us to."

Open to thoughts — let’s trade clean.

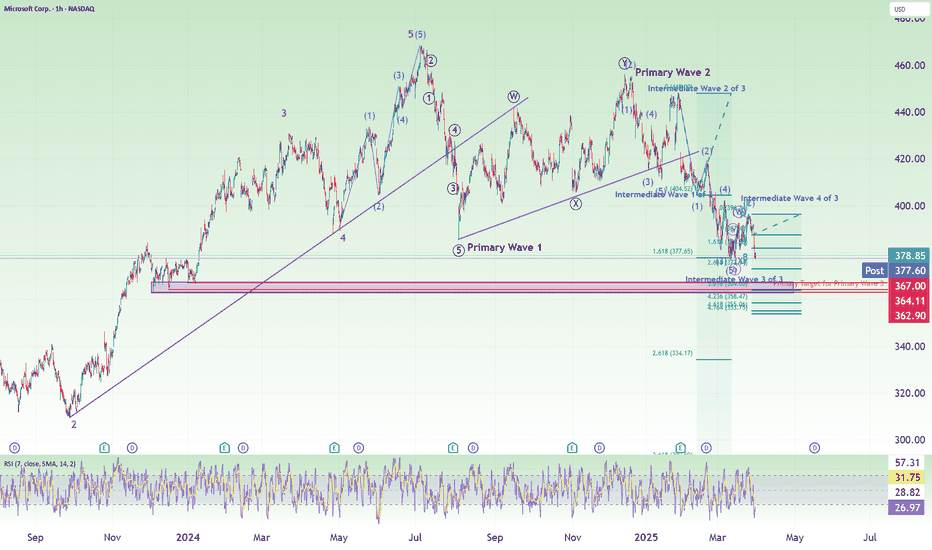

MSFT Short to Neutral: Last Wave 5 of 3 (Target: $364)A video update to Elliott Wave Counts and Price target for MSFT (and Nasdaq).

A summary:

1. Intermediate wave 3 of 3 has ended.

2. Intermediate wave 4 of 3 has ended in a double combination.

3. We are in Minor wave 3 of Intermediate wave 5 of Primary wave 3.

4. Using Fibonacci Extension from Minor wave 1 of against overall Intermediate wave 5 gives us a target of $364, which is within a support zone. This is the Primary Wave 3 completion target.

5. Using Nasdaq, we also noted that we still have a little bit more to our final target.

MSFT Approaching a Key Reversal Zone – Will Bulls Defend Gamma?🔎 Technical Analysis (TA) – Intraday Outlook

Current Price: ~$389.27

* MSFT is pulling back after making a local high near 396.31.

* The price is now sitting just above a demand block, marked by previous CHoCH and BOS levels, signaling a potential bounce zone.

* Structure is showing early signs of weakness, but key support at 382-385 is still intact.

Indicators:

* MACD: Bearish crossover with histogram declining — watch for a potential shift if buyers step in at support.

* Stoch RSI: Oversold, hinting at possible bounce if support holds.

Key Support Zones:

* 385 → Critical intraday support with 2nd PUT Wall.

* 382.87 → High confidence PUT level.

* 376.85 → Strong PUT support and bottom of the SMC zone (high reward bounce setup if defended).

Resistance Zones:

* 392.59 → Local rejection level.

* 396.31 → Key intraday resistance.

* 400 → Highest Positive NetGEX & Gamma Wall (major resistance zone).

* 405 → 2nd CALL Wall.

🧠 GEX & Options Flow Analysis (TanukiTrade GEX Zones)

* GEX Sentiment: 🟢🔴🟢 (Mixed — but put wall support is closer, bullish if held)

* IV Rank (IVR): 31.3

* IVx avg: 26.1 → Options pricing not overly volatile

* PUT$%: 9.6% – Moderate, suggesting dealers may provide support on dips

* Gamma Wall: At 400, major resistance

* PUT Support: At 380 with strong negative GEX (key defensive zone)

* HVL Cluster: Near 390 (May expiry), could pin price today if no catalyst.

🛠️ Trade Scenarios

📈 Bullish Setup – Support Bounce from 385 or 382

* Price bounces from key SMC demand zone and starts reclaiming 390+

* Entry: 386–387 zone reclaim + volume

* Target 1: 392

* Target 2: 396

* Target 3: 400

* Stop-Loss: Below 382.5

* Options Play:

* Long Apr 12 $390 Calls on bounce confirmation.

* Sell $385 Puts if confident in bounce continuation.

📉 Bearish Setup – Breakdown of 382

* If support fails at 382, expect a retest of 376.85 PUT support.

* Entry: Break below 382 with momentum

* Target 1: 376.85

* Target 2: 374 (liquidity sweep zone)

* Stop-Loss: Above 385.5

* Options Play:

* Long Apr 12 $380 Puts

* Debit Spread: Buy $385 Put / Sell $380 Put

🧭 Final Thoughts & Bias

* Short-Term Bias: Neutral → Leaning bullish if 382-385 holds

* GEX Context: Gamma compression is possible between 382-392 – breakout above or breakdown below will trigger expansion.

* Intraday Plan:

* Watch for bounce at 385 zone.

* Flip bearish only below 382 with strong volume.

* If 392.5 breaks, bulls may charge back toward 396-400 zone.

📛 Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Always do your own due diligence and manage risk.