MTCH1 trade ideas

Short, Medium & Long Term $MTCH Long$MTCH is in a new channel between $48 and $60\

Powerful moving stock with alot of growth potential, one of the highest returning stocks the last 2 years, averaging 100% growth per year

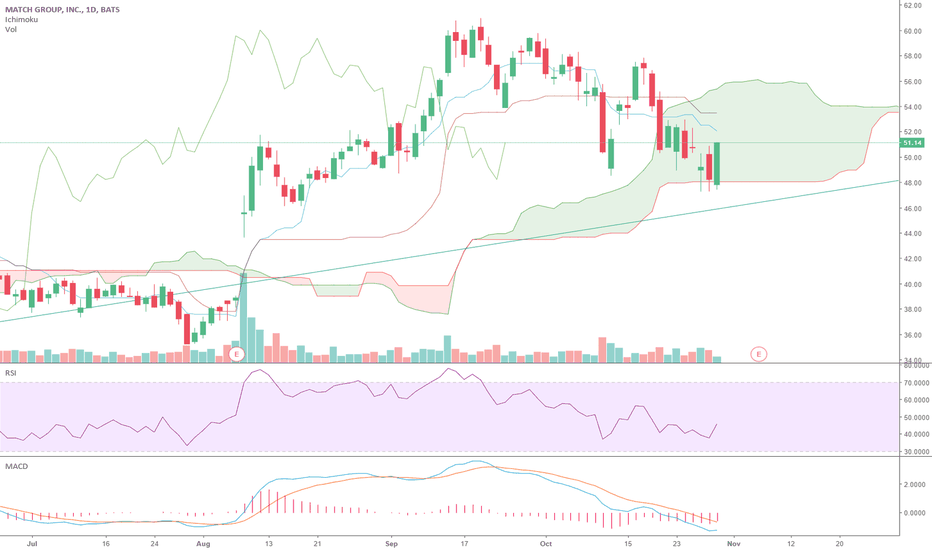

MACD is beginning to Cross from a relatively low position with RSI in its mid range.

A similar setup was before the spike of $38 to $50 and then its range in the $50s

Short Term target of $58

Long term this stock has alot of room to grow, with a MCAP of only $16B and it seeming like a large CAP company in the making

Dangers to watch out for is compition from FB new dating service, yet i dont think this will pose a great risk as i dont think people would want to mix their facebook and dating profiles.

Strong support at $48

STOP LOSS $46

TARGET 1 $55 (30%)

TARGET 2 $58 (20 %)

LEAVE REMAINING 50% TO RIDE POTENTIAL LARGE CAP GROWTH

MTCH Symmetrical Triangle Breakout to UpsideMTCH is currently consolidating in a symmetrical triangle. Since symmetrical triangles are continuation patterns, we will likely see price break to the upside next week. However, be ready to play both sides of the breakout. MTCH currently has super high levels of short interest with 49% of float being shares shorted. If we break up, we can see a short squeeze to $64 in the next week or two.

ROKU + MTCH - solid long-term winnersFor this post, I want to bring up and recommend ROKU and MTCH, which have been two of my best performers this year and are just beginning to break out to new ATHs.

Said simply, I think these are both ~$100 stock. I think that this price tag is likely going to come sooner than some might expect due to multiple catalysts that I will talk about in future posts. I just wanted to bring these names up now, put it on your radar, and later share what drove my thesis.

The green and red arrows show my buy/sell points this year. Below are my returns so far:

MTCH (12/21/18 $43 Calls): +32% (sold)

MTCH (9/21/18 $50 Calls): +56% (open)

ROKU (10/19/18 $49 Calls): +104% (sold)

ROKU (9/21/18 $65 Calls): +247% (trimmed/open)

Total = +439%

While my timing could have been better (more on that later), I'm satisfied with that return - who wouldn't be. I'm always learning and getting better with my trades (learning from losers and staying humble is key).

I'm recommending that investors should buy these names for the long-term (think 2-5 years). I'd wait for a small pullback here before jumping in; as you can see RSI is in overbought territory, but not significantly so historically (I may buy Puts to hedge my current positions). I'll provide updates on technical levels soon. However, since this is a long-term holding you could buy now and average in if it declines meaningfully. Again, I think 2-5 years from now, these names are going to generate very nice returns.

I'm also not suggesting options at the moment because of the massive run-ups and short-term pullback risk.

My plan overall is to own the stock, and play weekly, monthly, and longer dated options.

Action: Buy ROKU + MTCH

I'm posting a link to Seeking Alpha where I first mentioned why I was buying MTCH back in May-2018. My name there is: soajustice. I post more trades/commentary there as well -- Trading View is all new for me. seekingalpha.com

More to come, stay tuned.

Would love to hear your thoughts, feedback and analysis.

Cheers!

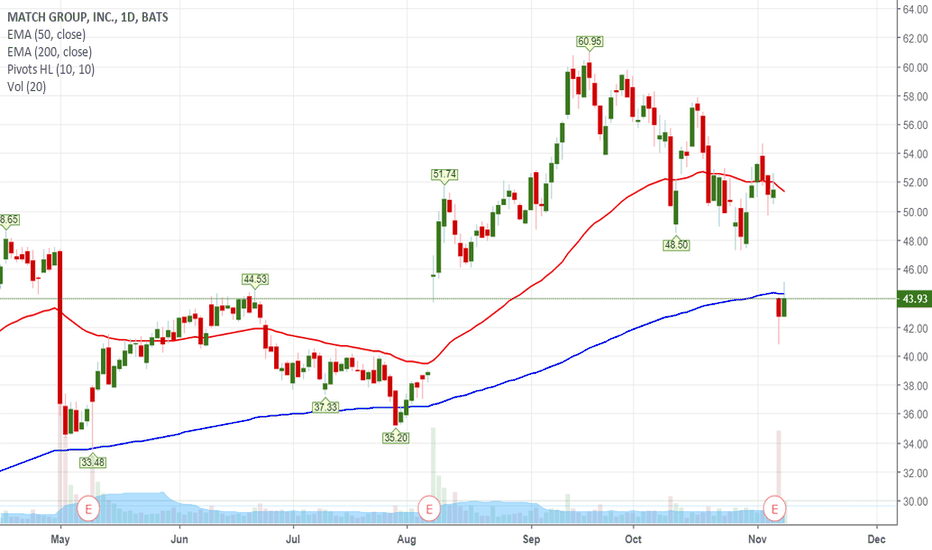

$MTCH setup @1SimpleTraderWaiting for the green to cross over the red. Simple, but by god it just might work. @1SimpleTrader on Twitter turned me onto this plan. Been trying to find a way to call the reversals for stocks like $GRUB that popped after earnings then dropped, only to reverse up higher. Its your standard bull flag movement, but they look funky because of how much the price jumped after earnings. I'm excited to see how this one plays out.

MTCH: Match Group Inc.Never fully recovered from the Facebook competition announcement back in early May, which caused a huge selloff. Earnings on 8/7 AMC, might consider covering before then. XLK will continue to consolidate in my opinion. We should have downward market momentum with us in the short run.

TA:

Moving Averages: Rejected by the 50 day moving average continuously since early July. Finally tested and was shot down to fall out of the trendline and dip below the 200 day moving average.

Trendlines: MTCH recently fell out of its wedge looking like it has much more downside after an astronomical climb.

Momentum: Momentum showing that the stock is cooling down with the momentum indicator in a downtrend.

MACD: Daily just signaled bearish again, with the weekly showing what will most likely be continued downward momentum.

Short 50 shares @ 36.00

Targets:

First: 34.60

Second: 31.00 (what I'm really aiming for)

Third: 26.20

Stop 40.00

match.com has meet its match (2)on the chart this company looks weak, i see a potential ABCD pattern forming to the downside that i have marked in (orange) and also it would land very nicely on the (blue) line 30$. I dont want to short at current price bc i hate shorting at bottoms, i would much rather short near a resistance line like the (yellow) areas

volume = 1

timing in the market = 1

group strength = - 1

abcd pattern = 1

fractal = 0

$MTCH Short-term + Long-term = Long As nice a dip the $FB vs. Cambridge Analytics was, the $MTCH vs. $FB cupid contest is looking just as attractive. May 18th is shareholder meeting, so if the setup today (May 17th) doesn't look breakout ready, next week should definitely see some action. A1 (most realistic) target price is mid $42. Purple rectangle indicates potential target before re-trace to next long entry (green rectangle). June 18th $42 & $44 seem promising, although I can see a $47 TP by then.

MTCH Stock dropping towards 31 handleSetup:

It was noted that MTCH stock could drop to the 31 handle.

Our setup is complemented by the following:

1. Multiple timeframe trend analysis

2. Divergence on H1.

Approach:

Our trade strategy is as follow: We will open two consecutive trades, they will both have the same stop loss but different take profits.

Trade 1:

Entry: 41.83

SL: 44.79

TP: 37

Trade 1:

Entry: 41.83

SL: 44.79

TP: 31.53

It should be noted that once TP1 is hit, we will move the stop loss of trade 2 to breakeven.

Risk & Reward:

Total Risk:

2%

Total Reward:

5 %