NOK/N trade ideas

NOK on the way up! Go long now!This is one of my first publishing’s. I’d love some critiques. I had a tough time understanding where to start my wave pattern. I do think NOK is heading up soon considering it’s 5G tech coming soon. They’ve had some recent good news and. NASA contract in the recent past so NOK is far from dead. On the contrary, I think it’s just beginning. Please let me know your thoughts. I’m open and welcome to CONSTRUCTIVE criticism only.

NOKIA looks quite attractiveLooks like NOKIA is ready for a major reversal under few conditions:

Price must break above resistance downtrend line.

Chances for a serious bullrun will rise if the breakout takes place inside greenest area.

To confirm a bullish incentive we must look for reversal patterns on daily TF.

Under these circumstances, for this scheme to work out, price must not break below green support line.

Anyways, let's see how integration of 5G network in nokia products might influence the stock in positive way.

So at least I'd dare to say that NOKIA is undervalued at this point of time.

Show Finland some love - Part 2Swing Trade Idea.

Wave (3) projections:

Minimum - $6.60 (1.272 fib ext)

Tgt 1 - $7.57 (1.618 feb ext) - lines up to 2015 consolidation area

Tgt 2 - 10.38 (2.618 fib ext) - lines up to 2010 consolidation area

Zoom this out on the weekly to note two previous major highs. Serious upside potential depending on timeframe.

This is an easy swing. Definte possible long term hold with size for me.

Show Finland some love - Part 1Swing Trade Idea.

Previous concolidation area of late March 2020/1st week of April 2020 highlighted. Previous gap also falls in the .618-.786 fib retracement. Currently working on A-B-C correction to complete wave (2).

If beginning of wave (3) is accurate and clear upper trend line then shorter term tgts of:

Minimum - $6.60 (1.272 fib)

Tgt 1 - $7.57 (1.618 fib)

If beginning of wave (3) is accurate then likely Inverse Head and Shoulders will develop as drawn.

Alternate scenario is longer consolidation within upper and lower trend lines with evenetual breakout to upside.

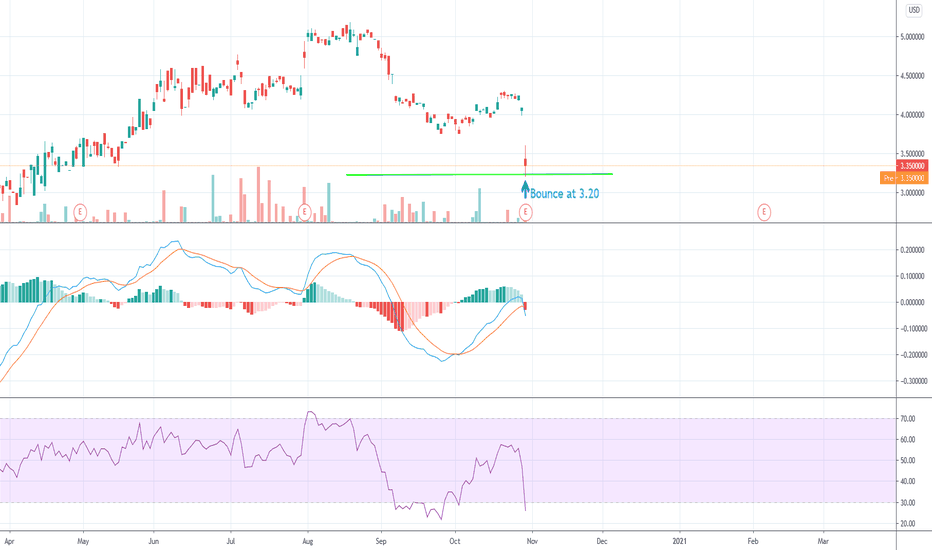

Nokia dip opportunity on a swing. I am giving it a few days to see if it goes any lower but this is a big post earnings drop that is not entirely justified because Nokia has somethings going for it. They adjusted their earnings expectations for 2021 and that suddenly scared a lot of people.

Non the less. It has not traded this low since April 27th, as such, an argument can be made that sometime between now and February 2021 (next earnings) it will be trading at least a dollar higher than where it is now. The problem is that you may be tying up some capital waiting for the move.

Nokia possible impulse wave in the making!Nokia hasnt been looking to good the past couple of years, but this all could change very fast.

with the upcomming Q3 earnings release coming up this thursday and alot new 5G contracts in their pocket this could be the start of a big impulse wave up.

fundamentals:

# march 2015 can be seen as the beginning of a HUGE descending triangle with a fake bearish break out starting at september 2019. Nokia is currently being traded at that so important level and needs to be taken in order for this lookout to become truth. after that the level to watch is 4.3 as this would confirm the bullish breakout of the triangle. NOTE: descending triangles are normally bullish patterns, but trade carefully as their are some huge levels to conquer.

# Nokia has been a big factor in the 5G industry with over 125 contracts concerning 5G, with the expectations of 5G becoming bigger and bigger this would logically push nokia's shares higher and higher.

# the chart shows that the fibbonaci level 0.786 drawn from our last H/L was accepted as a support level (currently being traded in the golden pocket area which i didnt draw to clear the chart a bit )

If we manage to break the golden pocket area upwards these are the level to watch and possibly take profit:

TP 1: 4.30

TP 2: 4.97

TP 3: 6.59

TP 4: 7.82

TP 5: 8.45

Stop-Loss : between 3.2 - 2.7

Dont over leverage!

Trade safely and do your Risk Management !

Give a follow and a like if u liked my analyse on nokia!