PCG trade ideas

Trouble in PCG Continues. Short PCG here at resistancePG&E is under massive headline pressure these days after being blamed for the recent California wildfires. The stock went down 60% recently and has rallied 50% off of its low of $17.26.

On Friday after the close, new headlines came out suggesting that PCG falsified gas pipeline safety records for years. Bankruptcy is definitely in the cards. When stocks become super weak and then bounce, they frequently 'bump their heads' into their 13-day EMAs. That's exactly where PCG sits right now.

There is a potential for a gap down on Monday given the news so be careful with this one, but the first line of support for PCG is not until $22.70, but it obviously can and likely will go lower.

Short PCG between $25-26.

Target 1: $22.70

Target 2: $18

Stop: $27.40

PGE Short Squeeze!!Crypto Crusader here with another analysis.

From the time of the Santa Rosa fire, PCG has been facing much pressure to attempt retribution from the damages associated with the fire. When discussing large utility fires, it's important to note that these utility companies, PCG included, have insurance policies for natural disasters like this. Regardless of the newer "Camp Fire" , the deadliest and most destructive in California State history, PCG was already pinned against the wall regarding exceeding their insurance policy. PCG is the nations largest utility by revenue, provides power to 10's of millions of people in California, and has near 90% institutional ownership. From the previous three reasons alone, PCG cannot go "belly up." My condolences go out to everyone who is directly and indirectly effected by the "Camp Fire." From passing loved ones, to destroyed homes, cars, missing loved ones, displacement of hundreds of thousands of people, and the air pollution, nothing in writing could sum up the destruction that has unfolded over the past few weeks.

From a technical standpoint, PCG hasn't been at these levels for an extremely long time (July of 03).

From a strict price perspective, given these levels in conjunction with fundamentals, one could deduce that PCG will get bailed out and all will be well for investors, however, to only look from that approach would be naive and foolish.

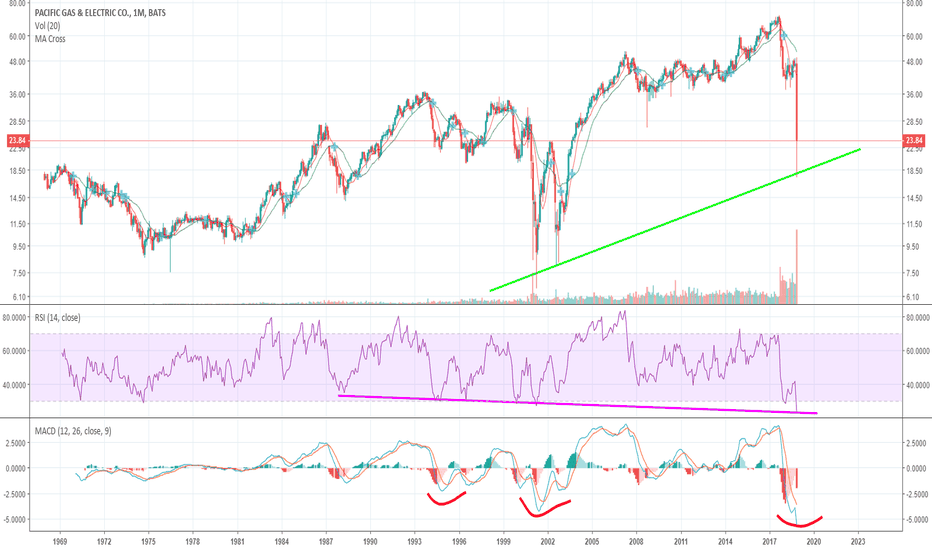

Therefore to further bolster our analysis we can look at multiple indicators to give us further insight into the levels that be, and act accordingly. On the monthly chart PCG has been going through a hidden divergence really since the crash of 87. At current RSI levels on the monthly we can see that current levels, even pushing $23 from $17.50 are still at a historical low in respect to RSI level. Typically extreme oversold levels like this have a squeeze of sorts to gain more momentum towards a neutral mark and diverge in a positive direction.

Moving from RSI to MACD cross whats also immediately prevalent on the chart is that the MACD levels are at historical lows as well, another indicator to show just how oversold PCG really is, regardless of the 9 billion dollars it's going to have to cough up.

Thanks for reading, and may the trades be with you.

Crypto Crusader

PCG Wow, PG&E rapidly going to one of my old targetsWhat can I say... I'm speechless. PG&E went heavily down, straight to my good turn, but even close to my old target.

My PV is around $43, so definitely I would consider to buyback at the level of $17 - $15. The potential profit is more than 100% .

Wish you the Best!

Learn how to beat the market as Professional Trader with an ex-insider!

Have a Nice Trading Week!

Cream Live Trading, Best Regards!

Bullshit PCG longWell California approved a bill to raise utility bills for its citizens to protect PCG from bankruptcy due to all the lawsuits against them for being liable for 12 wildfires. Looks like it breaks this resistance look for it to fill more of that gap. But one thing with upcoming elections must be watch if any candidates gets in to try to change this legislation that was passed.

www.marketbeat.com

Why CA Fires Are Burning PG&E Shares To A Crisp Today??PG&E Corporation (NYSE:PCG) shares are having one of their worst days in years, losing nearly 10% after it came to light that downed PG&E power lines may be responsible for starting one of the deadliest wildfires in California’s history.

The inferno, which started Sunday and has claimed the lives of at least 32 people, may have started due to power lines being knocked down during a windstorm on Sunday, when winds were gusting as high as 70 miles per hour. Those winds then exacerbated the issue by rapidly fanning the flames, which have consumed over 220,000 acres of California land since.

*I would think about buying PCG at $48.00, if rest of October price action stabilizes. That is what hurricanes, earthquakes, fires does, some people lose (which is saddest part) & other's win (with new building, buying stock at low prices) etc.. KEEP WATCHING for best time to buy this stock, if this of interest to you.

What about utility stocks? Gann Fibonacci Elliott Wave ForecastAfter forming a double top base around $45, a A-B-C Elliott wave retracement has been in an expanding range. Ultimately the bearish price divergence indicate the swing downtrend is continuing. If that occurs, the next target, and likely forecast resistance area, is between $43 and $42 (0.5-0.61 fibonacci) in 30 days - Gann time