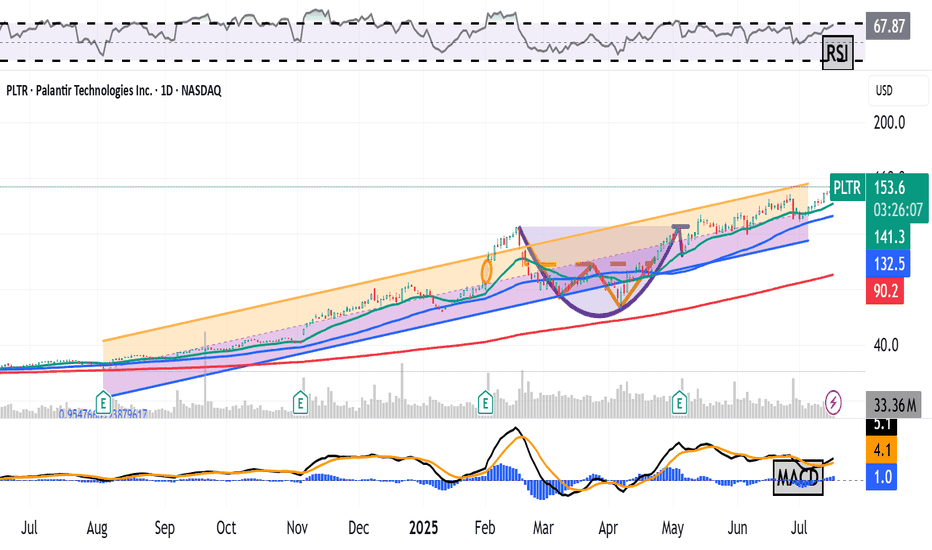

Palantir Is Up 600%+ Since August. What Do Its Charts Say?National-security software firm Palantir Technologies NASDAQ:PLTR hit a new all-time high this week and has gained more than 600% since hitting a 52-week low last August. What does technical and fundamental analysis say could happen next?

Let's look:

Palantir's Fundamental Analysis

PLTR has b

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

5.11 MXN

9.64 B MXN

59.74 B MXN

2.14 B

About Palantir Technologies Inc.

Sector

Industry

CEO

Alexander Caedmon Karp

Website

Headquarters

Denver

Founded

2003

FIGI

BBG012S29HP5

Palantir Technologies, Inc. engages in the business of building and deploying software platforms that serve as the central operating systems for its customers. It operates through the Commercial and Government segments. The Commercial segment focuses on customers working in non-government industries. The Government segment is involved in providing services to customers that are the United States government and non-United States government agencies. The company was founded by Alexander Ceadmon Karp, Peter Andreas Thiel, Stephen Cohen, Joseph Lonsdale, and Nathan Dale Gettings in 2003 and is headquartered in Denver, CO.

Related stocks

Earnings HFT gapsThe gaps that form during earnings season on or the next day after the CEO reports the revenues and income for that past quarter are always HFT driven. The concern over the past 2 previous quarters was the fact that the High Frequency Trading Firms were incorporating Artificial Intelligence into the

7/15/25 - $pltr - going for kill shot again.7/15/25 :: VROCKSTAR :: NASDAQ:PLTR

going for kill shot again.

- using the 2x levered meme etf PTIR to buy P's

- there are no logical explanations anymore for me to justify valuation "yeah V valuation doesn't matter"... you'll see what i mean, kid

- even 2x'ing FCF over the next 2 yrs and this th

PLTR local top $150Palantir has has a nice run but this could be a local top. Reasons include hitting peak Trendline + hitting 2.618 fib + plus hitting #5 fib time zone. Also BTC appears to hit it's ATH Trendline today as well. So is everything hitting its local top before Trumps Liberation Day II on Aug 1? This week

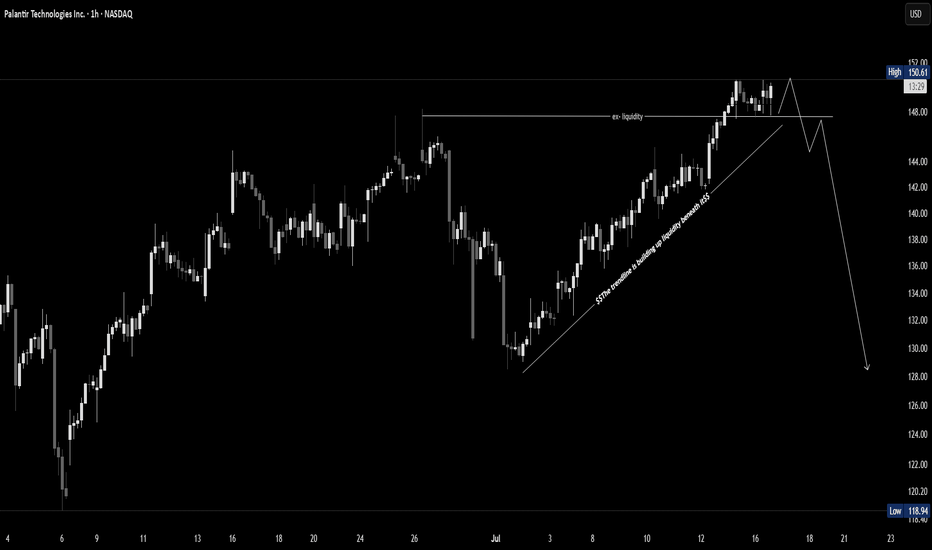

PLTR Just Broke the High - But Don't Get Trapped Palantir just broke its recent high, sparking breakout excitement. But this could be a classic liquidity grab — not a genuine breakout. If price fails to hold and shifts structure, a sharp reversal could follow.

🧠 Wait for confirmation — don’t chase green candles.

PLTR Sitting on the Edge! Will $147 Hold or Break? July 16Technical Overview:

PLTR is showing signs of a distribution top after a strong rally. The most recent 1H structure shows a Change of Character (CHoCH) just under $149 with lower highs forming and weak bullish reaction.

* CHoCH confirmed under $148.50

* Price struggling inside supply zone: $148.50–$1

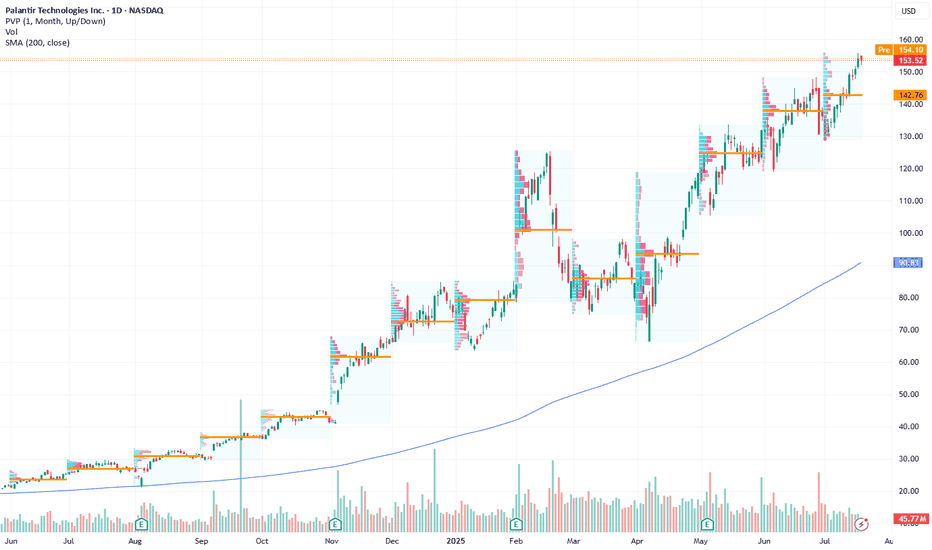

Palantir Technologies: Long Opportunity Amid AI MomentumCurrent Price: $153.52

Direction: LONG

Targets:

- T1 = $159.20

- T2 = $165.80

Stop Levels:

- S1 = $150.70

- S2 = $147.30

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to ide

PALANTIR REMAINS YOUR TRADING GOAL, DOUBLING IN PRICE IN 2025In the Faraway Kingdom... In the Thirtieth Realm....

Somewhere in another Galaxy.. in late December, 2024 (yet before The Second Coming of Trump), @TradingView asked at it awesome Giveaway: Happy Holidays & Merry Christmas .

1️⃣ What was your best trade this year?

2️⃣ What is your trading goal fo

Jade Lizard on PLTR - My 53DTE Summer Theta PlayMany of you — and yes, I see you in my DMs 😄 — are trading PLTR, whether using LEAPS, wheeling, or covered calls.

I took a closer look. And guess what?

📈 After a strong move higher, PLTR was rejected right at the $143 call wall — pretty much all cumulative expiries cluster resistance there

Usin

PLTR: Trend Analysis 📈 PLTR | SMC Trend Continuation or Reversal? Watch This Key Zone

🔍 Chart Type: 15m

🧠 Strategy: Smart Money Concepts (LuxAlgo), EMA Stack (20/50/100/200)

📊 Volume Surge: 177.99K

🧭 Narrative: Institutional Accumulation + Premium Rejection

🚨 Current Price: $145.88

📍 Market Structure:

Price is curren

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of PLTR is 2,828.61 MXN — it has decreased by −0.53% in the past 24 hours. Watch PALANTIR TECHNOLOGIES INC stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BIVA exchange PALANTIR TECHNOLOGIES INC stocks are traded under the ticker PLTR.

PLTR stock has risen by 8.25% compared to the previous week, the month change is a 9.50% rise, over the last year PALANTIR TECHNOLOGIES INC has showed a 452.04% increase.

We've gathered analysts' opinions on PALANTIR TECHNOLOGIES INC future price: according to them, PLTR price has a max estimate of 3,000.19 MXN and a min estimate of 750.05 MXN. Watch PLTR chart and read a more detailed PALANTIR TECHNOLOGIES INC stock forecast: see what analysts think of PALANTIR TECHNOLOGIES INC and suggest that you do with its stocks.

PLTR stock is 2.69% volatile and has beta coefficient of 2.30. Track PALANTIR TECHNOLOGIES INC stock price on the chart and check out the list of the most volatile stocks — is PALANTIR TECHNOLOGIES INC there?

Today PALANTIR TECHNOLOGIES INC has the market capitalization of 6.79 T, it has increased by 9.16% over the last week.

Yes, you can track PALANTIR TECHNOLOGIES INC financials in yearly and quarterly reports right on TradingView.

PALANTIR TECHNOLOGIES INC is going to release the next earnings report on Aug 4, 2025. Keep track of upcoming events with our Earnings Calendar.

PLTR earnings for the last quarter are 2.66 MXN per share, whereas the estimation was 2.64 MXN resulting in a 1.05% surprise. The estimated earnings for the next quarter are 2.59 MXN per share. See more details about PALANTIR TECHNOLOGIES INC earnings.

PALANTIR TECHNOLOGIES INC revenue for the last quarter amounts to 18.11 B MXN, despite the estimated figure of 17.66 B MXN. In the next quarter, revenue is expected to reach 17.58 B MXN.

PLTR net income for the last quarter is 4.38 B MXN, while the quarter before that showed 1.65 B MXN of net income which accounts for 166.19% change. Track more PALANTIR TECHNOLOGIES INC financial stats to get the full picture.

No, PLTR doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jul 21, 2025, the company has 3.94 K employees. See our rating of the largest employees — is PALANTIR TECHNOLOGIES INC on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. PALANTIR TECHNOLOGIES INC EBITDA is 8.92 B MXN, and current EBITDA margin is 11.93%. See more stats in PALANTIR TECHNOLOGIES INC financial statements.

Like other stocks, PLTR shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade PALANTIR TECHNOLOGIES INC stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So PALANTIR TECHNOLOGIES INC technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating PALANTIR TECHNOLOGIES INC stock shows the strong buy signal. See more of PALANTIR TECHNOLOGIES INC technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.