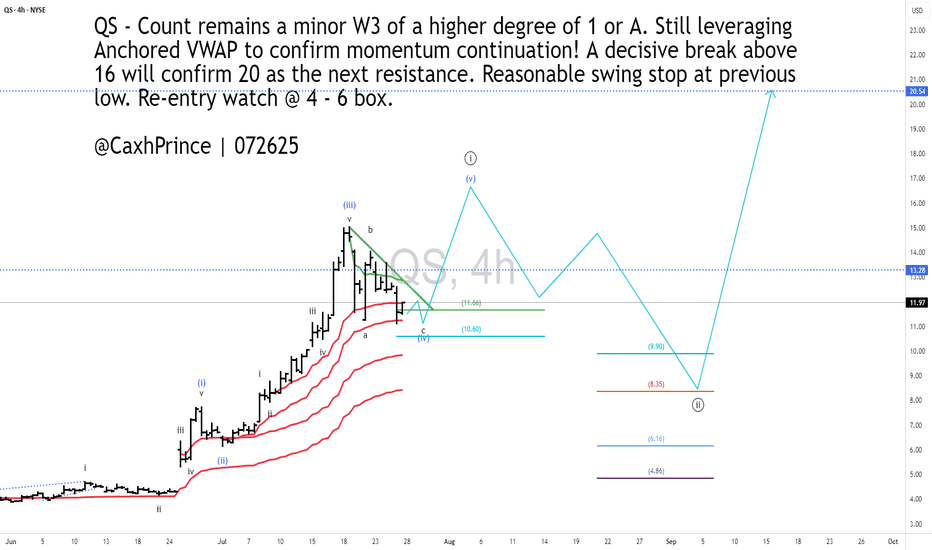

#QS - 4HR [Will the last boost last or will it bust? With a new Volkswagen investment and partnership. Quantum Scape’s earnings were far from stellar with a 26% decrease in income compared to same time last year. They have, nevertheless, made advancements with their very promising lithium-Metal battery technology.

With fundamentals aside, I am curious to gauge how long-term investors have priced-in the company's stock price.

Technically, I see price moving to present yet another opportunity by EOY if not sooner. My count shows important levels to watch.

Go #QuantumScape, Go!!!

Check out my other chart ideas @CaxhPrince everywhere.

QS trade ideas

Quantumscape: a stock set to double soon?Quantumscape: a stock set to double soon?

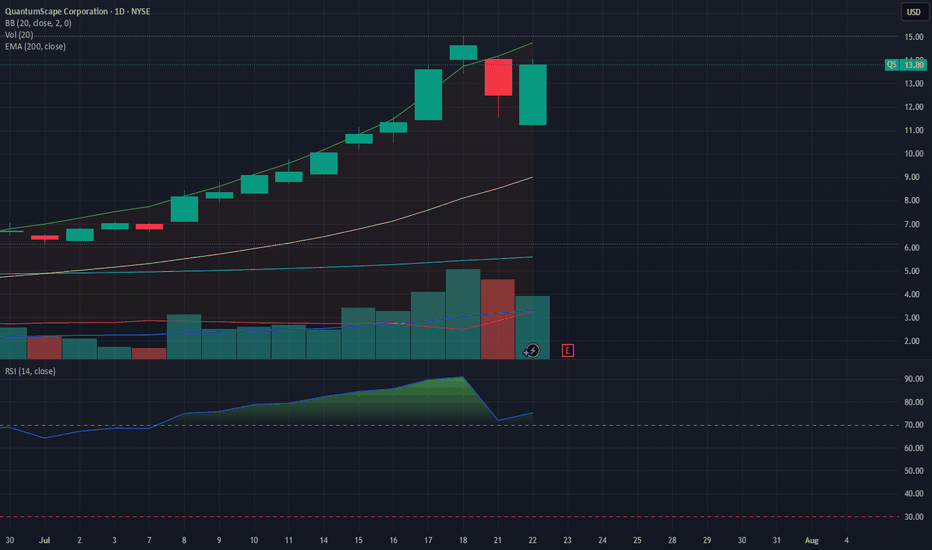

In June, I made a speculative investment in QuantumScape Corporation (NYSE: QS). In June 2025, it was announced that QuantumScape had introduced its Cobra separation process into basic production, with a 25-fold increase in heat treatment speed and a significant reduction in the physical space required to start the film. Following this announcement, the value of QS shares doubled.

QuantumScape Corporation is dedicated to developing advanced battery technologies for electric vehicles (EVs) and other applications. The company focuses its efforts on the research, development, and commercialization of solid-state batteries with lithium-metal anodes. These batteries are designed to offer higher energy density, reduced charging times, and high safety standards, supporting the global transition to low-carbon energy sources. The company's core technology lies in the solid-state separator, an inorganic ceramic that ensures the reliable operation of lithium-metal anode batteries. This separator is positioned between the cathode and the anode current collector, forming the fundamental layer of the battery cells. The basic module of the battery pack design is the bilayer cell, featuring a double-sided cathode sandwiched between two separators. QuantumScape integrates these bilayer cells by stacking them to achieve multi-layer configurations.

This is a company in the early stages of start-up, during which a significant amount of liquidity is needed to sustain the business. The operation presents a certain degree of risk, as evidenced by the high short interest in the stock. A high short interest indicates that many investors have taken short positions on a stock, i.e., they have sold borrowed shares with the expectation that the price will fall. This can be interpreted as a sign of a negative market view on the stock. In addition, a high level of short interest can lead to a “short squeeze”: a sudden increase in the stock price that causes investors to buy back shares to limit losses, causing further price increases.

The goal of this operation is to generate a quick profit by exploiting a potential short squeeze on Quantum stock. Technical analysis confirms this strategy: since June, when positive news was released regarding the Cobra separation process—a technology developed by QuantumScape Corporation that represents a major advancement in battery production—the stock has seen above-average volume increases and prices that remain steadily above the 200-period moving average.

When evaluating an investment in early-stage companies, it is essential to monitor available liquidity; low liquidity to support start-up costs forces the company to repeatedly raise capital, with potentially negative effects on share value.

Quantum currently has liquidity exceeding debt, amounting to $860 million, a condition that reduces the likelihood of capital increases in the short term. The stock's seasonality over the past four years has seen average growth of 25%. Funds are rapidly covering their positions and, together with buyer demand, this situation could result in a value of $30 per share in the next quarter.

To receive notifications about new articles, simply select the “FOLLOW” option at the top. If you would like to explore a specific topic in more depth or need assistance, please leave a comment below the article; I will be happy to provide the support you need.

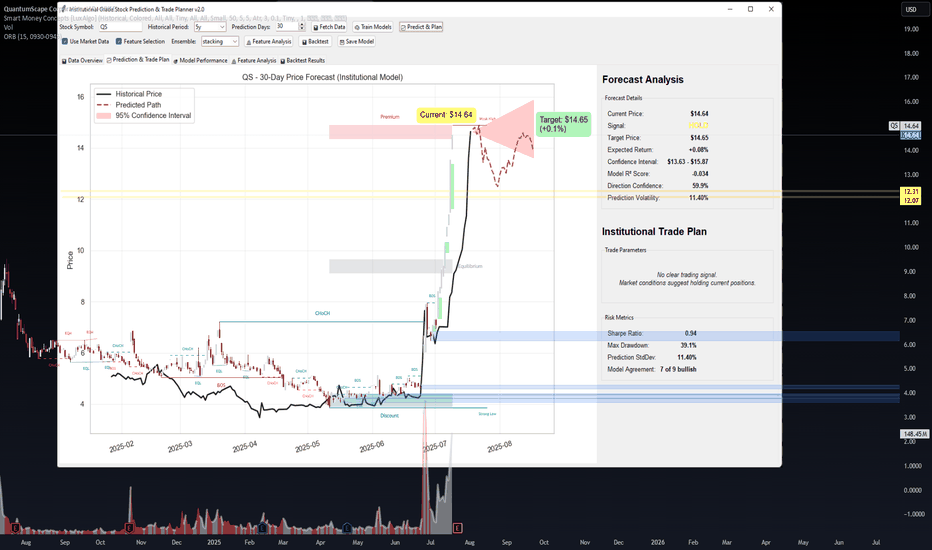

QS Forecast – Holding Premium Territory After Parabolic Move📊 QS Forecast – Holding Premium Territory After Parabolic Move

🔍 WaverVanir DSS Forecast (VolanX Protocol)

Our institutional AI model flags no fresh signal on NYSE:QS , suggesting a HOLD posture as the stock consolidates above the equilibrium band. Current price: $14.64, with a 30-day target of $14.65 (+0.1%).

📈 The move from discount zone (sub-$5) to premium levels was confirmed by multiple Break of Structure (BOS) and Change of Character (CHoCH) events, alongside explosive volume (148M+).

🧠 Model Forecast Summary:

Expected Return: +0.08%

Confidence Interval: $13.63 – $15.87

Direction Confidence: ~60%

Prediction Volatility: 11.4%

Risk/Reward: Flat – Hold Bias

Model Agreement: 7/9 bullish

🔺 Sharpe Ratio: 0.94

📉 Max Drawdown: 39.1%

⚠️ No entry/exit suggested. Market in balance zone. Wait for a new signal confirmation (premium rejection or re-accumulation).

🧠 Forecast Engine: VolanX Institutional Stack

📡 Front-tested on WaverVanir DSS

Not financial advice – this is an R&D model output used for predictive analytics and AI infrastructure testing.

#VolanX #WaverVanir #QS #TradingAI #SmartMoneyConcepts #Forecasting #MachineLearning #InstitutionalFlow #TradingStrategy #MacroAI #StockForecasts

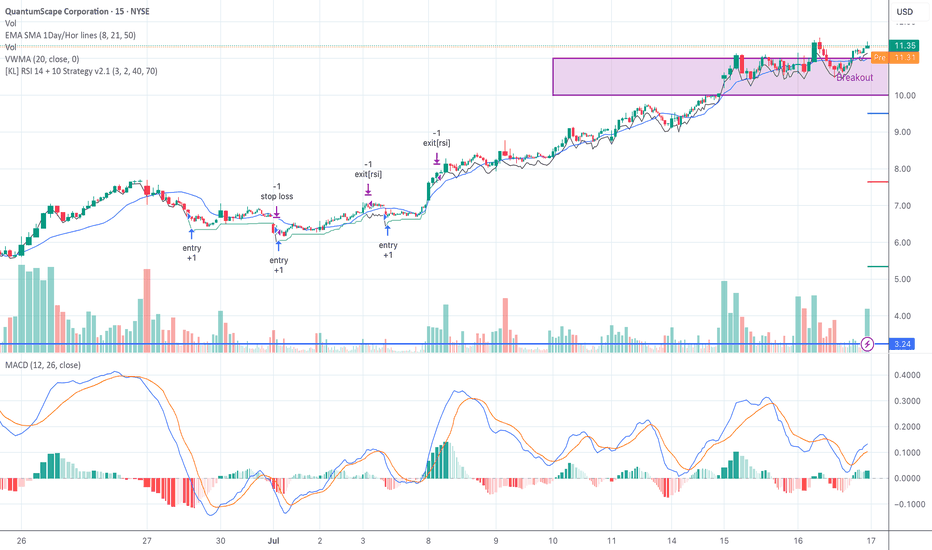

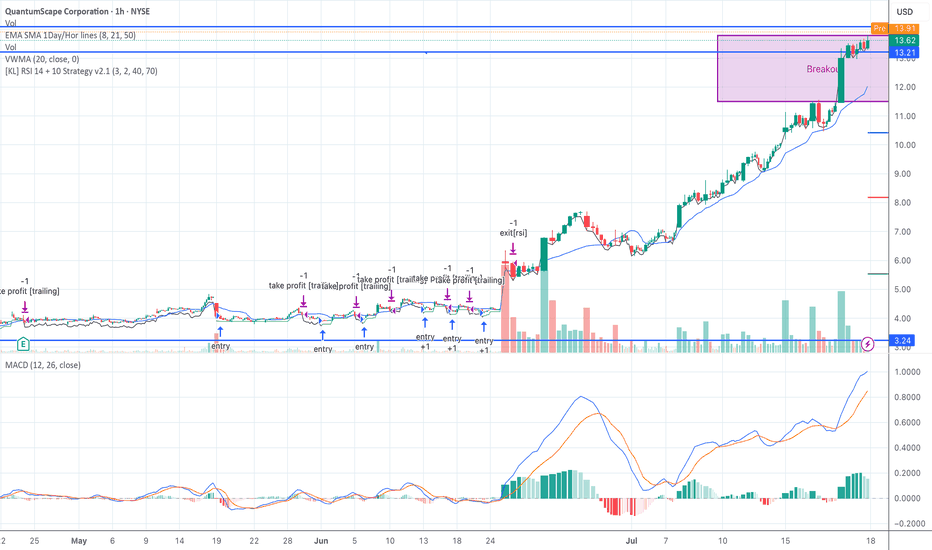

QS Breakout Setting Up — Entries Triggered, Waiting for ConfirmSeed System entries are printing on QS with trailing profit zones holding firm.

MACD crossovers confirming the move. Watching RSI cooling just under breakout resistance at $11.35.

A push through $11.50 with volume and I’m adding — slowly.

Support at $10.03, cut fast if price shows weakness.

Let the market do the heavy lifting.

#QS #SeedSystem #SwingTrading #TrendFollowing #LivermoreStyle #BreakoutWatch

QS Re-Tested Box Top – Waiting for $14.10 + VolumeQS is currently re-testing this morning’s high at $13.79 (box top).

VWMA and EMA alignment are bullish. MACD remains strong.

Plan: Buy above $14.10 on volume, stop at $13.20, trim at $15.00, extended target $16.50.

#QS #SeedSystem #DarvasBox #BreakoutWatch #VWMA #LiveUpdate

QuantumScape ($QS) | Long-Term Bet on Solid-State Battery RevoluQuantumScape has officially re-entered our radar after today's +32.72% move—driven by their “Cobra” separator scaling breakthrough. Volume surged to 171M+ confirming a major displacement event.

From a Smart Money Concepts (SMC) lens, the market structure shows repeated Change of Character (ChoCH) and Break of Structure (BOS) patterns, indicating institutional accumulation underway since late 2023.

Our internal Decision Support System (DSS) highlights this zone between $5.60–$7.50 as the “Equilibrium Rebuild Range.” The future projection targets $132.92, aligned with historical inefficiencies and Fibonacci cluster zones.

🔋 Catalysts to watch:

Cobra separator now in baseline production

Volkswagen licensing & Murata JV scaling

July 23, 2025: Q2 earnings & 2026 commercialization roadmap

💼 We are personally invested in QS and plan to scale out near the projected yellow level. Trade is actively monitored. Risk-managed with invalidation below key demand zones.

⚠️ This is not financial advice. For educational and strategic research purposes only.

—

WaverVanir_International_LLC | Quantified Capital Deployment

#QS #QuantumScape #SolidState #BatteryTech #LongTermInvesting #WaverVanir #SMC #EVRevolution #OptionsFlow

7/8/25 - $qs - Pass. No thanks.7/8/25 :: VROCKSTAR :: NYSE:QS

Pass. No thanks.

- Great story bro, company

- Does this thing continue to ape higher a la meme market? idk idc

- I think pre-revenue stuff can be interesting if there's clear visibility toward scaling revenue or the costs are contained, but let's be real... 4 years post de SPAC and this thing has just ""now"" turned the corner

- maybe.

- i'll give you that. maybe.

- i'm not close to it, i'm going to turn over the battery "rocks" tonight to see if i can find anything more compelling than NYSE:SES (ironically, the smallest cap battery-related name... usually it's the opposite - the big stuff is more de-risked and obvious)

- so here we have a co that's just doubled it's stonk price on this announcement

- do investors genuinely believe manufacturing is "easy" or this transition to scaling or monetizing the JV w VW will start to justify a nearly $4B enterprise value "easily"?

- here's what i'll give the bulls, especially those coming to the story fresh and without all this: run-rating nearly $400mm in R&D is probably worth something (*throws finger into rear end and then into the air*) in the $400/.2 = $2 bn region (20% is a high benchmark for risky tech, it should be higher but again let's give a lil cred). I tend to like to double this (usually for co's that r revenue-generating and have traction) but let's just throw V's rules out the window and do it here - alas i don't know what i don't know - and perhaps there's something here. So that's $4 bn. So i better have a good idea or alpha to make money at this pt.

- add to this a TON of co's (that shouldn't be public co's) are doing all sorts of whacky jerk fests with banks... ATMs, converts... you name it! scammy banks are going to have a great year! so then i have to believe this co won't do any "proactive" raise. they shouldn't *need* to given nearly $1 bn in cash on the books... but again, tis not like they're going to buy back stock... so even if the risk is low... it's there.

- all in: i'd need a CLEAR catalyst that the co was hitting strides with OEMs, VW was seriously interested in taking this thing out and locking down this game changer tech. and that's just not what i want to have in my book at a 50 bps or 100 bps position *crossing fingers*. i go big. and it's hard for me to understand where i'd get that conviction.

- so i keep my finger on the battery pulse. it's a sector that is probably most exciting to me from an energy-investment perspective over the coming years. there will be some massive winners here. maybe NYSE:QS is one of those.

- but i'm going to pass.

V

QuantumScape ($QS) – VolanX SMC Activation Zone🔍 Technical Context

QuantumScape is setting up for a potential bullish breakout after consolidating within a descending wedge and maintaining structure above the golden Fibonacci pocket (0.5–0.618 zone). Smart Money Concepts (CHoCH + BOS) have been triggered, indicating the start of institutional positioning. Volume has compressed, often a prelude to explosive movement.

📊 VolanX Probability Matrix

🎯 Probability of Bullish Continuation (Target $8.47): 70–75%

📉 Probability of Failure (Drop to $6.43 or lower): 25–30%

🧠 Key Levels & Confluences:

Entry Zone: Break & close above red trendline ($6.85+)

Premium Target: $7.65–7.70 (Liquidity Zone)

Final Target: $8.47 (Fib 2.0 Extension)

Stop-Loss Invalidation: Below $6.43 (structural break)

SMC Zones: Liquidity void + breaker retest + CHoCH confirmation

📈 Risk-Reward Setup:

RRR ≈ 3.8x, with structural confluence across Fib, volume, and SMC

💡 “We don’t just trade the chart — we activate the timeline.” – VolanX Protocol

🔐 This post is part of WaverVanir International LLC’s multi-asset DSS framework.

#SMC #QuantumScape #VolanX #WaverVanir #Fibonacci #SmartMoneyConcepts #OptionsFlow #LiquidityZones #Breakout #TradingStrategy #RiskReward #TechnicalAnalysis

QS | Price PredictionNYSE:QS is one of the most promising assets in my stock portfolio. I expect massive upside and becoming revenue positive from 2026-27.

That level is from my platform. I think the "safe" is the most realistic in the first phase of the upside, and the "base" is quite realistic too. For the next levels, we should see really good sales and more partners.

QS heading a lot higherFor those that have been following me for a while know I have been a long time holder of QS and have been accumulating even up until yesterday. Its been a long painful hold but I believe we are finally ready to begin the upward trajectory that many expected. I pointed out in the chart where most retail give up after holding for years but that is exactly where big money accumulate. They send the price below a support trend line fooling retail into selling as retail expect a water fall to the downside. In this instance it seems they were accumulating for almost 3 months before the news came out which sent the price higher recently. I expect this to be the start of a new rally.

Hold tight.

Not investment advice, please do your due diligence. Please like and share.

QuantumScape Stock Chart Fibonacci Analysis 061125Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 4.25/61.80%

Chart time frame:B

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress:B

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E) Hit the top

Stocks rise as they rise from support and fall from resistance. Our goal is to find a low support point and enter. It can be referred to as buying at the pullback point. The pullback point can be found with a Fibonacci extension of 61.80%. This is a step to find entry level. 1) Find a triangle (Fibonacci Speed Fan Line) that connects the high (resistance) and low (support) points of the stock in progress, where it is continuously expressed as a Slingshot, 2) and create a Fibonacci extension level for the first rising wave from the start point of slingshot pattern.

When the current price goes over 61.80% level , that can be a good entry point, especially if the SMA 100 and 200 curves are gathered together at 61.80%, it is a very good entry point.

As a great help, tradingview provides these Fibonacci speed fan lines and extension levels with ease. So if you use the Fibonacci fan line, the extension level, and the SMA 100/200 curve well, you can find an entry point for the stock market. At least you have to enter at this low point to avoid trading failure, and if you are skilled at entering this low point, with fibonacci6180 technique, your reading skill to chart will be greatly improved.

If you want to do day trading, please set the time frame to 5 minutes or 15 minutes, and you will see many of the low point of rising stocks.

If want to prefer long term range trading, you can set the time frame to 1 hr or 1 day.

OK, who’s been dumping QS. Is it time to hop on this ride UPTechnical Analysis for QuantumScape (QS) - Daily Chart

Trend Analysis & Market Structure:

• Current Price: $5.12 (+0.99%)

• Short-Term Trend: Bearish

• Price is trading below short-term moving averages, indicating continued weakness.

• Failed breakout attempts in recent weeks suggest strong resistance above $6.50.

Medium-Term Trend: Consolidation/Potential Reversal

• The price is sitting near a strong historical support zone ($5.00-$5.10).

• Recent price action suggests sellers losing momentum, with multiple retests of this support.

Momentum & Indicator Analysis:

• Stochastic Oscillator:

• Oversold levels with StochK < 20, indicating a potential bounce.

• Several blue triangles (buy signals) at the bottom suggest an upcoming reversal.

• RSI:

• Trading near 30, meaning the stock is close to being oversold.

• Previous bounces occurred when RSI was at similar levels.

• Volume Analysis:

• Volume remains low, meaning confirmation of a reversal needs an increase in buying pressure.

Trade Setup & Price Targets:

Short-Term (1-2 weeks):

Bullish Scenario:

• If price holds $5.00, a bounce towards $5.50-$5.75 is likely.

• Confirmation of reversal needs a Stochastic crossover and RSI>40.

Bearish Scenario: (this cover all basis)

• A breakdown below $5.00 could send the stock towards $4.75-$4.50, testing lower support.

Medium-Term (1-2 months):

• Bullish Target:

• If QS reclaims $5.75-$6.00, it could rally towards the $6.50-$7.00 zone.

• Bearish Target:

• If selling continues, expect a retest of $4.50, which aligns with longer-term support.

Conclusion:

• Short-Term: Watch for a potential bounce off $5.00 with resistance at $5.50-$5.75.

• Medium-Term: A break above $6.00 could trigger a move to $6.50-$7.00.

• Risk Management:

• Stop Loss: Below $4.90 (if price breaks below support).

• Entry Consideration: On a confirmed Stochastic crossover & RSI recovery.

Final Bias: Cautiously Bullish, but needs confirmation via volume and trend shift.

So imma gonna say. This is a good “meat in the middle” as any good trade opportunity in my view.

QS one to put in the booksYes they are dirt cheap and have been but this company is in position to have explosive results. They are operating right now at a negative balance per year. However They have somewhere around $821 million to use for R&D and just signed a deal with one of The V named Car Companies I want to say Volkswagen.

-QuantumScape (NYSE:QS) soared by more than 20% in trading on Thursday after the company announced that it has entered into a collaboration with Volkswagen’s (OTC:VWAGY) battery unit PowerCo....

There you have it. The kick is I was in an option play on this when it was still Low $5 and it leaped to +$6.

Because of this (I know all those lines its going to give me a seizure. or it looks like spaghetti.) To anyone that doesnt like the indicator let me say this. It makes me money. And I am not the only one that understands it now. ChatGPT can read it too. So know there are at least two smart people in the world that appreciate this indicator.

Using the indicator I can find quickly Everything I need to know about a company just by waiting for specific conditions to align.

I think this stock hits double digits in the next 3 months if not sooner.

That Said I NEVER talk about stocks that are less then Bili. Bili Bili is the cheapest company I will talk about because its proven to hit $30 and come back to low Teens several times a year.

So for me to post an idea on this, really says a lot.

The indicator, timing of the news after the signals. The Pop to $6 to show its going into expansion phase. Its all aligning.

by iCantw84it

01.02.25

QS LongQS has broken out of the downtrend from July/August, retested it, and is continuing higher on increasing volume. The MACD is still bullish. Because of the MACRO breakout it's likely we squeeze higher. I missed the A+ trend retest entry but there's still a good Risk to Reward on this trade. Roughly 50-60% upside potential if it squeezes with a 20-25% SL below all time lows at 4.70.

$QS Quantum QrazyDon't miss this. Possible port changing play here. Quantum is disgustingly hot, this ticker has had larger highs year ago and above $9 this year. Trend in the sector and volume. IV% on options are exquisite, use it to your advantage. I grabbed $6c 1/17/2025 and $10c 1/17/2025. Talk to you soon.

Wall St. Lsr

$QS : A QUANITIFIED SWING SETUP! 80%+ MOVE LOOMING! NYSE:QS A QUANITIFIED SWING SETUP! 👊

NASDAQ:TSLA DEAL INBOUND?!

3 Reasons Why in this Video: 📹

1⃣ My "High Five Trade Setup" strategy

2⃣ Catalyst: #QuantumScape started shipping Battery cells to carmakers and had price target increased to $7

3⃣ Symmetrical Triangle Breakout (MM: 80%+)

Company Overview:

QuantumScape Corp, a company focused on developing next-generation battery technology for electric vehicles (EVs) and other applications.

Video analysis 3/5 dropping today. Stay tuned!🔔

Like ♥️ Follow 🤳 Share 🔂

Are they gonna be a batter cell goliath in this space?! Comment below if you are a believe in NYSE:QS

Not financial advice.

AMEX:IWM NASDAQ:QQQ AMEX:SPY NASDAQ:TSLA NASDAQ:IBRX NASDAQ:UPXI NASDAQ:WULF #ElectricVehicles #TradingSignals #TradingTips #options #optiontrading #StockMarket #stocks

QuantumScape: A Battery Revolution or a Risky Venture?QuantumScape Corporation, a trailblazing firm specializing in solid-state batteries, has garnered significant attention in the investment sphere. Given its capacity to transform the electric vehicle (EV) sector, numerous investors are closely monitoring this company. Nevertheless, before delving into the realm of QuantumScape, it is essential to grasp the associated risks and potential rewards.

Is It Time to Buy or Sell QuantumScape?

Deciding whether to purchase or sell QuantumScape stock is influenced by various factors, such as your investment objectives, risk tolerance, and the financial stability of the company. Despite the significant potential of QuantumScape's groundbreaking technology, it is crucial to take into account the following:

Research and Development: The company is currently in the initial phases of bringing its solid-state battery technology to the market. There is a possibility that obstacles in development or unexpected technical challenges may cause delays or hinder the successful introduction of products.

Competition: The electric vehicle sector is fiercely competitive, with established companies like Tesla and emerging rivals competing for market share. QuantumScape must distinguish itself and establish partnerships to establish a significant presence in the industry.

Financial Performance: Being a relatively young firm, QuantumScape's financial performance could be subject to fluctuations. Investors should meticulously scrutinize the company's financial reports, encompassing revenue, expenses, and cash flow, to evaluate its overall financial well-being.

The Role of Call and Put Options

For investors aiming to manage risk and potentially capitalize on QuantumScape's stock price movements, purchasing call or put options can be a beneficial strategy.

Call Options: If you anticipate an increase in QuantumScape's stock price, acquiring a call option grants you the right to buy the stock at a predetermined price (strike price) within a specified time-frame. If the stock price surpasses the strike price, you can exercise the option and profit from the difference.

Put Options: If you foresee a decline in QuantumScape's stock price, purchasing a put option provides you the right to sell the stock at a predetermined price within a specified time-frame. If the stock price drops below the strike price, you can exercise the option and profit from the variance.

When deciding between call and put options, consider your projected stock price direction and your risk tolerance. Keep in mind that options trading can be intricate and involves substantial risks.

QuantumScape's Financials and Investor Sentiment

To make a well-informed investment choice, it is crucial to assess QuantumScape's financial performance and the sentiment of professional investors.

Financial Analysis: Evaluate the company's revenue growth, profitability, and cash flow to evaluate its financial stability. Look for indications of sustainable growth and robust financial management.

Investor Sentiment: Take note of analyst ratings, news articles, and investor discussions to gauge the general sentiment towards QuantumScape. While positive sentiment can be a bullish sign, conducting your own due diligence is essential.

A Word of Caution

Investing in stocks, including QuantumScape, carries risks. There is no assurance of profits, and there is a possibility of losing a portion or all of your investment. Conduct thorough research, comprehend the risks involved, and only invest an amount that you can afford to lose.

Conclusion

QuantumScape offers an enticing opportunity for investors seeking exposure to the potential of solid-state batteries. Nevertheless, it is essential to approach this investment cautiously and consider the inherent risks. By meticulously analyzing the company's financials, investor sentiment, and potential market dynamics, you can make an informed decision on whether QuantumScape is a suitable addition to your investment portfolio.

------------------------------------

Rating: BUY

The article information and the data is for general information use only, not advice!

---------------------------------------------------------------------

Risk Warning Trading stocks and options is a risky activity and can result in losses. You should only trade if you understand the risks involved and are comfortable with the potential for losses. Risk Disclaimer! General Risk Warning: Trading on the Financial Markets, Stock Exchange and all its asset derivatives is highly speculative and may not be suitable for all investors. Only invest with money you can afford to lose and ensure that you fully understand the risks involved. It is important that you understand how Trading and Investing on the stock exchange works and that you consider whether you can afford the high risk of loss!

QS May Bounce Back From The Current Support AreaQS May Bounce Back From The Current Support Area

QS is testing the support area near 5.2 for the fourth time.

From the chart we can see that QS has already reacted 3 times perfectly and may rise again.

The current support area appears to be very strong as long as the price reversed the direction several times.

QS could get ready to go up to 7.8 as a minimum movement.

In a normal scenario, it should increase to 9.4 as it was in the past.

It is better if you trade QS with Call Options and long-term expiration date.

You may find more details on the chart.

Thank you and Good Luck!

❤️PS: Please support with a like or comment if you find this analysis useful for your trading day❤️

QS QuantumScape Corporation Options Ahead of EarningsIf you haven`t sold QS before the previous earnings:

Now analyzing the options chain and the chart patterns of QS QuantumScape Corporation prior to the earnings report this week,

I would consider purchasing the 8usd strike price Puts with

an expiration date of 2024-11-15,

for a premium of approximately $1.50.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

QS - Possible rally due to agreement with Volkswagen GroupQuantumScape Corp is engaged in the development of next-generation solid-state lithium-metal batteries for use in electric vehicles. It developed an anode-less cell design, which delivers high energy density while lowering material costs and simplifying manufacturing.

Trading Strategy for QuantumScape Corp (NASDAQ: QS)

Recent News

On July 11, 2024, Volkswagen Group’s battery company PowerCo and QuantumScape Corp (NASDAQ: QS) announced an agreement to industrialize QuantumScape’s next-generation solid-state lithium-metal battery technology. This significant partnership is expected to drive positive momentum for QS stock.

Upcoming Event

QuantumScape's Earnings Report (ER) is scheduled for July 24, 2024. This event may provide further insights into the company's performance and future prospects.

Technical Analysis

Current Resistance Levels: $10, $11, $12

Trading Strategy

Entry Point

Expected Pullback: $6.5 - $7.0 range

Action: Monitor the stock closely. If it pulls back to this range, consider it a strong buy opportunity.

Volume Confirmation: If the stock bounces in this range with strong volume, it might signal a continuation of the upward trend.

Profit Target

Target Price: $13.50

Rationale: Given the recent positive news and technical setup, this target is realistic.

Risk Management

Stop Loss: Place slightly below $5.90

Purpose: To protect against significant losses if the stock reverses.

Considerations

Market Conditions: Overall market conditions can influence the stock's performance. Monitor broader market trends.

News Updates: Stay informed about any news related to QuantumScape Corporation, especially regarding strategic initiatives, partnerships, and financial results.

Chart Analysis

Resistance Levels: $10, $11, $12

Trading Advisory

Caution: Exercise caution and align your trading actions with your risk tolerance and market conditions.

Research: Conduct comprehensive research or consult with a financial advisor to tailor the strategy to your individual circumstances.

Disclaimer

This content is for informational purposes only and should not be considered financial advice.

By following this strategic approach, you can potentially capitalize on the recent positive developments and technical signals for QuantumScape Corp (NASDAQ: QS).