Rocket Lab Is Up 800%+ in 12 Months. What Does Its Chart Say?Space-services company Rocket Lab NASDAQ:RKLB , which has seen its stock shoot up by more than 75% year to date and 800%+ over the past 12 months, will report its latest quarterly earnings next Thursday. Does RKLB's chart show the company has more altitude to gain ... or will it crash back to Earth?

Let's check things out:

Rocket Lab's Fundamental Analysis

For those of you unfamiliar with RKLB, it's a Long Beach, Calif.-based end-to-end space company. (Full disclosure: I own shares in the name.)

Rocket Lab designs and manufactures its own small- and medium-class rockets in order to provide launch services from its sites, which are primarily in Virginia and New Zealand.

The company has mostly had commercial customers since its founding, but is starting to get some traction providing these services to the U.S. government for national-security purposes. You might say the firm competes with Tesla chief Elon Musk's privately held SpaceX and Amazon founder Jeff Bezos' private Blue Origin firm, just on a smaller scale.

RKLB is set to release Q2 results after the bell on Aug. 7, with the Street looking for a $0.07 adjusted loss per share on $135.3 million of revenue.

That would represent a 27.3% revenue gain from the $106.3 million the company took in during the same period last year, although profitability would have eased from the $0.05 adjusted loss per share RKLB posted in Q2 2024.

Of the seven sell-side analysts that I found that cover the stock, three have increased their earnings estimates since the quarter began, three have cut their estimates and one has sat on his hands.

Notably, Jeff Van Rhee of Craig-Hallum this week initiated Rocket Lab with a "Hold" rating and a $51 target price (vs. the $45.30 the stock was trading at Friday afternoon).

Looking further ahead, analysts expect Rocket Lab's revenues to grow 32% for 2025 as a whole, followed by another 56% for all of 2026.

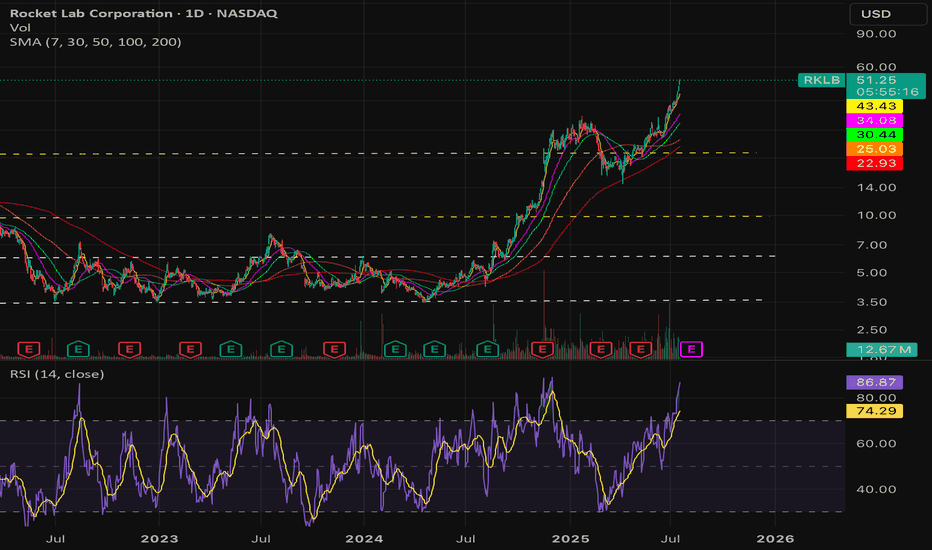

As for price action, Rocket Lab's shares have traded more volatilely as the firm approaches its earnings release. After spiking into mid-July on an almost parabolic run, RKLB has recently consolidated with a number of days that saw multi-percentage-point drops.

As of Wednesday, options markets were pricing in a 50% likelihood of a move greater than 13%.

Rocket Lab's Technical Analysis

Now let's look at RKLB's chart going back to December:

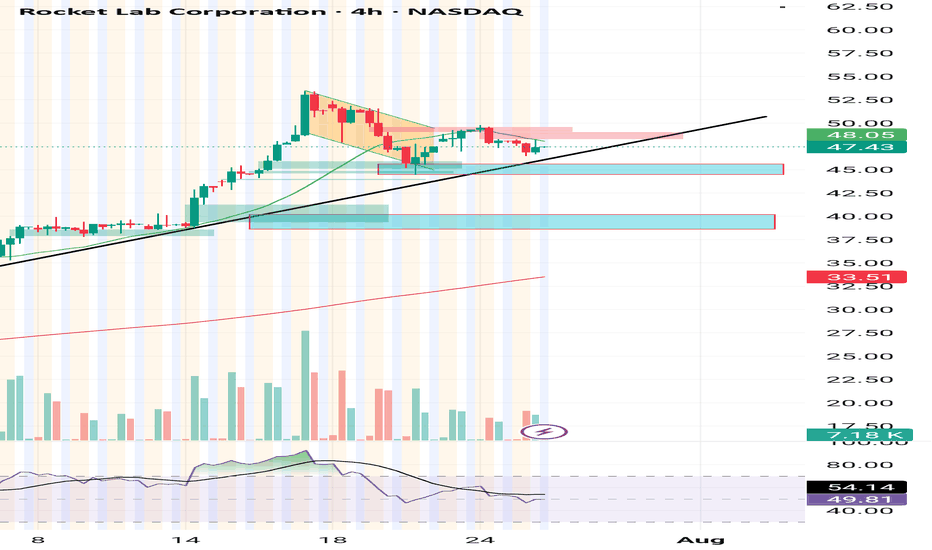

Readers will note that since Rocket Lab ended its sharp upward run in mid-July, the stock's Relative Strength Index (the gray line at the chart's top) has exited overbought territory -- although the RSI still remains healthy.

Readers will also see that within the daily Moving Average Convergence Divergence indicator (marked "MACD" at the chart's bottom), the histogram of the stock's 9-day Exponential Moving Average (or "EMA," denoted by blue bars) has entered negative territory. That's usually short-term bearish.

Meanwhile, Rocket Lab's 12-day EMA (the black line near the chart's bottom) has also crossed below its 26-day EMA (the gold line). This is also traditionally a bearish signal.

However, one positive for the RKLB is that the stock appears to have found support in recent days at its 21-day EMA (the green line above). This suggests a willingness of swing traders to support the stock at that line.

Still, Rocket Lab's chart is showing what looks like a completed "head-and-shoulders" pattern of bearish reversal at the chart's right (denoted by curving black lines).

Should this pattern foretell a sell-off (as the daily MACD seems set up for), Rocket Lab's downside pivot would likely show up as a neckline at around $37 a share. That's well below the $45.30 that RKLB was trading at Friday afternoon.

What if Rocket Lab fails to hold its 21-day EMA ($45.90 in the chart above)? In that case, both the 50-day Simple Moving Average (or "SMA," marked with a blue line) and 200-day SMA (the red line) would have to come into play for the pattern implied here to become fully realized.

(Moomoo Technologies Inc. Markets Commentator Stephen “Sarge” Guilfoyle was long RKLB the time of writing this column.)

This article discusses technical analysis, other approaches, including fundamental analysis, may offer very different views. The examples provided are for illustrative purposes only and are not intended to be reflective of the results you can expect to achieve. Specific security charts used are for illustrative purposes only and are not a recommendation, offer to sell, or a solicitation of an offer to buy any security. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal. This content is also not a research report and is not intended to serve as the basis for any investment decision. The information contained in this article does not purport to be a complete description of the securities, markets, or developments referred to in this material. Moomoo and its affiliates make no representation or warranty as to the article's adequacy, completeness, accuracy or timeliness for any particular purpose of the above content. Furthermore, there is no guarantee that any statements, estimates, price targets, opinions or forecasts provided herein will prove to be correct.

Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. In the U.S., investment products and services on Moomoo are offered by Moomoo Financial Inc., Member FINRA/SIPC.

TradingView is an independent third party not affiliated with Moomoo Financial Inc., Moomoo Technologies Inc., or its affiliates. Moomoo Financial Inc. and its affiliates do not endorse, represent or warrant the completeness and accuracy of the data and information available on the TradingView platform and are not responsible for any services provided by the third-party platform.

RKLB trade ideas

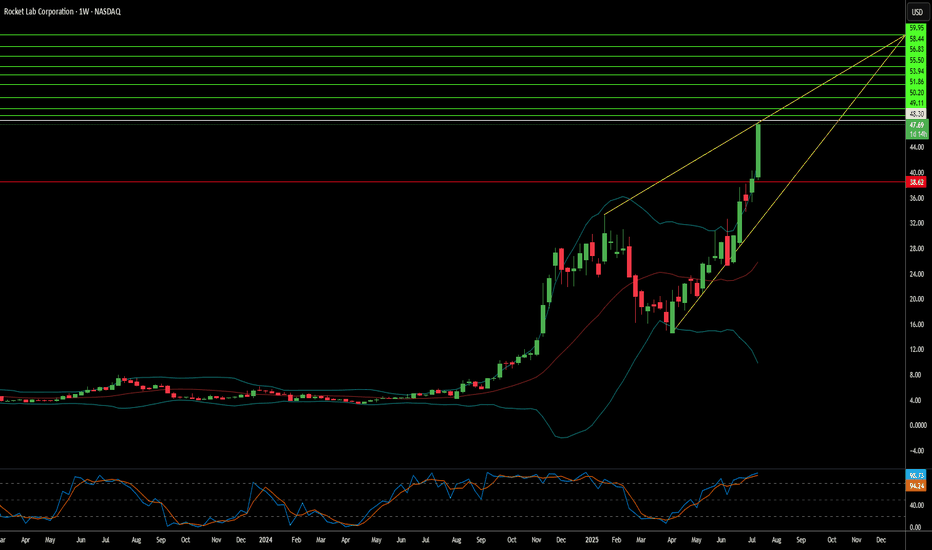

$RKLB – Momentum Pullback to 20 SMA with Trendline Break IncominRocket Lab ( NASDAQ:RKLB ) is setting up for a classic trend continuation move after a strong run. It just pulled back to the 20 SMA for the first time since breaking out over $35 — and it’s holding like a champ.

🔹 The Setup:

After peaking near $55, price pulled back in an orderly fashion on lower volume — a healthy correction.

Now we’ve got a hold at the 20 SMA, with a close back over the 9 EMA and a trendline break in progress.

This is where momentum tends to re-ignite.

🔹 Why It’s Powerful:

First 20 SMA test since the breakout = high probability bounce zone.

Lower volume on the pullback signals no panic selling.

A close over the 9 EMA + trendline = potential speed-up candle.

🔹 My Trade Plan:

1️⃣ Entry: Looking for confirmation over the 9 EMA and trendline.

2️⃣ Stop: Under the 20 SMA — tight structure, defined risk.

3️⃣ Target: Retest of highs near $55 with potential extension on breakout.

Why I Love This Chart:

NASDAQ:RKLB is a momentum name — when it moves, it moves fast.

The trend is intact, the pullback was clean, and now we have structure + volume setup.

How We're Earning A 13%+ Yield Selling Puts On Rocket LabThe commercial space sector is booming, and Rocket Lab NASDAQ:RKLB stands out as one of the most promising players—not just another speculative startup or space tourism hype. But while the company is making strong operational strides, its stock valuation appears stretched, prompting a more strategic approach to investing.

📈 Strong Execution, Growing Opportunity

Rocket Lab continues to hit meaningful milestones. In Q1, the company:

Secured a U.S. Space Force contract for its upcoming Neutron heavy-lift rocket.

Won hypersonic-related contracts with the U.S. Air Force and the U.K. Ministry of Defense.

Successfully completed five Electron rocket launches and booked eight more.

Made a strategic acquisition for developing "Flatellites," enhancing vertical integration.

Revenue rose 32% year-over-year, with gross margins in the mid-30% range. Importantly, Rocket Lab has a $1 billion+ revenue backlog, with over half expected to convert in the next year, and a healthy mix of government and commercial clients across both its Launch and Space Systems divisions.

💰 Valuation: Big Potential, Bigger Price Tag

Rocket Lab's business is solid, but its valuation raises red flags. With a price-to-sales ratio near 55x (compared to SpaceX's ~14x), investors are paying a steep premium for future success. The company is still unprofitable, and the high valuation leaves little room for error. Simply put, the market may be rewarding Rocket Lab too early.

📊 The Smarter Move: Sell Put Options

Instead of buying shares at inflated levels, the better approach is to sell put options—a strategy that earns upfront cash and offers the opportunity to buy shares at a discount if the stock drops.

Recommended trade:

Sell October 17th $30 strike put options

Premium: ~$96 per contract

Required buying power: ~$2,904

Implied return: ~3.3% over 90 days, or ~13.4% annualized

This provides income now, while still giving investors potential exposure to Rocket Lab at a 40% discount to current prices.

⚠️ Risks to Consider

This isn’t risk-free. If Rocket Lab’s execution falters—especially with Neutron—shares could drop sharply. Selling puts means you may still be forced to buy at $30, even if the stock falls much lower. This strategy works best for investors comfortable owning RKLB long term at a lower entry price.

✅ Bottom Line

Rocket Lab is a strong business, but the stock looks overheated. Selling put options offers a more balanced way to participate in its growth story—earning income now while positioning to buy the stock later at a better value.

Rating: Buy (via options strategy)

Rocket Lab to new all time highs as more things go to spaceRocket Lab build rockets. CEO has an extremely bright aura. Hard to find a better story-driven pure space play with SpaceX being private. I like Rocket Lab and invested because as more and more things fly and go to space, it has the wind at its back.

$RKLB Overvalued asf! - NASDAQ:RKLB is overvalued. I will either stay on the sidelines or short the heck out of this POS.

- Company sells hopium which doesn't have meaningful materialization as of now and not even in the distant future.

Fundamentally,

2025 | 2026 | 2027 | 2028

-0.32 | -0.08 | 0.17 | 0.47

Revenue:

576.83M | 905.01M | 1.21B | 1.69B

- Market cap of NASDAQ:RKLB currently sits at 24.61B as of July 17, 2025.

- People who are buying now are buying someone else bag and are in for a horrible ride.

- Consider buying it under $15 if you are super bullish

Is Rocket Lab the Future of Space Commerce?Rocket Lab (RKLB) is rapidly ascending as a pivotal force in the burgeoning commercial space industry. The company's vertically integrated model, spanning launch services, spacecraft manufacturing, and component production, distinguishes it as a comprehensive solutions provider. With key operations and launch sites in both the U.S. and New Zealand, Rocket Lab leverages a strategic geographic presence, particularly its strong U.S. footprint. This dual-nation capability is crucial for securing sensitive U.S. government and national security contracts, aligning perfectly with the U.S. imperative for resilient, domestic space supply chains in an era of heightened geopolitical competition. This positions Rocket Lab as a trusted partner for Western allies, mitigating supply chain risks for critical missions and bolstering its competitive edge.

The company's growth is inextricably linked to significant global shifts. The space economy is projected to surge from $630 billion in 2023 to $1.8 trillion by 2035, driven by decreasing launch costs and increasing demand for satellite data. Space is now a critical domain for national security, compelling governments to rely on commercial entities for responsive and reliable access to orbit. Rocket Lab's Electron rocket, with over 40 launches and a 91% success rate, is ideally suited for the burgeoning small satellite market, vital for Earth observation and global communications. Its ongoing development of Neutron, a reusable medium-lift rocket, promises to further reduce costs and increase launch cadence, targeting the expansive market for mega-constellations and human spaceflight.

Rocket Lab's strategic acquisitions, such as SolAero and Sinclair Interplanetary, enhance its in-house manufacturing capabilities, allowing greater control over the entire space value chain. This vertical integration not only streamlines operations and reduces lead times but also establishes a significant barrier to entry for competitors. While facing stiff competition from industry giants like SpaceX and emerging players, Rocket Lab's diversified approach into higher-margin space systems and its proven reliability position it strongly. Its strategic partnerships further validate its technological prowess and operational excellence, ensuring a robust position in an increasingly competitive landscape. As the company explores new frontiers like on-orbit servicing and in-space manufacturing, Rocket Lab continues to demonstrate the strategic foresight necessary to thrive in the dynamic new space race.

RKLB - LTF Cooling OffWe are currently starting to see the first signs of trend reversal for RKLB. From April we saw a massive 150%+ surge towards $38. After forming a 4H doji (LTF signal) we are starting to see sellers come in.

If selling pressure does continue our first zone to watch for support would be our white box ($30-32). Then the levels of $28 and $23.

If price is able to continue this uptrend and close a 4H candle body above where the doji printed then we could see new highs.

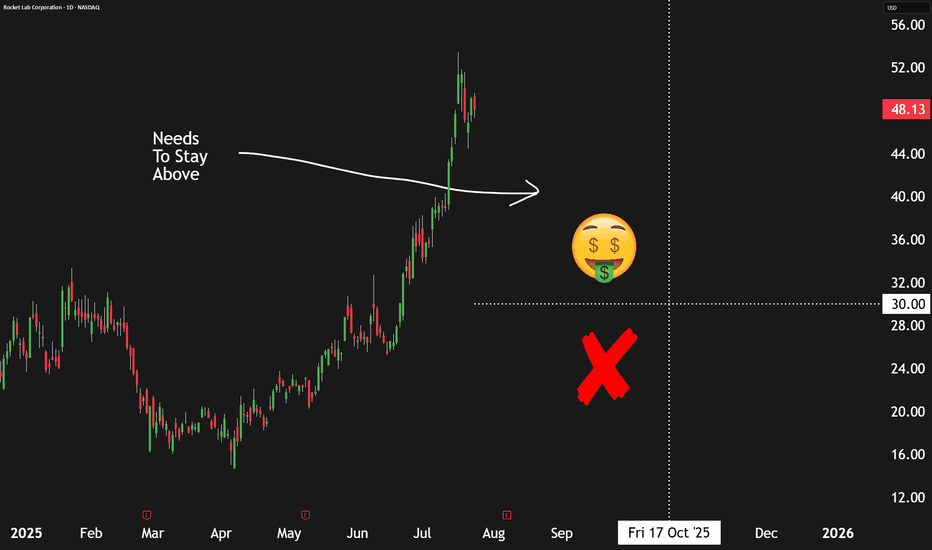

My RKLB for the rest of 2025 before sell offI believe we are going through these 2 scenario drawn out on my chart

1) we have a head and shoulder sell off. target $48-55

2) we go higher following the orange line neutron and really good news. target $95-124

good luck to all may u have success in all your trading setup

Rocket (RKLB) From Launch Innovator to Space Systems PowerhouseCompany Evolution:

Rocket Lab NASDAQ:RKLB is transforming into a vertically integrated space and defense systems company, leveraging its launch heritage to build long-term, diversified revenue streams.

Key Catalysts:

Rapid Launch Cadence 🛰️

3 Electron launches in 24 days demonstrate operational agility and scalability.

Meets rising demand for high-frequency satellite constellation deployments.

Strategic GEOST Acquisition 🛡️

$275M deal expands into electro-optical and infrared payloads, key for defense/ISR.

Boosts margin profile, backlog durability, and government contract appeal.

Validated Execution & Recurring Revenue 💼

100% mission success rate and multi-launch contract with Japan's iQPS reinforce credibility.

Positions RKLB for long-term cash flow stability and multiyear contract wins.

Investment Outlook:

📈 Bullish above $23.00–$24.00, backed by high reliability and strategic expansion.

🎯 Price Target: $42.00–$43.00, reflecting an expanding TAM, defense sector momentum, and vertically integrated execution.

🌠 RKLB is no longer just reaching orbit—it's building the infrastructure of space. #RKLB #SpaceStocks #DefenseGrowth

Rocket Lab (RKLB) Offers Full Launch To Space ServicesRocket Lab Corporation (RKLB) is an aerospace company that provides small- to medium‑lift launch services and spacecraft systems. Their Electron rocket supports commercial satellite deployments while the forthcoming Neutron vehicle targets larger payloads. The company also develops satellite components and the Photon satellite bus, and recently expanded into satellite manufacturing with the Flatellite platform—positioning itself as an end‑to‑end space company with national security contracts.

On the chart, RKLB recently showed a confirmation bar accompanied by rising volume and moved above the .236 Fibonacci level—entering the momentum zone. This suggests growing buyer confidence and sets up potential for an extended upward move. Traders may use the .236 Fibonacci level as a trailing stop via the Fibonacci snap tool to manage risk while staying aligned with the trend.

This one is speculative, but it could be a moon shot for a flipSo this one is a little riskier than most trades I take, but the juice has been historically worth that squeeze. Historically, this setup has never produced a losing trade on RKLB, so I don't expect this time to break that streak. In addition to having a perfect record, it also has stellar (no pun intended) daily rates of return. It's also in the midst of a solid uptrend, making the trade a little less risky than it otherwise might be.

The average trade using this signal lasted 15 days and gained 6.2% - a .41% per day return (10x the long term market daily average return). However, that number was skewed by a few long trades. The median was 4% in 6 days (15x the average daily market return) and almost 1 in 4 trades produced a gain of > 10%. I don't expect that kind of gain here, but it'd be nice if it happened.

This one is also a stock that tends to produce multiple signals in succession, so I am prepared to add to the position if that occurs. I may or may not use FPC depending on the return on the FPC day.

As always - this is intended as "edutainment" and my perspective on what I am or would be doing, not a recommendation for you to buy or sell. Act accordingly and invest at your own risk. DYOR and only make investments that make good financial sense for you in your current situation.

$RKLB: Early Entry Ignites as Momentum Builds🚀 NASDAQ:RKLB – Rocket Lab USA | Breakout Watch

Chart Notes:

Rocket Lab is showing impressive strength after successfully holding its 200-day moving average, even as broader markets pulled back. That type of resilience often points to institutional support.

Today’s move delivered a low-cheat early entry backed by strong volume, a key sign of accumulation. We’re also seeing the moving averages start to stack, signaling that momentum is building.

The recent earnings report is behind us, removing near-term volatility risk—and the market’s positive reaction to that report is another bullish signal. In terms of industry positioning, Rocket Lab is part of the emerging commercial space sector, which continues to attract investor interest and capital as a high-growth frontier.

This stock is of the higher-octane variety, and with more and more growth names breaking out recently, conditions look favorable for RKLB to follow suit.

Trade Plan:

Entry Zone: 23.76 – 24.95

Stop: 7% below entry

Target: 2:1 minimum reward-to-risk or 14%+ upside

We’ll be watching for continued strength or additional entry points as it pushes toward the top of its base. Keep this one on your radar—it could live up to its name and rocket to new highs.

RKLB Long Trade Setup – Breakout in Motion!🚀

✅ Trade Type: Long

🕒 Timeframe: 30-Minute

🎯 Entry Zone:

$28.76 (Breakout candle from ascending triangle)

🔻 Stop-Loss (SL):

$27.22

Placed below key support and trendline – smart risk placement

🎯 Target Zones:

TP1: $30.70 (Red line – short-term resistance)

TP2: $33.28 (Green line – higher resistance zone / previous supply)

📊 Risk-Reward Ratio:

Strong (Estimated R:R ≈ 1:2.5+)

🔍 Chart Analysis Notes:

Breakout from ascending triangle with bullish momentum

Volume spike confirms buyer participation (+13.14%)

Clean trendline break + horizontal resistance flip potential

Yellow line may act as a retest or confirmation level

Update on Nuclear Stocks SMR, OKL0 + NEW IDEAS VRT, TSLA OKLO, SMR going through the roof. NNE is trailing today. Sold out most of the RKLB.

Lets go over the SPY, QQQ which are flagging now after holding support.

Liking this VRT and LTBR AND LUNR for potential swings along with HIMS!

Lets dig into the charts and see whats up!

Rocket Lab (RKLB) – Breakout Setup With 22.95% UpsideRocket Lab (NASDAQ: RKLB) is setting up for a potentially explosive move. The price just closed above the Ichimoku Cloud with a bullish Kumo breakout, reclaiming the pivot level at $22.42. We're also seeing confirmation from multiple technical signals:

🔍 Technical Breakdown:

✅ Price above the cloud (bullish confirmation)

✅ Strong bounce off Tenkan-sen (conversion line) acting as support

✅ Bullish momentum building after weeks of consolidation near the cloud top

✅ Break above recent highs with room to run to R1 at $28.80

This setup has a clear entry and stop with strong R/R dynamics:

Entry: $23.41

Target: $28.80 (22.95% upside)

Stop: $21.55 (7.96% downside)

Risk/Reward Ratio: 2.68

Size: 3,763 shares | Reward: $48,172 | Risk: $21,000

📡 Fundamental Bull Case:

Rocket Lab is one of the few pure-play space launch and satellite companies publicly traded. It's essentially a mini SpaceX with recurring revenue from satellite deployment, space systems, and a strong contract pipeline with NASA and defense partners.

🛰️ Recently won key government and defense contracts

💵 Revenue is growing YoY; expanding margins in Q1

🌎 Strong tailwinds from global satellite/defense expansion

🔋 Potential long-term upside from Neutron rocket program and vertical integration

This trade setup is backed by both technical momentum and macro tailwinds in the space sector. RKLB is quietly gaining traction as a Tier 2 space player with massive optionality.