Ascending Channels ✅ Bullish Case (If Price Holds Above ChoCh - $12.39)

Entry: Above $12.50 (Confirmation of 50 EMA break).

Stop-Loss: Below $12.30 (Invalidation of ChoCh).

Target 1: $13.07 (Key Resistance).

Target 2: $13.46 (Major Resistance).

❌ Bearish Case (If Price Falls Below ChoCh - $12.39)

Entry: Below $12.30 (Confirmation of failure).

Stop-Loss: Above $12.50 (Invalidation).

Target 1: $11.41 (Key Support).

Target 2: $10.92 (Major Support).

SOFI trade ideas

$SOFI - Working against the trendline and VWAP resistanceNASDAQ:SOFI declined to the 200-day moving average (DMA) area, which was the breakdown target, and then bounced. It’s remarkable how technical targets are hit with such high accuracy.

Currently, it is testing the channel trendline and VWAP resistance. If it can break above $13.70 and hold above that level, it could serve as a launchpad for the next leg.

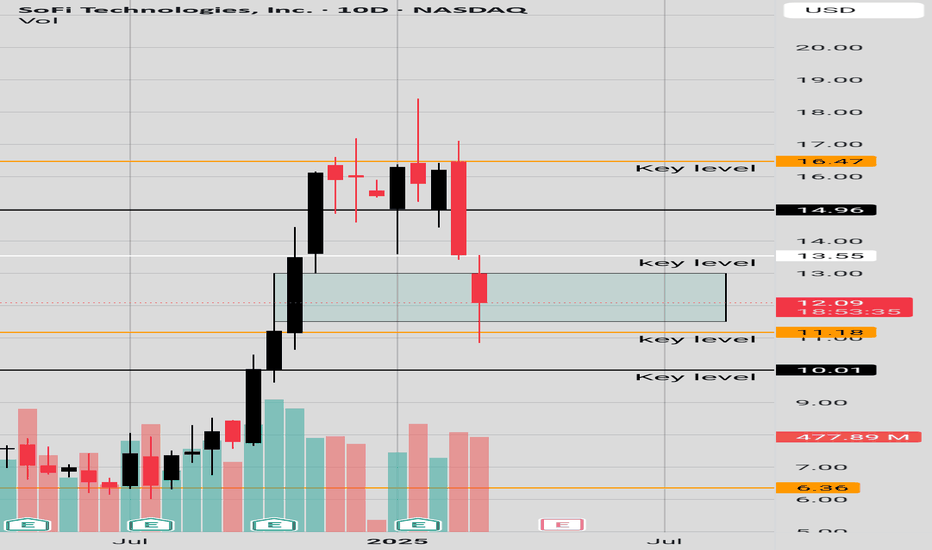

10Day High Wave CandleOn the 10Day Chart price had a serious correction, investors want to know is it over.

RSI is kind of bearish/neutral. Stochastic RSI says there is more room for price to decline. However, we have a high wave candle in a bullish FVG zone with price rejection around the 11.00 price range. On the 10Day Chart we are going to need price to clear 13.55 price for more signs of upward growth.

$SOFI - It can bounce butNASDAQ:SOFI This is a case of a diamond pattern breakdown. Diamond patterns can be either bullish or bearish, depending on how they resolve. In this case, the pattern resolved to the downside.

The breakdown target is around the 200-day moving average (200DMA) or $10–$11 range. So create a plan for that.

We are at the midway potential reversal area, supported by the VWAP.

We had a hammer candle on Friday, so let’s hope it follows through. 🙏

Bearish Sentiment and Wedges Please observe the wedgelike structure for SOFI, we had a little boost on Friday but not enough to close out the wedge like structure, price needs to overcome 12.50 and make a higher low or retest 12.50 for a safe long entry, if price falls back below the low of the wick candle and inside the wedgelike structure the shorting may continue, please observe the chart for key levels and for wedgelike structure. The asset is below the 200 EMA and 50 EMA candle confirming bearish sentiment.

$SOFI - Reversal signal is not clear yetNASDAQ:SOFI dropped to a loading zone and then bounced. It formed a hammer pattern on the weekly chart.

The $16 to $17 range marks a key resistance zone, and breaking above it would signal bullish momentum.

On the downside, $13 serves as a critical support level. If it fails to hold, we might see a pullback to $11.

My thoughts for the coming weeksWe are at a tough patch now unfortunately looking at the charts, and so I think it's safe to assume we will see some selling and slowing down in upward price action, until we find more momentum to carry us into price discovery.

As you can see, we're heading towards some very important areas. One being an old support level, now resistance. Following that we have the Fibonacci golden zone at an arms reach as well. If we manage to blow past those, we then have the big one which completely ruined us for years.

Conclusion:

As you can see from my comments on the chart, I can see us in the coming weeks cooling off, and eventually selling down towards the $10 range, to then eventually gain momentum and try again.

Key Zones and LevelsThe price is currently in the daily MMBM and has retraced from the -1.5 standard deviation level to the Optimal Trade Entry (OTE) zone. I would like to see a confirmed closure above the bearish imbalance, which initially drove the price down to the 0.62 Fibonacci retracement level. A strong close above this imbalance could indicate further bullish momentum and potential continuation toward higher levels.

Important ConsolidationGood day Team:

With time we can tell.

SOFI is consolidating after an intense correction at a key level 14.65; at times past that level served as a reversal after prior consolidation, but we need a lot of buying pressure to reverse that downtrend. Have a good day please stay safe.

$SOFI is poised to reach the $20 range following its correctionNASDAQ:SOFI 's price began 2025 at $15.40. Today, it traded at $15.56, marking a 1% increase since the start of the year. The forecasted price for SoFi at the end of 2025 is $41.23, representing a year-over-year change of +168%. The expected rise from today to year-end is +165%.

By mid-2025, the price is projected to reach $20-$29.56.

Strong Growth Prospects: NASDAQ:SOFI has shown significant growth in revenue and profitability. The company reported a 35.8% year-over-year revenue growth and a 45% net profit margin in 20241.

Positive Market Trends: Analysts are optimistic about NASDAQ:SOFI 's future performance, with some projecting a 72% upside potential, targeting a $25 share price.

Diverse Financial Services: NASDAQ:SOFI offers a wide range of financial services, including lending, investing, and banking, which helps diversify its revenue streams and reduce risk.

Member Growth: The company has been experiencing robust member growth, which is a positive indicator of its expanding customer base and market reach.

Buy NASDAQ:SOFI now and let's get wealthy!

Cycling Down and Head and Shoulders?Good day many thanks to Marta from Real Life Trading Academy from pointing out the hypothetical head and shoulders on the daily chart, please observe possible hypothetical downward action for SOFI and the key levels. All the best, remember anything could happen so please be safe and careful only go crazy paper trading with fake money.

SOFI - To fly, or not to fly...Been in this for a long time, not sure if I want to take profits and wait to buy back.

If we get over the $18 to $20 area, it could fly, but I am not sure of what catalyst could do that in this market.

It is about to retest the $18 area, it would be nice to break above and continue, but I feel a correction may be looming, 20%.

How does this sound to you? Any insight?

$SOFI: DIP BUYING OPP. INBOUND!NASDAQ:SOFI : DIP BUYING OPP INBOUND!

Are you looking to buy more cheap Sofi shares?

Check this out then...

DIP BUY BOX: $13-$15 🎯

The indicator up top is the Williams %R and it is one of my favorite tools!

Do you see how every time we break above -20 or hit the Red barrier and reject we go all the way down to -80 or the Green Support Beam and vice versa? 👀

Yes, every single time since NASDAQ:SOFI went public back in 2020!

If you are a probabilities person like me then you understand that we most likely will at a minimum go to -80 and would put the price under $15, thus giving an opportunity to investors and traders.

The bullish side to this is this is great consolidation before the next BIG MOVE! Which I believe when the pendulum swings in the opposite direction we could swing to ATHs before getting to the Red barrier!!

This time could be different but the probabilities say it won't be friends. Hope you enjoyed this TA! Have a great Sunday!

Not financial advice

Everyone wants $20, Here are my thoughts...Making this without looking at earnings numbers or there so called growth.

From what I am seeing in relative strength, $15 is the fair value price at the moment.

I am expecting to see a gap down to the $15 area and have it slowly or quickly climb to $20-$25.

If the inverse plays out, we will gap up to $20-$25 and then flash sell to $15 long term.

Right now, options market is wanting.

$20 for calls expiring 1-31.

$18 for calls expiring 2-07.

$17 for calls expiring 2-14.

BUT... a very large position of puts, expiring 02-28, is at the $12.5 strike.

I look at this as retail buying short term options expecting price to move there, while institutions have positioned themselves in longer term expiring contracts.

SofiTech Rally Not Over Yet. SOFIThe Elliott Wave count is hard on this one. In my experience if your count tell you that you are done with a trend bullish or bearish, then you are probably not. Unfortunately, often enough trend completion is only confirmed much, much later. So, that leaves us assuming that we are still then continuing with the trend. Technical indicators are supportive of this notion and price action trigger is seen with MIDAS line cross.

SOFI Ready to Break Out to $30+ ?I’ve been watching this move closely, and right now, we’re heading toward $16.49—a level that could decide the next big move. If we break through $16.98, there’s a real shot at pushing toward $18.33 and beyond, with a longer-term target of $30+.

But here’s the flip side: if we reject at $16.49, we could see a pullback to $15.50, maybe even $14.50 if buyers don’t step in. That $1 range is where things could get really interesting.

I know a lot of you are in SOFI or watching it closely. What’s your plan? Are you holding, adding, or waiting for a dip?

Kris/ Mindbloome Exchange

Trade Smarter Live Better