U : Long There were both good and bad developments for Unity.

While the joint project opportunity with BMW Group is very positive news,

Departure of the current CEO was negative news.

Technically, it is above the 50 and 200 period moving averages, and the 50 period ema is also above the 200 period ema.

A risk/reward ratio of 3.00 can be evaluated, with the Stop-Loss being close to the 200-period ema and the target price being targeted at the large gap closing value.(Small position size)

Entry : 24.76 - 24.81

Risk/Reward Ratio : 3.00

Stop-Loss : 22.23

Take Profit Level: 32.54

U trade ideas

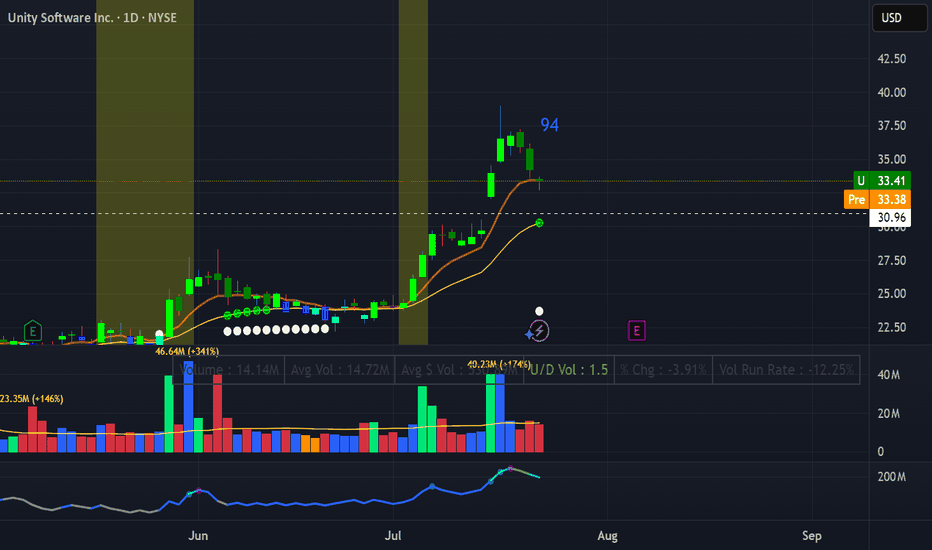

U Retest gap upSetup: Retest after gap up (on news)

RS 94

-uptrend

-volum contraction

-gap up not on EPS/Sales just on news. De volume when the news is damn high

Play:

entrty: Break above yesterday high , small position "buy the rumor sell the news" next earnings on 6/8

Stop loss; under candle yesterday

Target 2.5R, pivot

Holding for a breakoutIf you have never tried the unity software, it is very user friendly. There are a ton of resources for this software, making it an top choice for game development. With AI, more people are getting involved in creating because AI can help new developers write the code with simple prompts. AI is also changing the way games are made by allowing NPCs to now communicate with you as you speak into a microphone. Gaming is only going to get better from here. This stock has had a rough sell off but has managed to find a footing. I think this is a good buying opportunity for those who see long term value in this company that has been around since 2004 and only continues to improve upon their product.

Bagholders ApprovedYes, I’ll admit it — I’ve been holding the bag on Unity (U) since the $40 range back in August 2023. If this thing breaks through $69 and makes a run toward $96, I’ll gladly take some profits off the table.

But hey, if all you diamond-handed, kitty-loving bulls want to push it past $200 — be my guest. I’ll happily leave a few shares in the mix and enjoy the ride.

Let’s go. Rawr! 🐾📈

With Love... Long-Term Bag Holder Gang.

$U (Unity) — Breakout Into Premium Zone 📈 $U (Unity) — Breakout Into Premium Zone 🚀

Timeframe: 1D | Date: July 8, 2025 | Powered by WaverVanir DSS + SMC Framework

Unity ($U) just broke above a multi-month trendline and reclaimed structure with authority. Today's volume-backed candle has propelled price directly into the Premium zone, challenging the $28.28–31.34 range.

🔍 Technical Breakdown

✅ CHoCH + BOS Combo confirmed since late May

📈 Volume Spike (23.7M) → confirms institutional participation

🟥 Premium Zone Target: $31.34 (1.236 Fib)

⚡ Post-market sitting at $29.45 — breaking above trendline resistance

🔵 Equilibrium Zone: $23.50–25.50 (key reload area if pullback)

📍 Major Extension Target: $41.27–42.00 (Fib 2.0+) if continuation sustains

🧠 Macro Context

$U trading at historic lows, high short interest

AI & gaming convergence narrative gaining traction (Unity as infra layer)

Risk appetite rotation into small/mid-cap tech + software infrastructure plays

🧭 Bias: LONG (Momentum-Driven Breakout)

VolanX Signal Score: 79%

Risk Management:

Entry: $28.80–29.50

Stop: Below $26.50

TP1: $31.34

TP2: $39.34

TP3: $41.27

This move could evolve into a mid-term trend reversal, with $U now reclaiming its narrative and structure. Eyes on follow-through above $30. Let price validate.

📛 Not Financial Advice – For Educational Use Only

#Unity #U #BreakoutTrade #SmartMoneyConcepts #Fibonacci #LiquiditySweep #VolanX #WaverVanir #TradingStrategy #SMC #VolumeSpike #TechnicalAnalysis #TradingView

U Unity Is the Leader Powering the Mobile Gaming Boom in 2025If you haven`t bought the dip on U:

Now you need to know that U Unity Software stands as the dominant platform for mobile game development, fueling one of the fastest-growing segments in the global gaming industry. As mobile gaming continues its explosive expansion, Unity’s leadership in providing an accessible, powerful, and cross-platform game engine positions it for substantial growth and sustained market dominance in 2025 and beyond.

1. Unity Powers Over 70% of Mobile Games Worldwide

Unity is the engine behind more than 70% of all mobile games, a staggering market share that underscores its ubiquity and developer preference in the mobile gaming space.

This dominant position is supported by Unity’s user-friendly interface that appeals to a broad spectrum of developers—from indie studios to AAA game creators—enabling rapid prototyping and high-quality game production.

The company’s “build once, deploy anywhere” approach allows developers to launch games seamlessly across iOS, Android, consoles, and emerging platforms like AR/VR, saving time and development costs.

2. Mobile Gaming Market Growth Fuels Unity’s Expansion

The global mobile gaming market is projected to grow by $82.4 billion from 2025 to 2029, at a CAGR of 11.3%, driven by rising smartphone penetration, 5G connectivity, and increasing demand for multiplayer and free-to-play games.

Unity’s platform is uniquely positioned to capture this growth, as 90% of developers surveyed in 2025 reported launching their games on mobile devices.

The Asia-Pacific (APAC) region, accounting for over half of the mobile gaming market, represents a key growth area where Unity’s tools are widely adopted.

3. Cutting-Edge Technology and Innovation in Gaming Development

Unity’s continuous innovation, including the release of Unity 6 and Unity Vector, supports developers with advanced rendering, AI-driven content creation, and enhanced networking tools for smoother multiplayer experiences.

The platform’s integration of AI enables real-time, player-driven experiences such as dynamic content and adaptive storylines, which are becoming industry standards in 2025.

Unity’s cloud-based services and analytics empower developers to optimize monetization strategies, balancing user experience with in-app purchases and rewarded ads, which are booming in hybrid-casual games.

4. Thriving Developer Ecosystem and Support Network

Unity boasts a massive and active developer community, with over 8,000 companies worldwide adopting its platform for game development.

The Unity Asset Store and extensive tutorials reduce development time and costs, enabling faster time-to-market and innovation cycles.

This ecosystem fosters collaboration and accelerates problem-solving, making Unity the preferred choice for both startups and established studios.

5. Strong Financial Performance and Market Position

In Q1 2025, Unity reported revenue of $435 million with an adjusted EBITDA margin of 19%, reflecting operational discipline and strong demand for its platform.

Despite a GAAP net loss, Unity’s positive adjusted earnings per share ($0.24) and growing free cash flow demonstrate improving profitability metrics.

Unity’s leadership in mobile game development and expanding footprint in AR, VR, and metaverse projects provide multiple avenues for future revenue growth.

6. Cross-Platform and Metaverse Growth Opportunities

Unity’s “build once, deploy anywhere” philosophy extends beyond gaming into virtual concerts, interactive worlds, and digital marketplaces, positioning the company at the forefront of the metaverse evolution.

Enhanced networking and cloud gaming capabilities enable high-quality experiences across devices, including mobile phones and AR glasses, broadening Unity’s addressable market.

Unity interesting around these levelsNYSE:U

Unity showing some interesting price action at these levels.

I would be looking for this name to hold above the $25.33 level for continued upside. Anything below that I would no longer be watching.

If it can hold however we could potentially see upside towards the $40-$42 range.

will be looking for a breakout of this wedge which can be seen on the daily as well as the weekly timeframes.

worth adding to some watchlists imo at these levels.

Safe Entry ZoneFull Screen 1D Chart to get the General Direction Of Unity Stock Movement.

You May lower Time to 1h to see Recent Dicretion Movement.

The Stock Has Significate clear Resistances And Decent Support levels.

For Support Levels:

the 1h Green and 4h Green Zone are most signifacte support level sepcially in worse case scienario we visit the 4H its strongest support level.

For Resistance levels:

the Red 1h Zone P.High(Previous High) Line and Red 4h Red Zone acts as most significate Resistance level.

At each Either Support and Resistance watch-out for Volume Selling/Buying with 15M TF.

Note: 1- Potentional of Strong Buying Zone:

We have two scenarios must happen at The Mentioned Zone:

Scenarios One: strong buying volume with reversal Candle.

Scenarios Two: Fake Break-Out of The Buying Zone.

Both indicate buyers stepping in strongly. NEVER Join in unless one showed up.

2- How to Buy Stock:

On 15M TF when Marubozu Candle show up which indicate strong buyers stepping-in.

Buy on 0.5 Fibo Level of the Marubozu Candle, because price will always and always re-test the imbalance.

Unity software sees a strong bullish break potentiallyNYSE:U Unity Software is looking at a potential bullish break to the upside as the stock has broken out of the downtrend line which started since Nov 2021. Currently, the stock is in a rangebound consolidative range. Within it, the stock has also a v-shaped rounding bottom and the break above 22.50 resistance turned support has been broken.

Momentum indicator shows return to the upside and hence, we believe that Unity software may be embarking on a upside trend.

U Unity Potential Buyout Soon?!If you missed my previous signal on U (Unity):

Now Unity Technologies (NYSE: U) just caught fire — surging 12.5% in a single day — on a massive uptick in volume that should have every sharp trader watching closely. With $39.1M in volume against a daily average of 9.4M shares, something is clearly brewing beneath the surface.

But this isn’t just about technicals — the options market is lighting up with unusual activity, and there’s fundamental buyout potential that’s getting harder to ignore.

🔍 Options Traders Are Making Bold Bets

Yesterday: Traders loaded up on January 16 $37 strike calls — deep out-of-the-money, high-risk, high-reward plays.

Today: A massive $3.5 million bet was placed on the $30 strike calls, also expiring January 16.

These aren’t casual bets. This is smart money positioning for a potential takeover or major catalyst, and the timeline is clear: January 2025.

📈 Why a Buyout Could Be Back on the Table

Let’s rewind. On August 9, 2022, AppLovin (APP) made an unsolicited offer to acquire Unity in an all-stock deal worth $17.5B, valuing Unity shares at $58.85 — an 18% premium at the time. Unity rejected the deal.

Fast forward to today:

AppLovin's market cap has exploded — now sitting at a jaw-dropping $127B, up 3,800% since late 2022.

Unity, meanwhile, is a shadow of its former self, trading far below its ATH of $201.12 (November 2021), with ongoing struggles in monetization and competition.

But this disparity creates a prime M&A setup:

AppLovin now has the firepower and strategic incentive to revisit the acquisition — with Unity’s depressed valuation, it’s arguably a bargain.

The AI + gaming narrative is red hot. Combining Unity’s engine with AppLovin’s ad and monetization capabilities could be the synergy Wall Street loves.

🎯 The Trade Setup

Unity just broke out with conviction on high volume — this could be the first leg of a larger move.

Options flow suggests bullish sentiment into early 2025.

A renewed takeover offer could easily push the stock back toward the $50–60 zone, if not higher.

🧠 Final Thoughts

Unity is no stranger to volatility, but when volume spikes, options explode, and a cash-rich suitor like AppLovin is thriving, traders should sit up and pay attention.

We may be watching the early stages of a buyout story 2.0 unfold — and Wall Street might be starting to price it in.

📌 Watch Unity (U) closely in the coming weeks. The market may be whispering — or shouting — "Takeover incoming."

Unity Software (U) – Strong Earnings and Bullish FlowsFundamental Overview

Unity Software has been consolidating within a defined range for approximately a year following a significant decline in its stock price. Despite previous challenges, the company has consistently surprised investors with its earnings over the past year, maintaining strong performance. Historically, Unity tends to perform well during the May–June period. Looking ahead, projections suggest a decline in net margin, though net income is expected to increase, reinforcing the company's strong execution.

Additionally, Unity has exceeded expectations for four consecutive earnings reports, underscoring its resilience and growth trajectory.

Technical Outlook

- Momentum & Price Action: The stock exhibits solid momentum and is currently situated in a buy zone.

- Options Flow: Bullish sentiment is evident in options activity, signaling strong institutional interest.

- Analyst Ratings:

- Needham analyst Bernie McTernan maintains a Buy rating but lowers the price target from $33 to $30.

- Barclays analyst Ross Sandler maintains an Equal-Weight rating and lowers the price target from $26 to $25.

Given the current trends, bullish options flows, and favorable seasonality, Unity Software appears poised to test $25 in the upcoming weeks, particularly if momentum continues to drive price action.

$U $20 support, flagging in ascension Interesting setup here. Looks pretty good IMO. Software is a great name to look at in this market environment. It has a nice support at $20, even at large volume here it’s holding nicely so it shows relative strength. This name is definitely bullish long term. I’m in $21.5c for 2 weeks out, this is a high IV% name. Can run 10% in a day, 20% in a week, etc. We will see how it plays out.

WSL.

Cat's in the CradleHey Guys!! Here's one for you that you are going to Like

Let's Aim for a ~50% profit, on This one...

($22---->30 )

double-bottom,Trend Channel

Clearly defined Support-and-resistance Touch points.

Cheers!

And the cat's in the cradle and the silver spoon

Little boy blue and the man on the moon

"When you comin' home, Dad?"

"I don't know when, but we'll get together then

You know we'll have a good time then"

U - Unity Software - I like itI have had great results with this company as I waited for the first major crash into low teens, I have been in and out many time and want to build a longer term position, and feel the $15 area is great support.

I will most likely only buy shares to hold, possibly a few leap options 2 yrs out

What is your take on this call or company, I am an average guy that enjoys this stuff...

U Unity Software Options Ahead of EarningsIf you haven`t bought U before the previuos earnings:

Now analyzing the options chain and the chart patterns of U Unity Software prior to the earnings report this week,

I would consider purchasing the 21usd strike price Calls with

an expiration date of 2025-2-21,

for a premium of approximately $1.73.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Unity Software $U to $30+ IF They Beat Earnings on January 30thIf, and this is a BIG if, Unity Software can impress with their earnings report on January 30th (which I'm personally betting on) then I think that NYSE:U can make it's way up to the line of "conservative" resistance on this ascending channel by mid-February ($30+). 💸🏆📈

Also, I recently posted a video on YouTube discussing NYSE:U and why I'm bullish on it in 2025 if you want to check it out. 🤙🏼🎬🎥